That's it for today.

Looking for even more inspiration?

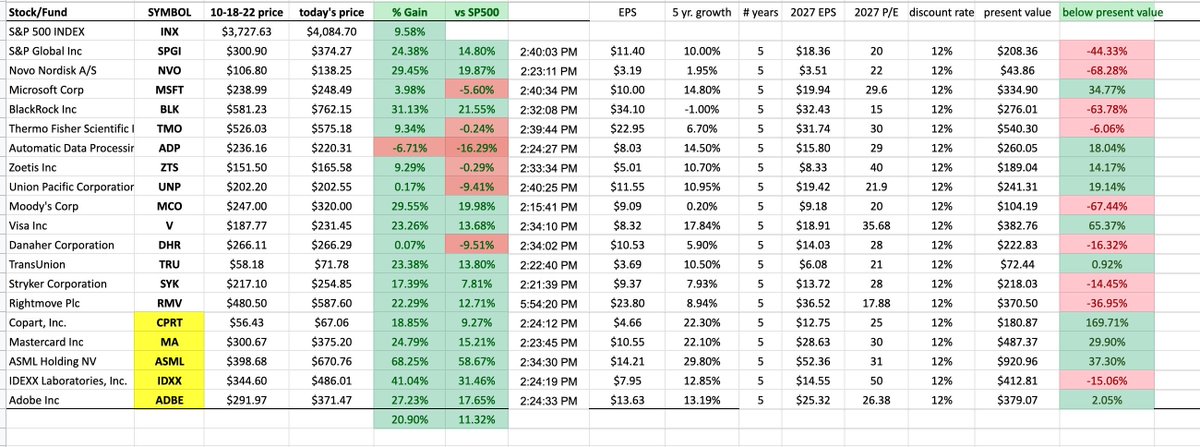

You'll love my FREE COURSE with more than 100 examples of Quality Stocks.

Grab it for free here: eepurl.com

Looking for even more inspiration?

You'll love my FREE COURSE with more than 100 examples of Quality Stocks.

Grab it for free here: eepurl.com

Loading suggestions...