By 2030, tokenization of real-world assets will be a $16 TRILLION industry.

It will entirely transform real estate, private equity, stocks, bonds, and most forms of investing.

Here's what you need to know:

It will entirely transform real estate, private equity, stocks, bonds, and most forms of investing.

Here's what you need to know:

According to Blackrock's Larry Fink, " the next generation for securities, will be tokenization of securities."

youtu.be

youtu.be

Tokenized assets can also be used to secure loans.

This is useful for businesses that struggle to get regular financing, especially in developing markets where funding is often hard to come by.

This is useful for businesses that struggle to get regular financing, especially in developing markets where funding is often hard to come by.

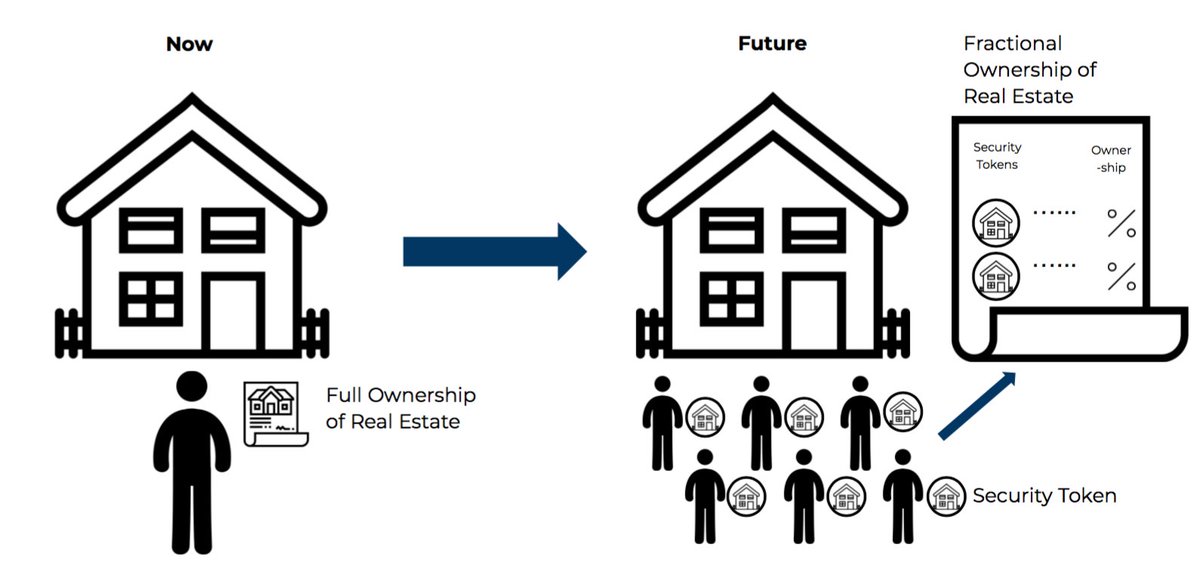

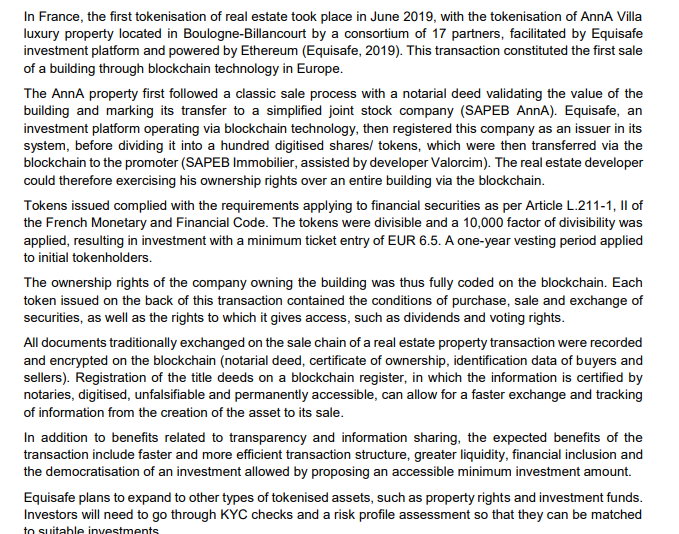

The first tokenization of real estate in France took place in June 2019 with the tokenization of a luxury property using the Ethereum blockchain.

oecd.org

oecd.org

Homebase is a DAO that makes it easier to invest in real estate.

