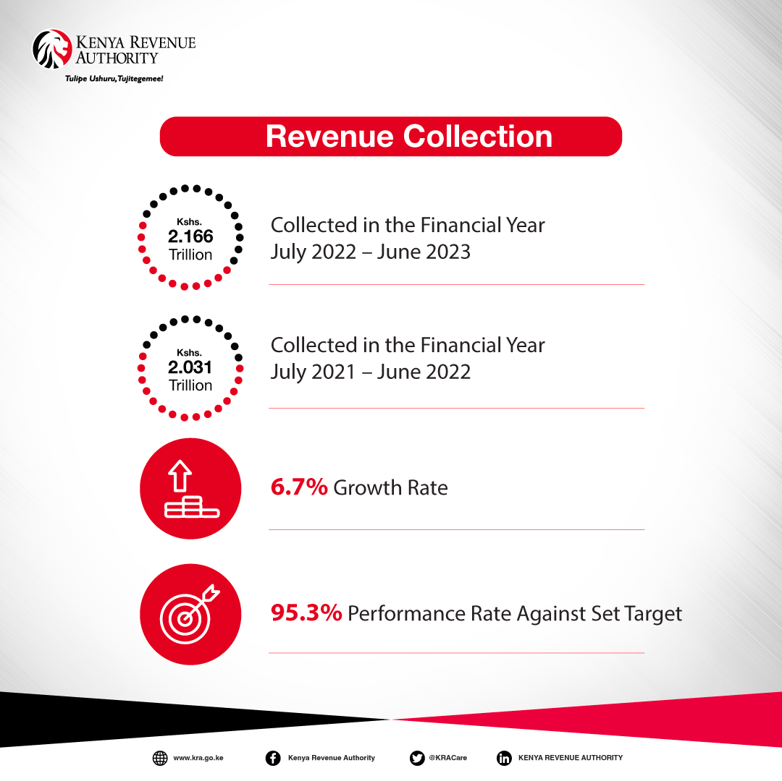

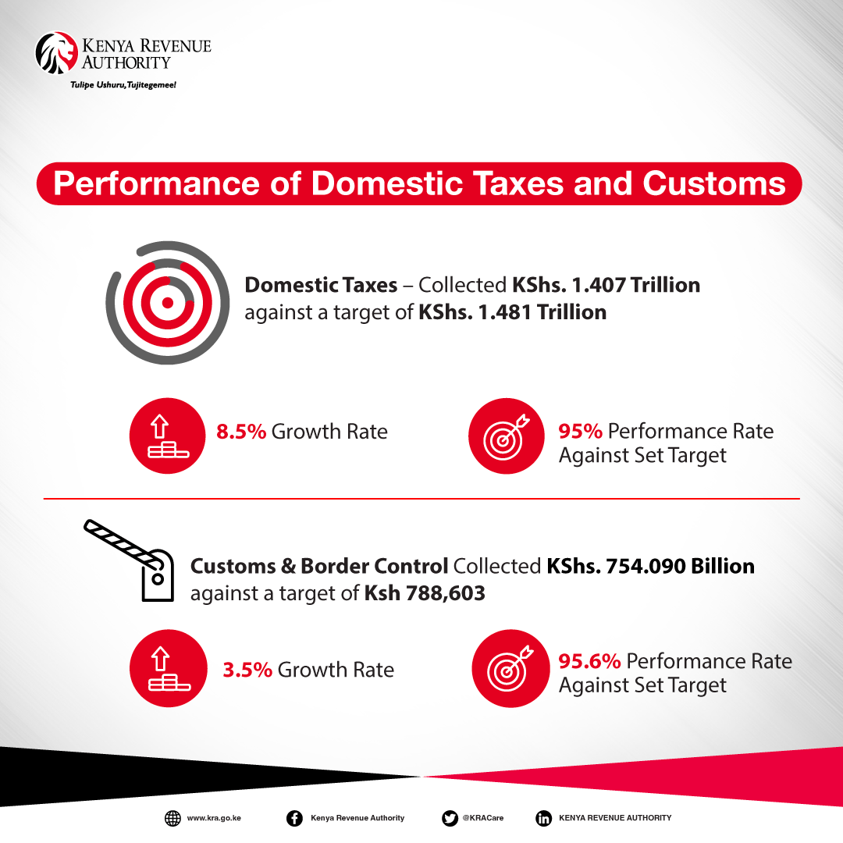

The revenue collection signifies a performance rate of 95.3 per cent against the target despite an economic slowdown occasioned by unfavorable global fiscal environment.

