Part 1: The @VelodromeFi context

Velodrome is an AMM DEX with a ve(3,3) structure. However, it is better described as a liquidity marketplace designed to direct liquidity towards the pools that contribute most to the overall health of Optimism.

🧵 2

Velodrome is an AMM DEX with a ve(3,3) structure. However, it is better described as a liquidity marketplace designed to direct liquidity towards the pools that contribute most to the overall health of Optimism.

🧵 2

Unlike most AMMs, where the majority of swap fees go to Liquidity Providers, ve(3,3) AMMs have a different approach.

They distribute fees to ve token voters, who receive rewards for the pools they voted for while LPs receive emission rewards from weekly token mintings.

🧵 3

They distribute fees to ve token voters, who receive rewards for the pools they voted for while LPs receive emission rewards from weekly token mintings.

🧵 3

This separation aligns emissions with the protocol's desired actions to incentivize. The pools that generate the highest fees for voters will receive the most votes, ultimately deepening those pools and rewarding LPs.

frogsanon.neworder.network

🧵 4

frogsanon.neworder.network

🧵 4

Part 2: Ve3,3 DEXes in new ecosystems.

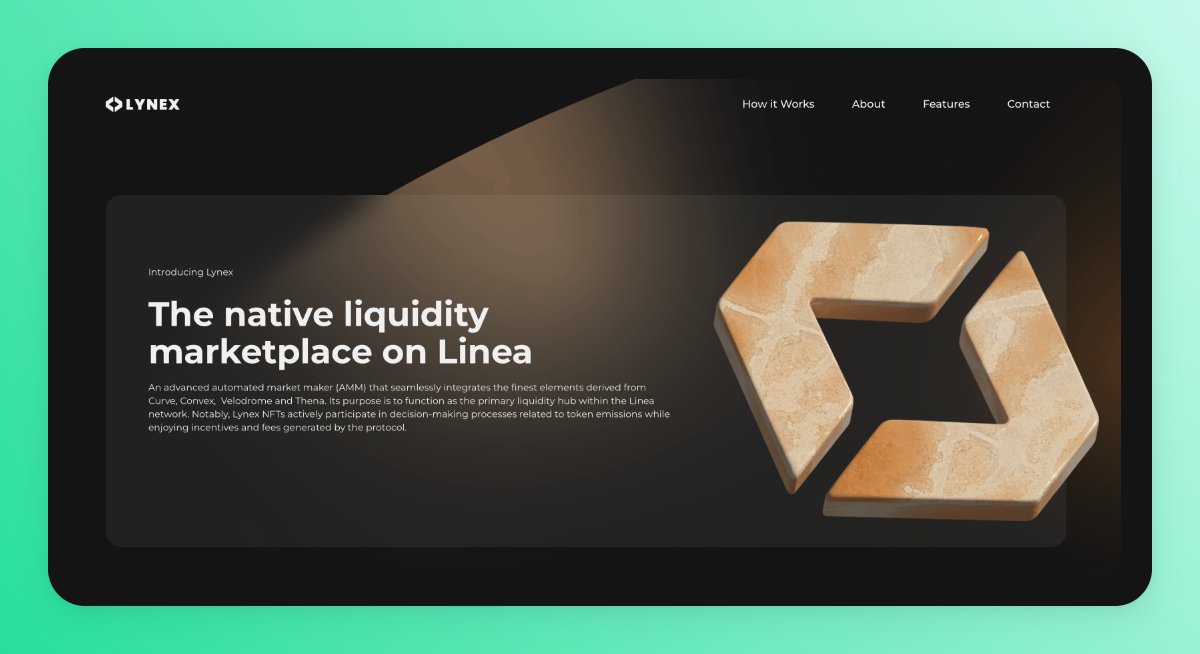

• Linea: @LynexFi.

• Base: @aerodromefi, @VelocimeterDEX, @Baso_Finance.

• Mantle: @CrustFinance, @ve_ZARD, @VelocimeterDEX, @stratumexchange, @magma_fi.