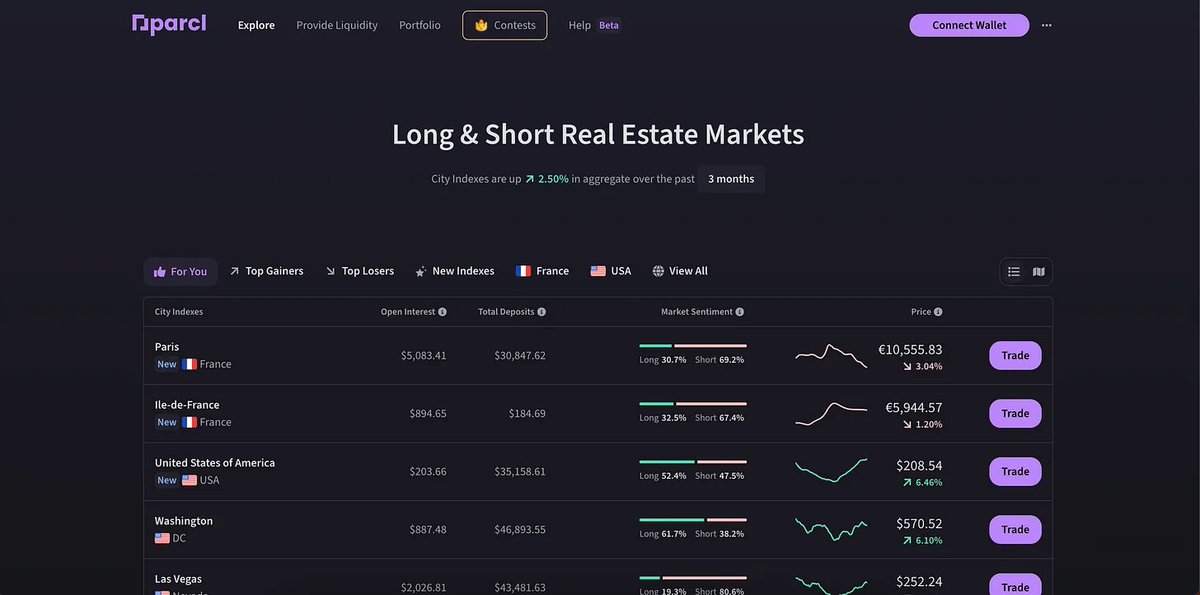

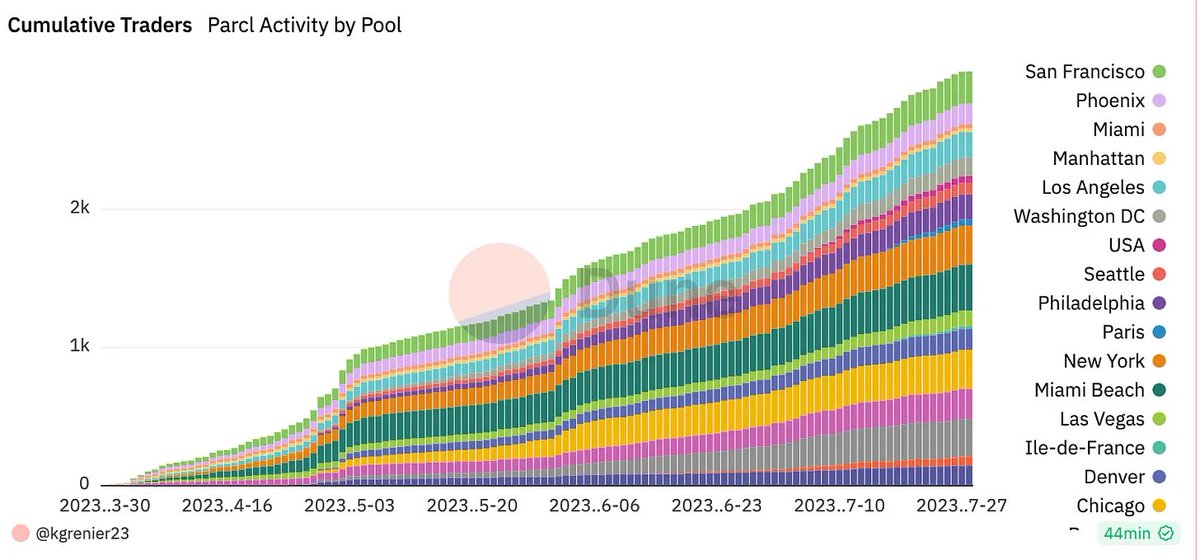

@Parcl is a startup that can bring millions of new investors to real estate.

