Weekly profiles as follows 👇👇

1⃣ Classic Tuesday High/Low Of The Week

2⃣ Wednesday High/Low Of The Week

3⃣ Consolidation Thursday Reversal

4⃣ Consolidation Midweek Rally/Decline

5⃣ Seek & Destroy Bullish/Bearish Friday

6⃣ Wednesday Weekly Reversal

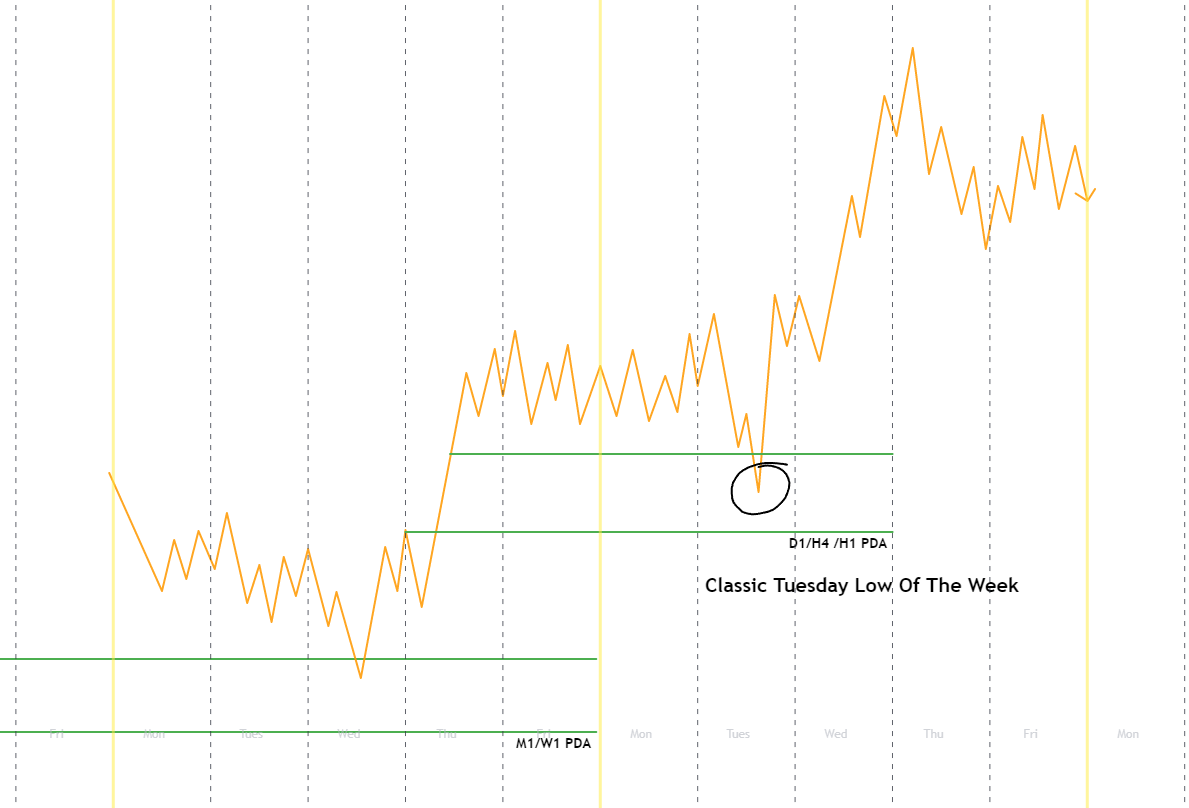

1⃣ Classic Tuesday High/Low Of The Week

2⃣ Wednesday High/Low Of The Week

3⃣ Consolidation Thursday Reversal

4⃣ Consolidation Midweek Rally/Decline

5⃣ Seek & Destroy Bullish/Bearish Friday

6⃣ Wednesday Weekly Reversal

1⃣ Classic Tuesday High/Low Of The Week

Market should be in trending environment on higher timeframe for this profile to form. As you all know some PDAs are where reversals form and some of them are where continuations form. ➡️➡️➡️

Market should be in trending environment on higher timeframe for this profile to form. As you all know some PDAs are where reversals form and some of them are where continuations form. ➡️➡️➡️

If the market reversed from HTF PDA (M1/W1) previous week, then current week will likely be continuation week, where we should seek HTF PDA, where price might reverse from intraweek. (D1/H4/H1)

➡️➡️➡️

➡️➡️➡️

Monday consolidates above HTF discount array for the bullish example and drops into HTF Discount array on Tuesday.

