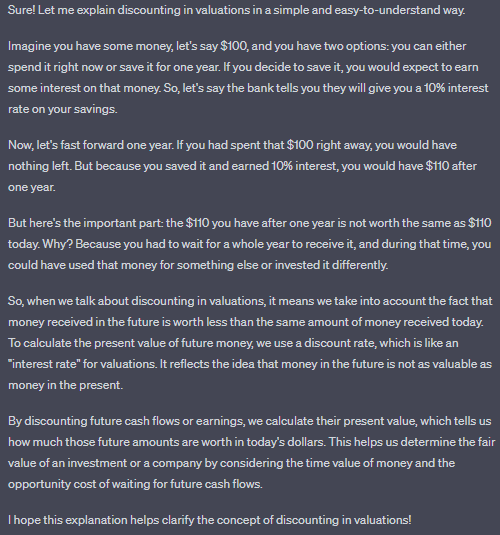

3/ Each of these three types are very different from each other and emphasize on a key aspect of valuation.

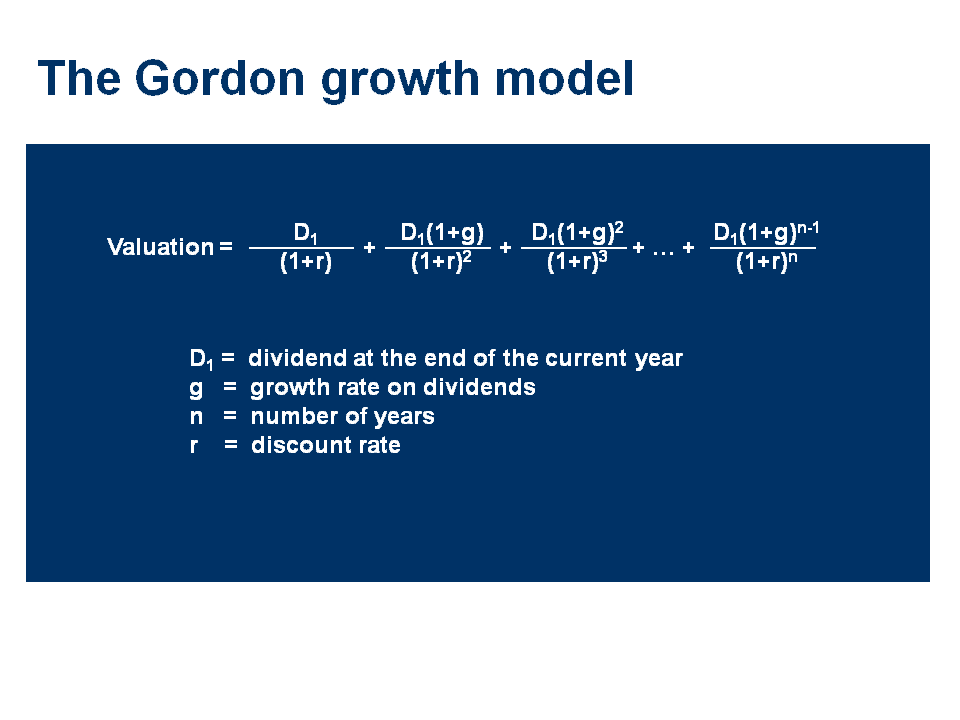

8/ Here is my earlier thread on Dividend Discount Model, if you are keen to learn that.

10/ But the crux of all of them is the same, they are discounting earnings (of whatever type) to their present state in order to value a company.

12/ This multiple can be either EV/EBITDA or Price to Earnings or Price to Book or Price to Sales

You can even come up with your own multiples (as long as they make sense)

You can even come up with your own multiples (as long as they make sense)

13/ EV / pre-tax CFO is a multiple I use often

Some multiple are better suited for a certain type of industry vs others

For e.g Price to Book is a better multiple for asset heavy deep cyclical industries

where as high growth asset light tech companies PS is more suited

Some multiple are better suited for a certain type of industry vs others

For e.g Price to Book is a better multiple for asset heavy deep cyclical industries

where as high growth asset light tech companies PS is more suited

14/ Now once you have determined which multiple to use, you have to determine the value to assign to that multiple in order to determine fair valuation

