In this thread, I will cover the following:

- some MS points

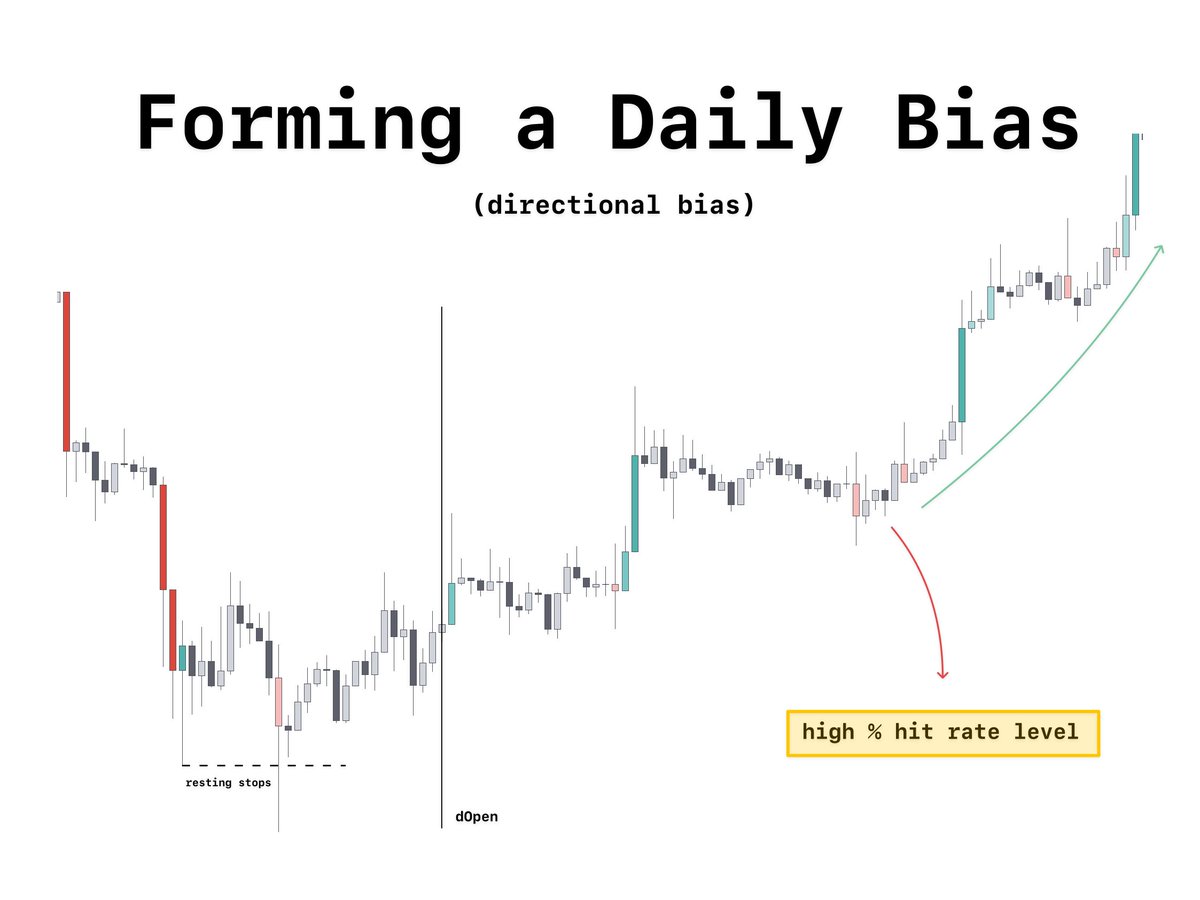

- using stats to help my bias

- directional bias through liquidity

- some MS points

- using stats to help my bias

- directional bias through liquidity

combination

resting liquidity - below price

high hit rate level - below price

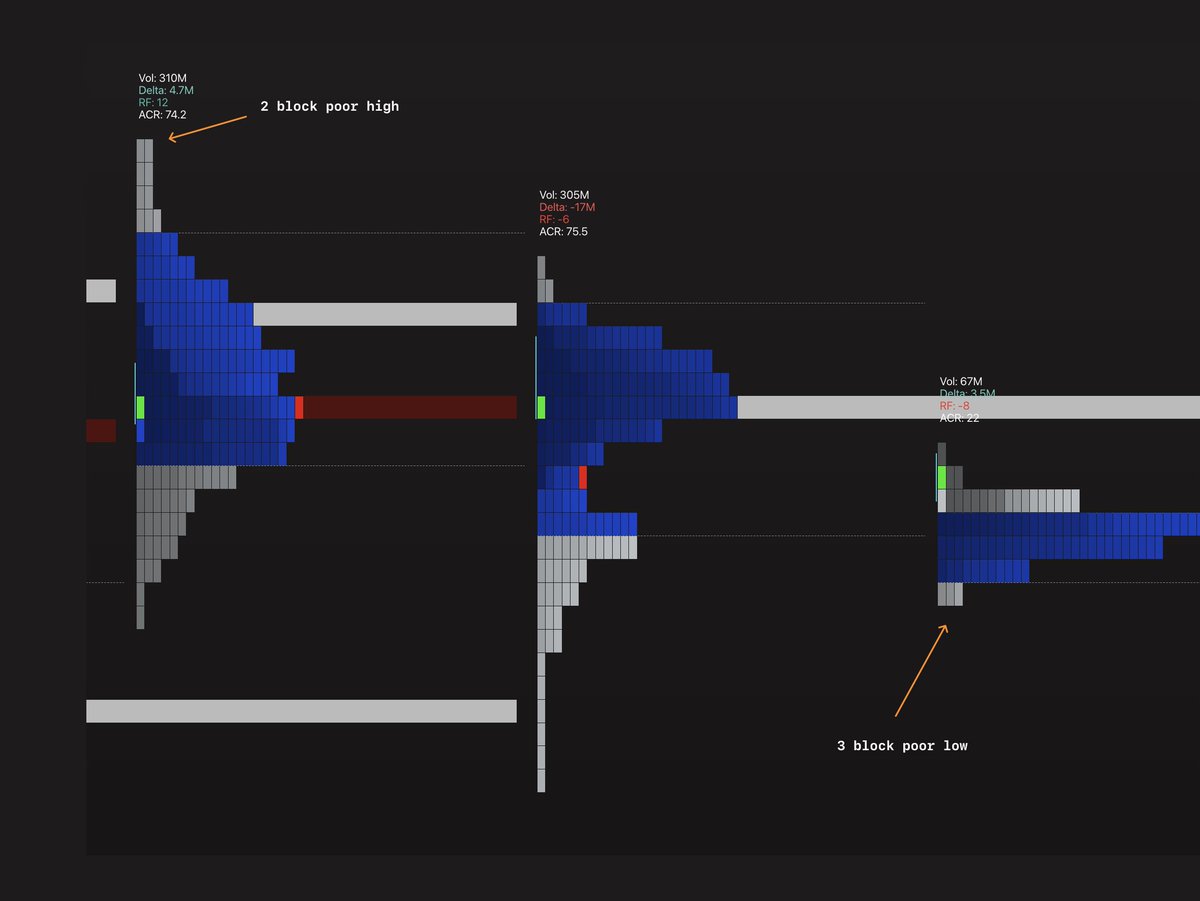

poor highs/lows - below price

I would be favoring shorts that day

and visa versa

