"VolUmE Is laGgiNg" 🤓

Candle spreads the secret to unlocking VPA.👁️

How to turn volume from lagging to real-time actionable ideas.

Let's talk about it...🧵

1/16

Candle spreads the secret to unlocking VPA.👁️

How to turn volume from lagging to real-time actionable ideas.

Let's talk about it...🧵

1/16

For all the nerds, YES volume is lagging. Alongside just about every single indicator traders can use.

In fact, even LEVELS are lagging!!😳

Price pays, duh. But we can gain something very special from volume that the candlesticks do not reflect...

2/16

In fact, even LEVELS are lagging!!😳

Price pays, duh. But we can gain something very special from volume that the candlesticks do not reflect...

2/16

SENTIMENT.💡

Volume measures activity.

Activity = Interest.

Activity in and of itself is useless. This is to say, don't blindly follow volume spikes. Introduce key levels or whatever point of interest you use for your system, and we have something beautiful.

3/16

Volume measures activity.

Activity = Interest.

Activity in and of itself is useless. This is to say, don't blindly follow volume spikes. Introduce key levels or whatever point of interest you use for your system, and we have something beautiful.

3/16

As we proceed, pay attention to how I use levels and the 9/20 EMA to narrow down the information I am analyzing. This will be key. 🔑

In the examples below, I will break down first a daily chart and then an intraday 2 min chart. Buckle up.

4/16

In the examples below, I will break down first a daily chart and then an intraday 2 min chart. Buckle up.

4/16

CONTINUATION: DAILY CHART

Good ole continuation. I think a common misconception about VPA is we buy AFTER we see big volume.❌

If that were the case, we would all be unprofitable and have a horrible risk to reward system. We take advantage through continuation...

5/16

Good ole continuation. I think a common misconception about VPA is we buy AFTER we see big volume.❌

If that were the case, we would all be unprofitable and have a horrible risk to reward system. We take advantage through continuation...

