21 year olds are making $10,000+ /m trading simply because they understand Technical Analysis.

Technical Analysis will make you fall in love with #crypto again!

Here’s how to read charts like a pro 🧵 (Plus stop loss & take profit strategy)

Technical Analysis will make you fall in love with #crypto again!

Here’s how to read charts like a pro 🧵 (Plus stop loss & take profit strategy)

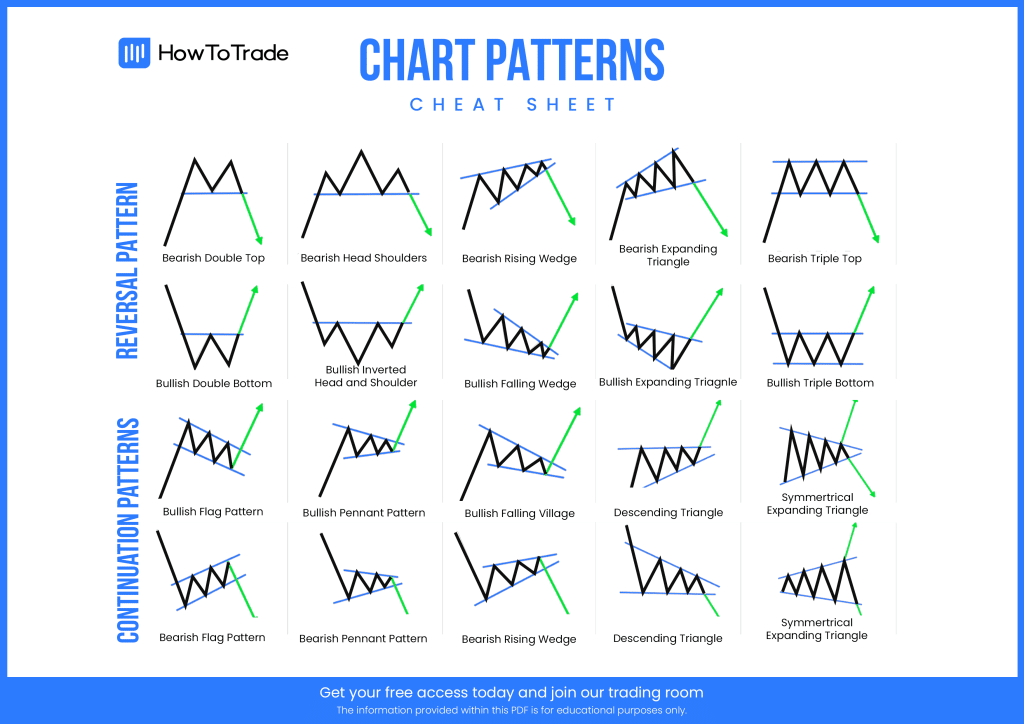

Today we’ll be exploring

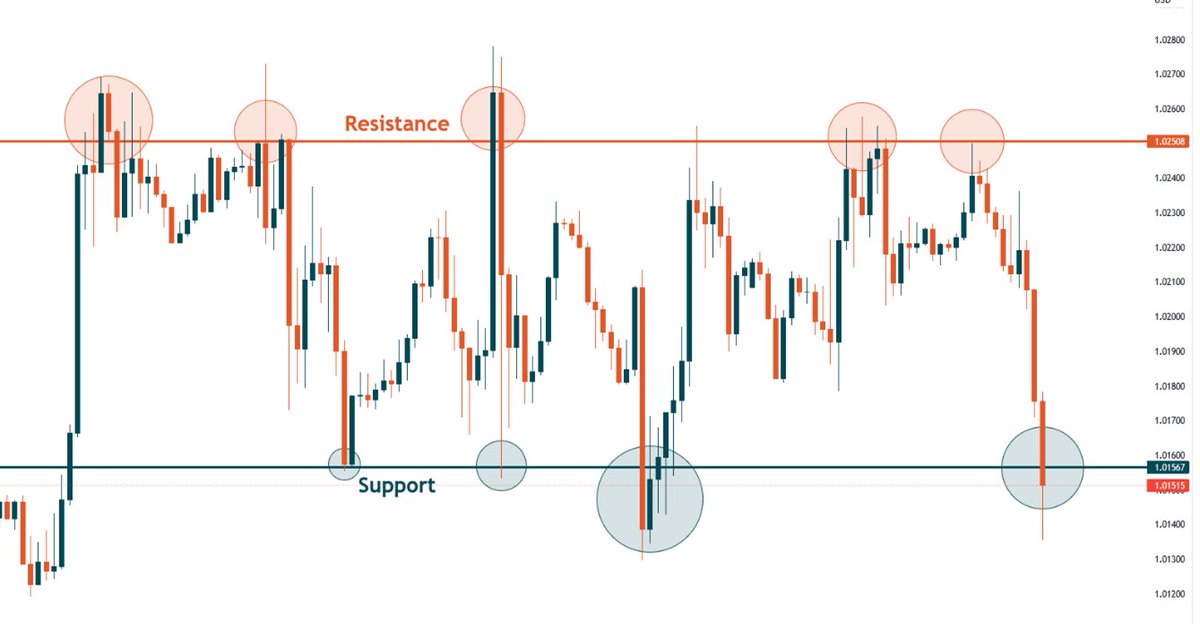

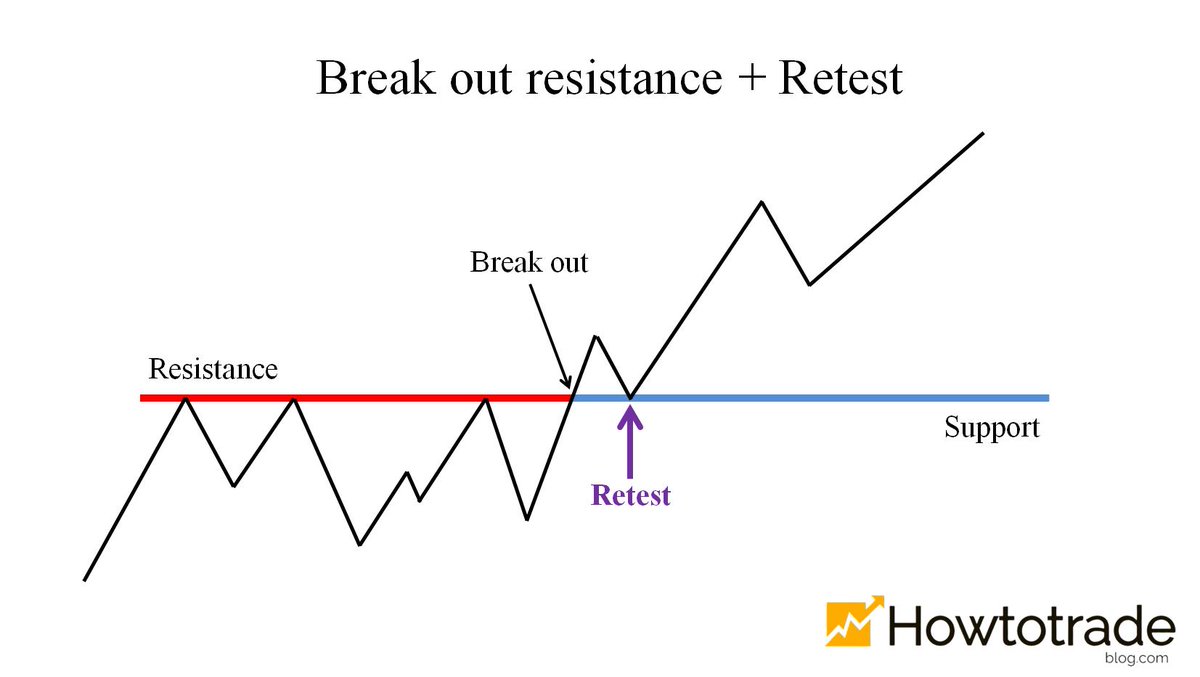

1️⃣ Support and resistance

2️⃣ Take profit and stop loss strategy

3️⃣ Major indicators

4️⃣ Helpful videos

1️⃣ Support and resistance

2️⃣ Take profit and stop loss strategy

3️⃣ Major indicators

4️⃣ Helpful videos

Only trades with this or greater risk to reward should be opened.

⚠️ The 2% Rule: never put more than 2% of your account at risk.

e.g if you have a $50,000 trading account, you could risk only up to $1,000 per trade.

It might range from 1-4%.

⚠️ The 2% Rule: never put more than 2% of your account at risk.

e.g if you have a $50,000 trading account, you could risk only up to $1,000 per trade.

It might range from 1-4%.

