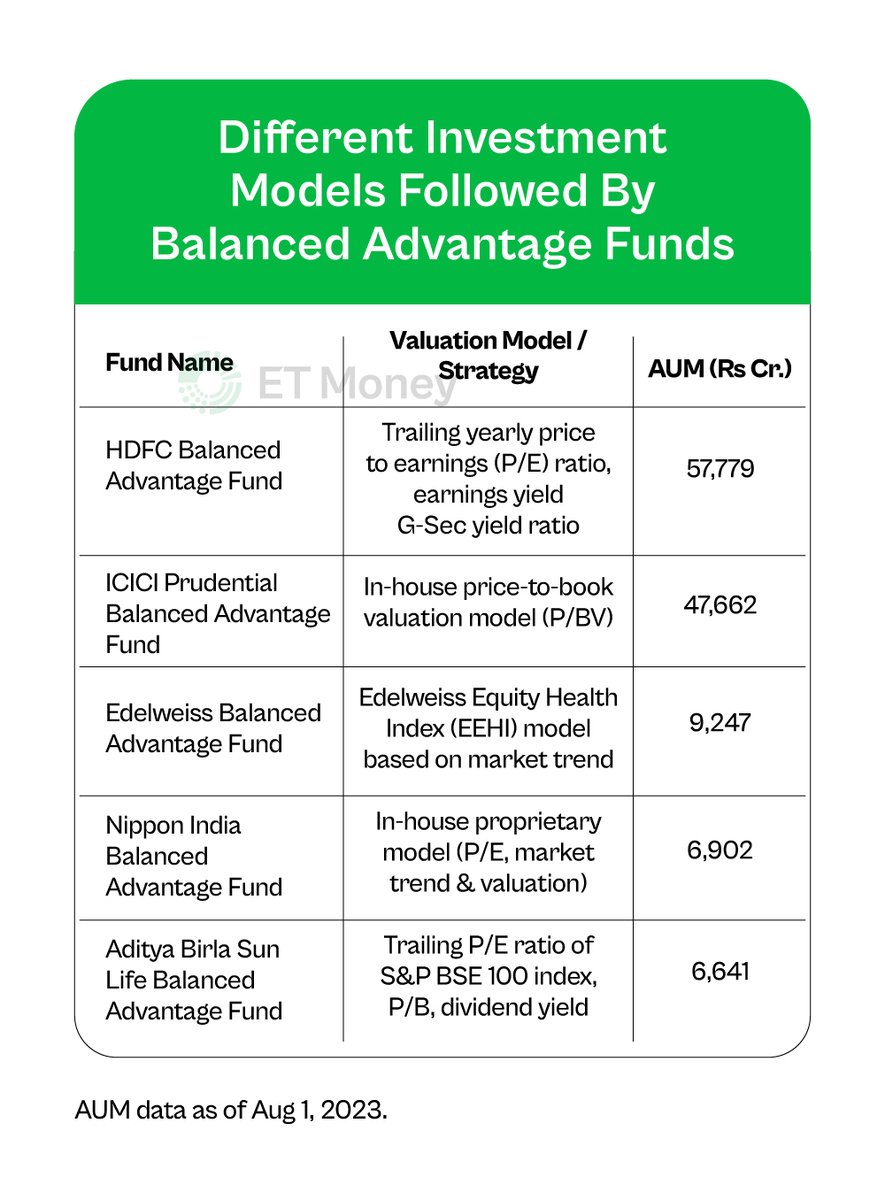

First, let’s understand the Balanced Advantage Fund (BAF) category.

Another cricket reference would help.

These schemes don’t try to hit fours and sixes every over.

Instead, they try to score singles & doubles on every ball.

Here’s what this means 👇

Another cricket reference would help.

These schemes don’t try to hit fours and sixes every over.

Instead, they try to score singles & doubles on every ball.

