1/ Polygon’s lack of a ve(3,3) exchange was a problem that was needed to be solved.

@PearlFi_ is capitalizing on this void to milk liquidity into it’s DEX.

Let’s dive in 🏄♂️

@PearlFi_ is capitalizing on this void to milk liquidity into it’s DEX.

Let’s dive in 🏄♂️

2/ The rise of solidly bribe protocols toppled the previous AMM dex model of protocols like sushiswap.

With @PearIFi_ , users can self-optimize the AMM which would not lead to the dumping of the platform's governance token.

How this is achieved is pretty simple.

With @PearIFi_ , users can self-optimize the AMM which would not lead to the dumping of the platform's governance token.

How this is achieved is pretty simple.

3/ It gives token emissions to the most voted LPs

LPs on the DEX offers incentive to liquidity providers to get votes.

These votes allow LPs to maximize token emmisions given to them by @PearlFi_

LPs on the DEX offers incentive to liquidity providers to get votes.

These votes allow LPs to maximize token emmisions given to them by @PearlFi_

4/ Pearl-fi has partnered with @tangibleDAO , one of the largest bribers and most widely adopted RWA

Using their stablecoin- $USDR , it allows auto-bribes sourced from USDR using the solidly model.

USDR is backed by tokenized real estate, offering 8% APR from rental yield.

Using their stablecoin- $USDR , it allows auto-bribes sourced from USDR using the solidly model.

USDR is backed by tokenized real estate, offering 8% APR from rental yield.

