2. How to identify order blocks?

There are a lot of different variations, but there are 4 main ones I use.

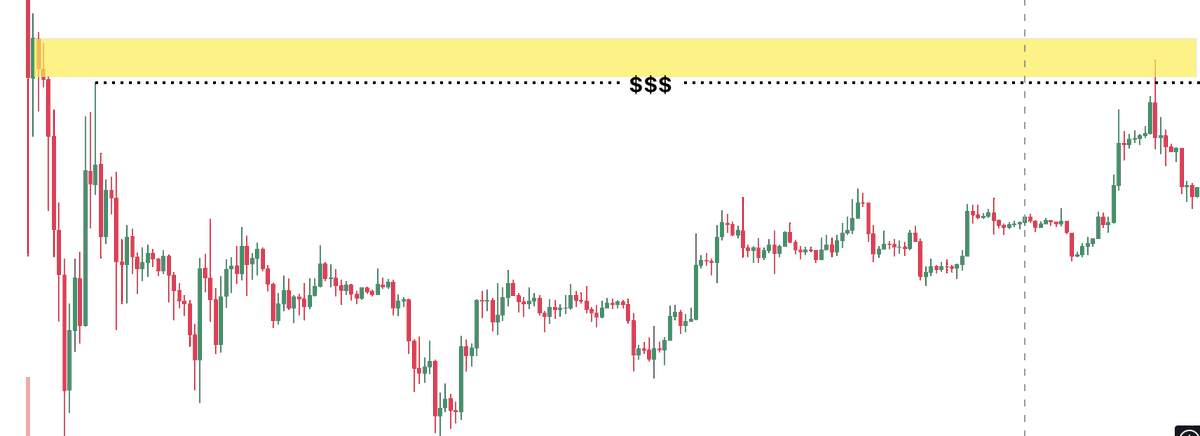

You always want to use the reversal candle that is the closest to the top/bottom that you can find.

There are a lot of different variations, but there are 4 main ones I use.

You always want to use the reversal candle that is the closest to the top/bottom that you can find.

3. Four main ways to identify if a given OB is high probability

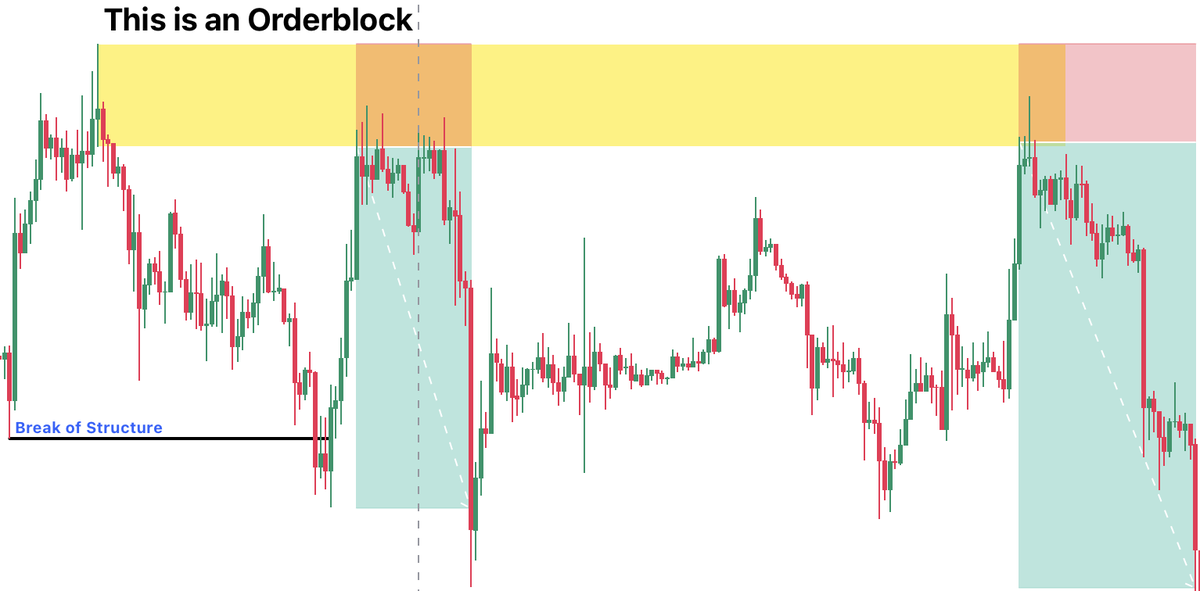

1. Break of Structure

As you can see, after the the top, #btc dumped and went below the past low and broke the market structure. This greatly increases the odds of the OB working out.

1. Break of Structure

As you can see, after the the top, #btc dumped and went below the past low and broke the market structure. This greatly increases the odds of the OB working out.

Thank you for reading this thread !🧵

I hope you thourougly enjoyed it and that It gave you some value 🫡

If you learned something, please consider Liking or Retweeting this thread.

#ct #CryptoTwitter #trading #crypto #thread

I hope you thourougly enjoyed it and that It gave you some value 🫡

If you learned something, please consider Liking or Retweeting this thread.

#ct #CryptoTwitter #trading #crypto #thread

Loading suggestions...