This phenomenon aligns with the economic calendar 90% of the time. If there's no high impact news on Tuesday, you should think twice, before taking the trade➡️➡️➡️

This phenomenon aligns with the economic calendar 90% of the time. If there's no high impact news on Tuesday, you should think twice, before taking the trade➡️➡️➡️

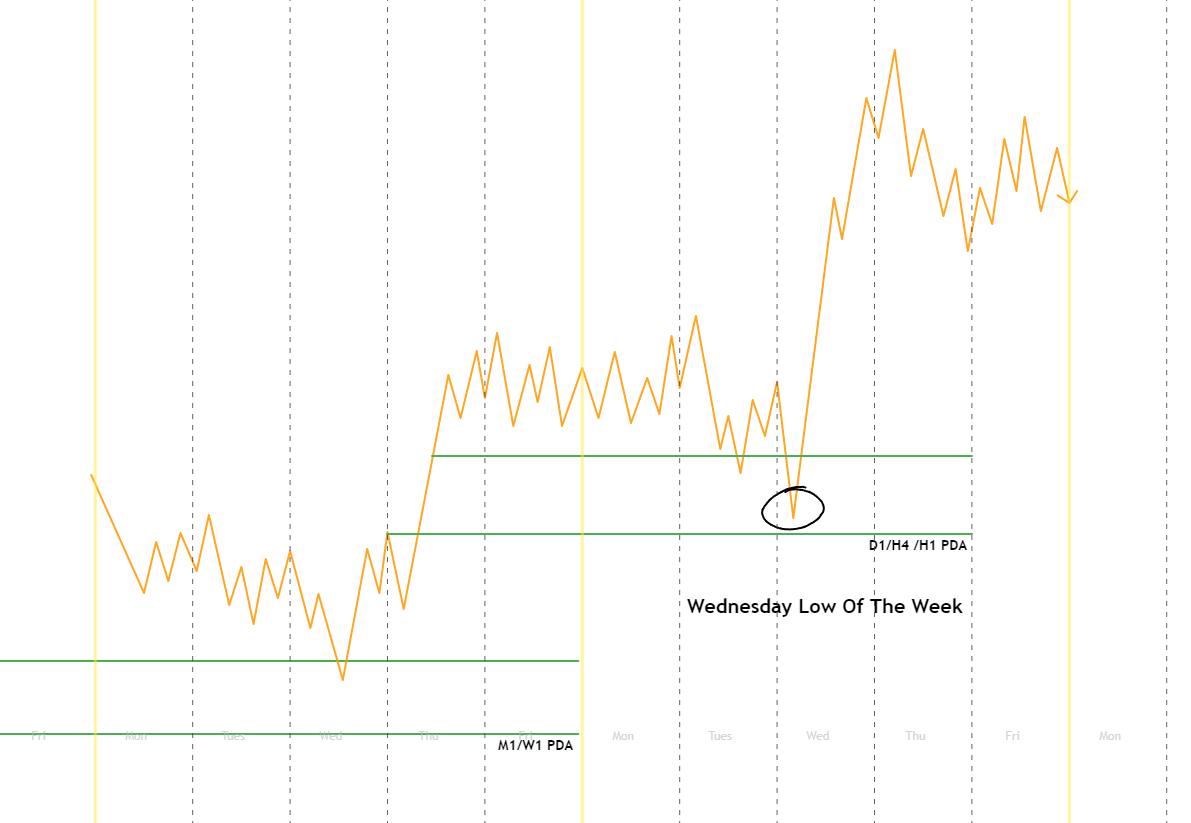

2⃣ Wednesday High/Low Of The Week

First off, let's point out that Wednesday reversal and wednesday H/L of the week profiles aren't the same profile. This profile is almost the same profile as Classic Tuesday H/L Of The Week profile.

➡️➡️➡️

First off, let's point out that Wednesday reversal and wednesday H/L of the week profiles aren't the same profile. This profile is almost the same profile as Classic Tuesday H/L Of The Week profile.