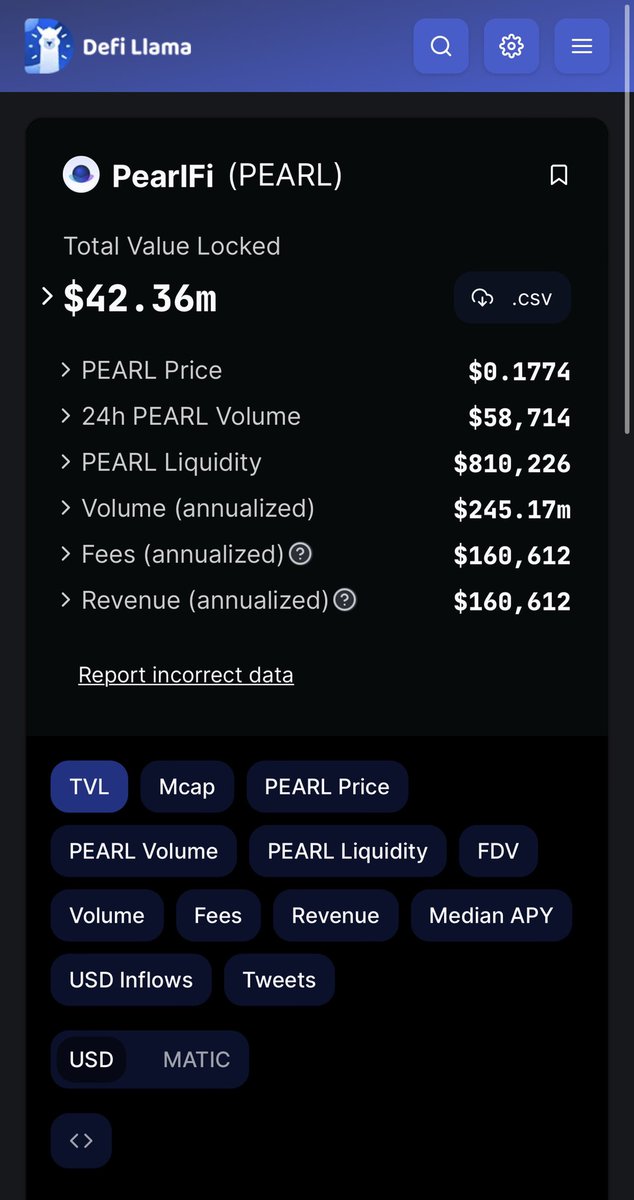

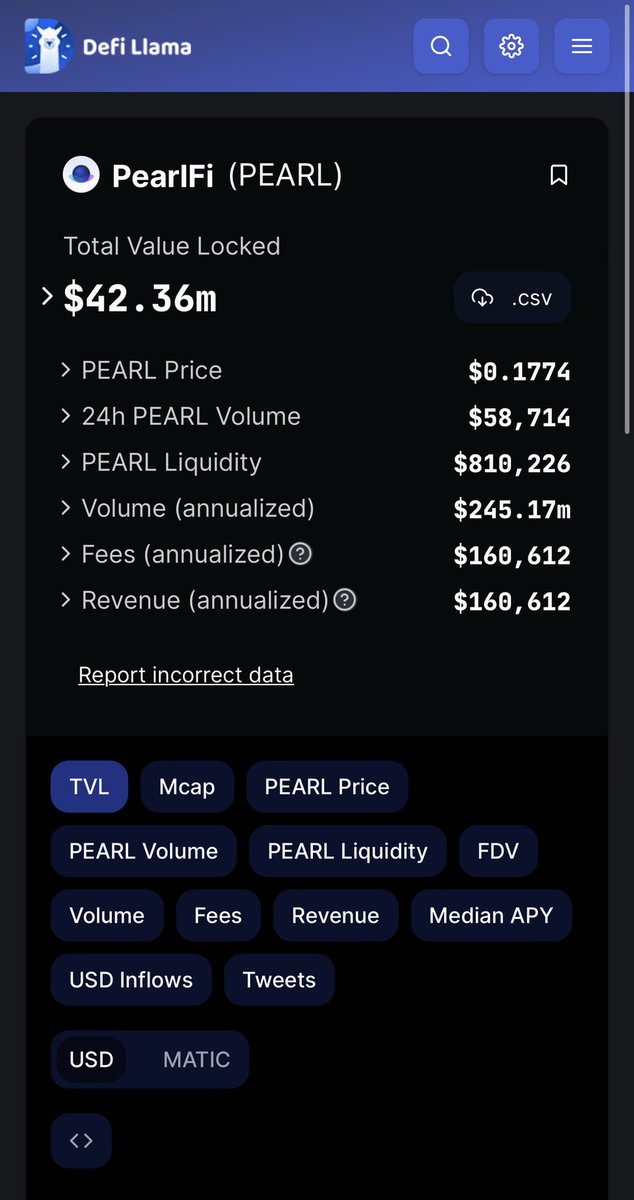

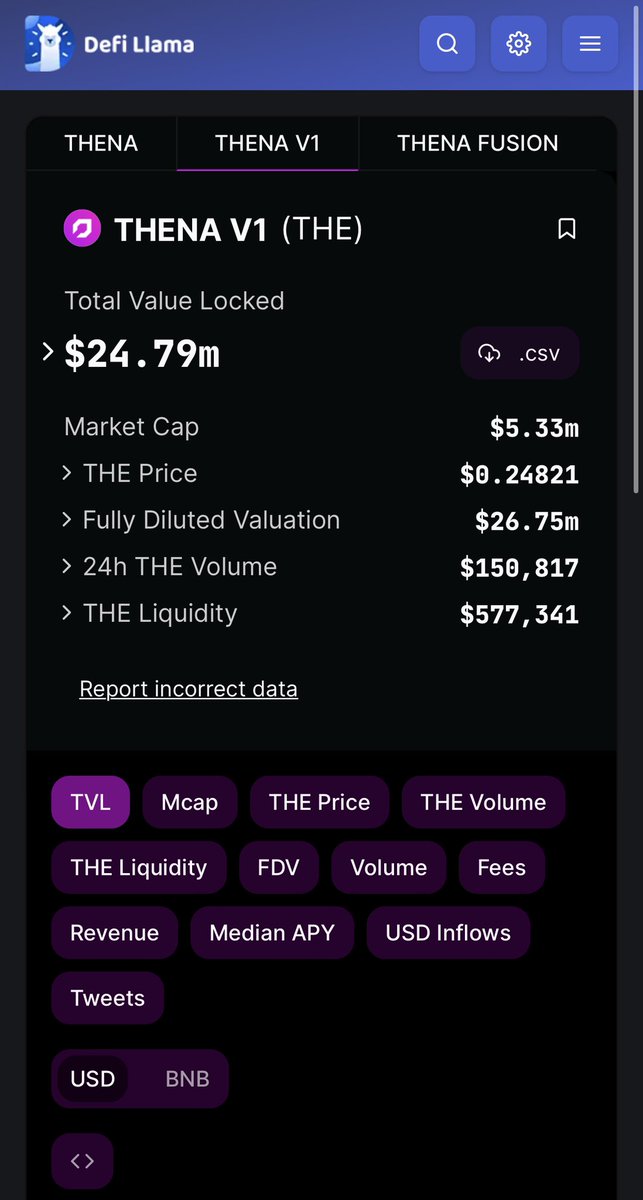

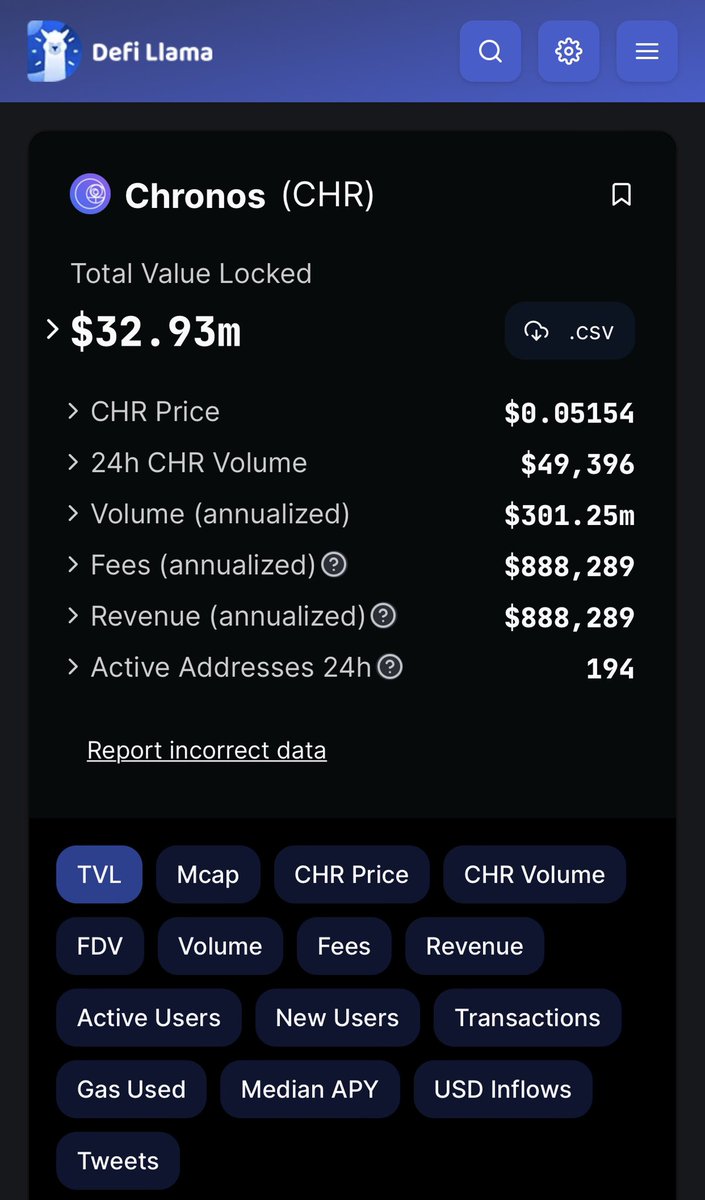

5/ With a whooping TVL of $43M, they are second only to @VelodromeFi as the leading solidly ve(3,3) DEX

With the growing demand for RWA integration with Defi, it won't be long before it shoots past its current position with more increase in volume.

With the growing demand for RWA integration with Defi, it won't be long before it shoots past its current position with more increase in volume.

