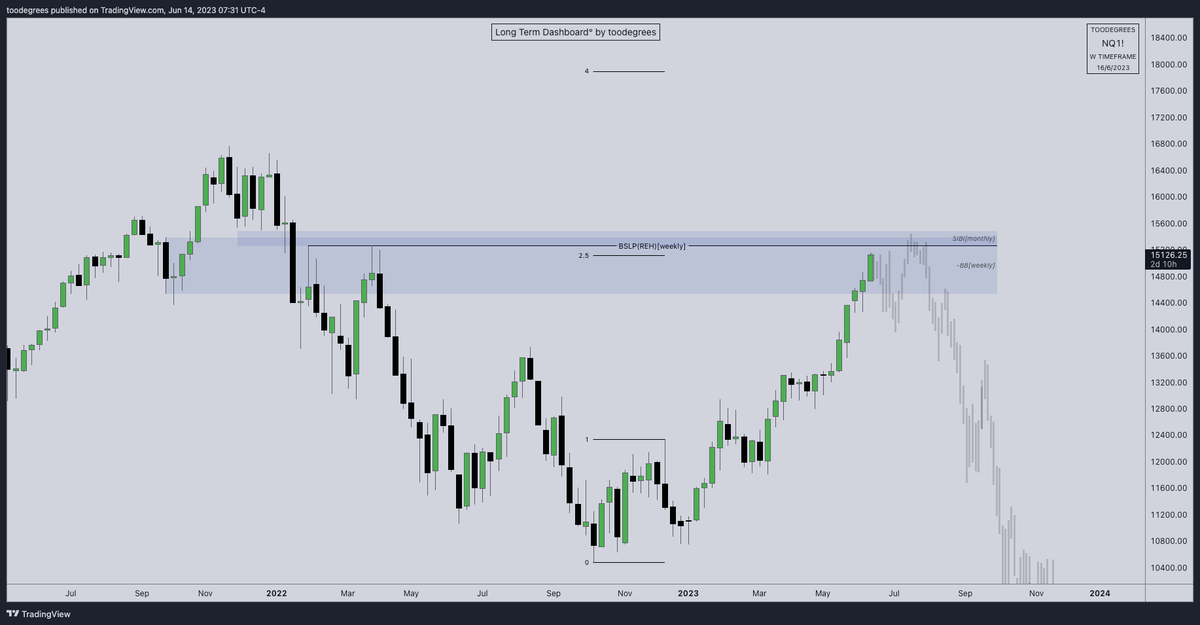

We have been drawn towards the Weekly Relative Equal Highs for some Time now.

Premium Arrays?

Currently delivering a Bearish Weekly Breaker, and we are approaching a Monthly SIBI.

Swing Projections? 2.5!

@TraderDext3r helped me realize the power of these (ty🤝)

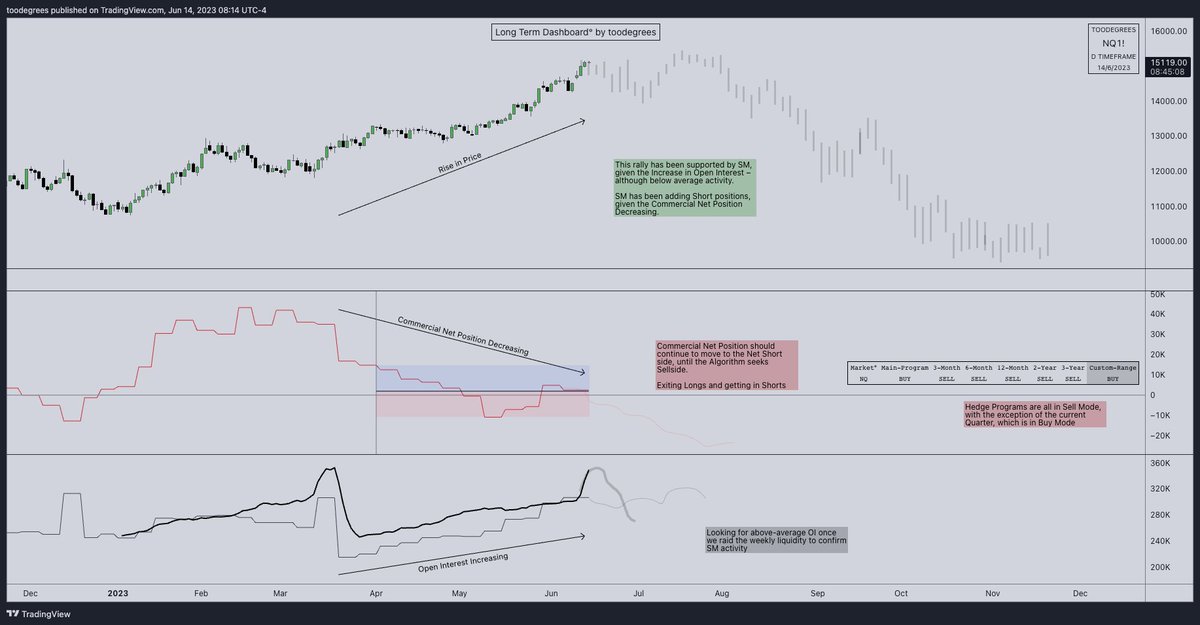

Premium Arrays?

Currently delivering a Bearish Weekly Breaker, and we are approaching a Monthly SIBI.

Swing Projections? 2.5!

@TraderDext3r helped me realize the power of these (ty🤝)

There is a point to be made about Geopolitical Sentiment and World Events.

Warren Buffett selling his shares in the Taiwan Semiconductor Manufacturing Group, Digital Dollar being hinted at, CBDC, and the US Elections in November.

Warren Buffett selling his shares in the Taiwan Semiconductor Manufacturing Group, Digital Dollar being hinted at, CBDC, and the US Elections in November.

If They decide to crash this plane we are going much lower than this MMSM.

I have a deep feeling the narrative is:

1) World Event -> Financial Panic

2) Chinese Yuan != Reserve Currency (not worth it for China)

3) CBDC

4) New President "the Saviour of the economy"

5) Bull Cycle

I have a deep feeling the narrative is:

1) World Event -> Financial Panic

2) Chinese Yuan != Reserve Currency (not worth it for China)

3) CBDC

4) New President "the Saviour of the economy"

5) Bull Cycle

I hope this helps someone out there, this is how I am currently developing and studying @I_Am_The_ICT's teachings.

All credit goes to him, eternally grateful.

I am not a consistent trader, yet. Just watch.

Psyche. Self positive talk.

I am wrong? I learn.

I am right? I learn.

All credit goes to him, eternally grateful.

I am not a consistent trader, yet. Just watch.

Psyche. Self positive talk.

I am wrong? I learn.

I am right? I learn.

Loading suggestions...