A detailed 🧵 on Shree Ganesh Remedies Limited (SGRL)

Disclosure: Invested, Holding and Biased

#multibaggers #investing #StockMarketindia

Disclosure: Invested, Holding and Biased

#multibaggers #investing #StockMarketindia

SGRL is primarily engaged in the business of Pharma Intermediate.

The revenue mix stands at:

- Pharma API (70%)

- Fine and Specialty chemicals (15%)

- Contract Manufacturing Process (15%)

Fine-Specialty chemicals and CRAMS are the new areas of development in last 2-3 years.

The revenue mix stands at:

- Pharma API (70%)

- Fine and Specialty chemicals (15%)

- Contract Manufacturing Process (15%)

Fine-Specialty chemicals and CRAMS are the new areas of development in last 2-3 years.

Before diving further, let us get a brief on the 💊💉Pharma industry and its value chain.

Pharma Value Chain:

Key Starting Material (KSM) -> Active Pharma Ingredient (API) Intermediates -> API -> Formulation -> End User

Key Starting Material (KSM) -> Active Pharma Ingredient (API) Intermediates -> API -> Formulation -> End User

Pharma Industry in India:

- Globally 3rd in drug production by volume and 14th by value contributing 3.5% of drugs & medicines exported globally

- Manufacturer of 60% of global vaccines

- More than 50% of generic drug requirements in the US are met by Indian drug-makers

- Globally 3rd in drug production by volume and 14th by value contributing 3.5% of drugs & medicines exported globally

- Manufacturer of 60% of global vaccines

- More than 50% of generic drug requirements in the US are met by Indian drug-makers

Made-in-India drugs are known for their safety and quality in the international markets, with the US, Japan, and the EU being some of the largest buyers.

#MakeInIndia #aatmanirbharbharat

#MakeInIndia #aatmanirbharbharat

While India is a world leader in generic drugs, the country is highly dependent on the import of key starting materials (KSMs) and active pharmaceutical ingredients (APIs)

Despite India being world's pharmacy, 70-80% of APIs are imported from China.

Despite India being world's pharmacy, 70-80% of APIs are imported from China.

Let us get back to what #SGRL does and business understanding of the segments in which it operates.

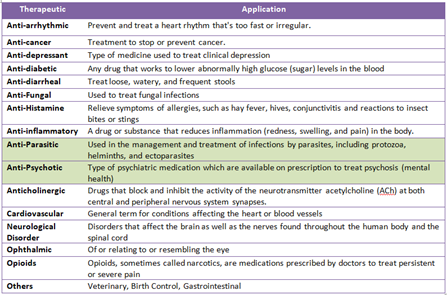

Pharma:

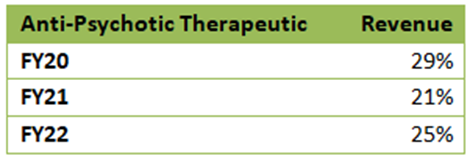

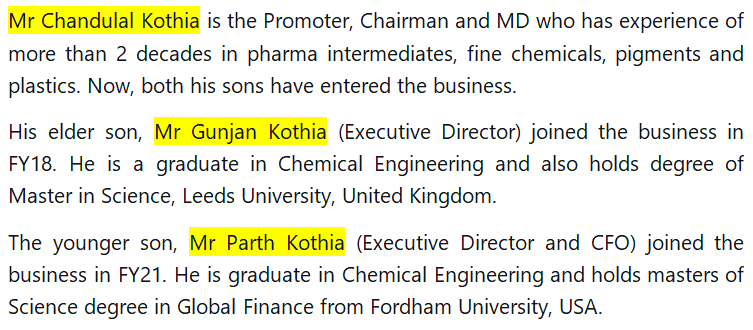

It is manufacturing pharma intermediates for API manufacturers. The company currently has 30+ API Intermediaries in Human Health and 10+ API Intermediaries in Animal Health.