Here’s what this means 👇

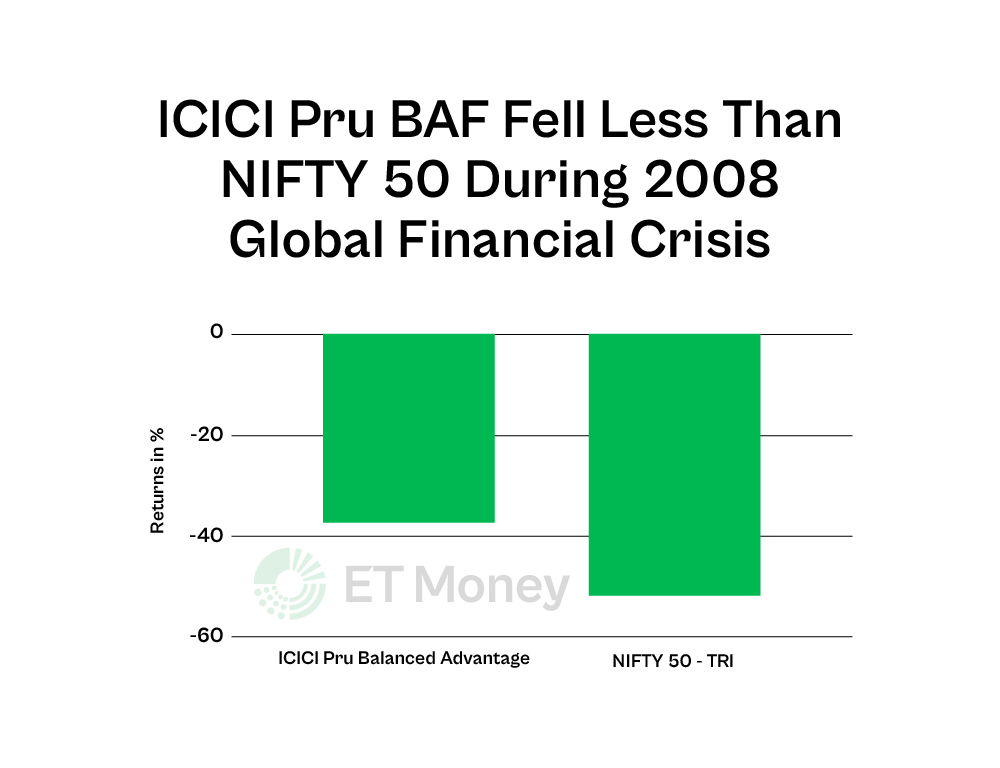

Balanced Advantage Funds (BAF) focus on falling less when markets correct.

And when markets rally, they try to catch some upside.

That’s how they make “good” returns over the long term.

And when markets rally, they try to catch some upside.

That’s how they make “good” returns over the long term.

