Swing Trading Strategy with Chartink Screener and Live Examples

A Thread🧵

A Thread🧵

Step 1 : Run this Screener

chartink.com

✅Filters Out Stock which are in 5% range of their 52 Week High

✅ RS > 0

✅ ROE, ROCE > 15

✅Above 21 ema

chartink.com

✅Filters Out Stock which are in 5% range of their 52 Week High

✅ RS > 0

✅ ROE, ROCE > 15

✅Above 21 ema

Step 2 :

After running the Screener you will find 100 Stocks in the list

If you want you can change Market Cap Filter , ROE , ROCE Filter which changes the no of Stocks in the Screener

After running the Screener you will find 100 Stocks in the list

If you want you can change Market Cap Filter , ROE , ROCE Filter which changes the no of Stocks in the Screener

Step 3 : Open each chart one by one

Assuming you take 1 min per chart , it will take only 90 mins per day for Stock screening which comes down to 45 min if you do it regularly

Assuming you take 1 min per chart , it will take only 90 mins per day for Stock screening which comes down to 45 min if you do it regularly

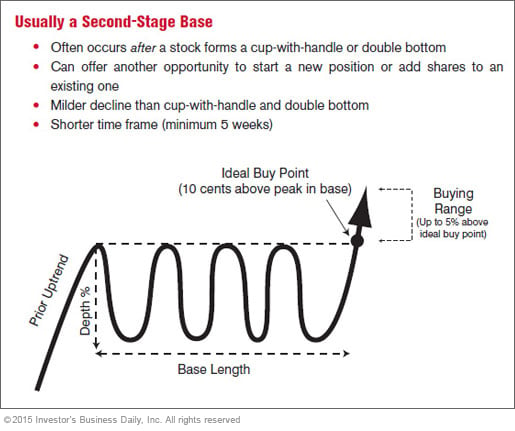

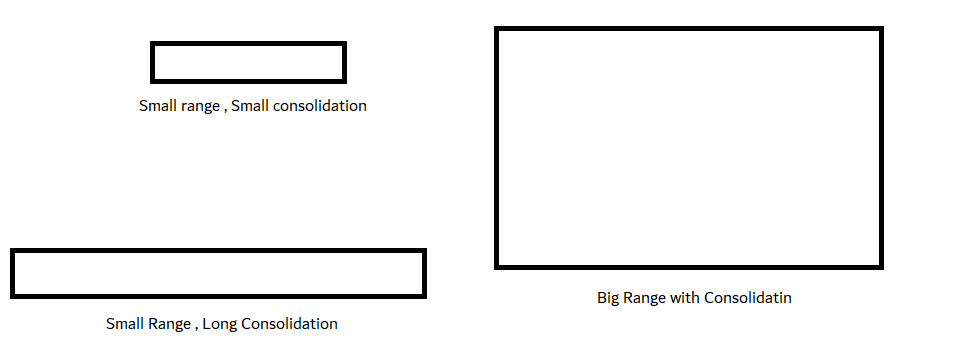

Entry Point :

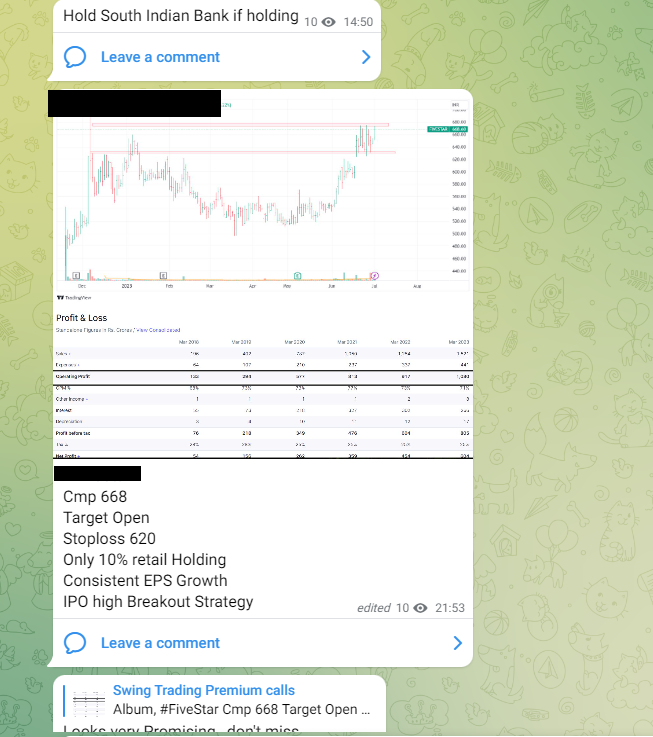

Enter on the breakout with max Stoploss of 8%

Tight base will have smaller stoploss

Target can be 1:2 Risk Reward or trailing use 21 ema

Position Size max 10% in a Stock

Enter on the breakout with max Stoploss of 8%

Tight base will have smaller stoploss

Target can be 1:2 Risk Reward or trailing use 21 ema

Position Size max 10% in a Stock

If this tweet added value

Consider following me and retweeting this tweet !

Consider following me and retweeting this tweet !

جاري تحميل الاقتراحات...