Business Overview:

- Q1 FY24 experienced well-balanced performance which was line with expectations

- Growth is aided by aerospace, automotive, energy & utility segments. Also growth is supported by healthcare & life sciences during second half of FY24

- Q1 FY24 experienced well-balanced performance which was line with expectations

- Growth is aided by aerospace, automotive, energy & utility segments. Also growth is supported by healthcare & life sciences during second half of FY24

Financial Performance:

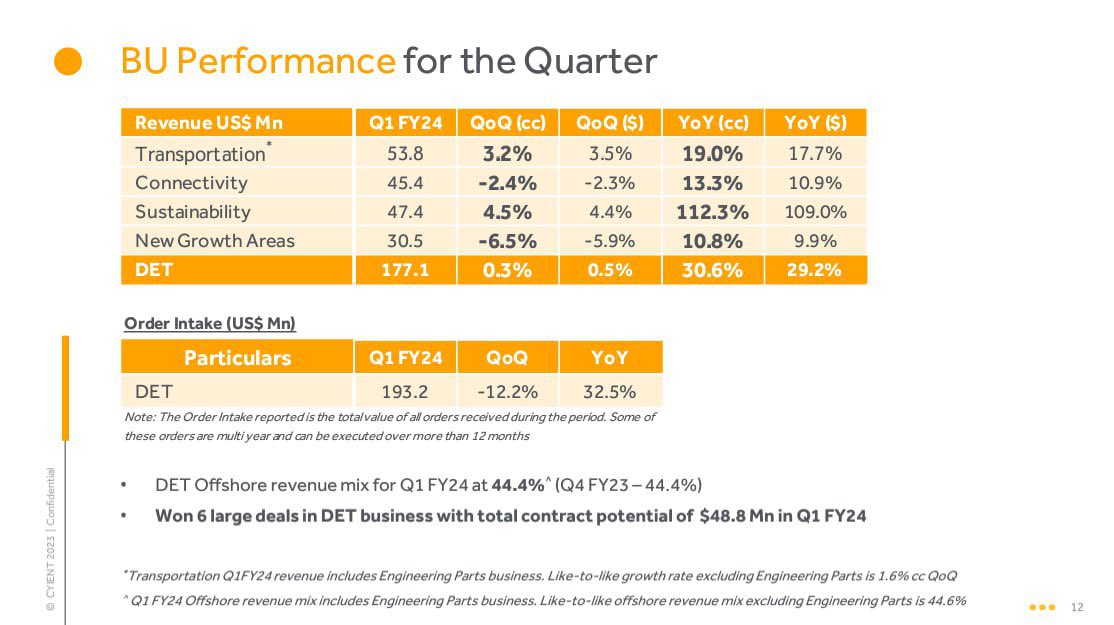

- DET revenue grew by 0.3% on QoQ basis & 30.6% on YoY basis

- DET margins stood at 6% which is highest in last 9 year, driven by improvement in SG&A cost

- Core segment of automotive & sustainability continue to witness a very strong growth on QoQ & YoY

- DET revenue grew by 0.3% on QoQ basis & 30.6% on YoY basis

- DET margins stood at 6% which is highest in last 9 year, driven by improvement in SG&A cost

- Core segment of automotive & sustainability continue to witness a very strong growth on QoQ & YoY

- Cyient DET

- It is most of what traditionally engineering services has transformed recently with adoption of digital transformation & now this has rapidly evolved in adopt of advanced technology such as generative AI

- Co. is strong rapidly evolving player in this space

- It is most of what traditionally engineering services has transformed recently with adoption of digital transformation & now this has rapidly evolved in adopt of advanced technology such as generative AI

- Co. is strong rapidly evolving player in this space

- It also includes earth-ware businesses & engineering part business

- Apart from evolution of segment nomenclature from services to DET, addition here is reclassification of engineering part business based on business & client efficiency

- Apart from evolution of segment nomenclature from services to DET, addition here is reclassification of engineering part business based on business & client efficiency

New Growth Areas:

- They have started to de grow at -6.5% which is attributed to hi-tech

- While co. continue to see good momentum in automotive

- There is some softness in semiconductor business

- While, healthcare & license business are flat compared to last quarter

- They have started to de grow at -6.5% which is attributed to hi-tech

- While co. continue to see good momentum in automotive

- There is some softness in semiconductor business

- While, healthcare & license business are flat compared to last quarter

Outlook:

- Co. continue investment in green transportation, energy transition, & security digital health & automotive as well as decarbonisation & saw growth in aerospace

- There is good momentum in advanced air mobility solutions so it could give acceleration in next 3 year

- Co. continue investment in green transportation, energy transition, & security digital health & automotive as well as decarbonisation & saw growth in aerospace

- There is good momentum in advanced air mobility solutions so it could give acceleration in next 3 year

- Wireless business has stronger footing with funding coming from US government on Argos

- Hydrogen & Pneumonia based green energy & carbon capture utilisation are investment areas

- Hydrogen & Pneumonia based green energy & carbon capture utilisation are investment areas

Success Stories:

- Co. won a large project on semi-autonomous drive collision & obstacles avoidance system for construction equipment from Europe

- Also won some projects on Ada’s feature development & integration with EV truck & software different vehicles are core embedded

- Co. won a large project on semi-autonomous drive collision & obstacles avoidance system for construction equipment from Europe

- Also won some projects on Ada’s feature development & integration with EV truck & software different vehicles are core embedded

- Network analytic & automation led by cloud enabled & driven by analytic & zero touch provision has given some of results & new wins, strong pipeline in this area

- Co. made progress in AI power software testing & industrial data fabric with AWS as key partnership

- Co. made progress in AI power software testing & industrial data fabric with AWS as key partnership

Learn about Nifty Option chain analysis, daily trading positions & top stocks to buy using Techno Funda analysis. Subscribe to our Telegram channel & follow on YouTube for valuable insights! 🚀 #StockMarket #Investing

👇🏻👇🏻👇🏻👇🏻👇🏻

T.me

@TheTycoonMindset" target="_blank" rel="noopener" onclick="event.stopPropagation()">youtube.com

👇🏻👇🏻👇🏻👇🏻👇🏻

T.me

@TheTycoonMindset" target="_blank" rel="noopener" onclick="event.stopPropagation()">youtube.com

Loading suggestions...