Which platform will emerge as the leading liquidity hub on these chains?

🧵 5

• Linea: @LynexFi.

• Base: @aerodromefi, @VelocimeterDEX, @Baso_Finance.

• Mantle: @CrustFinance, @ve_ZARD, @VelocimeterDEX, @stratumexchange, @magma_fi.

Which platform will emerge as the leading liquidity hub on these chains?

🧵 5

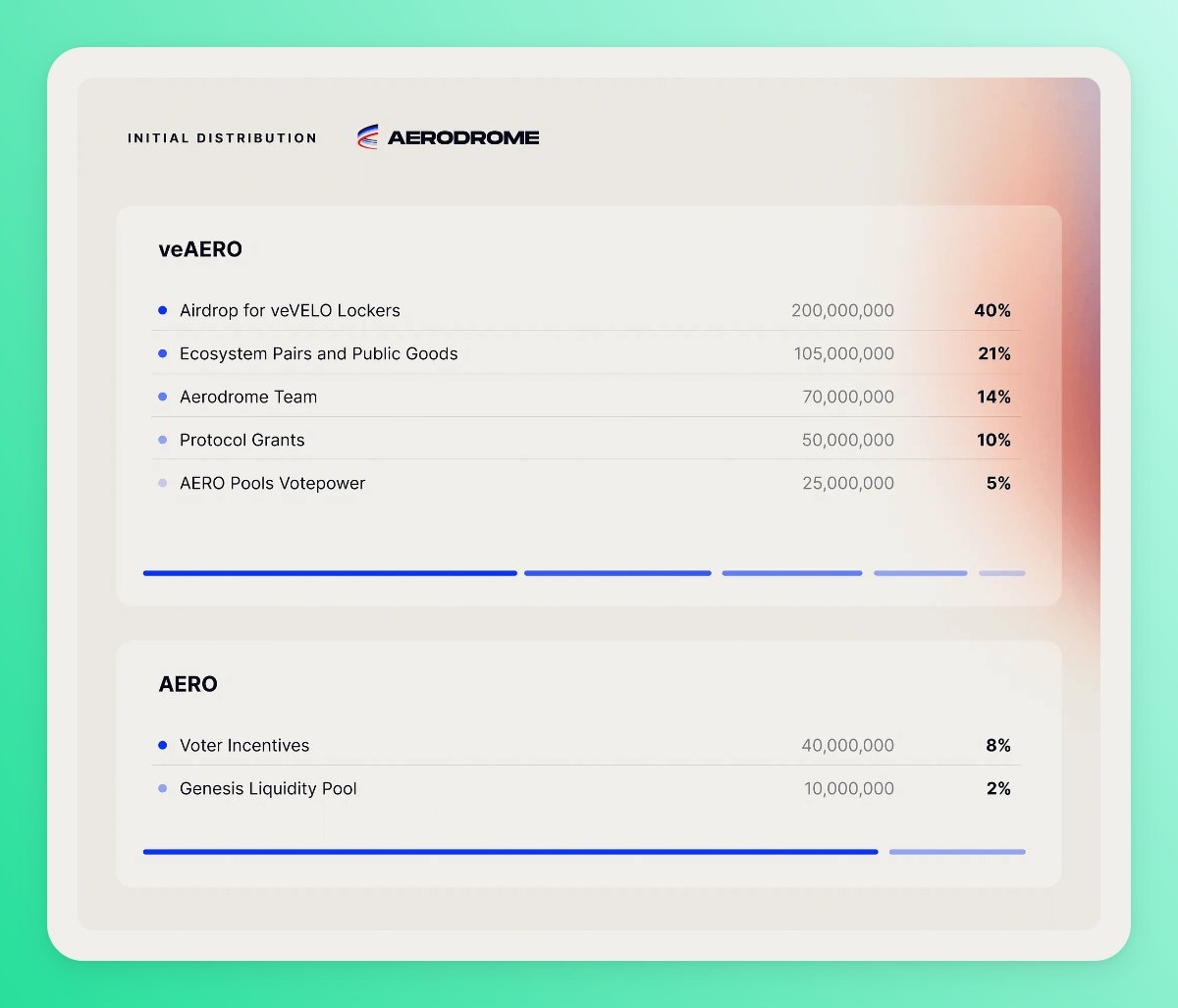

Base: @aerodromefi.

