1/ I’m currently farming this one cos community first and it’s very important

Wen I say community I mean 0 VCs, team self funding and the tech is gud asf!

Most times wen u hear VC funded it means us masses don’t get a fair share of price cos VCs get in earlier than us

Wen I say community I mean 0 VCs, team self funding and the tech is gud asf!

Most times wen u hear VC funded it means us masses don’t get a fair share of price cos VCs get in earlier than us

2/ But for Good entry, 0 VCs, u get the real price to the good tech cake

Enjoy enjoyoor!

GE is currently live on Arbitrum and is gearing up for massive moves in the whole ecosytem.

GOOD is Everywhere

Enjoy enjoyoor!

GE is currently live on Arbitrum and is gearing up for massive moves in the whole ecosytem.

GOOD is Everywhere

5/ Uses AMM to generate yield, and users have flexibility and control over their deposited assets.

ezVaults are similar to GLP and hold multiple Uniswap v3 asset positions, which are rebalanced for max yield generation.

Risks is Impermanent Loss

Now, you understand, now vault

ezVaults are similar to GLP and hold multiple Uniswap v3 asset positions, which are rebalanced for max yield generation.

Risks is Impermanent Loss

Now, you understand, now vault

6/ Imagine 10x leverage trading without no liquidation

Yes it’s possible, @goodentrylabs is doing that

GE (goodentry) does this 👆🏻with its protected preps technology

Uses the Uniswap V3 and AAVE lending market to ensure efficient usage for traders and farmers

Yes it’s possible, @goodentrylabs is doing that

GE (goodentry) does this 👆🏻with its protected preps technology

Uses the Uniswap V3 and AAVE lending market to ensure efficient usage for traders and farmers

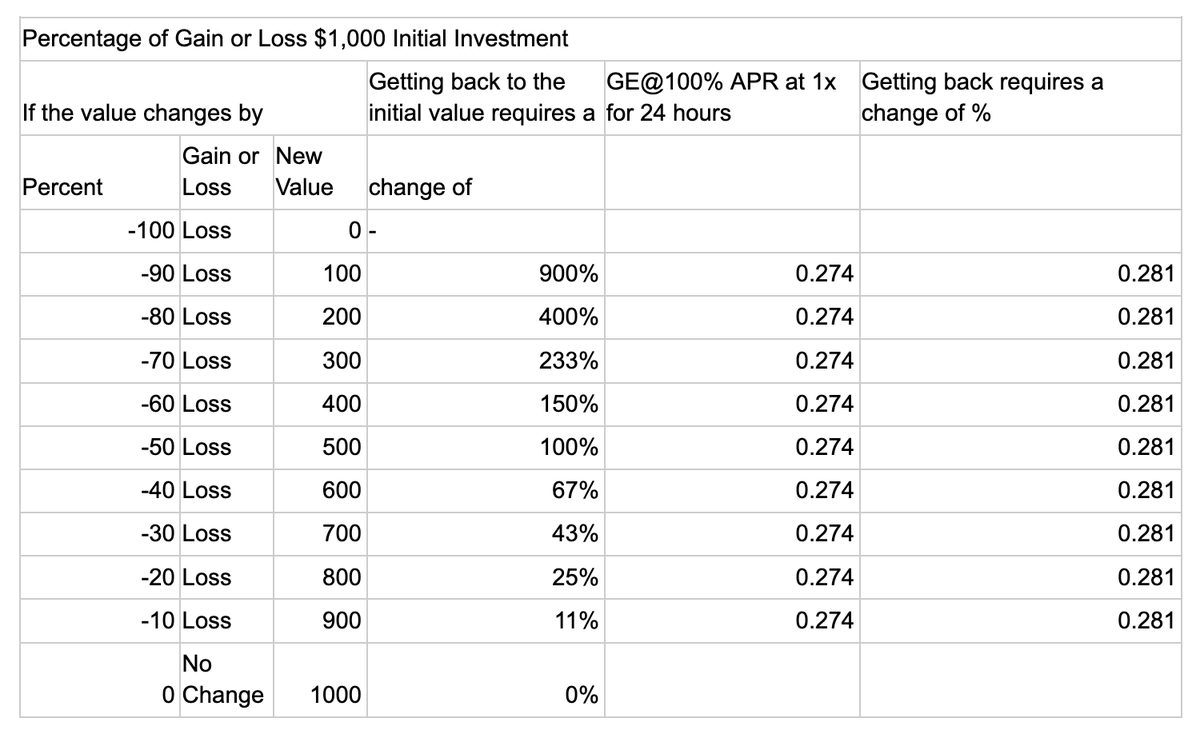

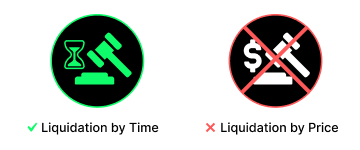

10/ Traders are not liquidated based on price movements.

Instead, liquidation occurs over time

Traders pay for protection block-by-block from their margin.

If margin usage exceeds 99%, a liquidator may close part of the position.

Instead, liquidation occurs over time

Traders pay for protection block-by-block from their margin.

If margin usage exceeds 99%, a liquidator may close part of the position.

11/ Watch margin usage & manage positions to stay safe.

All these 👆🏻works through a combination of Uniswap V3 and AAVE lending market

I’ll leave much of the liquidation tech talk for a better thread on it, will advise to read this👇🏻 if u wanna know more

All these 👆🏻works through a combination of Uniswap V3 and AAVE lending market

I’ll leave much of the liquidation tech talk for a better thread on it, will advise to read this👇🏻 if u wanna know more

Loading suggestions...