Intraday Technical Analysis

Mini Course worth 5000

Explained with 30+ Charts

Kindly Re-Tweet and Like for Max Reach

Mini Course worth 5000

Explained with 30+ Charts

Kindly Re-Tweet and Like for Max Reach

Index

1) Importance of Trend

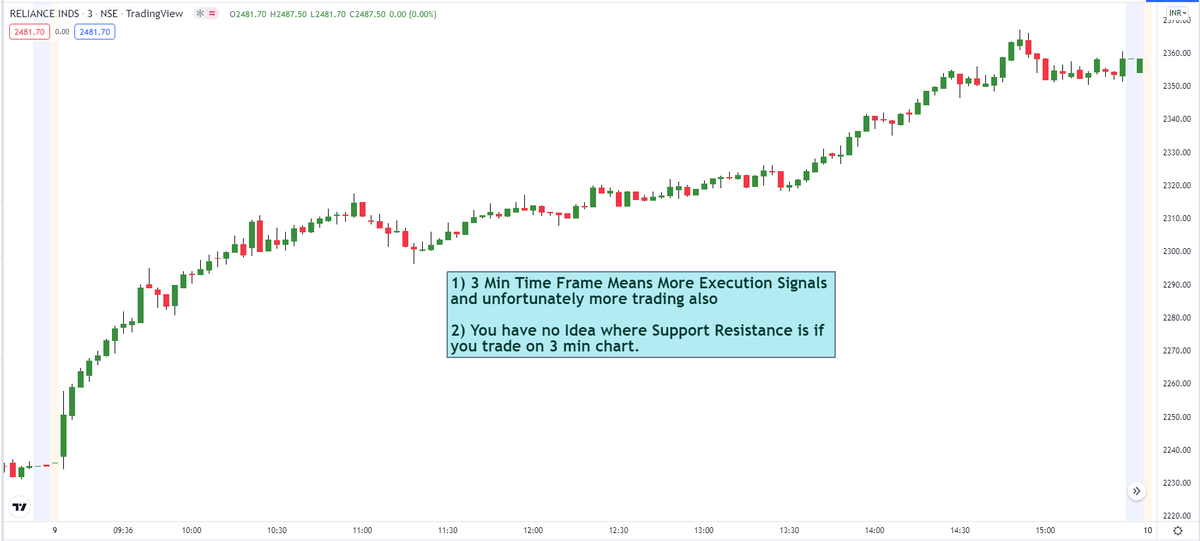

2) Time Frame Importance

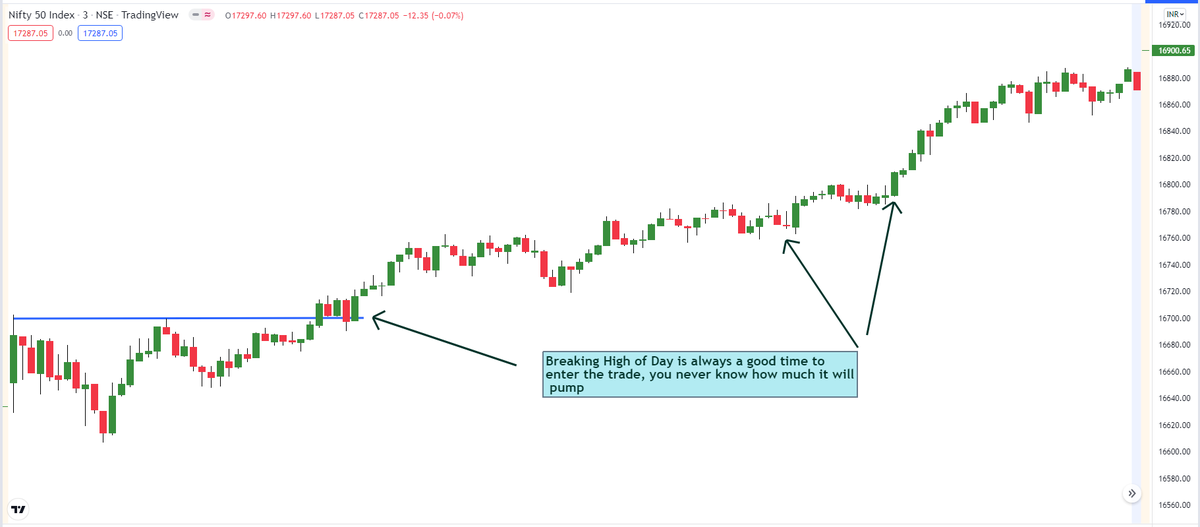

3) Bullish Day Signals

- Candles, VWAP, EMA, Patterns, Resistance BO

4) Bearish Day Signals - In Next Thread Soon

5) Reversal Day Signals - In PDF Only

6) Psychology - In PDF Only

Imp - Explanation in Charts Only

1) Importance of Trend

2) Time Frame Importance

3) Bullish Day Signals

- Candles, VWAP, EMA, Patterns, Resistance BO

4) Bearish Day Signals - In Next Thread Soon

5) Reversal Day Signals - In PDF Only

6) Psychology - In PDF Only

Imp - Explanation in Charts Only

Some Important Points -

1) Never Trade against the Big Candles

2) Never trade against the trend

3) Never trade without SL

4) Don't move SL accept it

5) 1:2 Risk Reward is minimum to take trade

6) 50% Win Rate is excellent

7) Try to make profit according to capital Only

1) Never Trade against the Big Candles

2) Never trade against the trend

3) Never trade without SL

4) Don't move SL accept it

5) 1:2 Risk Reward is minimum to take trade

6) 50% Win Rate is excellent

7) Try to make profit according to capital Only

Loading suggestions...