Nothing in the data shows the re-acceleration of the real economy. So are our bags ready to pump?

I've gone through 59 mins of Fed’s insider insights by @dimartinobooth and @jackfarkley96

Here are 7 key highlights that you need to keep a watchful eye for this year 🧵

I've gone through 59 mins of Fed’s insider insights by @dimartinobooth and @jackfarkley96

Here are 7 key highlights that you need to keep a watchful eye for this year 🧵

1. Powell's Interest Rate Policy

2. Quantitative Tightening (QT)

3. Labor Market Challenges

4. Impact of Chapter 11 Filings

5. Office Sector and Rental Market

6. Federal Reserve's Tools

7. Potential Banking Industry Collapse

Let dive into them!

2. Quantitative Tightening (QT)

3. Labor Market Challenges

4. Impact of Chapter 11 Filings

5. Office Sector and Rental Market

6. Federal Reserve's Tools

7. Potential Banking Industry Collapse

Let dive into them!

1. Powell's Interest Rate Policy

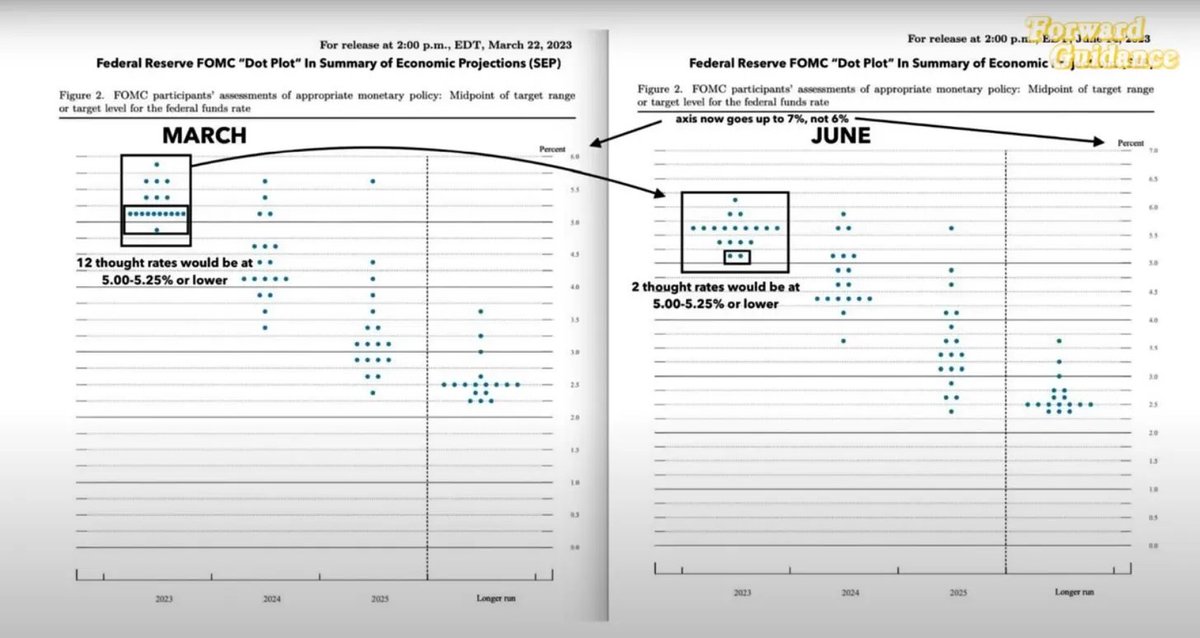

If Powell succeeds in raising interest rates, it would rewrite modern monetary policy history.

In June’s FOMC, Powell hinted that the Fed would not raise interest rates, but left the possibility open for a hike in July.

If Powell succeeds in raising interest rates, it would rewrite modern monetary policy history.

In June’s FOMC, Powell hinted that the Fed would not raise interest rates, but left the possibility open for a hike in July.

2. Quantitative Tightening (QT)

Powell's focus could be on QT instead of rate hikes.

The strategy would be to tighten through QT, while avoiding rate cuts and maintaining high rates would mean that property and companies that need to refinance with higher interest costs.

Powell's focus could be on QT instead of rate hikes.

The strategy would be to tighten through QT, while avoiding rate cuts and maintaining high rates would mean that property and companies that need to refinance with higher interest costs.

3. Labor Market Challenges

Labor market is dire and getting worse, despite the low unemployment rate of 3.7%.

Many capable workers are still sidelined, and there is a rise in working-age people over 55 returning to the workforce due to insufficient Social Security payments.

Labor market is dire and getting worse, despite the low unemployment rate of 3.7%.

Many capable workers are still sidelined, and there is a rise in working-age people over 55 returning to the workforce due to insufficient Social Security payments.

Lower-paid workers are being laid off, and Chapter 11 small business bankruptcies have increased significantly.

4. Impact of Chapter 11 Filings

Danielle mentions that the fast pace of Chapter 11 small business filings may not be reflected in the data as many companies lack the funds to file for bankruptcy or hire a bankruptcy attorney.

Danielle mentions that the fast pace of Chapter 11 small business filings may not be reflected in the data as many companies lack the funds to file for bankruptcy or hire a bankruptcy attorney.

This could lead to a delay in recognizing the job destruction resulting from bankruptcies.

She also notes that new company creations account for a significant percentage of non-farm payroll job creation in the last 12 months.

She also notes that new company creations account for a significant percentage of non-farm payroll job creation in the last 12 months.

5. Office Sector and Rental Market

Due to remote work, AI and the excess supply of office buildings, its hurting the property market.

It becomes a renter-driven market with falling rental rates.

Due to remote work, AI and the excess supply of office buildings, its hurting the property market.

It becomes a renter-driven market with falling rental rates.

6. Federal Reserve's Tools

Quantitative Easing (QE) is a broken tool that is expanding the Fed's footprint in the treasury market by too much.

Danielle suggests the best approach would be to leave the balance sheet alone and avoid further interest rate hikes.

Quantitative Easing (QE) is a broken tool that is expanding the Fed's footprint in the treasury market by too much.

Danielle suggests the best approach would be to leave the balance sheet alone and avoid further interest rate hikes.

7. Potential Banking Industry Collapse

Danielle raises concerns about the banking industry, reliance on interest rate cuts and possibility of a collapse.

Many banks are now making loans and approving them because they think the Fed is going to cut rates.

Danielle raises concerns about the banking industry, reliance on interest rate cuts and possibility of a collapse.

Many banks are now making loans and approving them because they think the Fed is going to cut rates.

Will banks be prepared for a normalized monetary policy? Will they struggle if rates are not cut as expected?

Appreciate a subscribe to my daily notes at ToE on telegram with a totally different kind of alpha packed content.

t.me

t.me

I hope you've found this thread helpful.

Follow me @arndxt_xo, Threading on the Edge newsletter and telegram channel for more alpha!

Retweet, Comment and Like the first tweet below if you can:

Follow me @arndxt_xo, Threading on the Edge newsletter and telegram channel for more alpha!

Retweet, Comment and Like the first tweet below if you can:

Loading suggestions...