➡️➡️➡️

Market should be in trending environment on higher timeframe for this profile to form. If the market reversed from HTF PDA (M1/W1) previous week, then current week will likely be continuation week, just as it forms in Classic Tuesday H/L Of The Week profile.

➡️➡️➡️

➡️➡️➡️

Monday and Tuesday consolidates above HTF discount array for the bullish example and drops into HTF Discount array on Wednesday to form low of the week.

What makes this profile different from Tuesday H/L of the week is the economic calendar aligment.

➡️➡️➡️

What makes this profile different from Tuesday H/L of the week is the economic calendar aligment.

➡️➡️➡️

And the 2nd possibility is where price drops into HTF discount array on Tuesday and consolidates at/inside HTF discount array by creating more liquidity for the news on Wednesday.

➡️➡️➡️

➡️➡️➡️

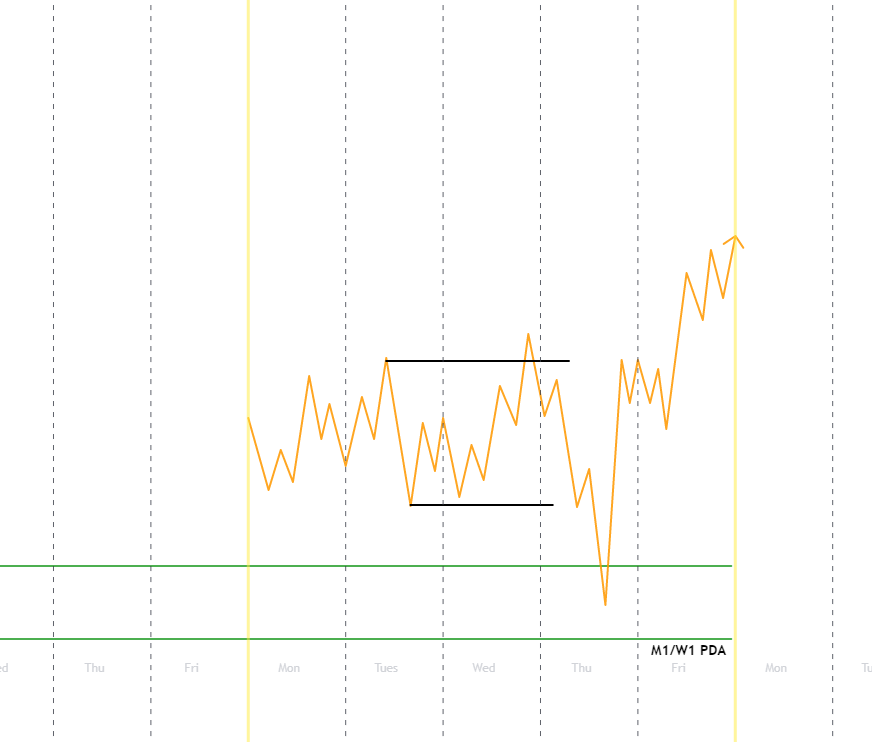

3⃣ Consolidation Thursday Reversal

The best way to anticipate this profile, even before monday trading is to check economic calendar on Sunday, If you ask me.

There should be high impact news on Thursday like interest rate decision or any type of FOMC event.

➡️➡️➡️

The best way to anticipate this profile, even before monday trading is to check economic calendar on Sunday, If you ask me.

There should be high impact news on Thursday like interest rate decision or any type of FOMC event.

➡️➡️➡️

Price consolidates monday through wednesday OR expands to create more liquidity. Most of the smart money uses equilibrium of HTF PD arrays in this profile, according to my experience

Tuesday or wednesday create so-called low of the week via HTF discount array and expands

➡️➡️➡️

Tuesday or wednesday create so-called low of the week via HTF discount array and expands

➡️➡️➡️

Price sweeps the intraweek lows to form reversal on Thursday with the news.

