The merger is approved only by the bank's board and the approval from RBI, SEBI, NCLT, and stock exchanges is still pending.

IDFC Ltd shareholders will receive 155 shares of IDFC First Bank for every 100 shares of IDFC Ltd.

IDFC Ltd shareholders will receive 155 shares of IDFC First Bank for every 100 shares of IDFC Ltd.

Currently, IDFC Ltd holds a 39.93% stake in IDFC First Bank through IDFC Financial Holding Company.

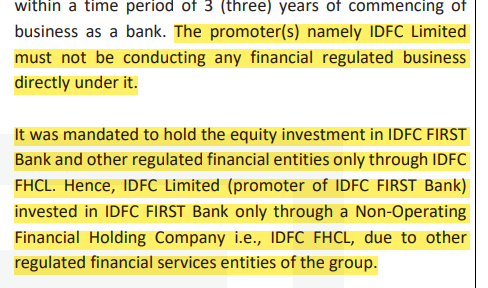

However, why didn't IDFC Ltd directly hold a stake in IDFC First Bank?

However, why didn't IDFC Ltd directly hold a stake in IDFC First Bank?

Post-merger, IDFC Bank will have complete public ownership, featuring diverse shareholders.

When we look at the financial performance of the bank and IDFC Ltd,

When we look at the financial performance of the bank and IDFC Ltd,

The bank currently has total assets of ₹2.4 lakh crores, while IDFC Ltd has total assets of ₹9,570 crores, which will be consolidated into a single entity after the merger.

The bank has a turnover of ₹27,195 crores while the IDFC Ltd has a turnover of ₹2,076 crores by FY23.

The bank has a turnover of ₹27,195 crores while the IDFC Ltd has a turnover of ₹2,076 crores by FY23.

Following the merger, the balance sheets of both entities will be merged into one, resulting in a 4.9% increase in the bank's book value.

The key reasons behind the merger are,

The key reasons behind the merger are,

▶️ The merger will simplify regulatory compliances for both IDFC Limited and IDFC FIRST Bank, leading to unification and streamlining.

▶️ The merger will help the bank with diversified institutional shareholders, like other large private sector banks, with no promoter holding.

▶️ The merger will help the bank with diversified institutional shareholders, like other large private sector banks, with no promoter holding.

Despite the positive aspects of the merger, why did the stock price of IDFC First Bank fall and the stock price of IDFC Ltd rise?

The answer is the Share Exchange Ratio.

The answer is the Share Exchange Ratio.

On July 3, the closing price indicated that IDFC shareholders were receiving a 17% premium.

Due to the favorable risk-reward ratio for the parent company, IDFC Ltd experienced a 2% surge on July 4, while IDFC First Bank witnessed a 4% decline.

Due to the favorable risk-reward ratio for the parent company, IDFC Ltd experienced a 2% surge on July 4, while IDFC First Bank witnessed a 4% decline.

What are your thoughts on this thread?

If you enjoyed it, show your support by liking 👍 and retweeting 🔁 the first tweet.

Stay updated with @Finology_Quest for similar content.

For a deeper understanding of finance, visit bit.ly.

If you enjoyed it, show your support by liking 👍 and retweeting 🔁 the first tweet.

Stay updated with @Finology_Quest for similar content.

For a deeper understanding of finance, visit bit.ly.

جاري تحميل الاقتراحات...