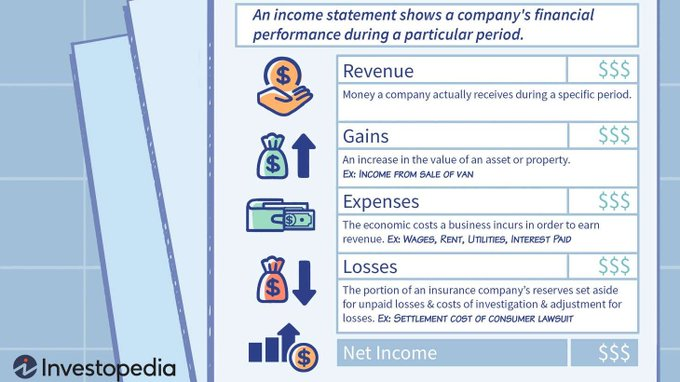

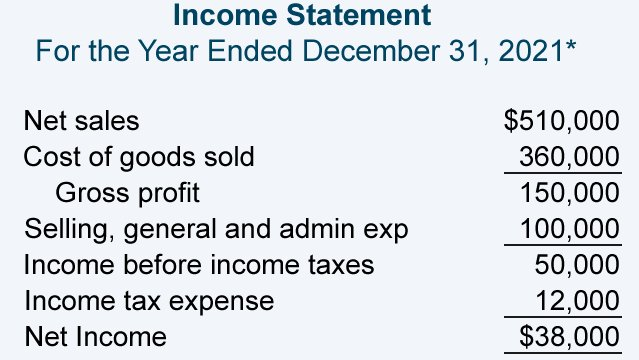

4) Net income (or loss) is calculated by subtracting expenses from revenues and is reported at the bottom of the income statement, along with any taxes and net income (or loss) per share of common stock.

3 items to analyze in an income statement:

3 items to analyze in an income statement:

5) 2 items to analyze in income statements:

A. Profit margins: Assess the portion of revenue turned into profits; higher margins suggest efficient expense management

B. Expense management: Ensure the company controls expenses; expenses rising faster than revenues are a red flag

A. Profit margins: Assess the portion of revenue turned into profits; higher margins suggest efficient expense management

B. Expense management: Ensure the company controls expenses; expenses rising faster than revenues are a red flag

6) Items to analyze in an income statement:

C. Revenue growth: Observe if the company's revenue is increasing or decreasing over time, indicating its overall health and growth prospects.

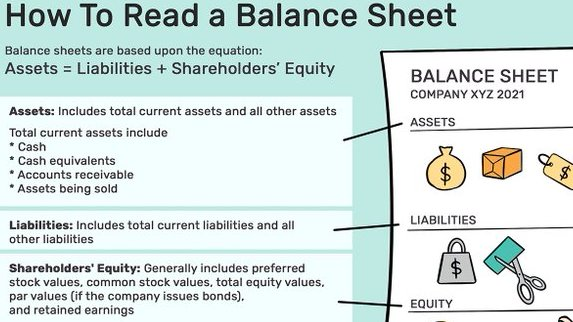

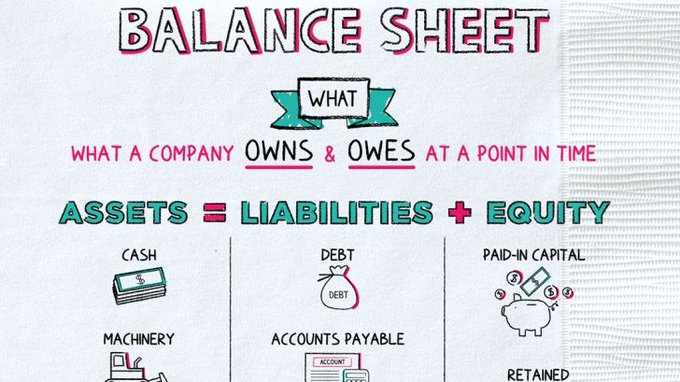

Let's talk about the balance sheet:

C. Revenue growth: Observe if the company's revenue is increasing or decreasing over time, indicating its overall health and growth prospects.

Let's talk about the balance sheet:

9) 3 items to analyze in a balance sheet:

A. Asset quality: Check for a strong, diverse asset base, which can support growth & withstand downturns

B. Working capital: Ensure there are enough resources to cover short-term obligations, indicating greater financial stability

A. Asset quality: Check for a strong, diverse asset base, which can support growth & withstand downturns

B. Working capital: Ensure there are enough resources to cover short-term obligations, indicating greater financial stability

10) Items to analyze in a balance sheet:

C. Debt levels: Assess if the company carries excessive debt, which can increase financial risk and vulnerability during economic downturns.

Let's talk about the statement of cash flows:

C. Debt levels: Assess if the company carries excessive debt, which can increase financial risk and vulnerability during economic downturns.

Let's talk about the statement of cash flows:

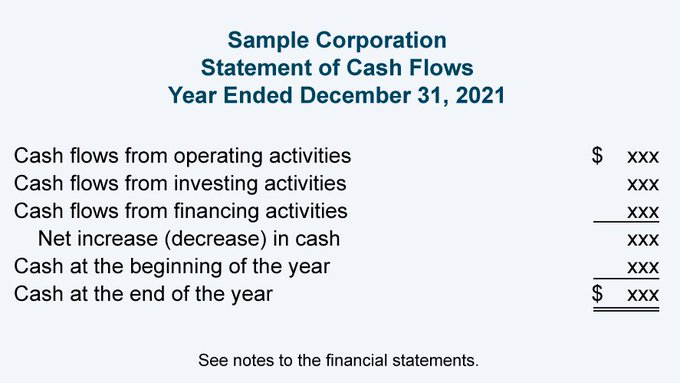

12) The statement of cash flows shows how a company generates & uses cash, helping assess financial health and ability to fulfill financial obligations

A. Operating activities show cash flows from core business operations (customer payments, supplier or employee expenses, etc)

A. Operating activities show cash flows from core business operations (customer payments, supplier or employee expenses, etc)

13) Cash flow statement:

B. Investing activities show cash flows from buying & selling long-term assets (investments in companies, property, plant & equipment, etc)

C. Financing activities show cash flows related to debt & equity (issuing shares, paying loans, dividends, etc)

B. Investing activities show cash flows from buying & selling long-term assets (investments in companies, property, plant & equipment, etc)

C. Financing activities show cash flows related to debt & equity (issuing shares, paying loans, dividends, etc)

14) 3 items to analyze in a cash flow statement:

A. Capital expenditures: Assess if the company is investing in its business, suggesting good growth prospects.

B. Financing activities: Examine new debt or equity issuance, as it affects the company's financial risk profile.

A. Capital expenditures: Assess if the company is investing in its business, suggesting good growth prospects.

B. Financing activities: Examine new debt or equity issuance, as it affects the company's financial risk profile.

15) Items to analyze in a cash flow statement:

C. Operating cash flow: Check if the company generates enough cash from operations to cover expenses and debts, indicating financial health.

C. Operating cash flow: Check if the company generates enough cash from operations to cover expenses and debts, indicating financial health.

Financial statements are essential for evaluating financial performance. These threads take time to write so if you found it helpful:

• RT the FIRST tweet to share it🔁

• Follow me @FluentInFinance for more

• Sign-up for my newsletter to learn more: TheInvestingNewsletter.com!

• RT the FIRST tweet to share it🔁

• Follow me @FluentInFinance for more

• Sign-up for my newsletter to learn more: TheInvestingNewsletter.com!

Loading suggestions...