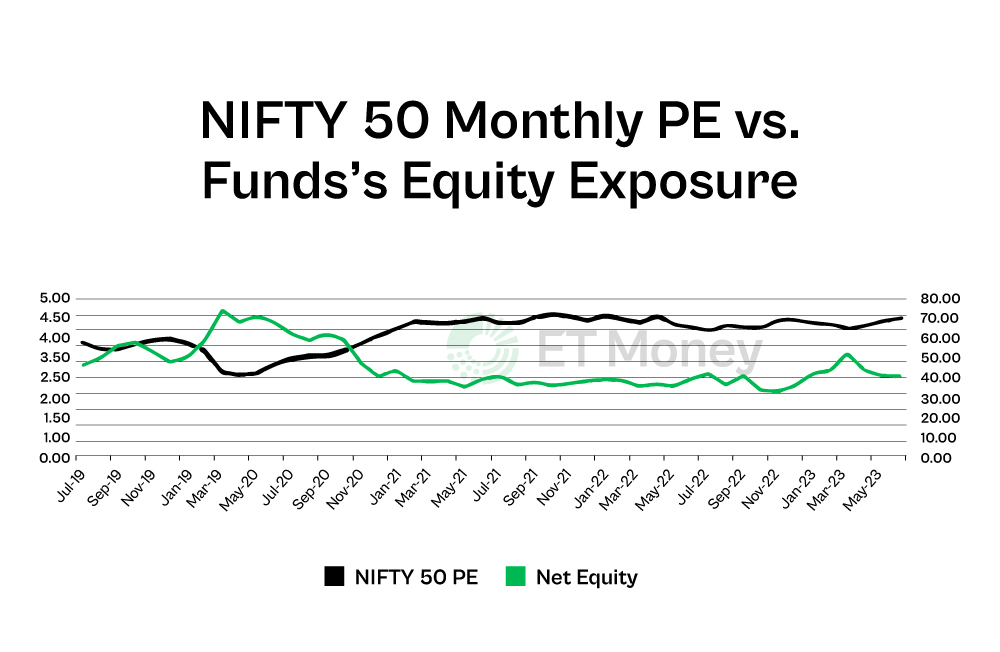

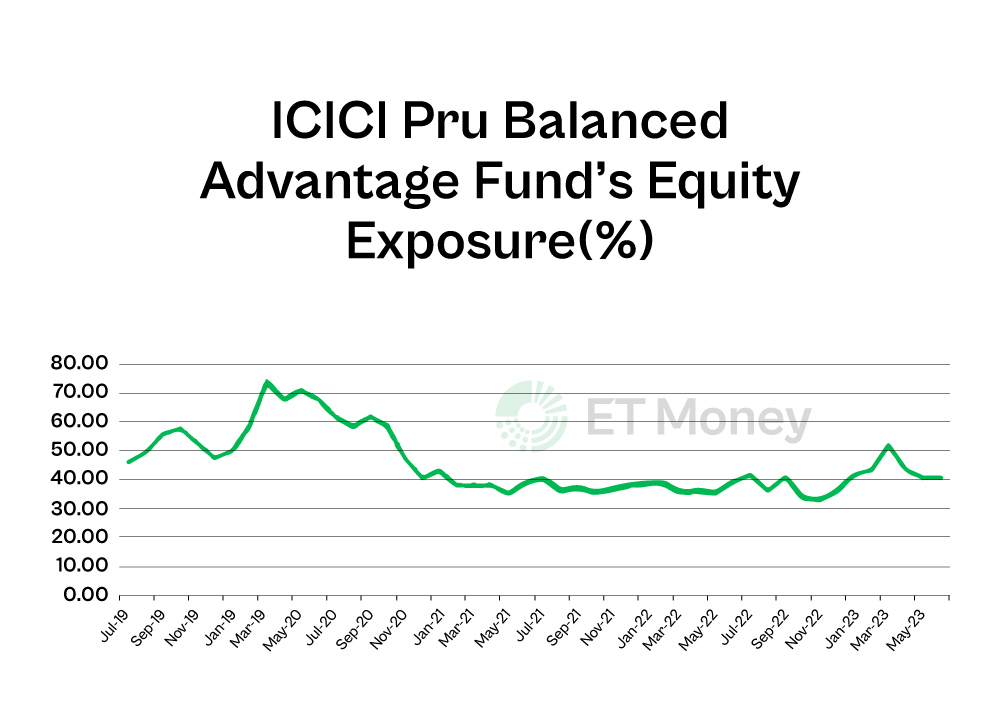

Now, at no point does the total equity exposure of ICICI Pru BAF goes below 65%.

This gives it the tax advantage that equity funds enjoy over non-equity funds.

But what if equity valuations are expensive?

Will the fund managers still invest 65% corpus in equities?

Not really.

This gives it the tax advantage that equity funds enjoy over non-equity funds.

But what if equity valuations are expensive?

Will the fund managers still invest 65% corpus in equities?

Not really.

If the equity valuations aren’t favourable, the fund uses equity derivatives to match the 65%-allocation criteria.

So, while the fund continues to enjoy equity taxation, it doesn’t remain vulnerable to a sudden market crash.

So, while the fund continues to enjoy equity taxation, it doesn’t remain vulnerable to a sudden market crash.

