A ₹10,000 crore mcap company, secured a massive order for 5,150 electric buses worth over ₹10,000 crores, driving the stock up by over 17%. 📈

Join us in this 🧵 as we analyze Olectra Greentech's future prospects. 🔎

Grab a coffee ☕ and stick around!

#OlectraGreentech #Quest

Join us in this 🧵 as we analyze Olectra Greentech's future prospects. 🔎

Grab a coffee ☕ and stick around!

#OlectraGreentech #Quest

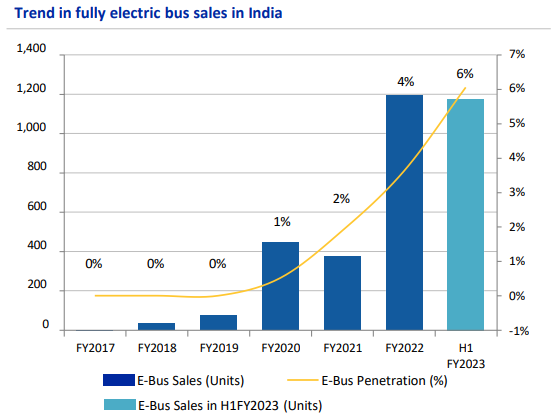

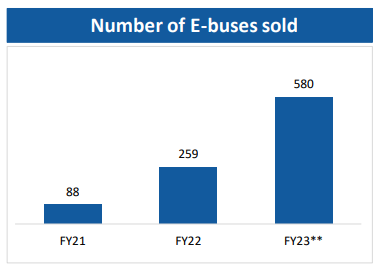

With over 1,188 electric buses hitting Indian roads, this company is revolutionizing the EV bus industry!

We can see the products of the company in the image.

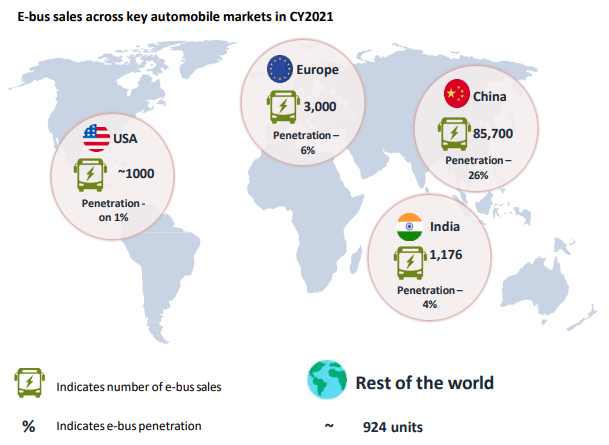

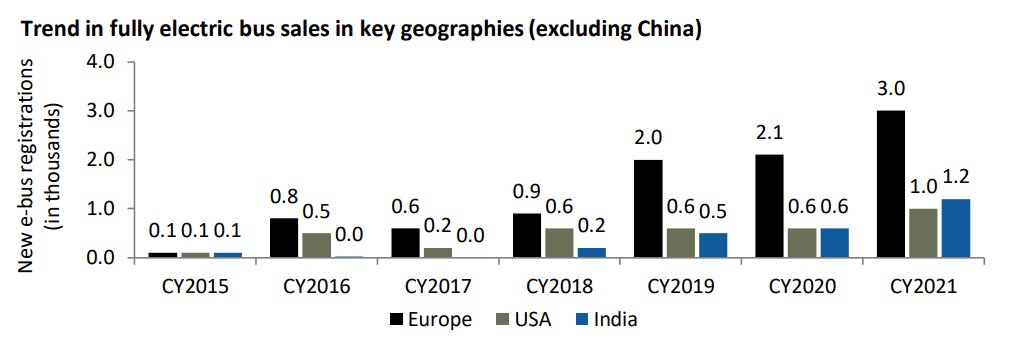

But first, let's try to understand this booming sector. ⤵️

#EV #ElectricBuses

We can see the products of the company in the image.