#KRARevenuePerformance

#KRARevenuePerformance

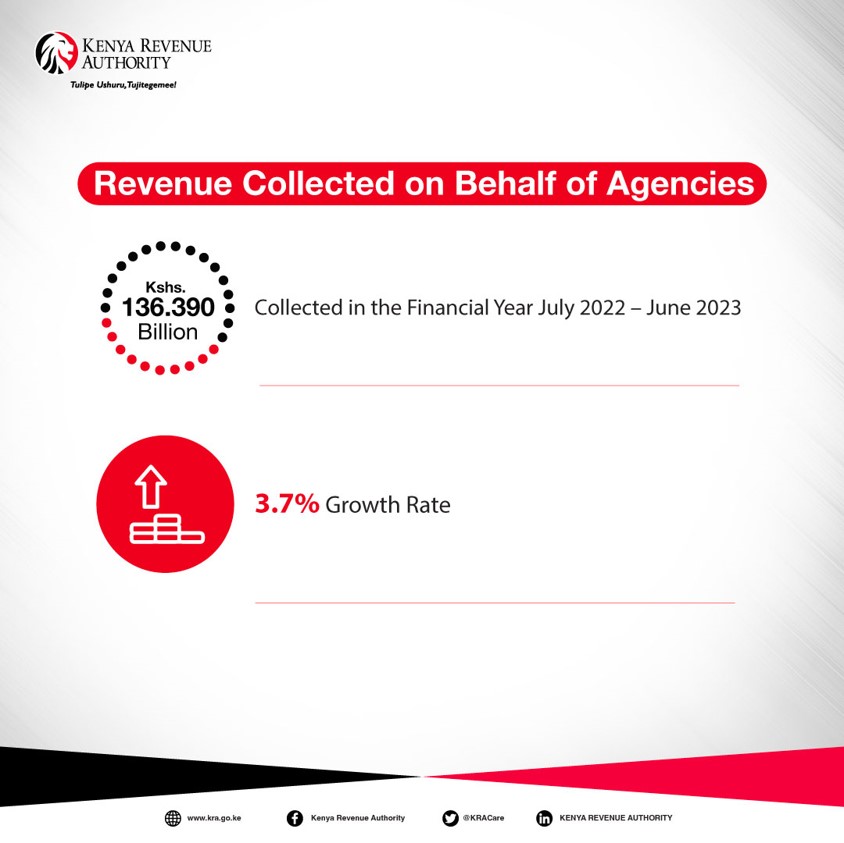

KRA is also mandated to collect revenue on behalf of other government agencies mainly at the ports of entry.

KShs. 136.390 Billion was collected on behalf of the agencies reflecting a growth of 3.7 per cent compared to the last financial year.

#KRARevenuePerformance

KShs. 136.390 Billion was collected on behalf of the agencies reflecting a growth of 3.7 per cent compared to the last financial year.