Aerodrome is the central trading and liquidity marketplace on @BuildOnBase, forked from Velodrome V2.

• Mainnet launch: ~August 2023.

• Catalyst: 40% of the token distribution → $VELO lockers, a minimum of 1000 veVELO required.

• Potential: High.

🧵 7

Aerodrome is the central trading and liquidity marketplace on @BuildOnBase, forked from Velodrome V2.

• Mainnet launch: ~August 2023.

• Catalyst: 40% of the token distribution → $VELO lockers, a minimum of 1000 veVELO required.

• Potential: High.

🧵 7

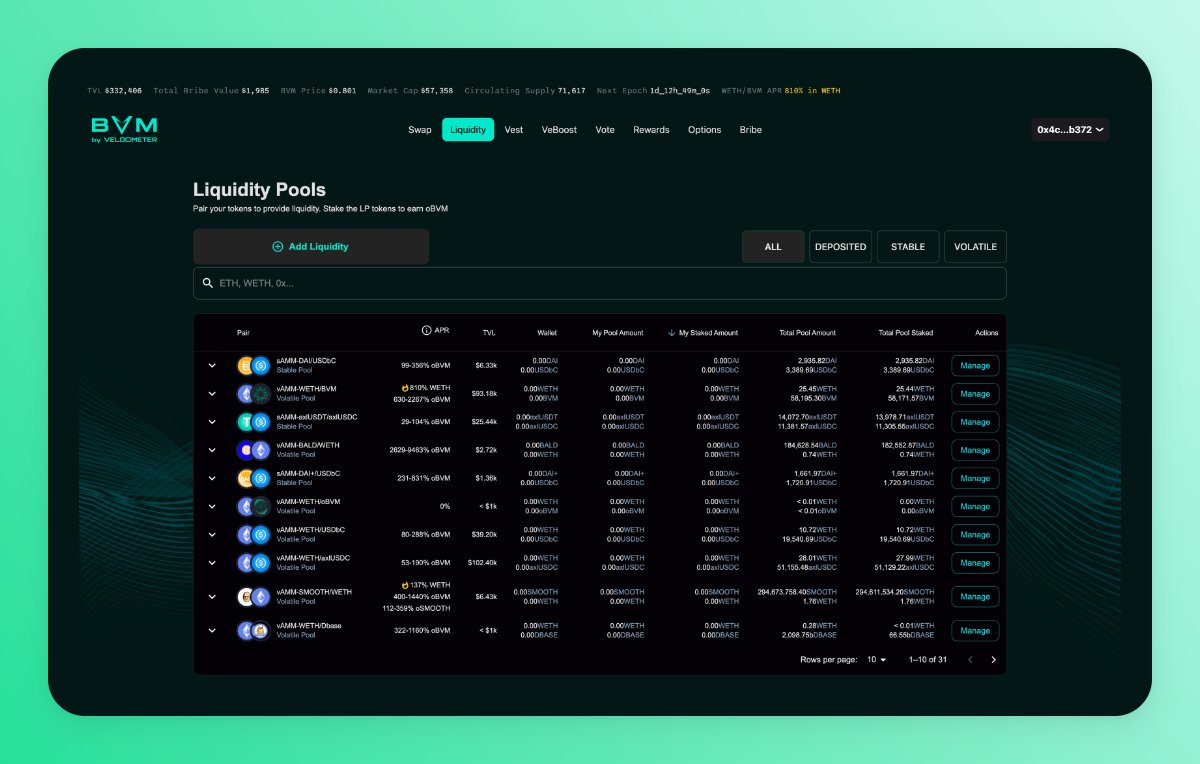

Base, Mantle: @VelocimeterDEX.

