1️⃣ What is Return On Invested Capital?

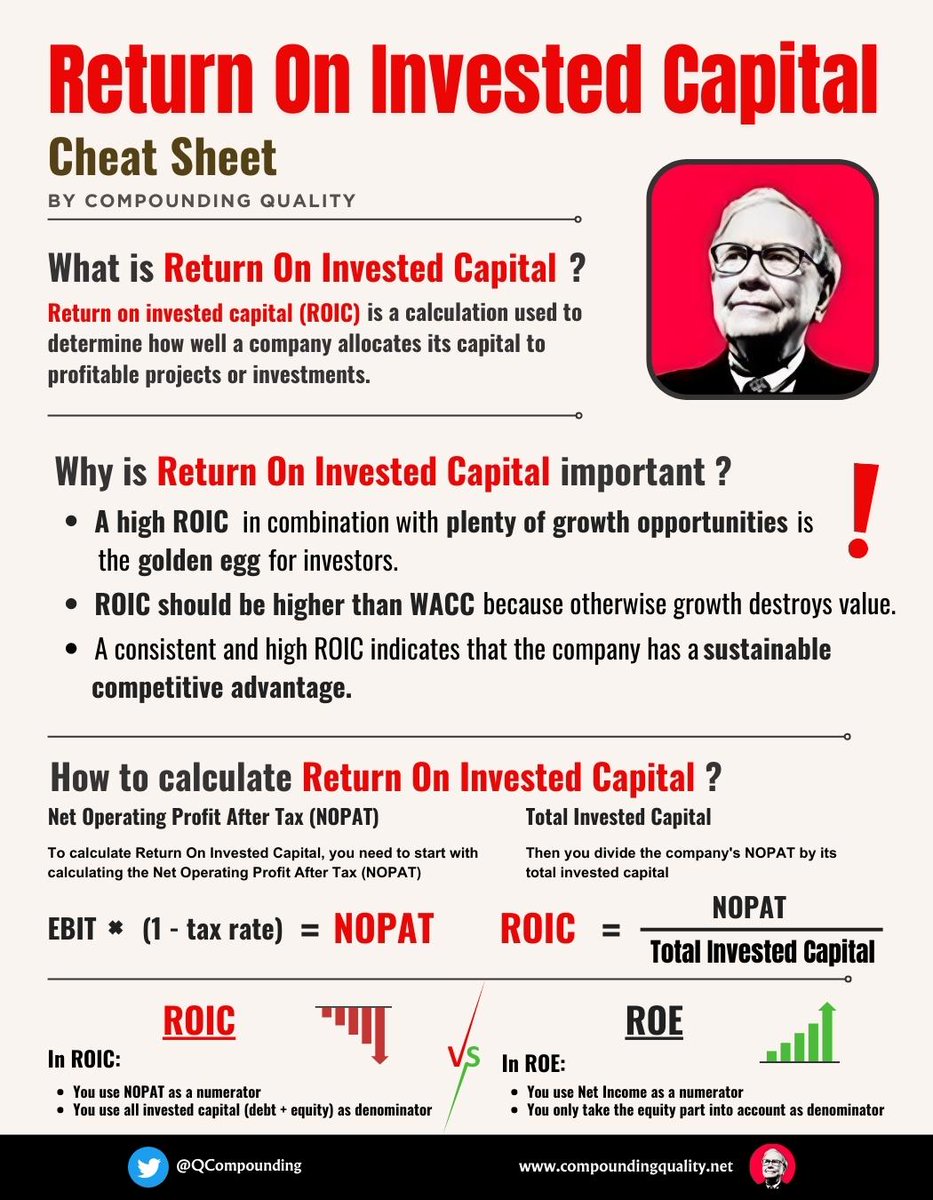

Return on invested capital (ROIC) is a calculation used to determine how well a company allocates its capital to profitable projects or investments.

Return on invested capital (ROIC) is a calculation used to determine how well a company allocates its capital to profitable projects or investments.

2️⃣ How high should ROIC be?

Capital allocation is the most important task of management.

As a rule of thumb, the ROIC should be higher than 10% and preferably higher than 15%.

Capital allocation is the most important task of management.

As a rule of thumb, the ROIC should be higher than 10% and preferably higher than 15%.

3️⃣ Why is it important?

▪️ A high ROIC + plenty of growth opportunities = golden egg

▪️ ROIC > WACC because otherwise growth destroys value

▪️ A consistent and high ROIC indicates that the company has a moat

▪️ A high ROIC + plenty of growth opportunities = golden egg

▪️ ROIC > WACC because otherwise growth destroys value

▪️ A consistent and high ROIC indicates that the company has a moat

4️⃣ How to calculate ROIC?

Return On Invested Capital = Net Operating Profit After Tax (NOPAT) / Total invested capital

NOPAT = Net Operating Profit After Tax

Invested Capital = Total assets - non-interest-bearing current liabilities

Return On Invested Capital = Net Operating Profit After Tax (NOPAT) / Total invested capital

NOPAT = Net Operating Profit After Tax

Invested Capital = Total assets - non-interest-bearing current liabilities

5️⃣ ROIC vs ROE

In ROIC:

•You use NOPAT as a numerator

•You use all invested capital (debt + equity) as denominator

In ROE:

•You use Net Income as a numerator

•You only take the equity part into account as denominator

In ROIC:

•You use NOPAT as a numerator

•You use all invested capital (debt + equity) as denominator

In ROE:

•You use Net Income as a numerator

•You only take the equity part into account as denominator

That's it for today.

If you liked this, you'll love our free Financial Analysis course.

It teaches you how to read Financial Statements like a professional.

Sign up here to receive it for free: eepurl.com

If you liked this, you'll love our free Financial Analysis course.

It teaches you how to read Financial Statements like a professional.

Sign up here to receive it for free: eepurl.com

Loading suggestions...