But first, let's try to understand this booming sector. ⤵️

#EV #ElectricBuses

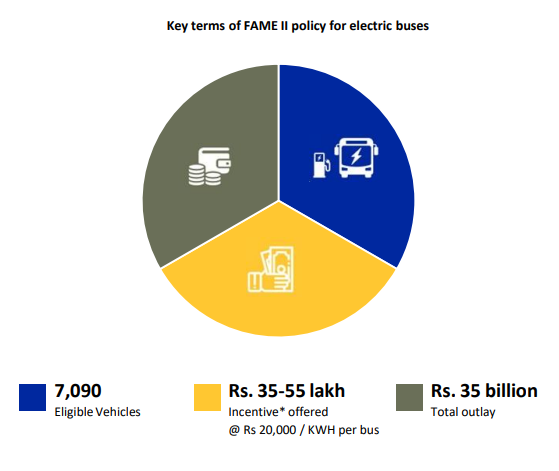

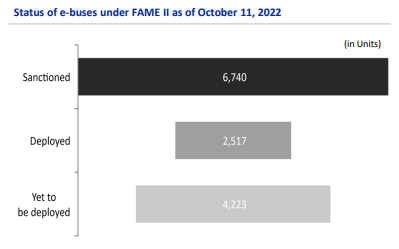

India's PLI Scheme aims to allocate a total of US$20 billion, including US$2.5 billion specifically for batteries.

These incentives will attract more players and foster the growth of the low-emission vehicle ecosystem.

Also...

These incentives will attract more players and foster the growth of the low-emission vehicle ecosystem.

Also...

The company received an order for 2,100 e-buses from Brihan Mumbai Electric Supply & Transport in May-23.

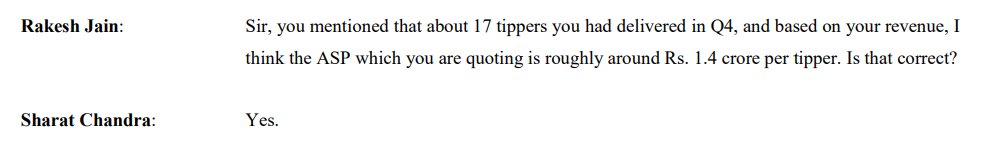

And today, on July 7, 2023, the company secured orders for 5,100 e-buses worth over ₹10,000 crores.

However, can the company meet the demand capacity?

Let's see⤵️

And today, on July 7, 2023, the company secured orders for 5,100 e-buses worth over ₹10,000 crores.

However, can the company meet the demand capacity?

Let's see⤵️

The company's Hyderabad facilities produce 1,500 units/year.

Olectra acquired 150 acres in Hyderabad for a new greenfield plant with a capacity of 5,000 units/year, which is scalable upto 10,000 units/year.

Also...

Olectra acquired 150 acres in Hyderabad for a new greenfield plant with a capacity of 5,000 units/year, which is scalable upto 10,000 units/year.

Also...

▶️ The company has entered into Staff Transport Segment.

▶️ The company is establishing TARMAC buses in airports.

▶️ The company is establishing TARMAC buses in airports.

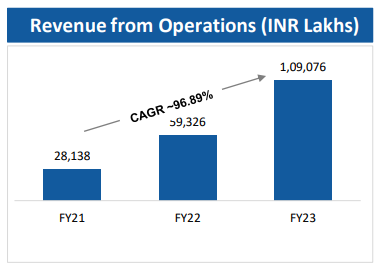

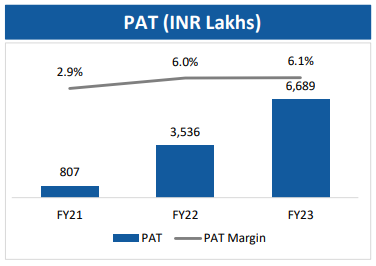

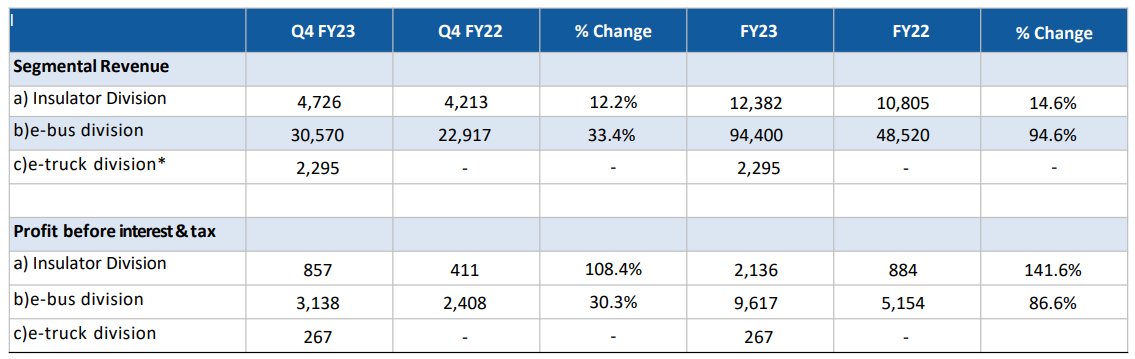

Considering the future plans, solid fundamentals, robust orderbook, and substantial CAPEX to meet the orders, the company's earnings may experience substantial growth. 📈