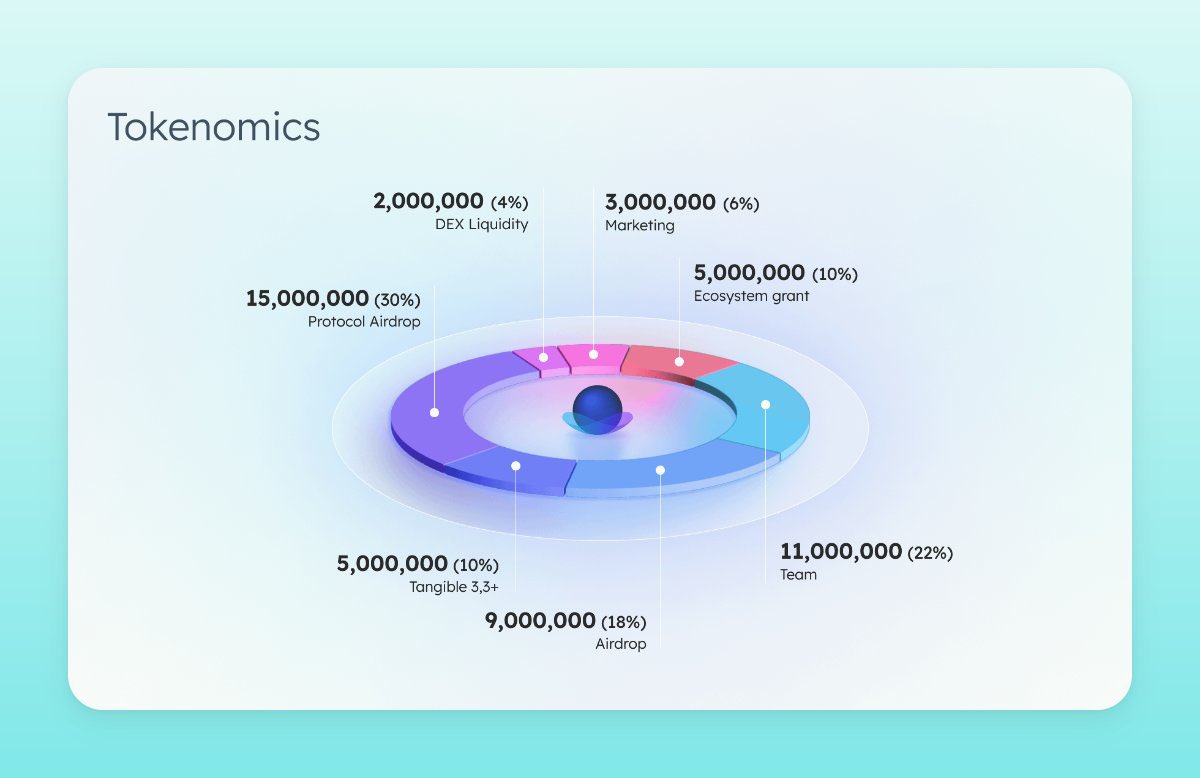

6/ Pearl-fi’s Tokens

• $pearl (ERC-20)- The main utility token used as a reward to incentivize liquidity providers and get better trading conditions.

• $vePearl (ERC-721)- With this, you can vote on which LPs emissions should be directed to on the pearl dex

• $pearl (ERC-20)- The main utility token used as a reward to incentivize liquidity providers and get better trading conditions.

• $vePearl (ERC-721)- With this, you can vote on which LPs emissions should be directed to on the pearl dex

7/ To get vePearl, users have to lock their $pearl and the longer the lock, the longer the amount of voting power you wield.

