We heard Operating Leverage many times on twitter,

Let me explain in easy format.

#OP #OperatingLeverage #Basics

Let me explain in easy format.

#OP #OperatingLeverage #Basics

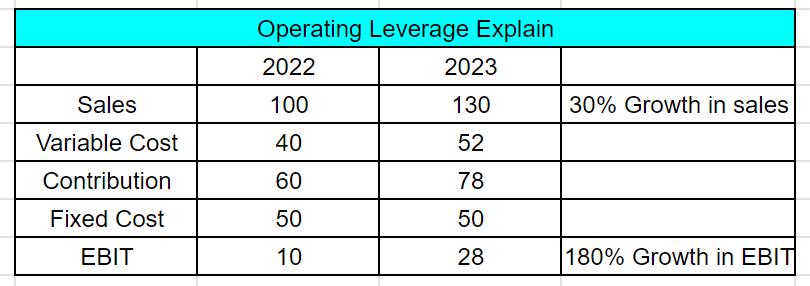

Operating leverage refers to the degree to which a company's fixed costs and variable costs are structured in its operations. It measures the impact of changes in sales or revenue on a company's operating income or earnings before interest and taxes (EBIT).

In simpler terms, operating leverage assesses how sensitive a company's profits are to changes in its sales volume. A company with higher fixed costs and lower variable costs will have higher operating leverage.

This means that a relatively small increase in sales can lead to a larger percentage increase in operating income, but the opposite is also true – a decrease in sales can result in a larger percentage decrease in operating income.

Mathematically, operating leverage can be expressed using the following formula:

Operating Leverage = Contribution Margin / Operating Income

Where:

- Contribution Margin = (Sales - Variable Costs) / Sales

- Operating Income = Earnings Before Interest and Taxes (EBIT)

Operating Leverage = Contribution Margin / Operating Income

Where:

- Contribution Margin = (Sales - Variable Costs) / Sales

- Operating Income = Earnings Before Interest and Taxes (EBIT)

A high degree of operating leverage can amplify a company's profitability in times of growth, but it can also increase risk when sales decline. Conversely, a lower degree of operating leverage means that a company's profitability is less sensitive to changes in sales volume.

Loading suggestions...