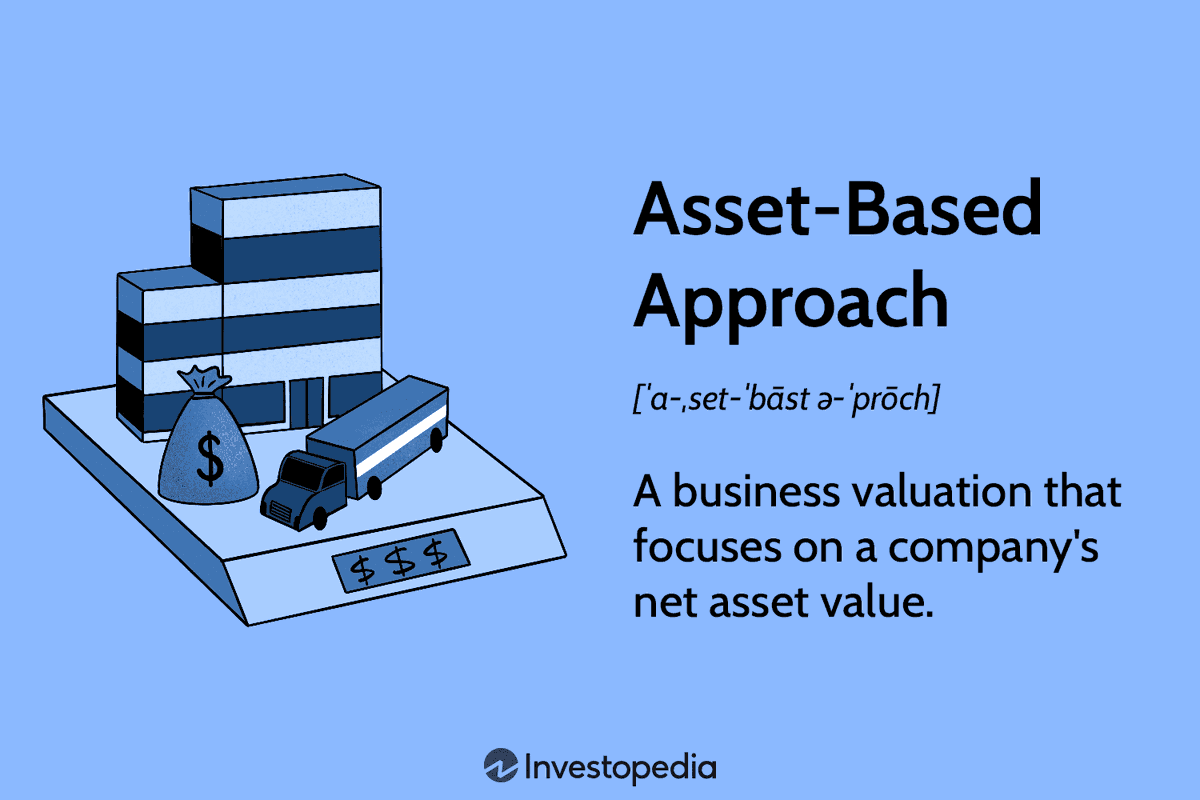

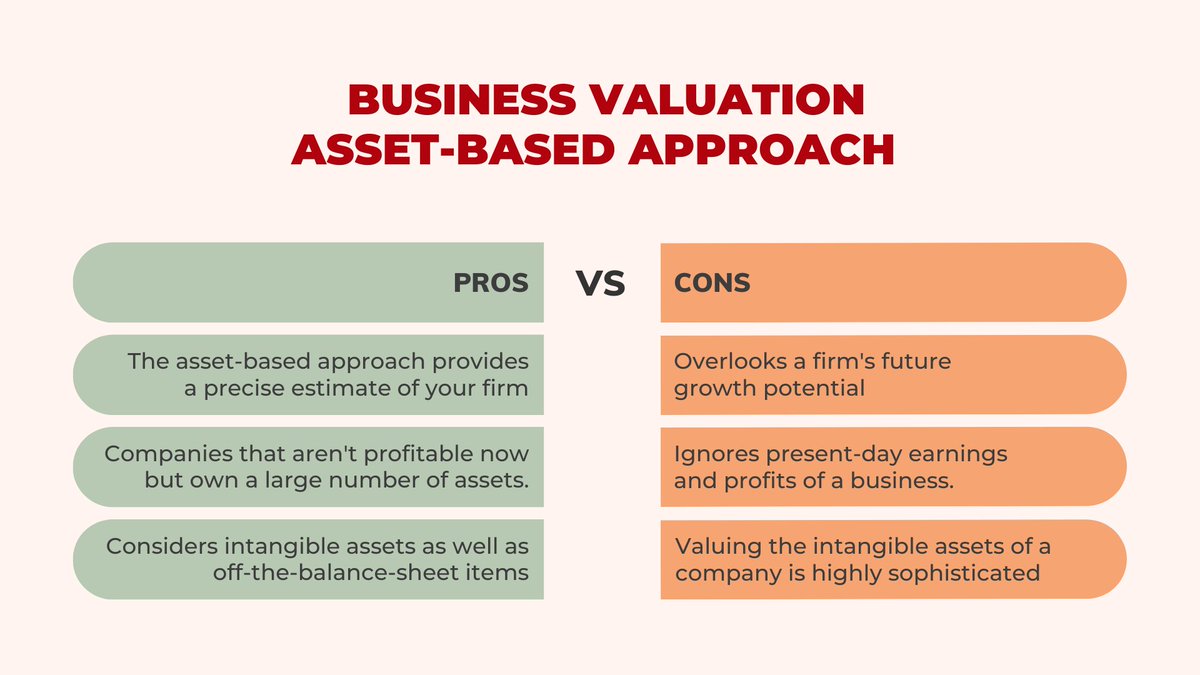

19/ This valuation method is typically used in companies that are undergoing liquidation or extremely asset heavy companies

