1. Coping with Mistakes

Don't be afraid to make a mistake.

Only ensure you make one that you can afford so that you may live to make another.

You can never completely avoid mistakes, but you can choose to only invest when the worst outcome isn't deadly.

Don't be afraid to make a mistake.

Only ensure you make one that you can afford so that you may live to make another.

You can never completely avoid mistakes, but you can choose to only invest when the worst outcome isn't deadly.

2. Judgement

Good judgment comes from experience.

Experience comes from bad judgment.

You can and need to learn the theory of investing, but the best teacher is experience.

Good judgment comes from experience.

Experience comes from bad judgment.

You can and need to learn the theory of investing, but the best teacher is experience.

3. Price

It's important what you buy.

But it's even more important at what price you buy.

The best business can be a bad investment at the wrong price.

A bad business can be a good investment at the right price.

It's important what you buy.

But it's even more important at what price you buy.

The best business can be a bad investment at the wrong price.

A bad business can be a good investment at the right price.

4. Invest in Businesses, not Companies

Most investors invest in companies.

They are excited about the story, the CEO, and the possible future.

Successful investors invest in the nature of the business.

Most investors invest in companies.

They are excited about the story, the CEO, and the possible future.

Successful investors invest in the nature of the business.

5. Selective but Decisive

Be very selective about what businesses are good enough to buy.

But if you see the right business at the right price, grab it.

There won't be many opportunities like this.

And those are the handful of investments that drive your wealth up.

Be very selective about what businesses are good enough to buy.

But if you see the right business at the right price, grab it.

There won't be many opportunities like this.

And those are the handful of investments that drive your wealth up.

6. Don't Clone

Blindly following the investments of great investors won't make you rich.

You don't know when they get in and when they get out.

You don't know their motivation or thesis for the investment.

Do your own research and see what works for you.

Blindly following the investments of great investors won't make you rich.

You don't know when they get in and when they get out.

You don't know their motivation or thesis for the investment.

Do your own research and see what works for you.

7. Cash

Always have some cash on hand to be able to grab an opportunity when it arises.

Liquidity gives you flexibility.

And you need that flexibility to react fast enough.

Always have some cash on hand to be able to grab an opportunity when it arises.

Liquidity gives you flexibility.

And you need that flexibility to react fast enough.

8. Aspire but never Envy

Envy is what drives many mindless investment decisions.

FOMO is kicking in, and you feel entitled to the same success others have.

Avoid these feelings, feel aspired but never envy.

Envy is what drives many mindless investment decisions.

FOMO is kicking in, and you feel entitled to the same success others have.

Avoid these feelings, feel aspired but never envy.

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

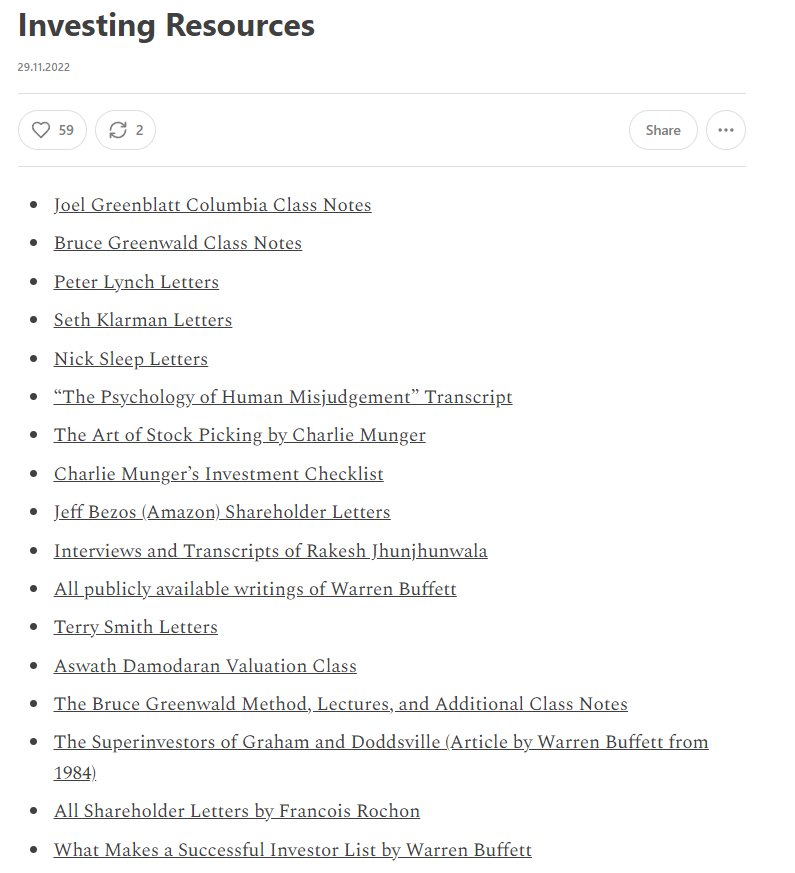

If you want to know more about Rakesh, I compiled a PDF of his public writings on my Website:

You can find it at "Investing Resources"

danielmnke.com

You can find it at "Investing Resources"

danielmnke.com

جاري تحميل الاقتراحات...