Velocimeter is a ve3,3 AMM DEX and a fork of @VelodromeFi which is live on Base (TVL $332K), Mantle (TVL $70K), Fantom (TVL $3.5M), Canto (TVL $250K), and Pulse ($50K).

• Potential: Medium.

🧵 8

Velocimeter is a ve3,3 AMM DEX and a fork of @VelodromeFi which is live on Base (TVL $332K), Mantle (TVL $70K), Fantom (TVL $3.5M), Canto (TVL $250K), and Pulse ($50K).

• Potential: Medium.

🧵 8

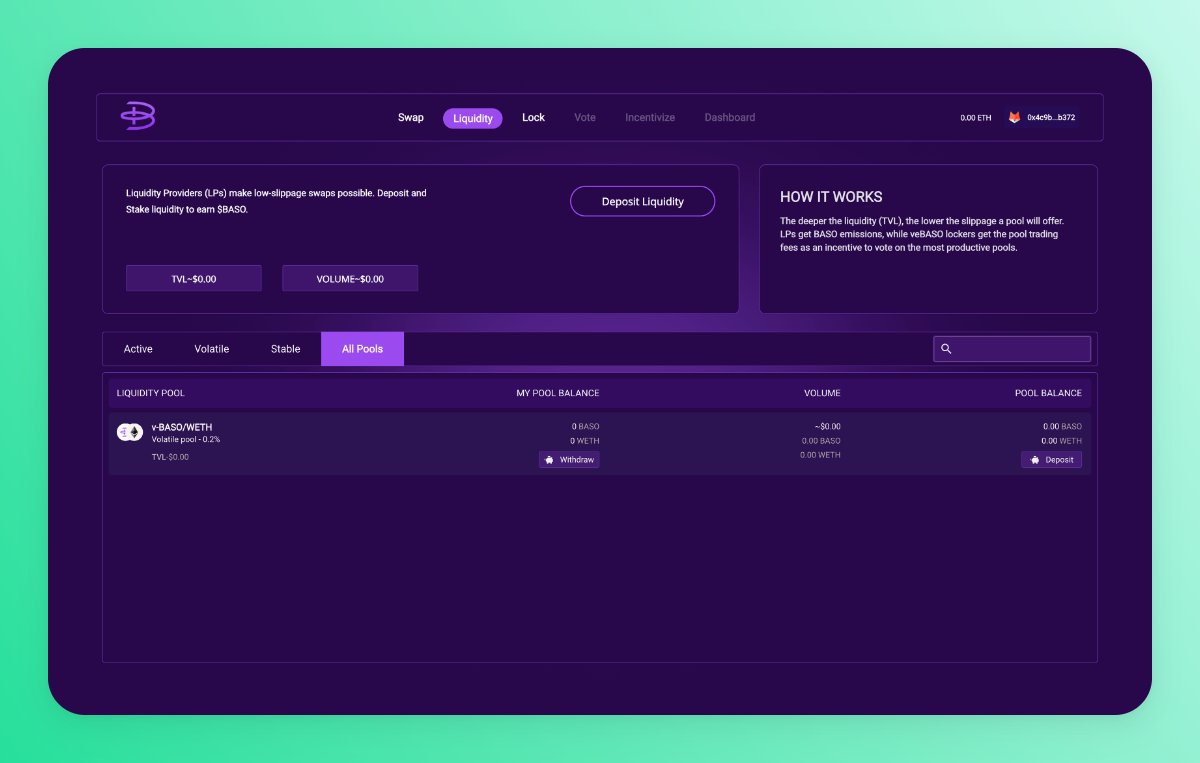

Base: @Baso_Finance.

Baso positions itself as the first fully community-owned ve(3,3) DEX on @BuildOnBase. The DEX is already live on the mainnet with only one liquidity pair and no liquidity.

• Potential: Low.

🧵 9

Baso positions itself as the first fully community-owned ve(3,3) DEX on @BuildOnBase. The DEX is already live on the mainnet with only one liquidity pair and no liquidity.

• Potential: Low.