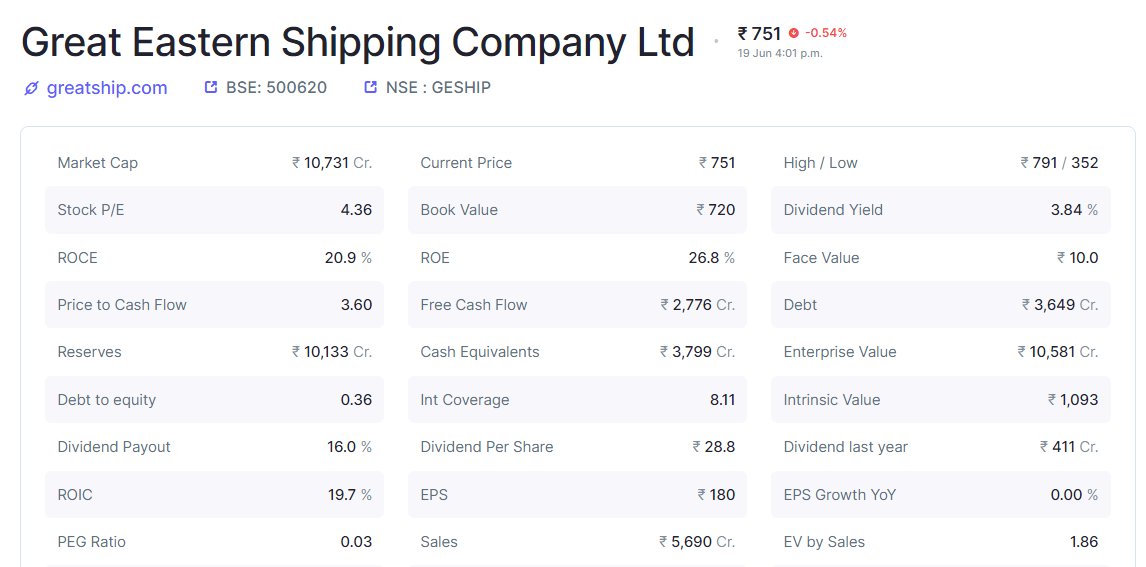

20/ A good example of such a company is GESHIP, a typical asset heavy company with over 90% of value tied up in fixed assets

Its also a deep cyclical company, so investors tend to compare its value to its NAV (Net Asset Value) in order to determine if it is fairly valued

Its also a deep cyclical company, so investors tend to compare its value to its NAV (Net Asset Value) in order to determine if it is fairly valued

22/ However, on a asset based valuation model, the company will appear more fairly valued.

Total Shipping Assets: Rs 8,450cr

Total Market Cap: Rs 10,697cr

As the demand and value of ships rose post Ukraine war, so did market cap of GESHIP and its earnings.

Total Shipping Assets: Rs 8,450cr

Total Market Cap: Rs 10,697cr

As the demand and value of ships rose post Ukraine war, so did market cap of GESHIP and its earnings.

23/ (Disclaimer: The above example of GESHIP is extremely simplified and there are more nuances to valuing a company)

Continuing on...

Continuing on...

24/ Now that we have understood the three main types of valuation models, lets explore which one to apply as an investor to determine fair valuation

26/ In my investment journey I have never ever used a rigid valuation model, however I have always relied on the process of valuation in order to think about the current valuation of a company

27/ Take this for example

A company with 10 year of history has grown its sales at 20%+ and profits at 25%+ every year for the last 10 years

It currently trades today at 15x trailing 12 month EPS while peers trade at 30x trailing 12 month EPS

A company with 10 year of history has grown its sales at 20%+ and profits at 25%+ every year for the last 10 years

It currently trades today at 15x trailing 12 month EPS while peers trade at 30x trailing 12 month EPS

28/ The company was able to grow even when industry went through a down cycle and margins for its peers compressed

The company's leverage (debt to equity) is under 0.25x and management is proven to build and scale up businesses

The company's leverage (debt to equity) is under 0.25x and management is proven to build and scale up businesses

29/ Now without doing any valuation exercise, tell me if this company is overvalued or undervalued or fairly valued?

31/ This is what is known as a the Valuation Mindset.

32/ I hope this thread helped you understand the broad categories of valuations and provide you with a framework to apply while valuing public companies.

33/ If you're new here, I write a new thread every weekend, explaining an investing concept.

Here is a link to all my other threads.

Here is a link to all my other threads.

34/ Also, publish deep dives into one listed company every month. Join 20,000+ readers for free at blog.investkaroindia.in

35/ Please retweet, the first tweet in this thread.

Follow me @itsTarH for more.

Thank you for reading!

See you next weekend with a brand new thread.

Follow me @itsTarH for more.

Thank you for reading!

See you next weekend with a brand new thread.

Loading suggestions...