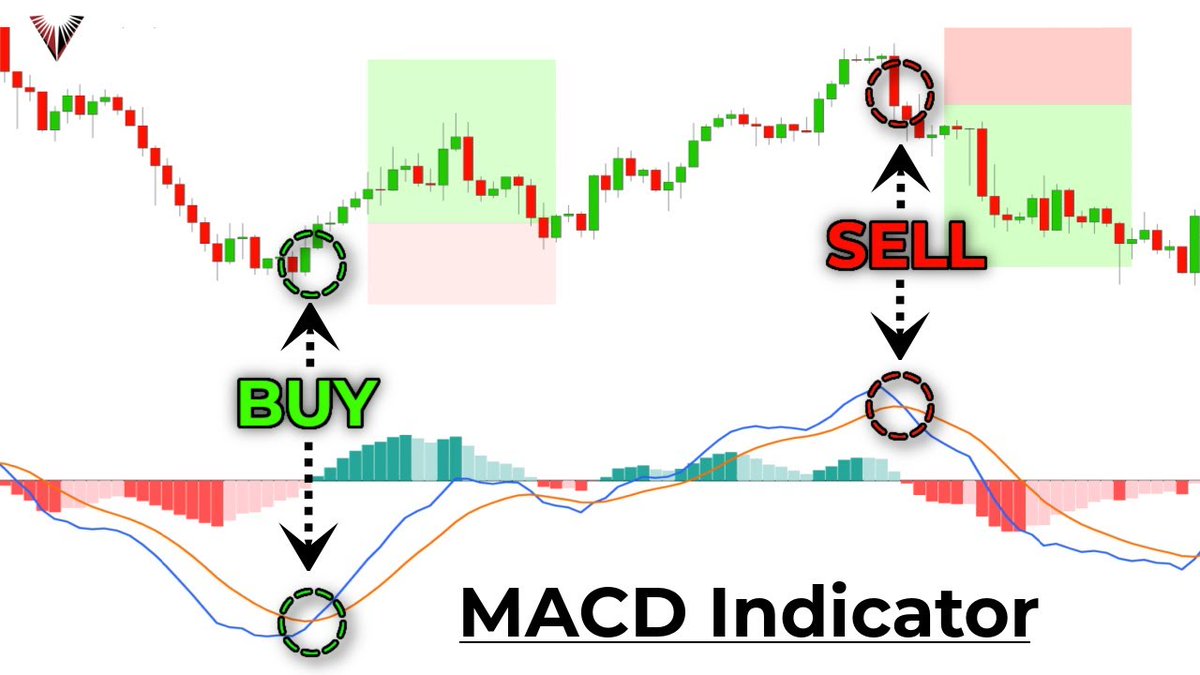

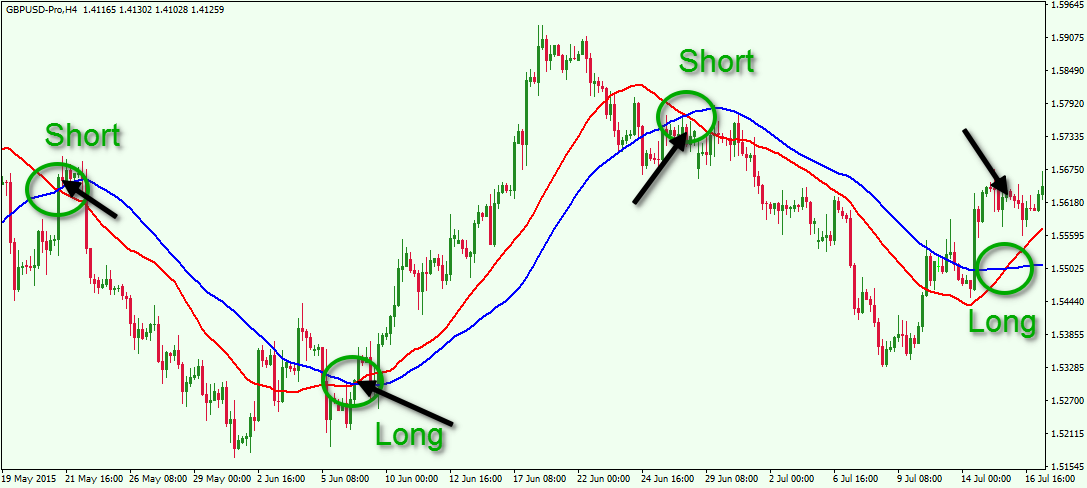

Mastering 1 or 2 indicators is the way to go.

When you see a promising chart plus the indicators to back up that analyses, trading becomes 10 times easier.

Using too many indicators will only confuse you.

Plus don't forget about fundamentals and general market conditions.

When you see a promising chart plus the indicators to back up that analyses, trading becomes 10 times easier.

Using too many indicators will only confuse you.

Plus don't forget about fundamentals and general market conditions.

Everything in this thread is my personal view and not financial advice.

For more alpha threads, latest airdrops, my trades, charts & calls, industry news & whale wallet tracking:

Join our free TG:

t.me

For more alpha threads, latest airdrops, my trades, charts & calls, industry news & whale wallet tracking:

Join our free TG:

t.me

Thats it for now.

I hope this brought value to you. If you gained from it please :

Like, RT & follow for more 🙏🏽.

I hope this brought value to you. If you gained from it please :

Like, RT & follow for more 🙏🏽.

Loading suggestions...