➡️➡️➡️

➡️➡️➡️

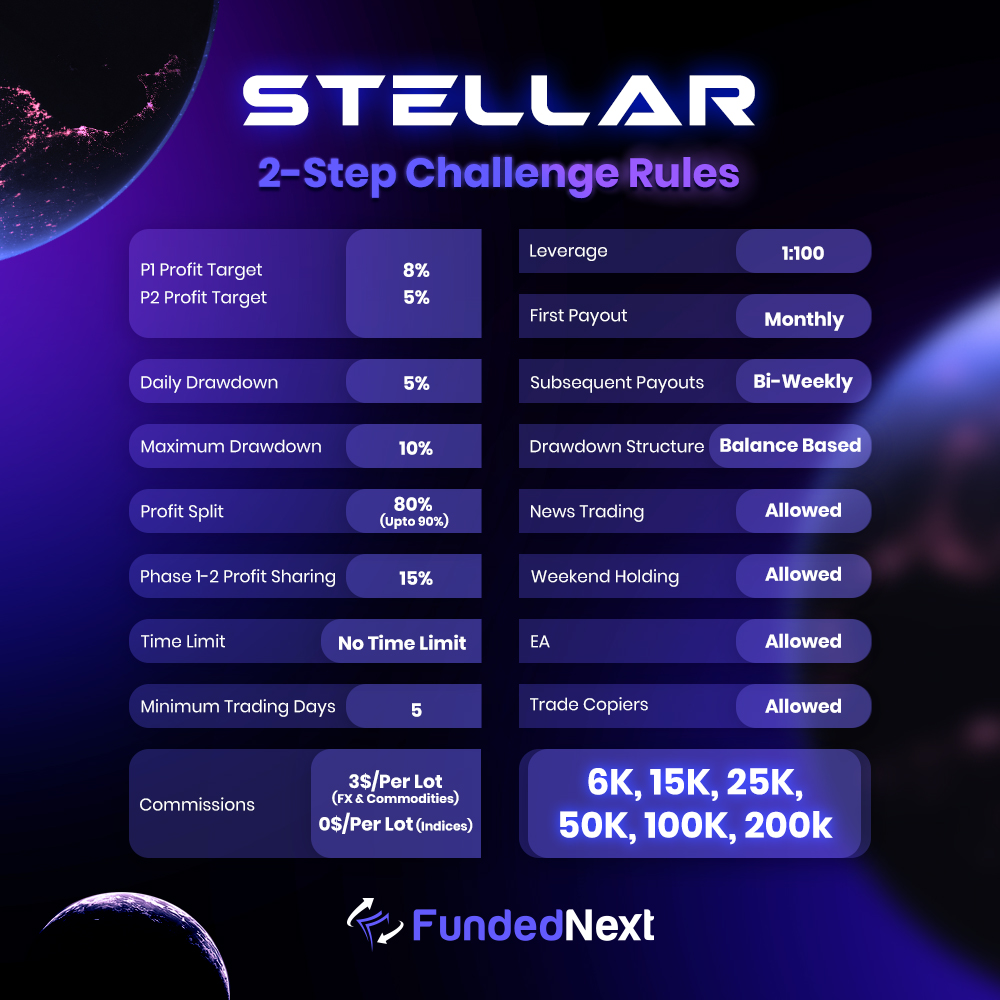

FundedNext shares profits during demo phases by 15% 😮😮 Also, initial profit share is 80% and it's up to 90% later on 🔥🔥🔥

Get your Stellar Account Today with 10% discounted price using promo code : MORPHEUS13

👇👇👇

fundednext.com

Get your Stellar Account Today with 10% discounted price using promo code : MORPHEUS13