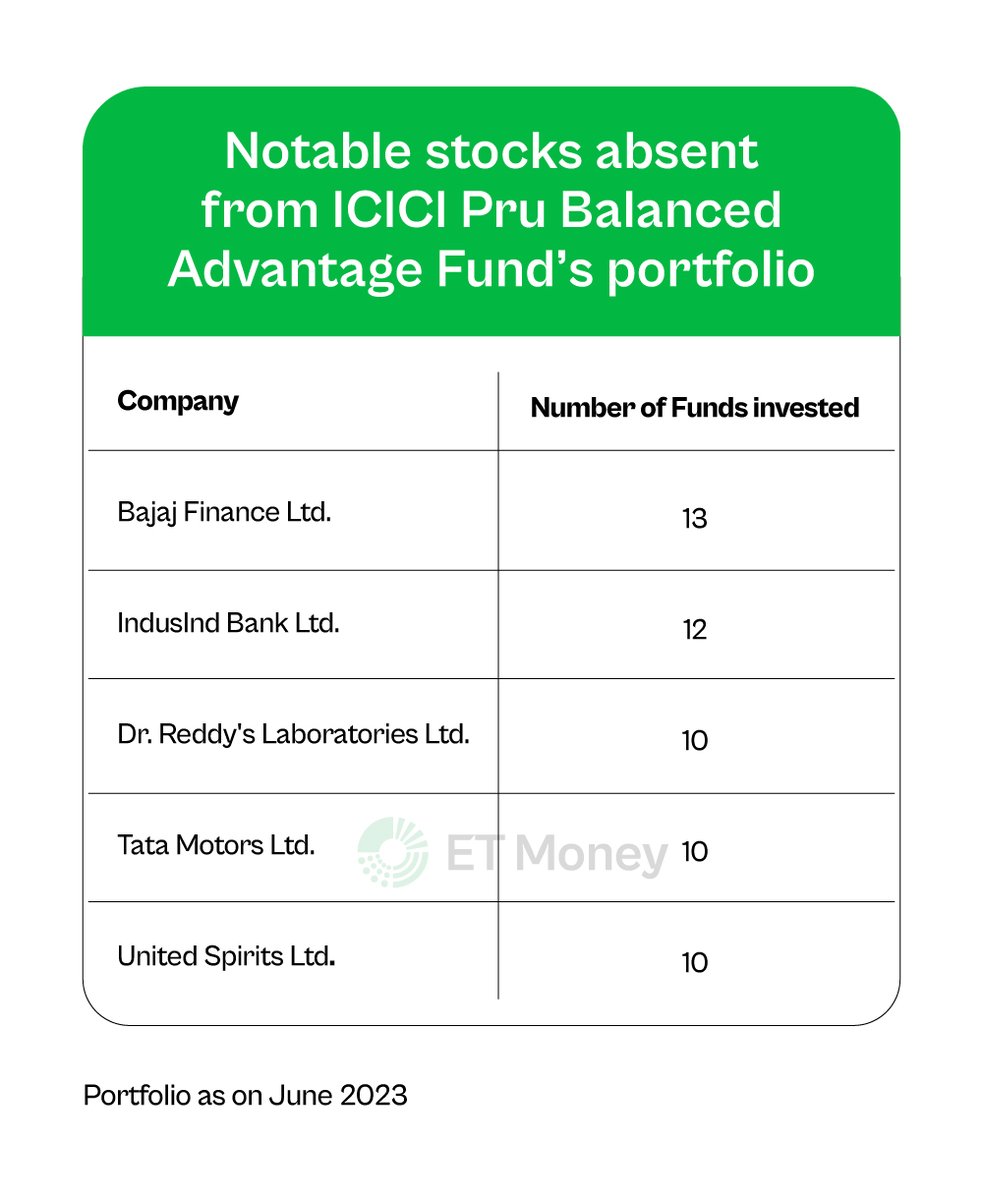

The fund has more than 70 stocks even though it has around 40% allocation to equities.

This is probably a move to avoid concentrated bets.

There are a few mid-cap stocks, but the fund largely tilts towards large caps - again, a classic approach to play safe.