Users can trade the price movements of real estate markets around the world.

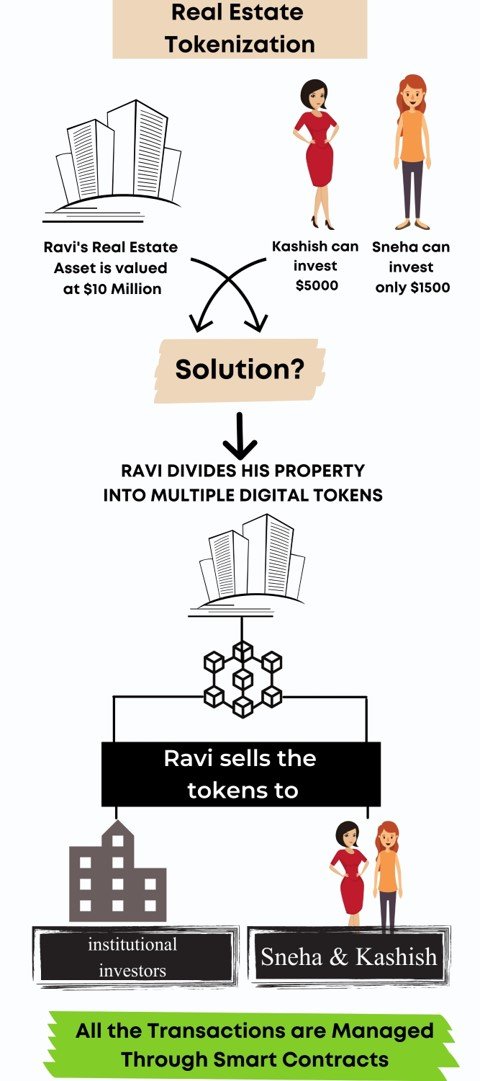

Instead of needing $100,000s now almost anyone can invest in real estate.

Users can trade the price movements of real estate markets around the world.

Instead of needing $100,000s now almost anyone can invest in real estate.

On this episode of the Zeitgeist podcast, Parcl founders Trevor Bacon & @kellangrenier discuss tokenization in real estate investing.

podcast.phantom.app

podcast.phantom.app

Tokenization is quietly changing multiple industries.

"Wall Street is diving in, creating tokens for everything from buildings to gold bars." @CoinDesk

coindesk.com

"Wall Street is diving in, creating tokens for everything from buildings to gold bars." @CoinDesk

coindesk.com

Tokenized Finance Is Inevitable | @SergeyNazarov at Barclays Crypto & Blockchain Summit

The benefits of blockchain technology for financial institutions, and the future of financial markets.

youtu.be

The benefits of blockchain technology for financial institutions, and the future of financial markets.

youtu.be

Real-world Asset Tokenization - The Next Generation of Markets | AIM Summit London 2023

Zoe Cruz – CEO Menai Financial Group Ami Ben-David – CEO Ownera

Jack Inglis – CEO AIMA

Why tokenization is the future of investing.

youtu.be

Zoe Cruz – CEO Menai Financial Group Ami Ben-David – CEO Ownera

Jack Inglis – CEO AIMA

Why tokenization is the future of investing.

youtu.be

Tokenization of real-world assets will democratize investing, expand opportunity, and transform business & lives.

That's it, folks. I hope this was useful.

If you enjoyed it, please share by retweeting the first tweet.

I write about the ideas, technology and people shaping the future. You can follow me @MishadaVinci.

If you enjoyed it, please share by retweeting the first tweet.

I write about the ideas, technology and people shaping the future. You can follow me @MishadaVinci.

My weekly newsletter helps you get smarter about the future.

Subscribe here (for free):

mishadavinci.substack.com

Subscribe here (for free):

mishadavinci.substack.com

Loading suggestions...