👇👇👇

fundednext.com

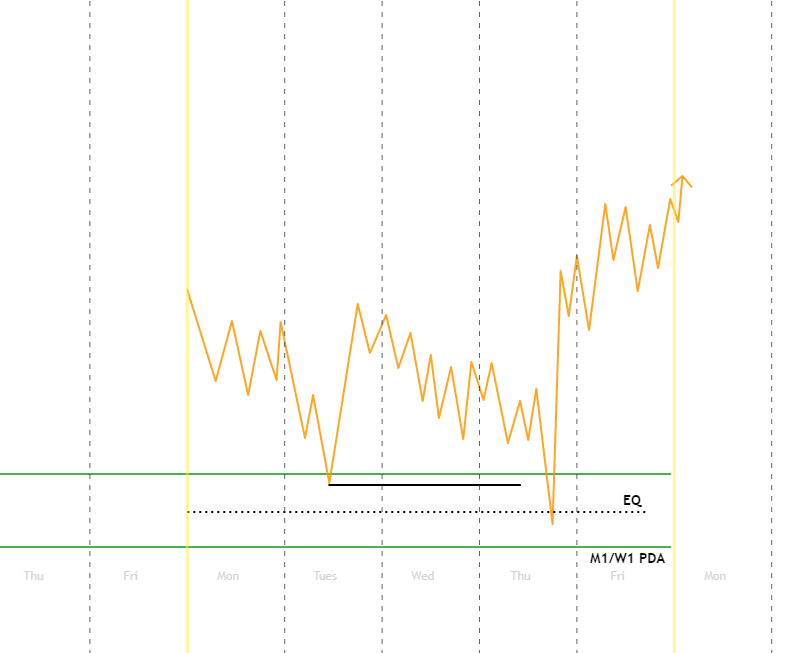

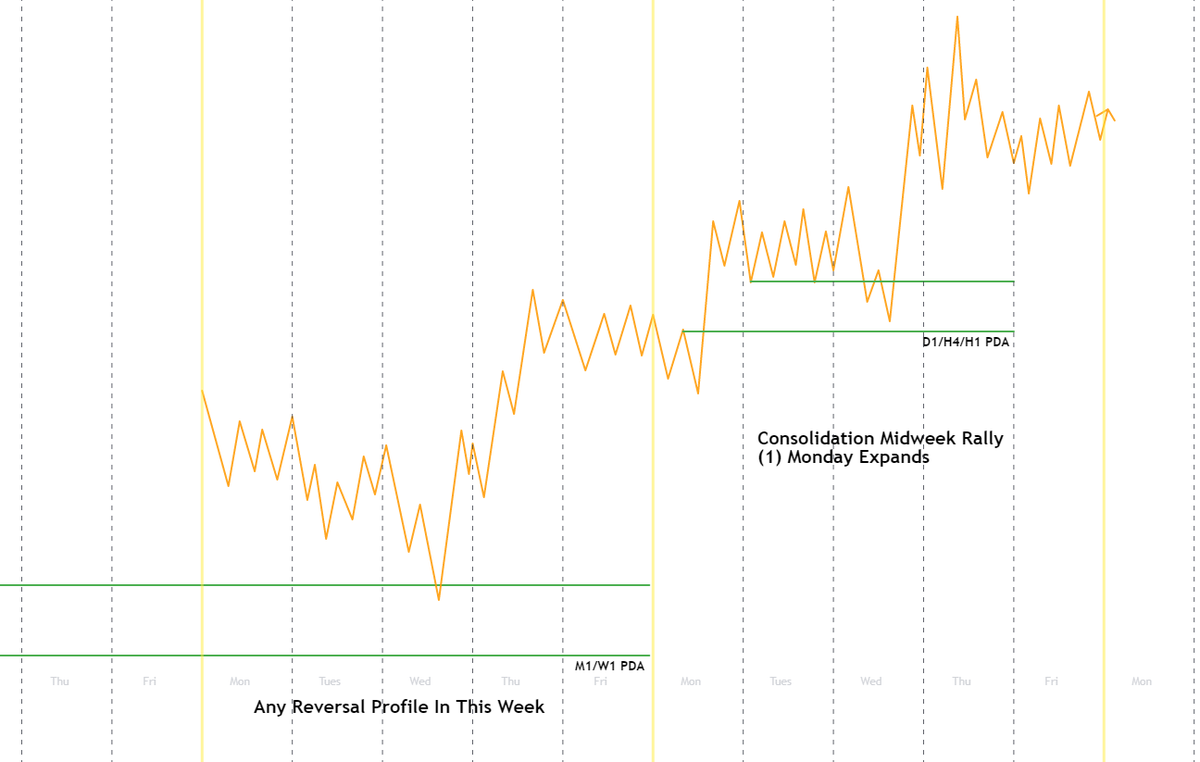

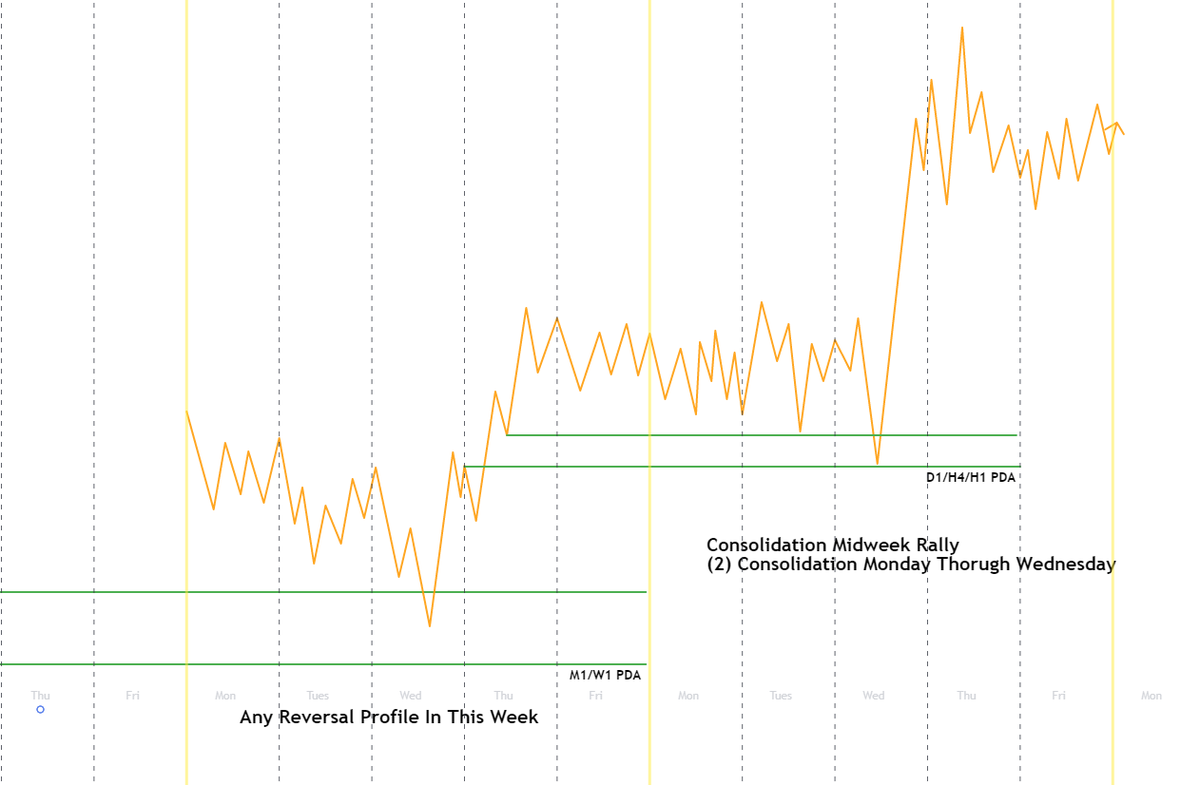

4⃣ Consolidation Midweek Rally/Decline

This is absolutely my favorite weekly profile and the best one for swing trades to me. This profile is observed, after large expansion weeks, in case price is not sill met with a opposite HTF PD array.

➡️➡️➡️

This is absolutely my favorite weekly profile and the best one for swing trades to me. This profile is observed, after large expansion weeks, in case price is not sill met with a opposite HTF PD array.

➡️➡️➡️

Economic calendar alignment doesnt have to perfect for this profile, yet this doesnt mean we dont use news for effective swing trade entries or short term trades.

Basically, Monday expands and Tuesday consolidates in this profile and price drops into HTF discount array.

➡️➡️➡️

Basically, Monday expands and Tuesday consolidates in this profile and price drops into HTF discount array.

➡️➡️➡️

Price expands off HTF discount array on Wednesday and creates the weekly expansion.

OR we observe monday through wednesday consolidation and wednesday creates the weekly expansion.

➡️➡️➡️

OR we observe monday through wednesday consolidation and wednesday creates the weekly expansion.

➡️➡️➡️

Let's point out once again that If the price meets the opposite PD array is the important thing in this profile‼️ ➡️➡️➡️