It is manufacturing pharma intermediates for API manufacturers. The company currently has 30+ API Intermediaries in Human Health and 10+ API Intermediaries in Animal Health.

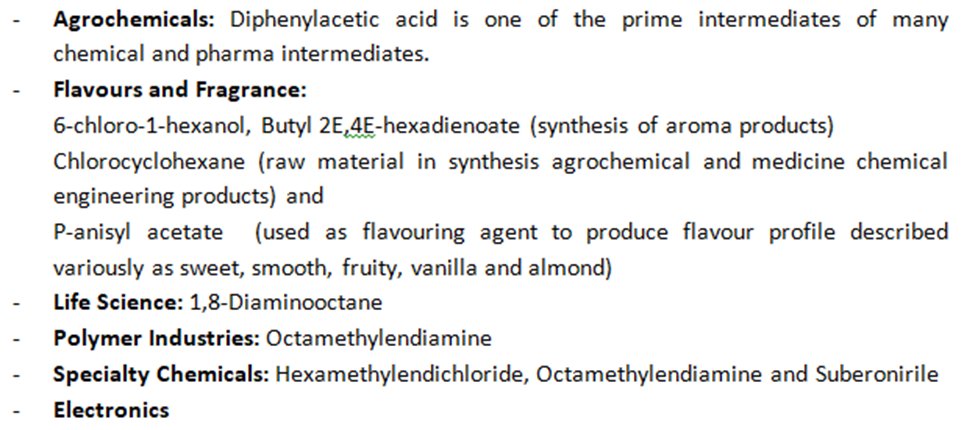

Fine and Specialty Chemicals:

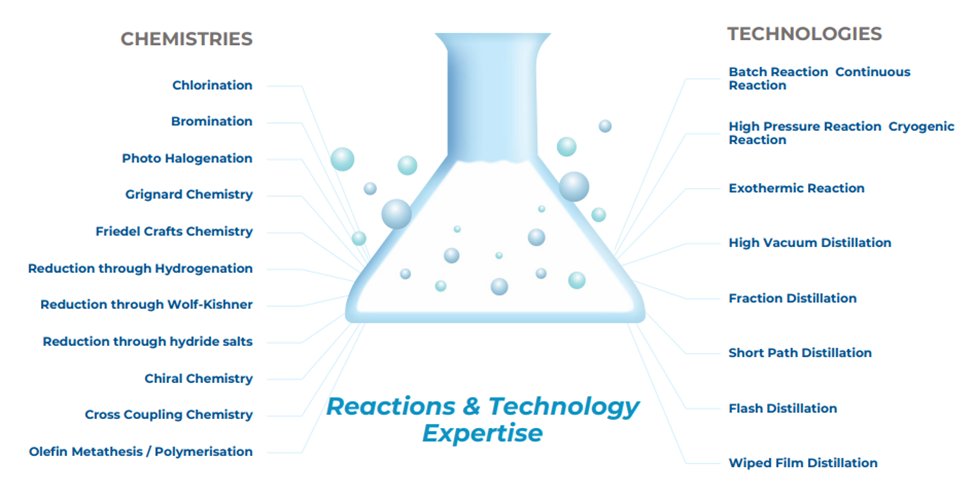

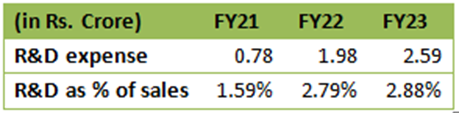

Until FY20, the company was solely into Pharma Intermediates. With continuous efforts in R&D, chemistries and technologies, the company added Fine and Specialty chemicals in FY21.

Until FY20, the company was solely into Pharma Intermediates. With continuous efforts in R&D, chemistries and technologies, the company added Fine and Specialty chemicals in FY21.