🧵 9

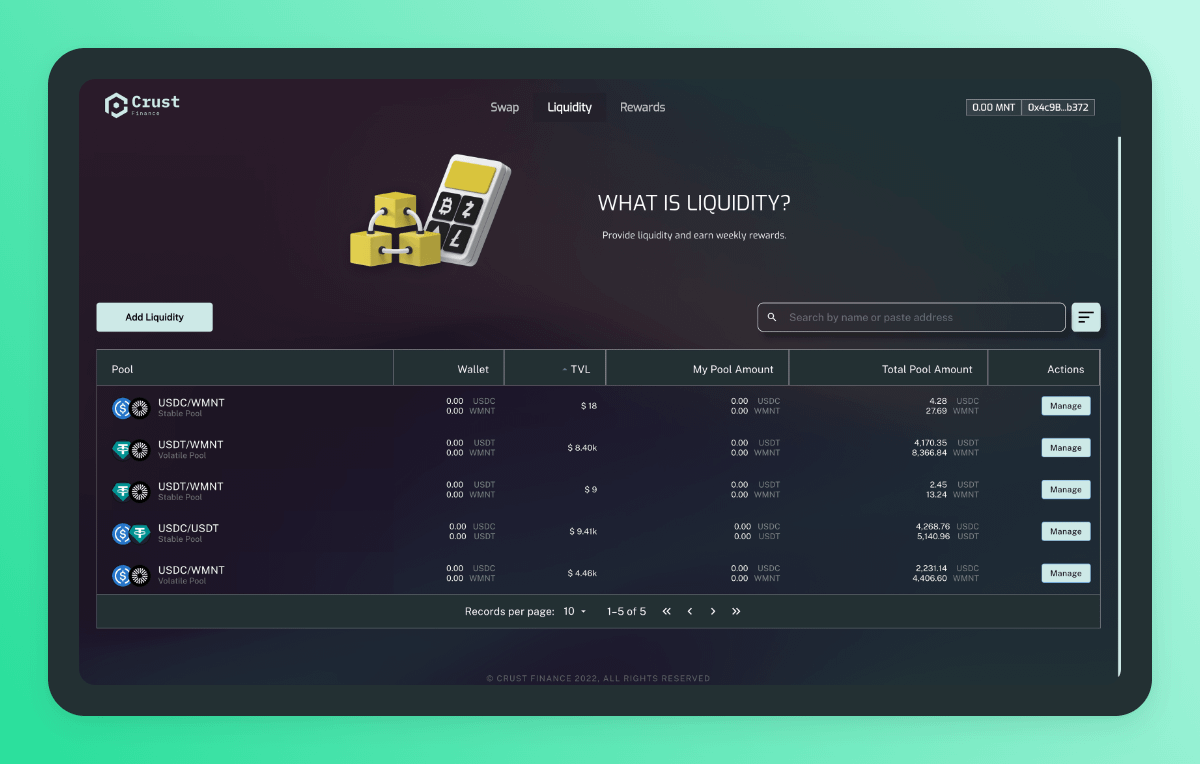

Mantle: @CrustFinance.

Crust is a ve3,3 DEX on Mantle built by the @FlairDefi team (ve3,3 on Avalanche with ~$700K TVL). Crust has been live on the mainnet with swaps and liquidity functionality available since July 20th.

Current TVL: ~20K.

Potential: Low.

🧵 10

Crust is a ve3,3 DEX on Mantle built by the @FlairDefi team (ve3,3 on Avalanche with ~$700K TVL). Crust has been live on the mainnet with swaps and liquidity functionality available since July 20th.

Current TVL: ~20K.

Potential: Low.

