Return on Equity:

It means how well Panipuri wale bhaiya uses its own money to make profits.

Imagine he started the business by investing ₹10,000 of his own savings.🛍️

At the end of the year, they made profit of ₹2,000

ROE = 2,000/10,000 x 100 = 20%

It means how well Panipuri wale bhaiya uses its own money to make profits.

Imagine he started the business by investing ₹10,000 of his own savings.🛍️

At the end of the year, they made profit of ₹2,000

ROE = 2,000/10,000 x 100 = 20%

It shows how effectively a company utilises its equity to generate profits.

Return on Capital Employed:

It looks at how well the Panipuri wale bhaiya uses all the money they have, whether it's their own savings or borrowed money.

Let's say he took a loan of ₹5,000 from a bank to grow the business.

It looks at how well the Panipuri wale bhaiya uses all the money they have, whether it's their own savings or borrowed money.

Let's say he took a loan of ₹5,000 from a bank to grow the business.

The total amount of money invested in the business is now ₹15,000 (own money + loan).

With a net profit of ₹2,000, the ROCE shows how much profit they made in relation to all the money invested.

ROCE - ₹2000/₹15,000 X 100 = 13.33%

ROCE - ₹2000/₹15,000 X 100 = 13.33%

In this case, the ROCE is around 13.33%, which means the Panipuri wala earned a return of approximately 13.33% on all the money they invested.

In simple terms, ROE looks at how well Panipuri wala uses his money, while ROCE looks at how well they use all money they have, including borrowed fund

Both ratios help us understand how effectively Panipuri wala is making profits based on the money they put into the business

Both ratios help us understand how effectively Panipuri wala is making profits based on the money they put into the business

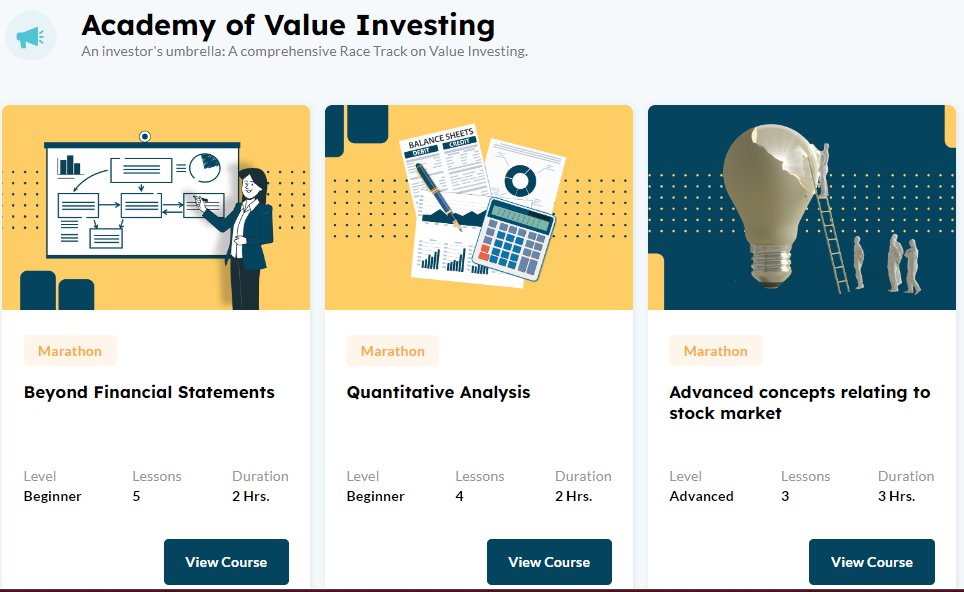

Apart from ROE & ROCE, there are many other metrics to analyse any company.

Learn about all those metrics through Quest's Value Investing Course - bit.ly

Learn about all those metrics through Quest's Value Investing Course - bit.ly

Loading suggestions...