Good traders worry all the time about blowing up. Most active investors have the opposite problem to traders- under-allocating to their winners.

💡 Position-sizing is the missing link.

💡 Position-sizing is the missing link.

Two ways investors end up under-allocated to their winners:

- not having a target allocation and buying arbitrary amounts of a stock,

- or not buying more of a stock because it has gone up after a small initial buy.

- not having a target allocation and buying arbitrary amounts of a stock,

- or not buying more of a stock because it has gone up after a small initial buy.

We anchor to absolute ₹ amounts when buying a stock, and focus on % when tracking stock-level movement, when it needs to be the other way around.

So, How much of a stock should you buy? 🤔

So, How much of a stock should you buy? 🤔

Consider this- a 300% return on a 0.5% position grows your portfolio by 1.5%.

If the market moves by 10% at the same time, absolute gain on the “market” part of the portfolio is still 6.6x the gain on your 3-bagger.

If the market moves by 10% at the same time, absolute gain on the “market” part of the portfolio is still 6.6x the gain on your 3-bagger.

With a 0.5% allocation to a 3-bagger in your portfolio, you’d still be only 1.45% better off than a 100% “fill-it-shut-it-forget-it” passive investor. Seems to be very little to show for identifying a brilliant stock.

How much you allocate to active positions needs attention!!

How much you allocate to active positions needs attention!!

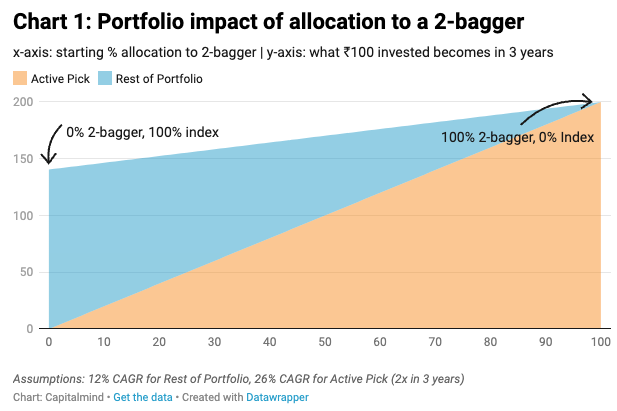

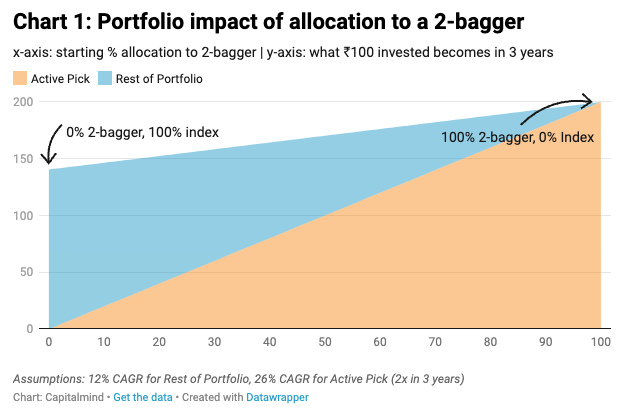

Let’s say you’ve done the research to find a stock that you think could double in the next three years.

You can’t be sure but you’re optimistic.

How much of an impact could this have on your portfolio?

You can’t be sure but you’re optimistic.

How much of an impact could this have on your portfolio?

Any “active” stock selection effort needs to outperform with respect to the index. And to outperform, overall i.e. the cumulative impact of active stock picks needs to beat the index.

If you consider the opportunity cost of time and effort involved, active investment decisions need to beat the index by a decent margin to be worth it.

Learn to make your winners count.

#investing #multibaggers #positionsizing #stockmarket

Learn to make your winners count.

#investing #multibaggers #positionsizing #stockmarket

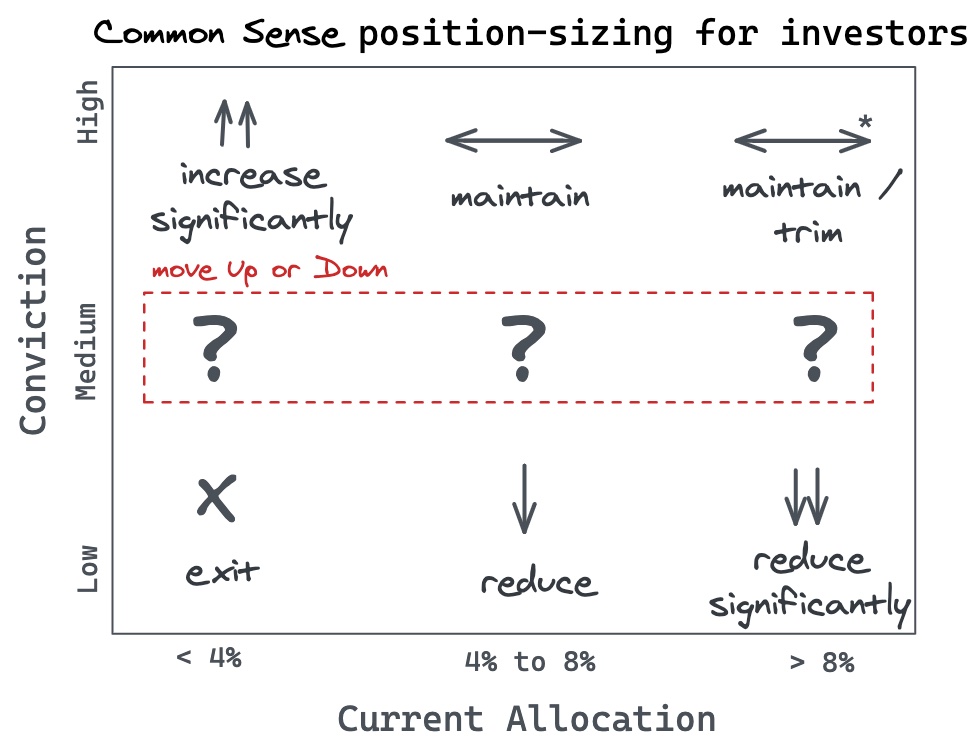

We provide a simple and effective framework that helps you think about position sizing.

Refer to the post by @CalmInvestor:

capitalmind.in

Refer to the post by @CalmInvestor:

capitalmind.in

Loading suggestions...