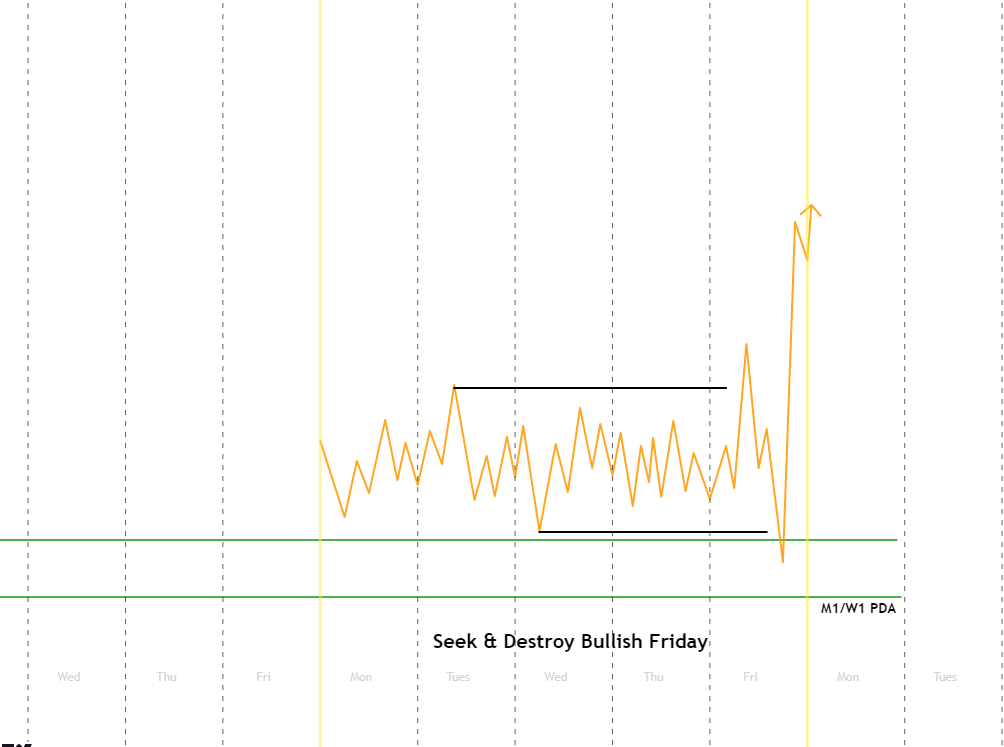

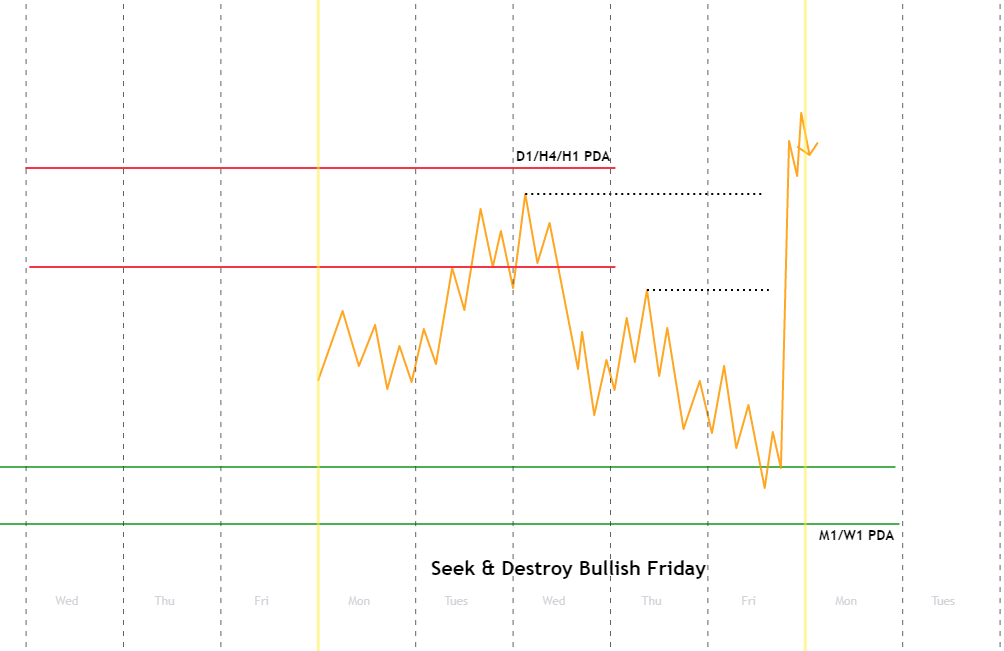

5⃣ Seek & Destroy Bullish/Bearish Friday

This profile is the hardest one If trader is inexperienced. Economic news alignment is obvious in this profile and the easiest one, in terms of detect this profile. ➡️➡️➡️

This profile is the hardest one If trader is inexperienced. Economic news alignment is obvious in this profile and the easiest one, in terms of detect this profile. ➡️➡️➡️

This profile occurs, when the market is waiting for interest rate announcement or Non-Farm Payroll in the Summer months of July and August.

