What is deriv synthetic index?

Deriv synthetic index are financial instruments that allow traders to speculate on the price movements of a basket of assets,these synthetic indices are created using a proprietary algorithms that stimulates real-time markets

A thread🧵🧵

Deriv synthetic index are financial instruments that allow traders to speculate on the price movements of a basket of assets,these synthetic indices are created using a proprietary algorithms that stimulates real-time markets

A thread🧵🧵

Benefits of trading synthetic index

>Pairs are available for trading 24/7 including weekends and public holidays

>Not affected by real-world actions such as news and liquidity risks

>Pairs are available for trading 24/7 including weekends and public holidays

>Not affected by real-world actions such as news and liquidity risks

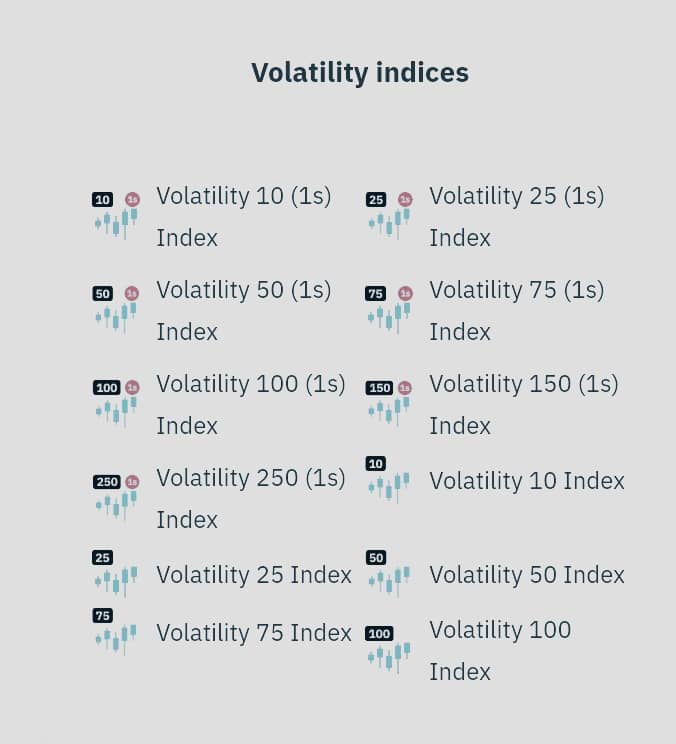

Some of the innstrument available for trading on synthetic index includes👇

1. Volatility index > ranging from the volatility 10 index - volatility 100 index (excluding the sectional pairs)

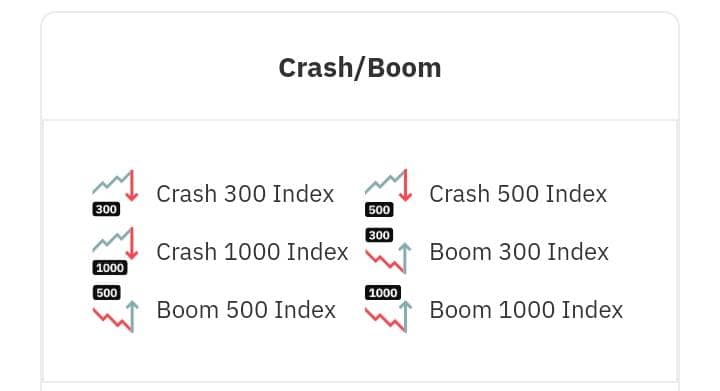

2. Boom and crash

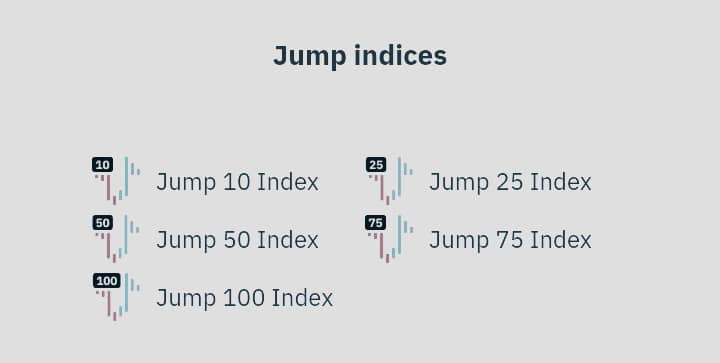

3. Jump index

4. Step index

1. Volatility index > ranging from the volatility 10 index - volatility 100 index (excluding the sectional pairs)

2. Boom and crash

3. Jump index

4. Step index

How do we analyze synthetic index?

Since the index don't move with real-time events

A sound technical analysis is okay to preDict the future price movement 💦

Since the index don't move with real-time events

A sound technical analysis is okay to preDict the future price movement 💦

If you find this thread helpful

Retweet and like for others to read🫡

#forextrading

#forextrader

#education

#XAUUSD

#BBNaijaAllStars

#BBNaija

#ICT

Retweet and like for others to read🫡

#forextrading

#forextrader

#education

#XAUUSD

#BBNaijaAllStars

#BBNaija

#ICT

Loading suggestions...