This is probably a move to avoid concentrated bets.

There are a few mid-cap stocks, but the fund largely tilts towards large caps - again, a classic approach to play safe.

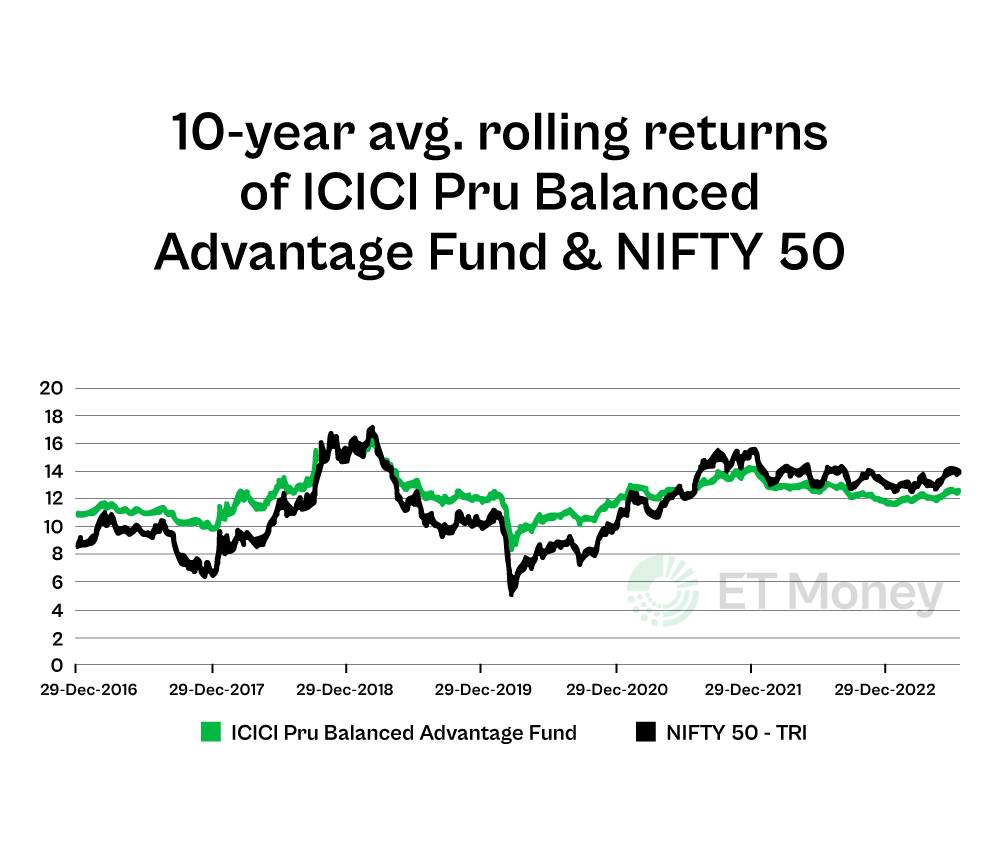

Does this fund’s strategies work?

So far, they have.

