But many things that aren't items can be mispriced:

• Interest Rates

• Derivatives

• Fees

• Funding Rates

• Yields

And if you can spot these price inefficiencies, you can often generate outsized returns with minimal risk.

• Interest Rates

• Derivatives

• Fees

• Funding Rates

• Yields

And if you can spot these price inefficiencies, you can often generate outsized returns with minimal risk.

Interest Rate Arb #2: Leveraged Lending

When an interest-bearing derivative of an asset (like wstETH) can be used as collateral and the yield of that asset exceeds the borrow cost of the underlying asset (ETH), you can arbitrage the difference between those rates with leverage.

When an interest-bearing derivative of an asset (like wstETH) can be used as collateral and the yield of that asset exceeds the borrow cost of the underlying asset (ETH), you can arbitrage the difference between those rates with leverage.

Leveraged Lending: Case Study

wstETH yield: 4%

ETH borrow cost (@MorphoLabs): 3.1%

Max LTV: 90%

Max Leverage: 1/(1-Max LTV)

Max Leverage = 1/(1-0.9) = 10

The yield is the difference between the rates multiplied by the leverage.

0.9% * 10 = 9% on ETH, 125% increase in yield

wstETH yield: 4%

ETH borrow cost (@MorphoLabs): 3.1%

Max LTV: 90%

Max Leverage: 1/(1-Max LTV)

Max Leverage = 1/(1-0.9) = 10

The yield is the difference between the rates multiplied by the leverage.

0.9% * 10 = 9% on ETH, 125% increase in yield

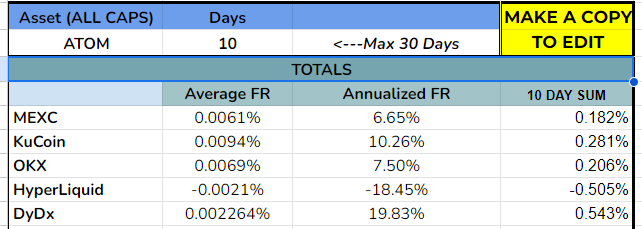

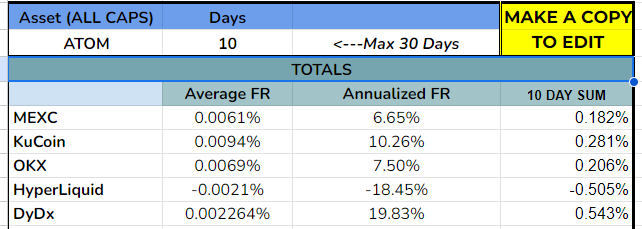

Funding Rate Arbitrage: Cash-and-Carry

When the funding rate of an asset is negative, you can arbitrage the cost to hold the asset and the return to short the asset.

Ex

Buy ATOM Spot (cost to hold: 0%)

Short ATOM on @dYdX (funding: 20%)

Delta Neutral Yield: 10% (no leverage)

When the funding rate of an asset is negative, you can arbitrage the cost to hold the asset and the return to short the asset.

Ex

Buy ATOM Spot (cost to hold: 0%)

Short ATOM on @dYdX (funding: 20%)

Delta Neutral Yield: 10% (no leverage)

You can also do fixed rate interest yields on things like @pendle_fi and @Flashstake.

But I've already talked about that before:

But I've already talked about that before:

These are some of the most profitable, risk-adjusted plays in DeFi.

Arbitrage also makes markets more efficient, being value-additive to the space long-term.

If you want to stay on top of arb opportunities, join the DeFi Dojo. We'll be waiting for you.

whop.com

Arbitrage also makes markets more efficient, being value-additive to the space long-term.

If you want to stay on top of arb opportunities, join the DeFi Dojo. We'll be waiting for you.

whop.com

If you liked this thread and/or found it valuable, please consider retweeting.

Loading suggestions...