The Fed finally paused yesterday after nearly a year and a half of interest rate hikes...

And we currently find ourselves in a truly fascinating situation macro-wise (to say the least).

Here's some random thoughts on all the craziness...

2/x

And we currently find ourselves in a truly fascinating situation macro-wise (to say the least).

Here's some random thoughts on all the craziness...

2/x

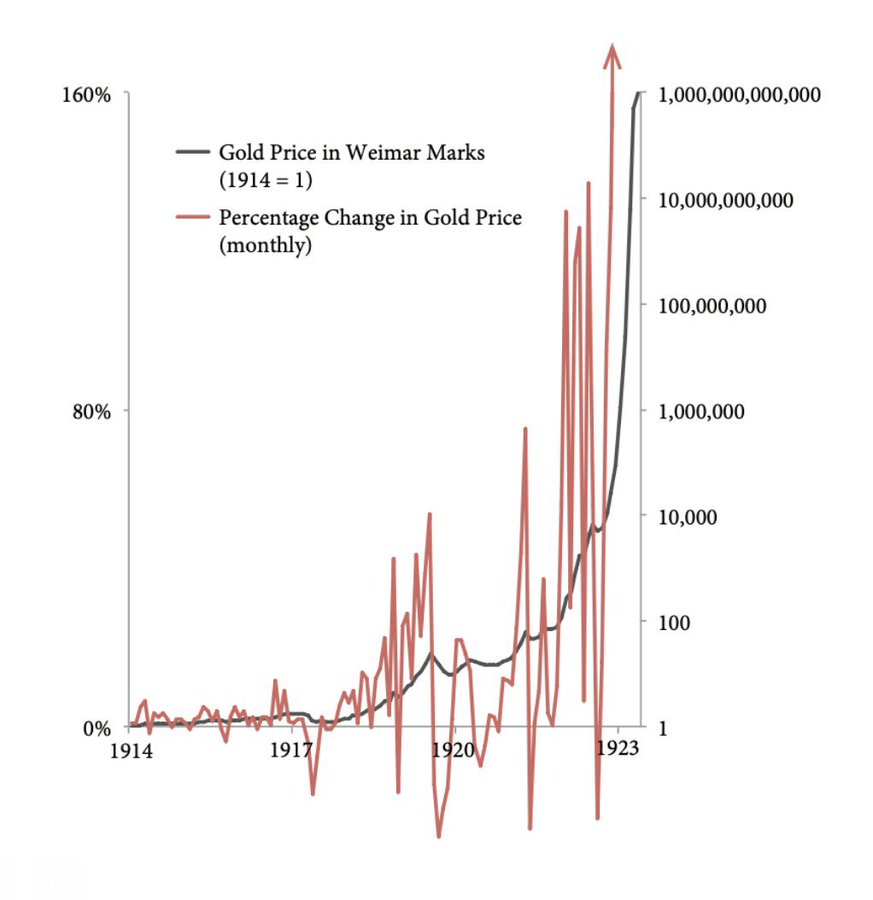

Two: It seems that the ultimate lesson of this hiking cycle might be that the Fed is increasingly powerless to overcome the effects of vast and ever-increasing US government fiscal spending (relevant chart below).

4/x

4/x

As @hkuppy and @lukegromen have both pointed out, the Fed paying 5% on T-bills ends up being stimulative in its own way, as all the excess money the government drunkenly spends still enters the economy, just in a different manner vs zirp and QE.

youtube.com

5/x

youtube.com

5/x

Indeed it seems that the rest of this decade might just be an increasingly creative dance between Fed and Treasury re: how to monetize our rising budget deficits/sovereign debt:

6/x

6/x

Three: It also appears a lesson of this hiking cycle is that we are in a new period of structurally low unemployment, primarily due to demographics (Boomers all retiring + precipitously dropping birthrates in US and globally the last 40 years)...

7/x

7/x

Obviously the official unemployment rate is a bit of a tortured data point, but there's no doubt labor is in growing demand and wages are (rightfully) going up for first time in 40 years, due to both demographics and societal factors (see below):

8/x

8/x

Four: Commercial real estate (specifically office) looks absolutely horrible, and not just because of the obvious high interest rates >>> higher cap rates >>> equity destruction process, but even more so because of the switch to remote work...

9/x

9/x

Five: Remote work is here to stay.

Its increasingly clear that a) cubicle farms are utterly anachronistic... & b) there has been a widescale cultural shift from "a preference for remote" to something approaching visceral hatred of in-office work..

10/x

Its increasingly clear that a) cubicle farms are utterly anachronistic... & b) there has been a widescale cultural shift from "a preference for remote" to something approaching visceral hatred of in-office work..

10/x

The consensus has been bearish, but I think the below thread from @concodanomics presents a much more nuanced view on the question:

13/x

13/x

Six: Similarly, on the medium term horizon, it still seems like energy prices are the big variable to watch, as they are the one thing that could start spiking inflation back upward.

14/x

14/x

Eight: With that said... it still seems very early for crypto, and there's still a lot of innovation that needs to take place- especially on the privacy and UX fronts- to enable normal stuff like payroll, AR/AP, etc to fully move on-chain:

16/x

16/x

Tagging some macro/crypto enjoyoors who may appreciate:

@JLabsJanitor

@CurveCap

@arndxt_xo

@crypthoem

@Dynamo_Patrick

@CryptoKoryo

@jake_pahor

@Route2FI

@_FabianHD

@DeFiMann

@zerototom

@alpha_pls

@defi_naly

@SimplifyDeFi

@JiraiyaReal

22/x

@JLabsJanitor

@CurveCap

@arndxt_xo

@crypthoem

@Dynamo_Patrick

@CryptoKoryo

@jake_pahor

@Route2FI

@_FabianHD

@DeFiMann

@zerototom

@alpha_pls

@defi_naly

@SimplifyDeFi

@JiraiyaReal

22/x

Linking back to first tweet below.

Again, please RT if you found interesting! 💪🫡

Again, please RT if you found interesting! 💪🫡

Loading suggestions...