Waiting to understand how IPDA engineers intraweek liquidity pools for smart money entity is the best decision in these weeks ➡️➡️➡️

Waiting to understand how IPDA engineers intraweek liquidity pools for smart money entity is the best decision in these weeks ➡️➡️➡️

Price consolidates monday through thursday to engineers liquidity in both sides of the market.

In some cases, we observe clean price displacements off the HTF PD arrays, where scalpers and daytrades can take nice trades. ➡️➡️➡️

In some cases, we observe clean price displacements off the HTF PD arrays, where scalpers and daytrades can take nice trades. ➡️➡️➡️

However, we're not focused on this, since our main goal is to catch weekly expansion, in terms of short term trades or swing trade entries

Generally one asset class sweeps the liquidity pools, meanwhile other one is not doing, before the news release at/inside of HTF PDA ➡️➡️➡️

Generally one asset class sweeps the liquidity pools, meanwhile other one is not doing, before the news release at/inside of HTF PDA ➡️➡️➡️

So, we can understand where the expansion forms towards and taking our swing trade entry based on that OR a short term trade. ➡️➡️➡️

Also, I would love to add that this profile is neutral. This profile can be reversal or continuation profiles based on the alignment of HTF PD arrays and previous weeks

➡️➡️➡️

➡️➡️➡️

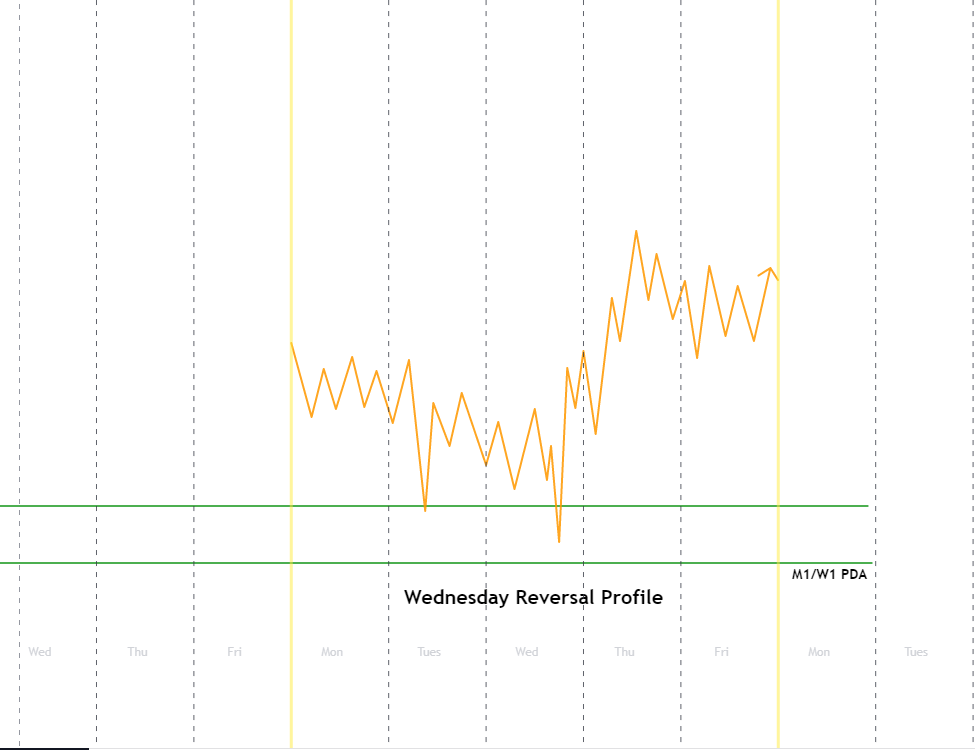

6⃣ Wednesday Weekly Reversal

This profile mostly occurs at M1/W1 HTF PD Arrays with the economic news alignment, where previous weeks are in a trending environment or exact consolidation week. ➡️➡️➡️

This profile mostly occurs at M1/W1 HTF PD Arrays with the economic news alignment, where previous weeks are in a trending environment or exact consolidation week. ➡️➡️➡️

Loading suggestions...