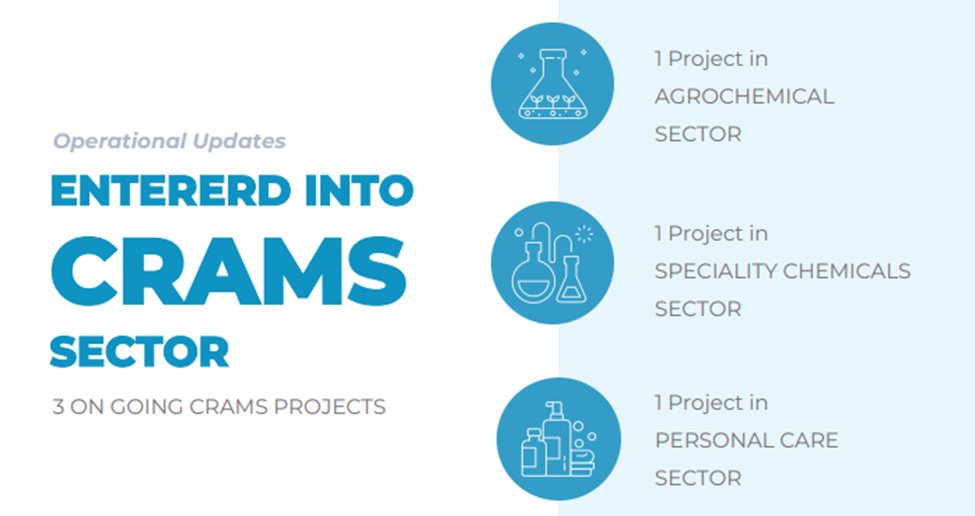

Contract Research & Manufacturing Services (CRAMS):

In FY22, the company started doing #CRAMS for both Pharmaceuticals and Specialty Fine Chemicals.

CRAMS is the recent buzzword in India Pharma industry.

In FY22, the company started doing #CRAMS for both Pharmaceuticals and Specialty Fine Chemicals.

CRAMS is the recent buzzword in India Pharma industry.

With increasing competition the global pharma companies are seeking to reduce their production and research costs. Indian companies with their strong chemistry skills and low costs are attempting to enter this new space as it represents a scalable opportunity.

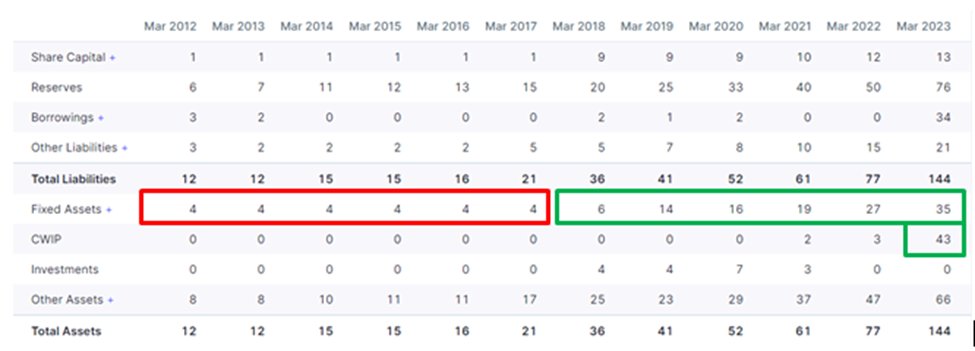

#IPO History:

The company came up with BSE (SME Board) IPO in 2017 to acquire adjacent land for capacity expansion and value unlocking.

In 2020, the company migrated to BSE mainboard.

The company came up with BSE (SME Board) IPO in 2017 to acquire adjacent land for capacity expansion and value unlocking.

In 2020, the company migrated to BSE mainboard.