🧵 10

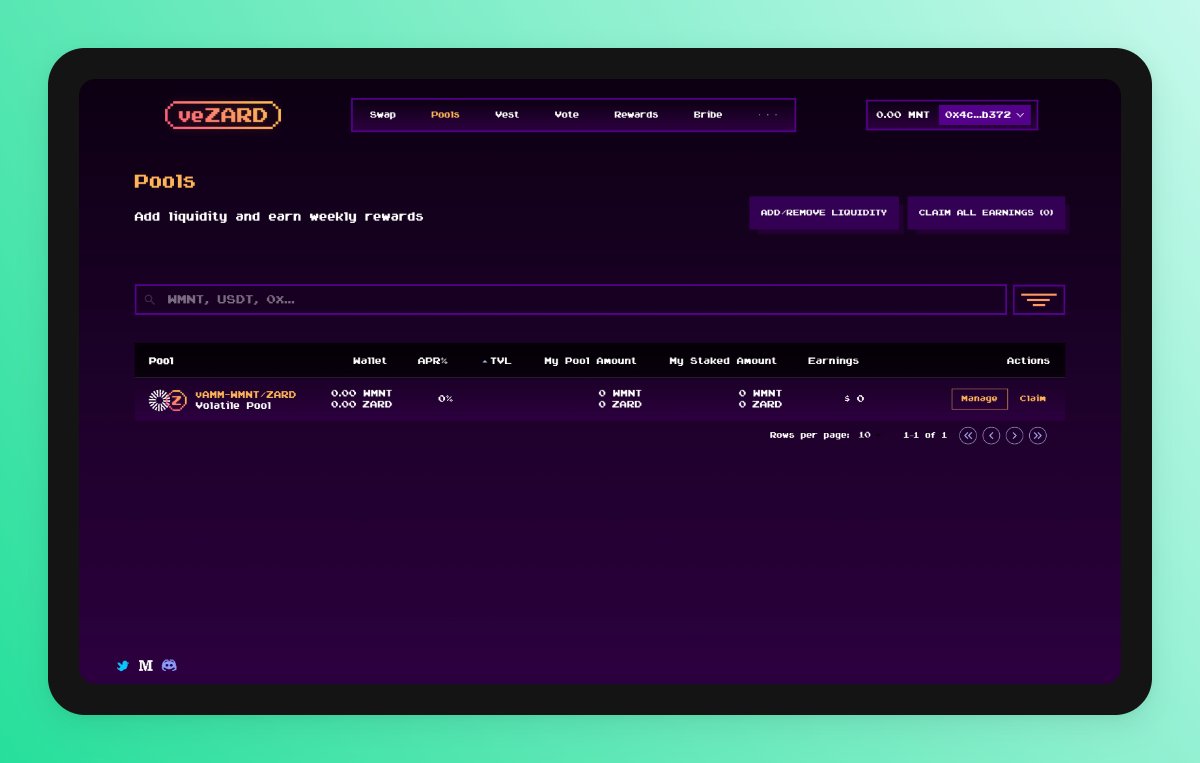

Mantle: @ve_ZARD.

VeZard is a ve3,3 DEX launched on Mantle. The product is currently in a pre-mainnet beta; the team has received an official grant and was KYCed by Mantle.

35% of tokens will be allocated to Public and Private sale investors.

Potential: Not enough data

🧵 11

VeZard is a ve3,3 DEX launched on Mantle. The product is currently in a pre-mainnet beta; the team has received an official grant and was KYCed by Mantle.

35% of tokens will be allocated to Public and Private sale investors.