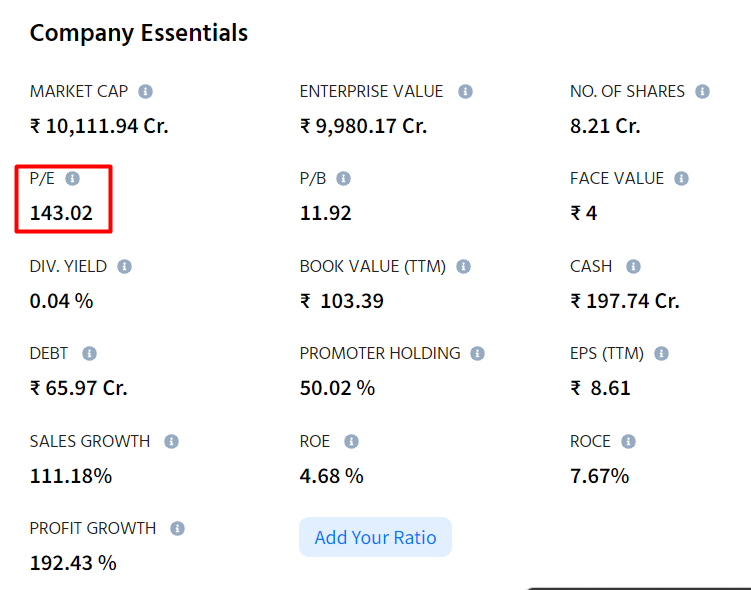

Considering all the factors, the market has assigned a price-to-earnings PE of 140 to this company.

Considering all the factors, the market has assigned a price-to-earnings PE of 140 to this company.

This was all.

Thanks for following our analysis on Olectra!

Like 👍, retweet 🔁 the first tweet, and comment your thoughts on the company's valuation.

Follow @Finology_Quest for more analysis.

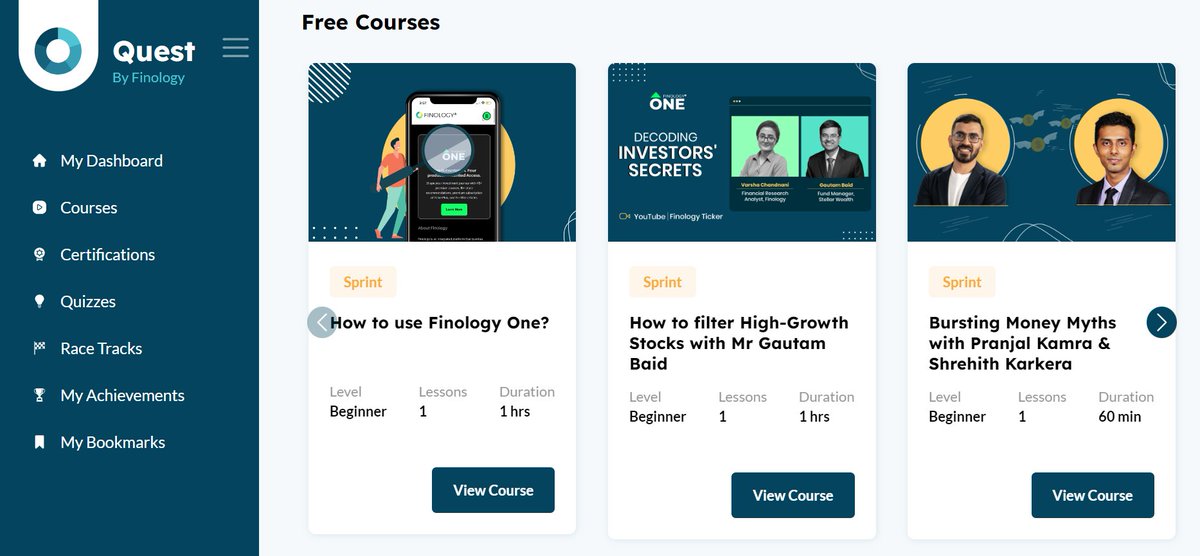

Visit bit.ly to learn about finance. Happy learning! 💼💡

#Quest

Thanks for following our analysis on Olectra!

Like 👍, retweet 🔁 the first tweet, and comment your thoughts on the company's valuation.

Follow @Finology_Quest for more analysis.

Visit bit.ly to learn about finance. Happy learning! 💼💡

#Quest

جاري تحميل الاقتراحات...