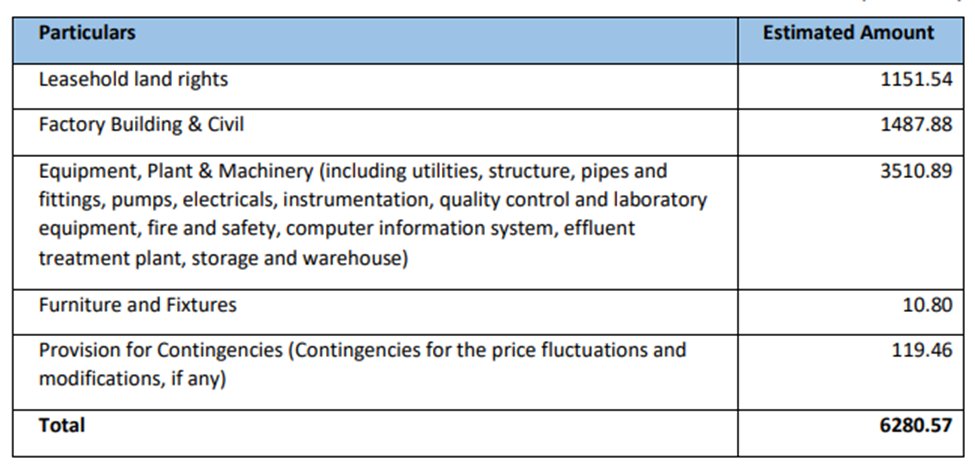

But in March 2022, company was declared as highest bidder with Rs.26 crores bid, for the E-Auction of Assets (in possession of GIIC Ltd.) of M/s Jaiswal Pharmachem Limited. This plant is adjacent to SGRL.

Now, all the expansion which was going to happen at Dahej is going to happen at the adjacent facility as it facilities sharing of utilities and saving other overheads.

The company did a Right Issue of 18.91 crores in February 2023 which was majorly for clearing dues of Leasehold land at Dahej and working capital requirement.

#rightissue

#rightissue

So, from ~16,000 sq. meters to ~76,000 sq. meters, the company has increased its land block by almost 5 times.

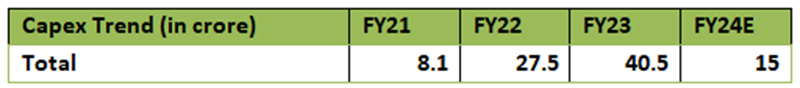

Expansion Details

Unit 1: Already have 3 manufacturing blocks + Coming up with 3 more blocks (Phase 1 of capex)

Unit 1: Already have 3 manufacturing blocks + Coming up with 3 more blocks (Phase 1 of capex)

1. New GMP manufacturing block for Advanced API Intermediates

(Expected to complete and commission by Q3 FY24)

(Expected to complete and commission by Q3 FY24)

2. State of Art Pilot Plant Block

(Scaling up complex process + manufacturing block for niche specialty chemicals)

(Low Volume, High Margin)

(Expected to commission by Q2 FY24)

(Scaling up complex process + manufacturing block for niche specialty chemicals)

(Low Volume, High Margin)

(Expected to commission by Q2 FY24)

3. State of art manufacturing block to cater wide range of product categories in Pharmaceutical + Specialty chemicals

(High pressure reaction) (From pressure reaction capacity of 12 bars to upto 40 bars)

(Expected to commission by Q1 FY24)

(High pressure reaction) (From pressure reaction capacity of 12 bars to upto 40 bars)

(Expected to commission by Q1 FY24)

A company has to offer several chemistries under one roof as customers prefer those players who are able to perform more and more chemistries/steps at a same place.

For example, if it is product a 9 step process but only 2-3 steps are performed in India, then the dependency is still there. China plus one and Supply chain de-risking doesn’t really work unless maximum of the steps are performed in India.

Exports accounted for ~80% sales in FY20. The company worked on several import substitute products and increased its domestic presence.

In July 2021, SGRL successfully commenced the commercial production of a newly developed Cyclo-Propyl derivative.

In July 2021, SGRL successfully commenced the commercial production of a newly developed Cyclo-Propyl derivative.

Exports now account for 60-65% of revenue with major geographies being Europe (Belgium, UK) and US.