resting liquidity - below price

high hit rate level - below price

poor highs/lows - below price

I would be favoring shorts that day

and visa versa

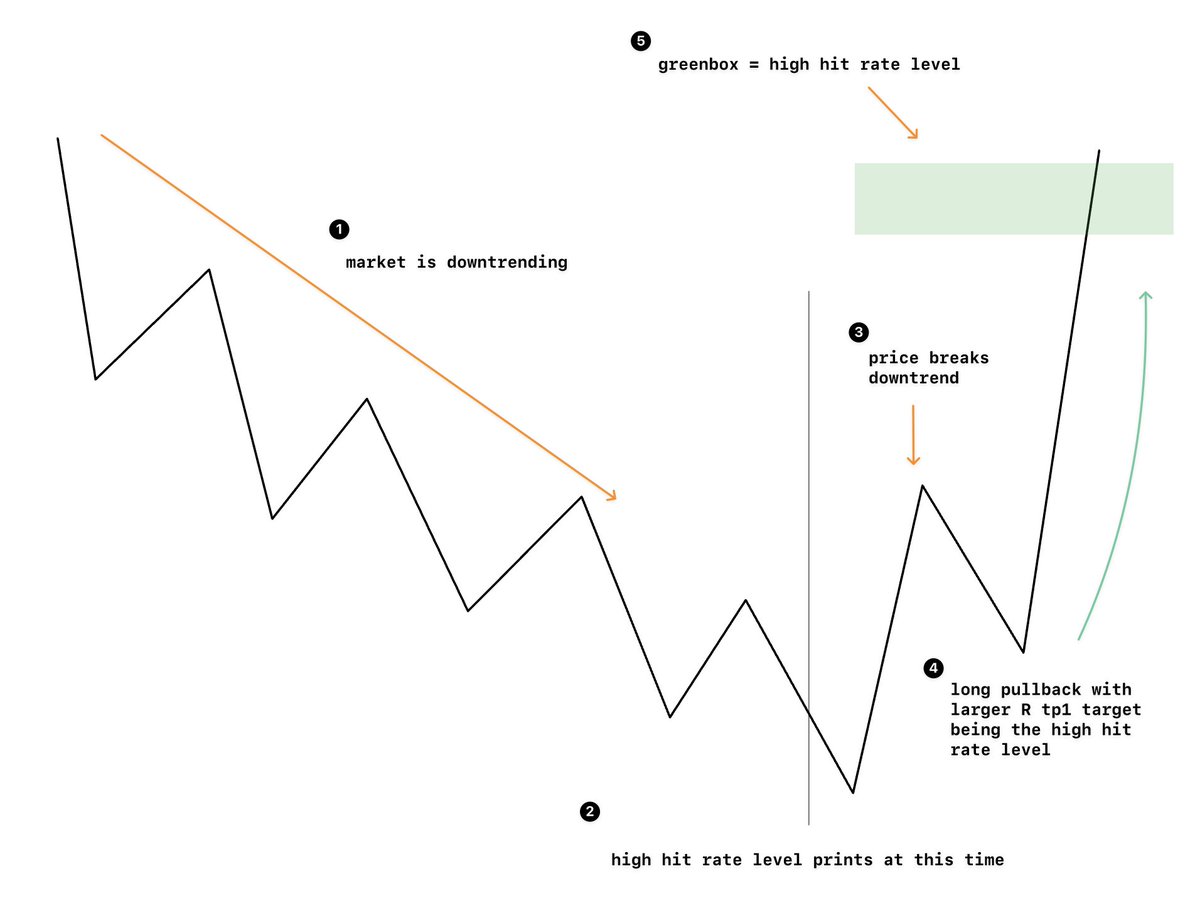

finding high hit rate levels

in the future, I will share some of mine, currently they do give me too much of an edge to release

what I suggest is to think about levels you generally feel would be revisited then put the work in and get direct figures on a trial-and-error basis

in the future, I will share some of mine, currently they do give me too much of an edge to release

what I suggest is to think about levels you generally feel would be revisited then put the work in and get direct figures on a trial-and-error basis

hope you found this valuable, likes and retweets are appreciated

Let me know below what thread you would like to see next 👇

Let me know below what thread you would like to see next 👇

Loading suggestions...