Potential: Not enough data

🧵 11

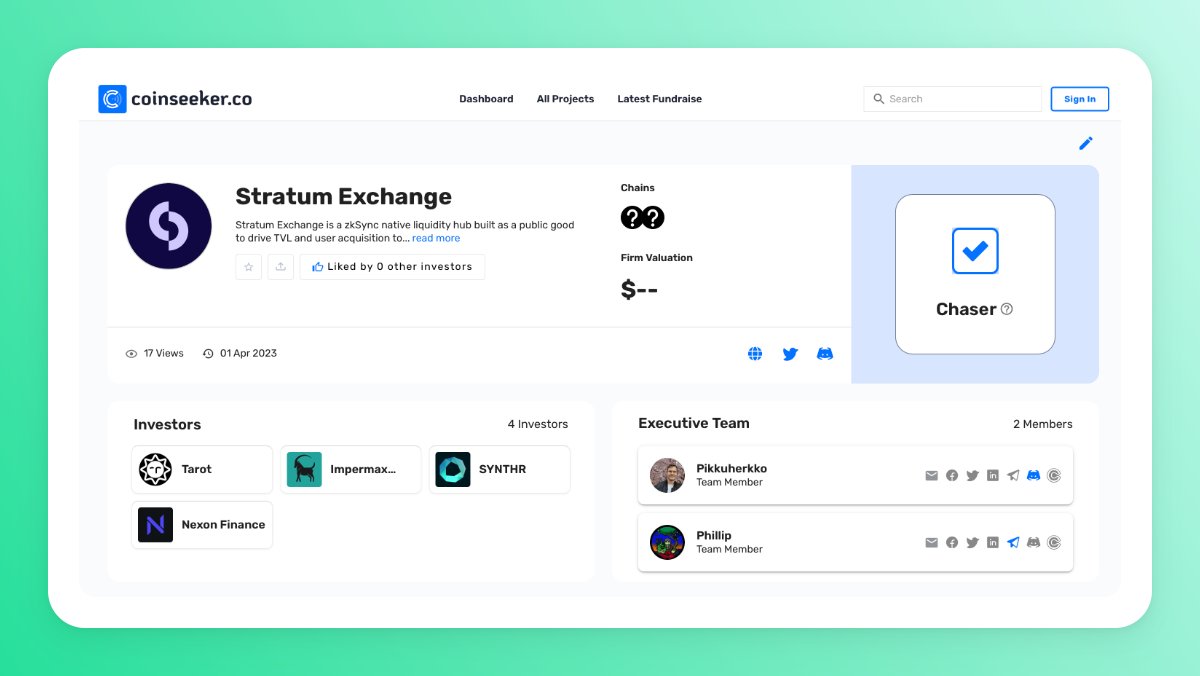

Mantle: @stratumexchange.

Stratum positions itself as a native liquidity layer on Mantle; the team received an official grant from Mantle. The product is currently in a closed beta testing stage.

Earlier, the team planned to launch on zkSync.

Potential: Not enough data.

🧵 12

Stratum positions itself as a native liquidity layer on Mantle; the team received an official grant from Mantle. The product is currently in a closed beta testing stage.

Earlier, the team planned to launch on zkSync.

Potential: Not enough data.

🧵 12

Mantle: @magma_fi.