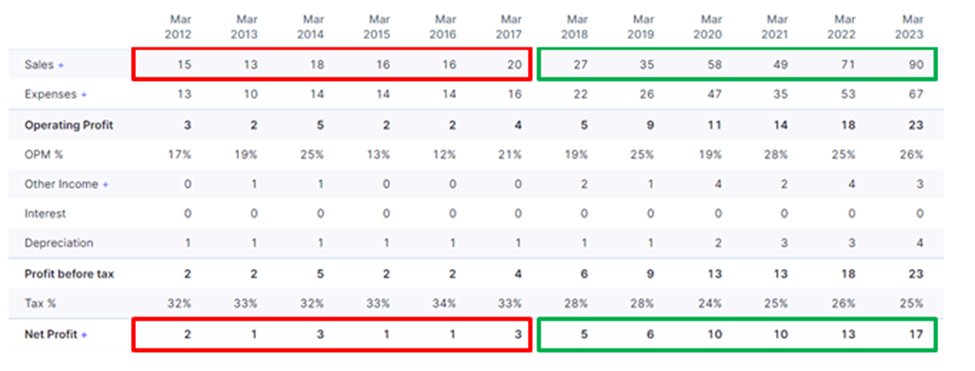

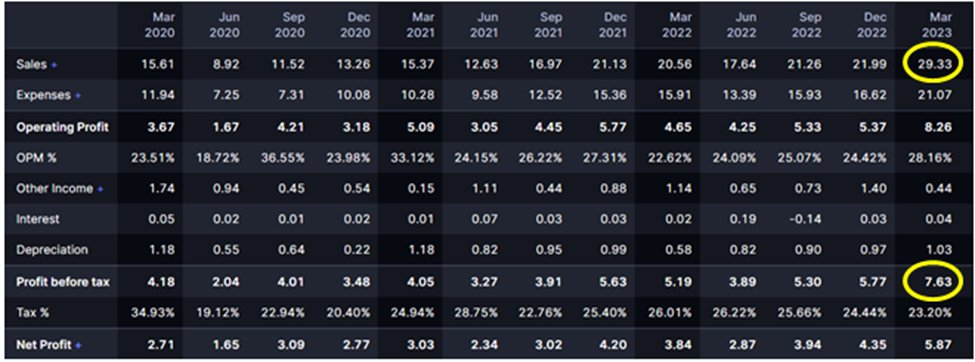

#Q4FY23 Superb financial performance

2 new products commercialized in FY23, one is for specialty chemicals and another is for Pharma intermediates. The specialty chemical product was in advanced talk with customers but due to slowdown in Europe it was getting delayed.

2 new products commercialized in FY23, one is for specialty chemicals and another is for Pharma intermediates. The specialty chemical product was in advanced talk with customers but due to slowdown in Europe it was getting delayed.

It got order in January and the numbers are reflected in Q4. Company is now confident to maintain this run rate as directly supplied at commercial stage.

Margins:

Since they book revenue on invoice-invoice based model, the company expects the operating margin to be between 25-28% going forward.

Since they book revenue on invoice-invoice based model, the company expects the operating margin to be between 25-28% going forward.

The company is eyeing 2.5-3x asset turnover on newer capex while guiding to maintain the margins. If the company is able to execute things as it has in the past, it can turn out to be a huge winner.

Do read and help to improve. Also guide to work on things to research better.

@drprashantmish6 @ValueEducator @ishmohit1 @MeetshahV @sahil_vi @SmartSyncServ @Aditya_joshi12 @Vims9886

@drprashantmish6 @ValueEducator @ishmohit1 @MeetshahV @sahil_vi @SmartSyncServ @Aditya_joshi12 @Vims9886

@drprashantmish6 @ValueEducator @ishmohit1 @MeetshahV @sahil_vi @SmartSyncServ @Aditya_joshi12 @Vims9886 As a believer of @niveshaay’s scuttlebutt and ground research approach, we did a plant visit recently to improve our understanding of the business.

@MeetKatrodiya_

@MeetKatrodiya_

Loading suggestions...