Real estate investing is one of the best ways to build wealth due to:

• Passive income & cash flow

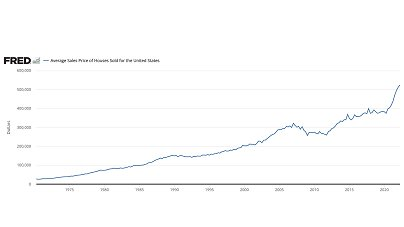

• Equity & appreciation

• Tax benefits

• Leverage

Here are 15 tips on investing in real estate for beginners:

• Passive income & cash flow

• Equity & appreciation

• Tax benefits

• Leverage

Here are 15 tips on investing in real estate for beginners:

Real estate allows you to control a valuable asset with little to no down payment. This is leverage.

You can buy real estate with a bank's money and have tenants help pay off the mortgage.

You can outsource the parts of running it to a property manager to make it 100% passive.

You can buy real estate with a bank's money and have tenants help pay off the mortgage.

You can outsource the parts of running it to a property manager to make it 100% passive.

With real estate, you have the ability to control a $300,000 asset with $10,500. The leverage you have by putting down 3.5% as a first-time homeowner is powerful.

In 30 years, you'll have a paid-off property that has appreciated in value & is cash-flowing.

In 30 years, you'll have a paid-off property that has appreciated in value & is cash-flowing.

In my opinion, home price appreciation outweighs paying PMI (and PMI is dropped once you reach 20% equity via payments or appreciation)

Don’t miss out on the appreciation of a property, due to the time it takes to save for a 20% down-payment.

Don’t miss out on the appreciation of a property, due to the time it takes to save for a 20% down-payment.

With Real Estate, you can leverage up for greater returns because equity accelerates over fixed debt over time.

Real estate offers many tax benefits (mortgage interest deductions, depreciation, capital gains tax exclusions, 1031 exchanges, pass-through taxation, etc.)

Real estate offers many tax benefits (mortgage interest deductions, depreciation, capital gains tax exclusions, 1031 exchanges, pass-through taxation, etc.)

One of the biggest advantages of real estate investing is that it provides investors with the opportunity to leverage their money.

This means that investors can borrow money from a lender to purchase a property and use the property itself as collateral for the loan.

This means that investors can borrow money from a lender to purchase a property and use the property itself as collateral for the loan.

Leverage allows you to purchase more property than you would be able to on your own, increasing your potential returns.

With real estate, you can leverage up for greater returns because equity accelerates over fixed debt over time.

With real estate, you can leverage up for greater returns because equity accelerates over fixed debt over time.

Another advantage of real estate investing is the potential for tax benefits.

Real Estate investors can deduct expenses related to their rental properties, such as mortgage interest, property taxes, and maintenance and repair costs, from their taxable income.

Real Estate investors can deduct expenses related to their rental properties, such as mortgage interest, property taxes, and maintenance and repair costs, from their taxable income.

If you can, make your first home a 2-4 unit multi-family home.

• Put 3.5% down with an FHA mortgage

• Have your tenants pay for your housing and pay off your home

In 30 years, you will have a paid-off home that will both cashflow and appreciate in value

• Put 3.5% down with an FHA mortgage

• Have your tenants pay for your housing and pay off your home

In 30 years, you will have a paid-off home that will both cashflow and appreciate in value

Inflation hedge:

Real estate can potentially serve as a hedge against inflation, as the value of the property may increase over time as the cost of living and other expenses rise.

This can preserve the purchasing power of your investment and increase your returns on investment.

Real estate can potentially serve as a hedge against inflation, as the value of the property may increase over time as the cost of living and other expenses rise.

This can preserve the purchasing power of your investment and increase your returns on investment.

Diversification:

Real estate tends to have a low correlation to other asset classes, meaning it potentially performs differently in different market conditions.

Adding real estate to an investment portfolio can help diversify your holdings, reduce risk, and increase stability.

Real estate tends to have a low correlation to other asset classes, meaning it potentially performs differently in different market conditions.

Adding real estate to an investment portfolio can help diversify your holdings, reduce risk, and increase stability.

Real estate can be residential, commercial, or industrial property (single-family homes & apartment buildings to office buildings and shopping malls)

Rental income at the property can provide a steady stream of income.

As property values increase, your net worth will increase.

Rental income at the property can provide a steady stream of income.

As property values increase, your net worth will increase.

It's important to do your research and consider the potential challenges before getting started, such as:

• Tenant risks

• Market risks

• Financing risks

• Maintenance costs

Despite these challenges, real estate investing is a very powerful way to build wealth over time.

• Tenant risks

• Market risks

• Financing risks

• Maintenance costs

Despite these challenges, real estate investing is a very powerful way to build wealth over time.

Understand your local real estate market:

To be a great rental property investor, you need to have a thorough understanding of your local real estate market, including the current trends, the demographics of the area, and the types of properties that are in demand.

To be a great rental property investor, you need to have a thorough understanding of your local real estate market, including the current trends, the demographics of the area, and the types of properties that are in demand.

Invest in Real Estate:

I believe that money is a tool that can be used to build wealth. When you rent, your money is solely being used to provide shelter. However, owning provides numerous benefits in addition to just providing shelter.

I believe that money is a tool that can be used to build wealth. When you rent, your money is solely being used to provide shelter. However, owning provides numerous benefits in addition to just providing shelter.

Real estate should be part of every investment portfolio.

Buy real estate with a bank's money and have tenants help pay it off.

If you qualify as a real estate professional for tax purposes, you can deduct rental property losses against your wages or business income.

Buy real estate with a bank's money and have tenants help pay it off.

If you qualify as a real estate professional for tax purposes, you can deduct rental property losses against your wages or business income.

Generalized real estate advice is horrible.

There is no “one-size fits all” approach in real estate, because everyone’s situation is unique.

People with different viewpoints are not incorrect, they just have different goals.

There is no “one-size fits all” approach in real estate, because everyone’s situation is unique.

People with different viewpoints are not incorrect, they just have different goals.

You can work a 9-5 job AND invest in real estate, never limit yourself. These threads take time to write, so if you found it helpful:

• RT the FIRST tweet to share🔁

• Follow me @FluentInFinance for more

• Sign-up for my FREE newsletter to learn more: TheInvestingNewsletter.com!

• RT the FIRST tweet to share🔁

• Follow me @FluentInFinance for more

• Sign-up for my FREE newsletter to learn more: TheInvestingNewsletter.com!

Loading suggestions...