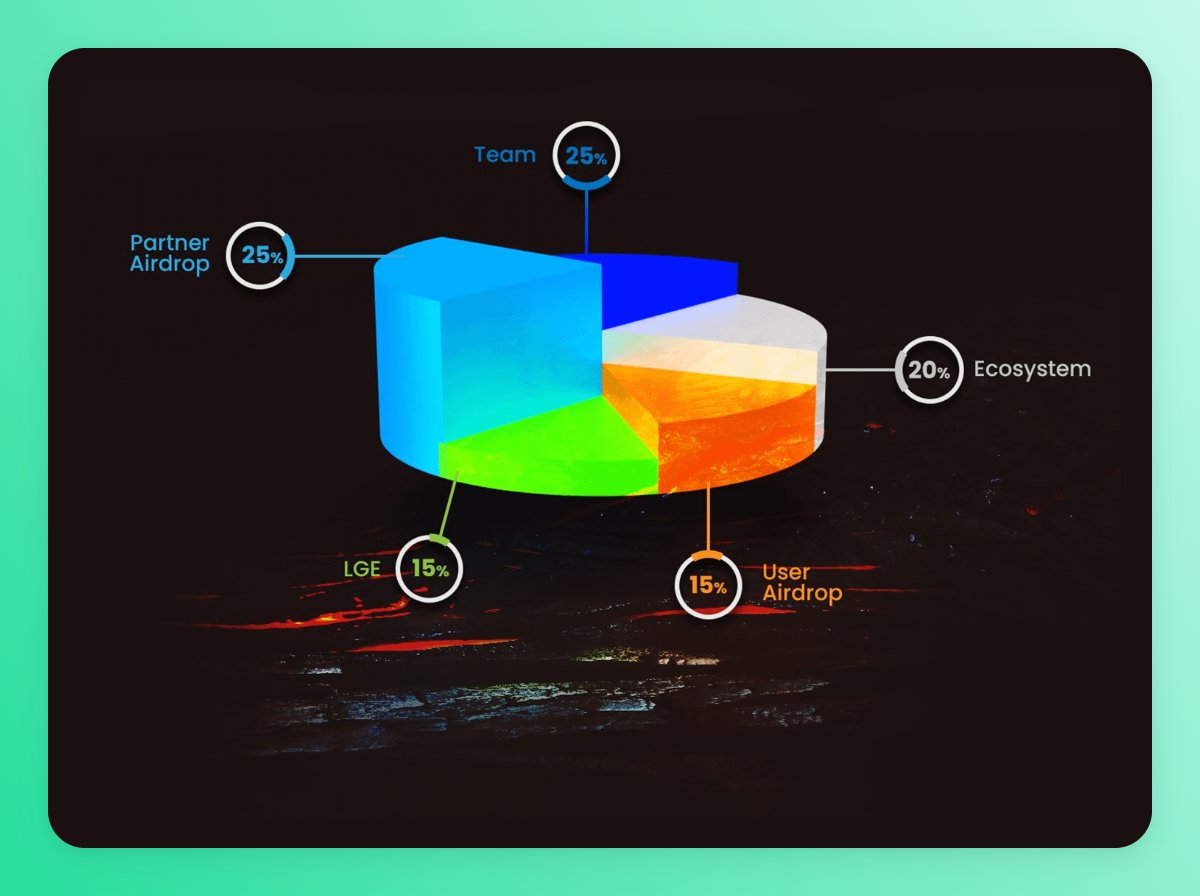

Magma is a new Mantle ve3,3 DEX which is yet to launch on Mantle. The protocol plans to airdrop 15% of oMAGMA tokens to users; another 15% is locked for the IDO event. The team allocation is quite high (25%).

Potential: Not enough data

🧵 13

Magma is a new Mantle ve3,3 DEX which is yet to launch on Mantle. The protocol plans to airdrop 15% of oMAGMA tokens to users; another 15% is locked for the IDO event. The team allocation is quite high (25%).

Potential: Not enough data

🧵 13

Right now, I see 2 promising ve3,3 protocols to lead the ve3,3 narrative on Linea and Base:

• @LynexFi, set to launch in August, stands out as the only Linea ve3,3 protocol.

• @aerodromefi is a protocol that aims to extract liquidity from @VelocimeterDEX.

🧵 14

• @LynexFi, set to launch in August, stands out as the only Linea ve3,3 protocol.

• @aerodromefi is a protocol that aims to extract liquidity from @VelocimeterDEX.

🧵 14

DISCLOSURE: I am a @LynexFi ambassador. I agreed to join the board because I strongly believe that the team has everything needed to become the main liquidity hub on Linea.

Though always do your own research; my content is NFA.

🧵 15

Though always do your own research; my content is NFA.

🧵 15

Which emerging ve3,3 protocols you watching closely, frens?

• @poopmandefi

• @wacy_time1

• @Defi_Warhol

• @CryptoGirlNova

• @0xSalazar

• @2lambro

• @Hercules_Defi

• @Defi0xJeff

• @Shitcoinomics

• @Dynamo_Patrick

• @DefiIgnas

• @hmalviya9

• @thedefiedge

🧵 16/16

• @poopmandefi

• @wacy_time1

• @Defi_Warhol

• @CryptoGirlNova

• @0xSalazar

• @2lambro

• @Hercules_Defi

• @Defi0xJeff

• @Shitcoinomics

• @Dynamo_Patrick

• @DefiIgnas

• @hmalviya9

• @thedefiedge

🧵 16/16

Loading suggestions...