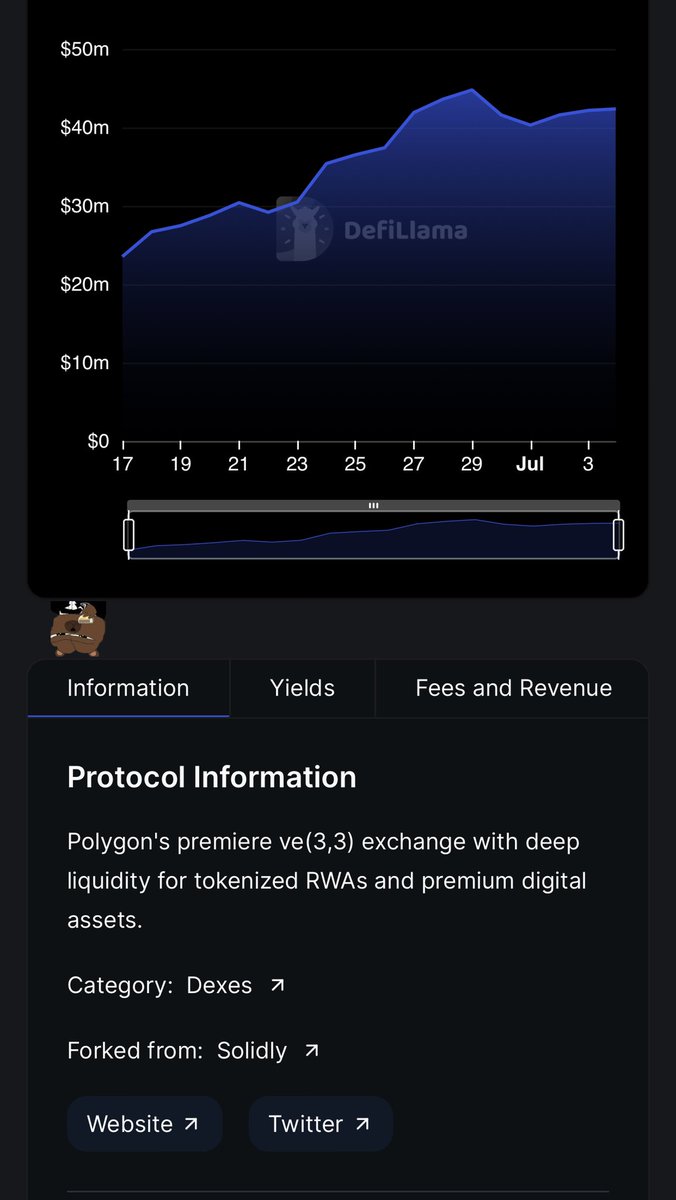

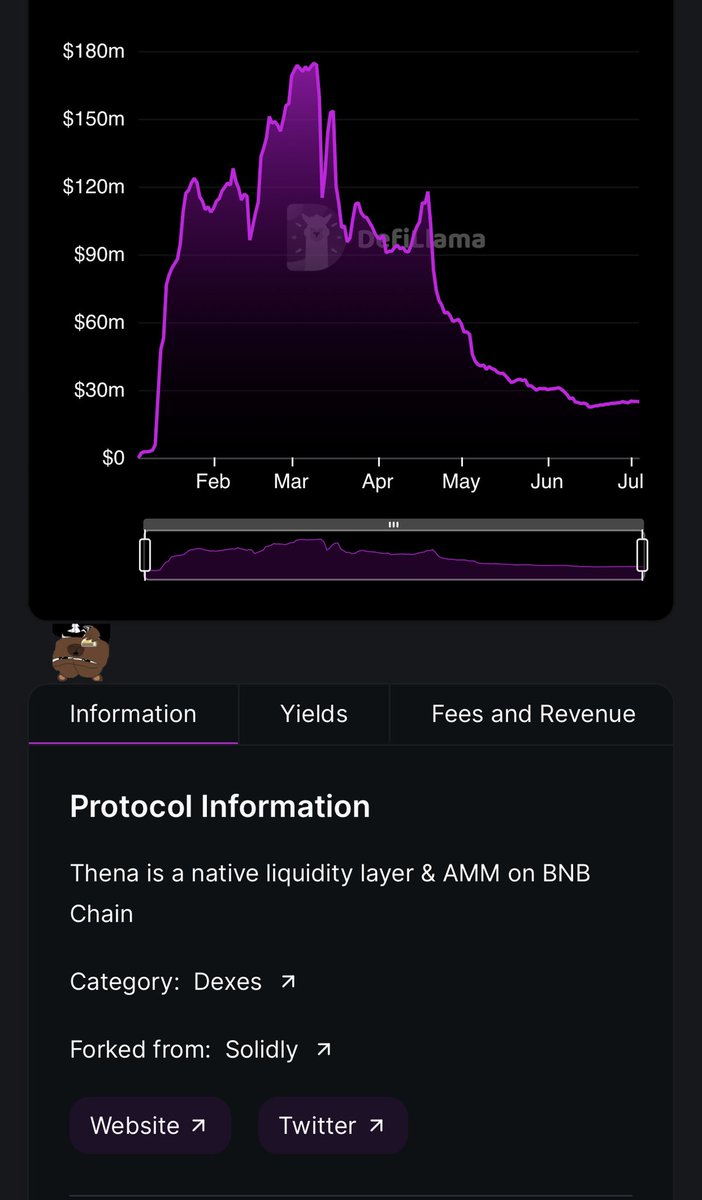

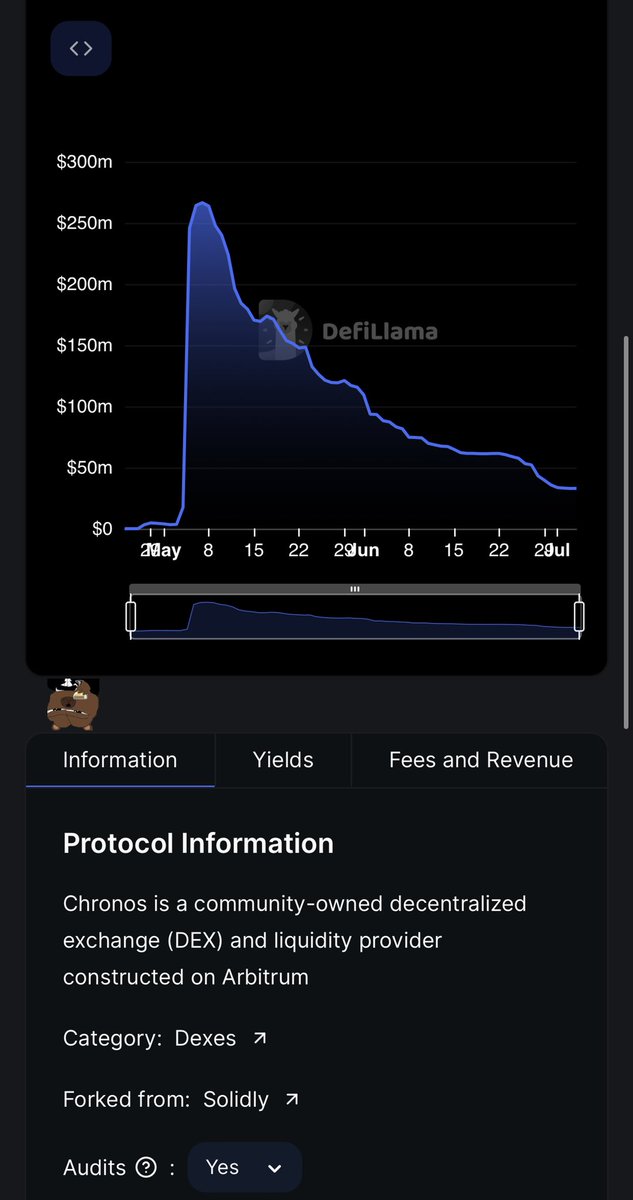

9/ In a solidly bribe model, incentives is king.

Platforms with better incentives naturally outcompete others.

As it's evident in the @PearlFi_ chart👇🏽

Platforms with better incentives naturally outcompete others.

As it's evident in the @PearlFi_ chart👇🏽

13/ Sustainability of pearlfi’s ve (3,3) mode;

•Incentivizing LPs with unlocked governance token emissions

•Directing trade fees to users who lock these tokens (veToken holders)

•Incentivizing LPs with unlocked governance token emissions

•Directing trade fees to users who lock these tokens (veToken holders)

•Allow for protocol emissions to be distributed unequally to pools and let protocols bribe locked token holders to vote for emissions to flow to the pools with their tokens

14/ Conclusion

@PearlFi_ ensures high utility and rewards for holding and locking the governance tokens which helps maintain the tokens price, resulting in sustained liquidity.

RWAs are gaining traction and it wont be long before the rest of the market catches up.

DYOR

@PearlFi_ ensures high utility and rewards for holding and locking the governance tokens which helps maintain the tokens price, resulting in sustained liquidity.

RWAs are gaining traction and it wont be long before the rest of the market catches up.

DYOR

@0x366e @0xAndrewMoh @belizardd @poopmandefi @CryptoDinduz @OxTindorr @rektdiomedes @Splinteron @Flowslikeosmo @the_smart_ape @RealDegenGMX @AlphaFrog13 @o_ponle @Only1temmy @lou_markets @LongtermR @francescoweb3 @0xsurferboy If you found this thread helpful, kindly follow, like and RT 🙏🏽💜

Loading suggestions...