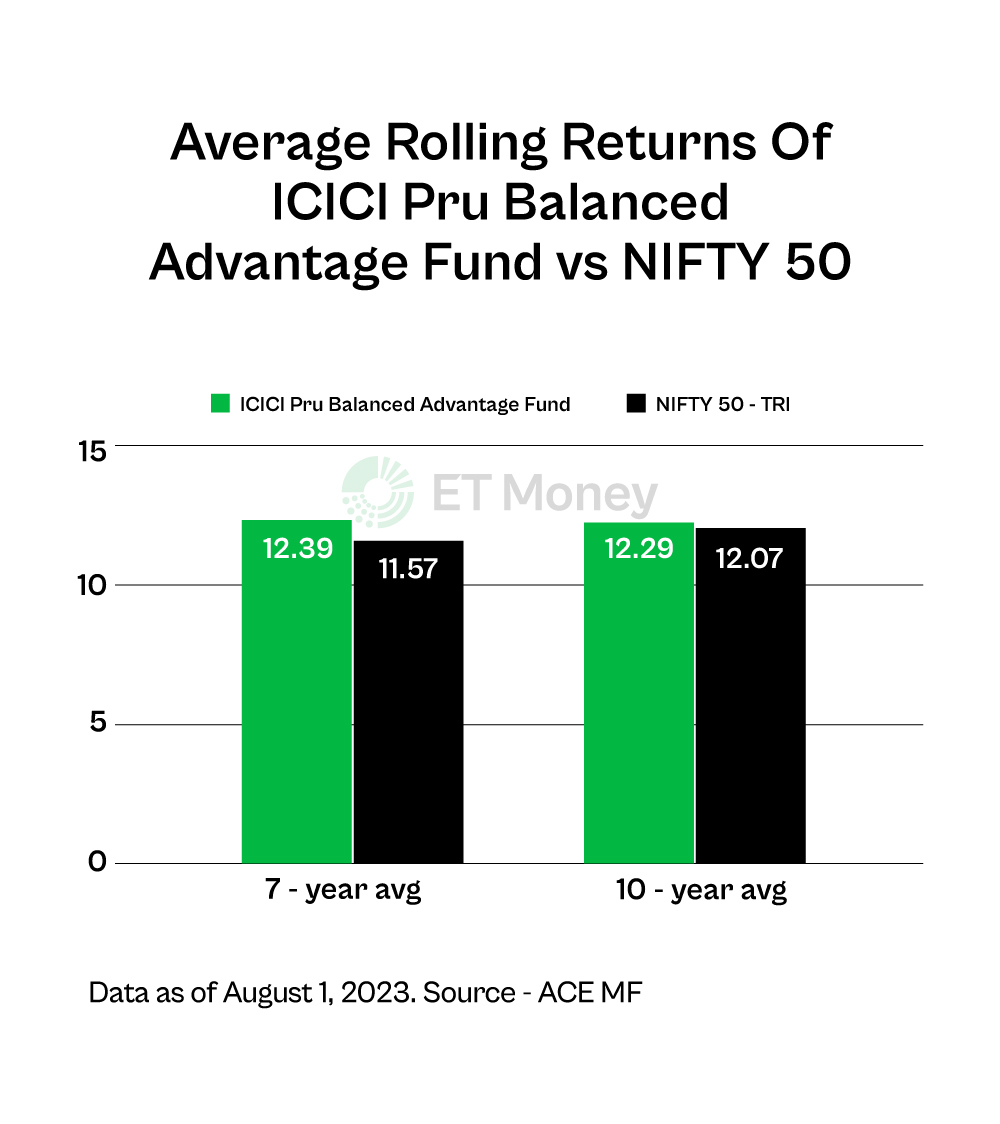

Since the fund’s inception, NIFTY 50 has witnessed negative returns in 22 quarters.

This fund has outdone NIFTY 50 in all 22 quarters.

Against peers, it has fallen less in 20/22 quarters.

What about overall returns?

So far, they have.

Since the fund’s inception, NIFTY 50 has witnessed negative returns in 22 quarters.

This fund has outdone NIFTY 50 in all 22 quarters.

Against peers, it has fallen less in 20/22 quarters.

What about overall returns?

Why does it behave this way?

Because the fund invests a sizable amount in debt and derivatives.