5/16

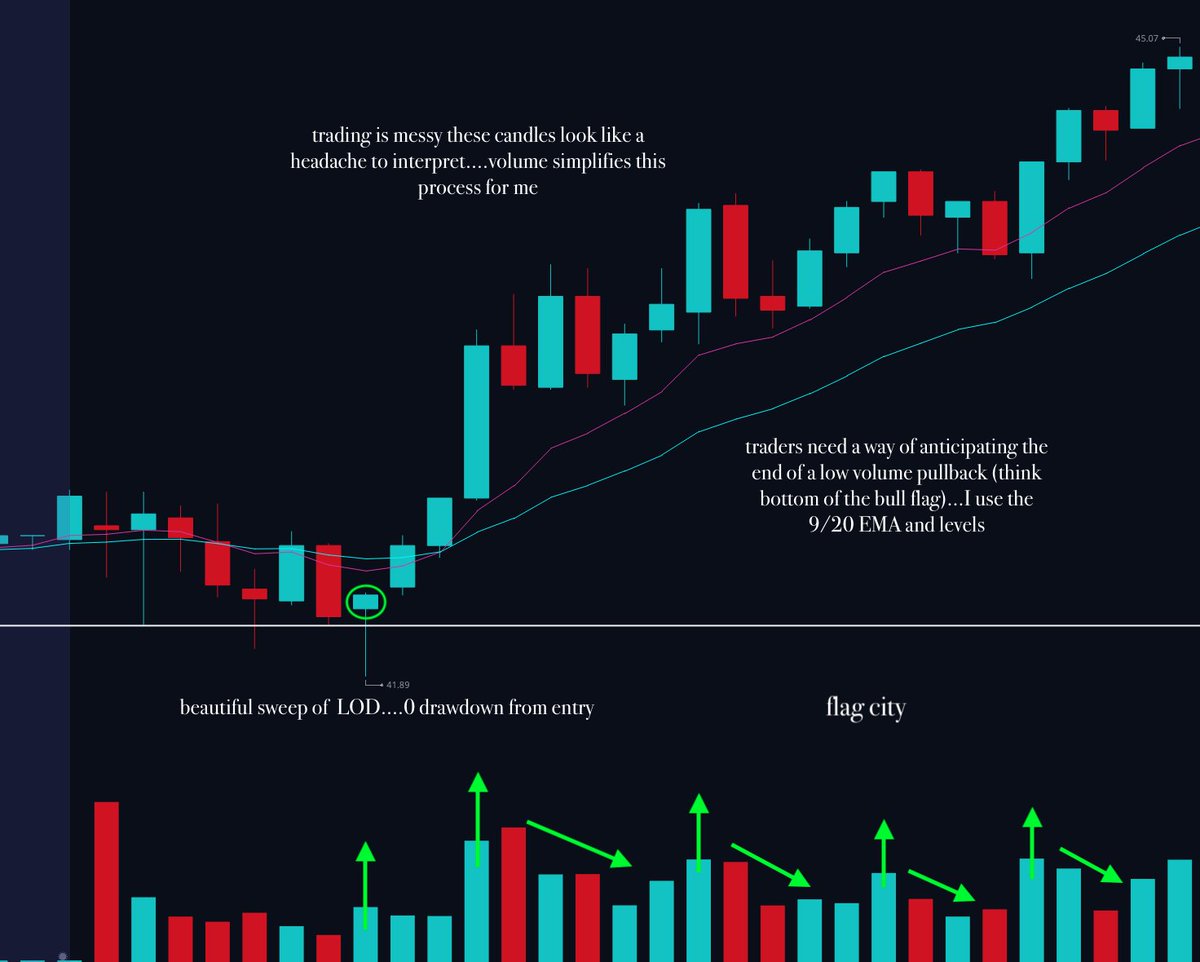

SURE, I missed the earnings reaction, but volume was not lagging when we pulled back right into old resistance + 9 EMA.

This was an actionable idea, and we used volume to confirm nothing funky was occurring in the bull flag.🥸

7/16

This was an actionable idea, and we used volume to confirm nothing funky was occurring in the bull flag.🥸

7/16

Using the 9EMA in this example shows how just like a daily chart, we can anticipate the end of a low volume pullback using a point of interest.🎯

This gives us an actionable process because we get the best RR possible.

9/16

This gives us an actionable process because we get the best RR possible.

9/16

Anticipatory entries are how we can time when the next round of volume will come in.

1. High volume move

2. Low volume pull

3. Point of interest

4. Repeat🔁

10/16

1. High volume move

2. Low volume pull

3. Point of interest

4. Repeat🔁

10/16

Stopping volume will be the gold of this thread. To reiterate, the common misconception regarding volume is we chase big green candles. BUT what happens when the candle spread is small.👀

What exactly are we missing if the stock hasn't actually moved...

11/16

What exactly are we missing if the stock hasn't actually moved...

11/16

The first of which is a high volume inside bar after a prolonged downtrend.

The second type is after a level hold or preferably sweep, as we see here.

When we see volume like this, oftentimes, there is very little to think about.☁️

13/16

The second type is after a level hold or preferably sweep, as we see here.

When we see volume like this, oftentimes, there is very little to think about.☁️

13/16

I want to take the time to reiterate that anything after stopping volume and a reversal begins is NOISE.

We can move up on thin air in the volume bars for all I care because institutions that accumulated already did so.🧃

You need to understand volume tells reversals.

14/16

We can move up on thin air in the volume bars for all I care because institutions that accumulated already did so.🧃

You need to understand volume tells reversals.

14/16

Volume is lagging, sure, but as soon as the highlighted candle closes and I see it reflected, I know the bottom is in.

That's really what's important here and what gives me an actionable edge in the markets.🧪

16/16

That's really what's important here and what gives me an actionable edge in the markets.🧪

16/16

I hope you were paying attention to the candle structure to the left. Volume anomaly sequences. We'll talk about that.🔜

Please drop a like and retweet my first 🧵back!

For more EDU, follow these boys: @ohiain @DBookTrading @notmrmanziel @PressTradez @Braczyy

Please drop a like and retweet my first 🧵back!

For more EDU, follow these boys: @ohiain @DBookTrading @notmrmanziel @PressTradez @Braczyy

Loading suggestions...