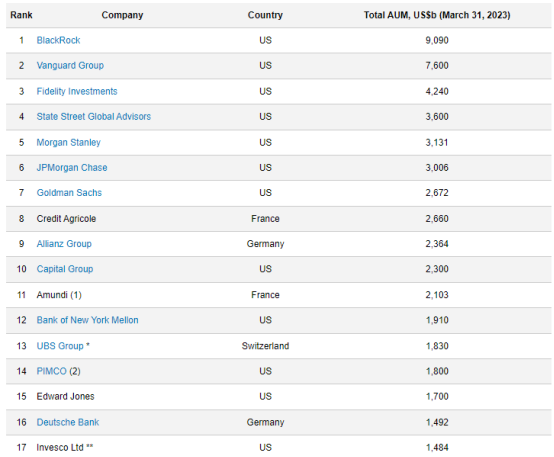

1⃣ Blackrock files for #BitcoinSpot ETF

Why is this massive?

• Blackrock is the biggest asset manager on planet Earth

• They have $10 trillion in assets under management.

• Blackrocks ETF approval rate with the SEC is 575 to 1

• ETF's median approval time is 221 days

Why is this massive?

• Blackrock is the biggest asset manager on planet Earth

• They have $10 trillion in assets under management.

• Blackrocks ETF approval rate with the SEC is 575 to 1

• ETF's median approval time is 221 days

The Bitcoin halving is only 299 days away.

@crypto_linn described it perfectly.

Three personal observations:

1. Follow the money

2. Do as they do, not as they say.

3. Expect everything to be manipulated

@crypto_linn described it perfectly.

Three personal observations:

1. Follow the money

2. Do as they do, not as they say.

3. Expect everything to be manipulated

Where do we go from here?

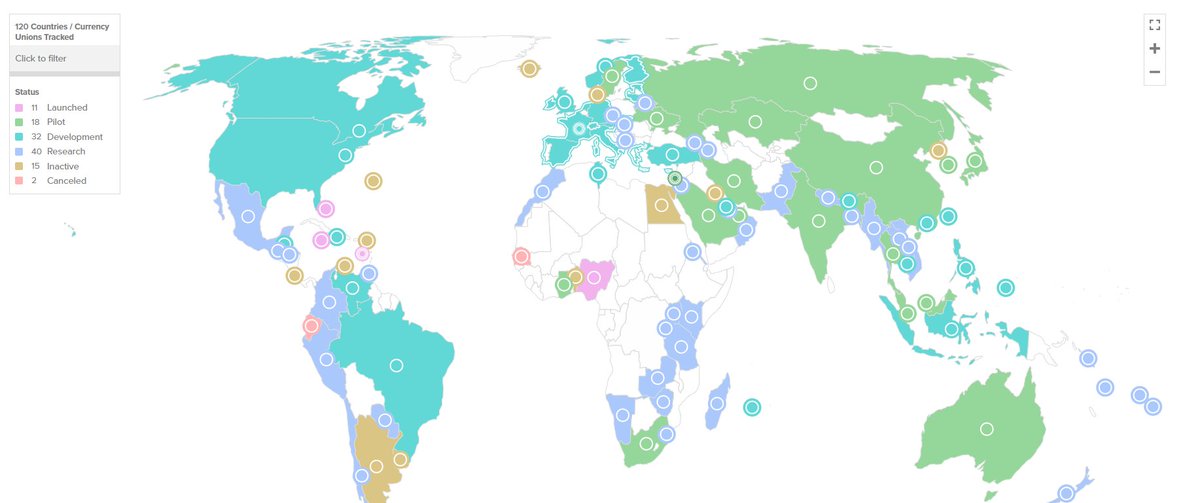

It’s obvious that institutional demand is going to skyrocket as the next halving approaches.

@tedtalksmacro outlined a possible scenario.

It’s obvious that institutional demand is going to skyrocket as the next halving approaches.

@tedtalksmacro outlined a possible scenario.

While I’m optimistic about the future of crypto, the war about control of digital assets is just ramping up

Is Tradfi taking over?

Is Tradfi taking over?

Summoning the wisdom of high quality crypto educators.

Do you think tradfi is taking over?

@rektdiomedes

@crypthoem

@crypto_linn

@ViktorDefi

@0xFinish (Hook inspiration 🙏)

@thedefiedge

@blockmates

@stacy_muur

@milesdeutscher

@IamZeroIka

@Louround_

@IamZeroIka

Do you think tradfi is taking over?

@rektdiomedes

@crypthoem

@crypto_linn

@ViktorDefi

@0xFinish (Hook inspiration 🙏)

@thedefiedge

@blockmates

@stacy_muur

@milesdeutscher

@IamZeroIka

@Louround_

@IamZeroIka

I hope you enjoyed this thread!

If you would like to see more:

1. Follow me

@thehiddenmaze

2. Retweet the 1st tweet linked below and let me know your thoughts in the comments

3. Subscribe to my Newsletter (Link in Bio)

If you would like to see more:

1. Follow me

@thehiddenmaze

2. Retweet the 1st tweet linked below and let me know your thoughts in the comments

3. Subscribe to my Newsletter (Link in Bio)

Loading suggestions...