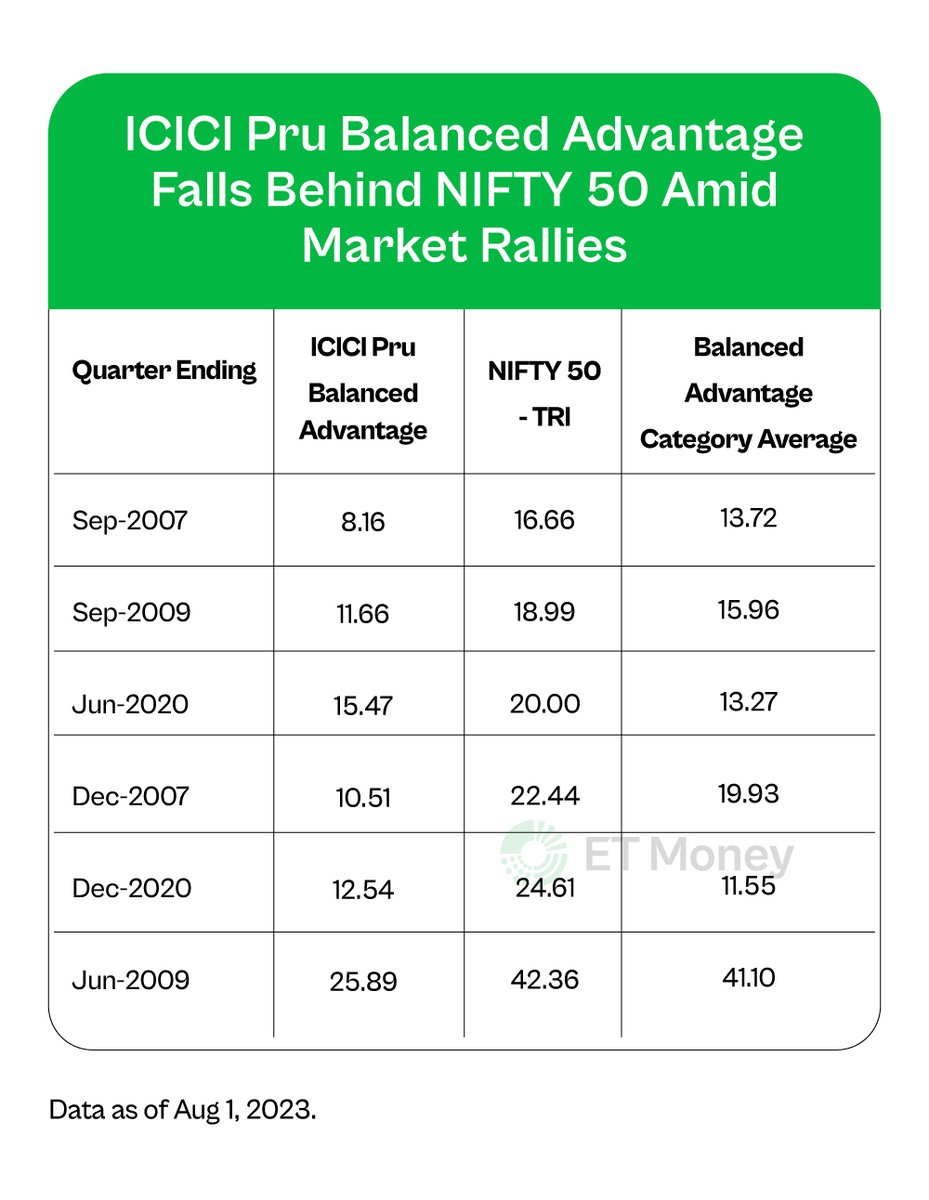

So, if there’s a rally in the market, it’s likely to fall short.

But in the long run, it catches up with broader indices like NIFTY 50 by falling less during corrections.

Because the fund invests a sizable amount in debt and derivatives.

So, if there’s a rally in the market, it’s likely to fall short.

But in the long run, it catches up with broader indices like NIFTY 50 by falling less during corrections.

What to expect from this fund?

The core strategy of this fund is to protect the downside and generate equity-like returns.

So, you can see bouts of underperformance during market rallies.

But when it comes to tough times, it can be your true friend.

The core strategy of this fund is to protect the downside and generate equity-like returns.

So, you can see bouts of underperformance during market rallies.

But when it comes to tough times, it can be your true friend.

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the FIRST tweet.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the FIRST tweet.

Let's know your thoughts on @ICICIPruMF Balanced Advantage Fund and the category.

#mutualfunds #NIFTY50 #markets

#mutualfunds #NIFTY50 #markets

Correction: In the chart, it's NIFTY 50 PB, not PE.

Loading suggestions...