#KRARevenuePerformance

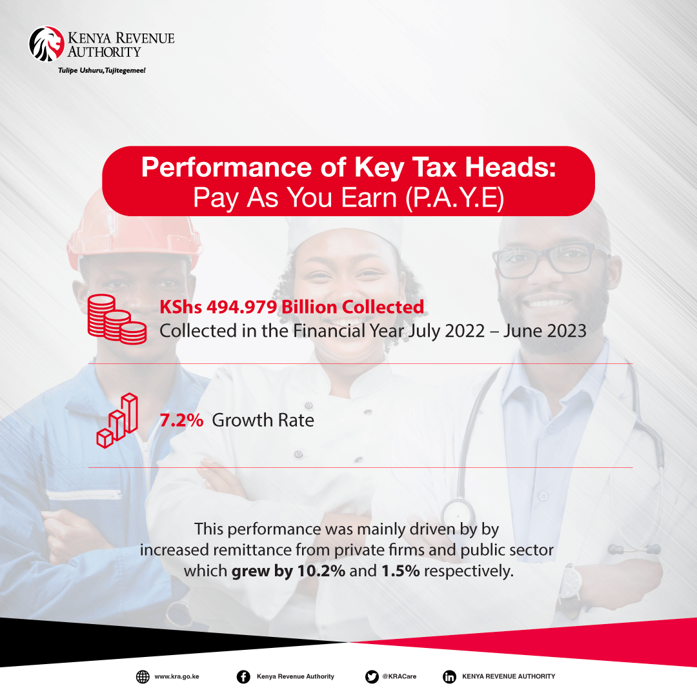

Pay As You Earn (PAYE) collected KShs. 494.979 Billion. The performance was mainly driven by remittance from private firms and public sector which grew by 10.7% and 1.9% respectively.

#KRARevenuePerformance

#KRARevenuePerformance

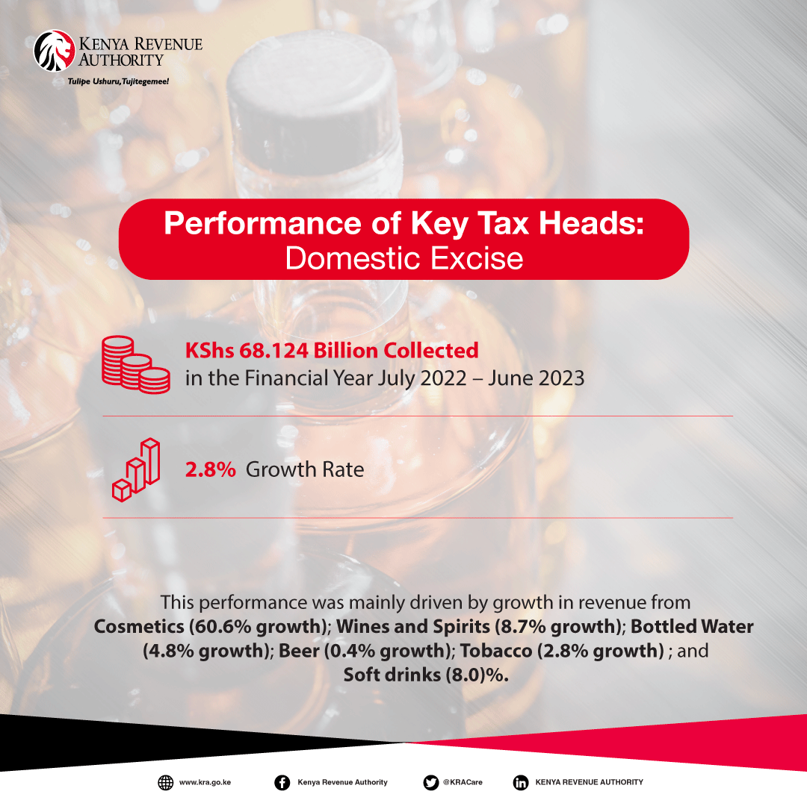

The revenue growth is attributed to implementation of key strategies as enshrined in KRA’s 8th Corporate Plan. Some of these strategies included:

1. Customer support programmes

2. Tax base expansion

3. Taxation on digital economy

4. Tax at source

5. Debt collection programmes

6.…

1. Customer support programmes

2. Tax base expansion

3. Taxation on digital economy

4. Tax at source

5. Debt collection programmes

6.…

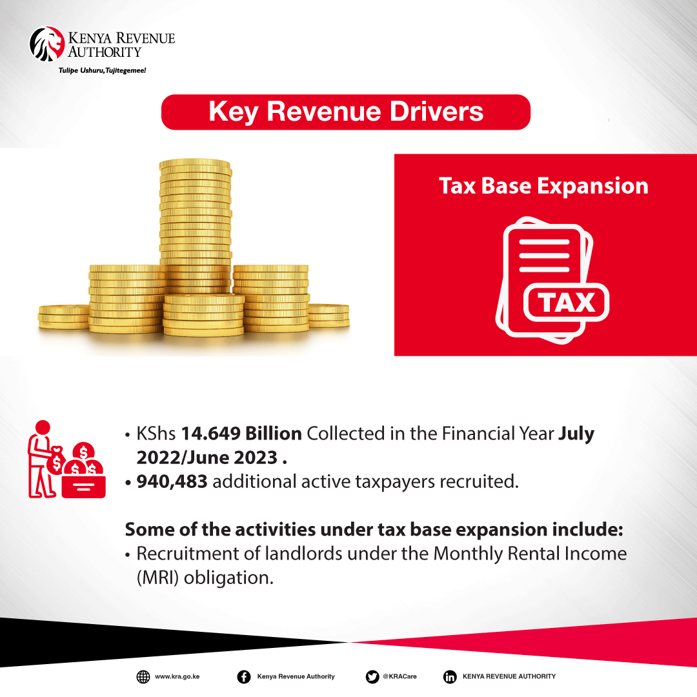

Furthermore, through the Tax Base Expansion program, KRA successfully on boarded previously non-compliant taxpayers, resulting in an impressive revenue collection of KShs 14.649 Billion and recruitment of 940,483 additional active taxpayers.

#KRARevenuePerformance

#KRARevenuePerformance

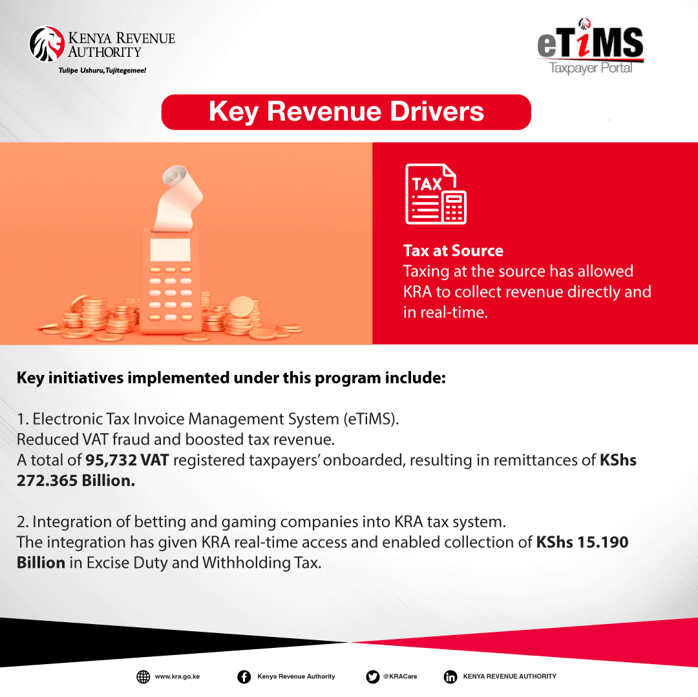

Digital Service Tax and VAT on Digital Market Supply collected KShs 5.328 Billion which is a growth of 207.9% compared to the previous FY.

These tax heads have brought inclusivity in payment of taxes especially from Non-residents.

#KRARevenuePerformance

These tax heads have brought inclusivity in payment of taxes especially from Non-residents.

#KRARevenuePerformance

KRA enhanced collection from debt programmes on non-compliant taxpayers, netting a total of KShs 99.272 Billion in FY 2022/2023.

The performance is attributed to follow up on demand notices issued and debt instalment plans agreed upon with taxpayers.

#KRARevenuePerformance

The performance is attributed to follow up on demand notices issued and debt instalment plans agreed upon with taxpayers.

#KRARevenuePerformance

Alternative Dispute Resolution (ADR) and Tax Appeals Tribunal (TAT) has enabled KRA to collect KShs 71.836 Billion from 7,458 concluded cases.

#KRARevenuePerformance

#KRARevenuePerformance

KRA has continued to leverage on technology to simplify tax processes and facilitate trade. KRA aspires to transform into a highly digitalized revenue administration in facilitating ease of tax compliance and trade.

#KRARevenuePerformance

#KRARevenuePerformance

Over 6.3 Million taxpayers filed their tax returns for the year 2022!

Thank you to all taxpayers who submitted their returns. We appreciate your efforts to comply.

The full revenue performance report can be accessed from the KRA website here bit.ly…

Thank you to all taxpayers who submitted their returns. We appreciate your efforts to comply.

The full revenue performance report can be accessed from the KRA website here bit.ly…

Loading suggestions...