The P/E Ratio: Explained🧵⤵️

#stockmarkets

#stockmarkets

What is P/E Ratio?

P/E Ratio tells us how much investors are willing to pay for each rupee of earnings generated by the company.

Let’s understand it with an example >>

P/E Ratio tells us how much investors are willing to pay for each rupee of earnings generated by the company.

Let’s understand it with an example >>

Imagine you know a famous Nariyal Paani wala, and you wish that you could buy his business.

But how to know if his business is a good investment?

Let's calculate his P/E ratio!⤵️

But how to know if his business is a good investment?

Let's calculate his P/E ratio!⤵️

He tells you that his coconut water is priced at ₹50 per serving.

➡️Earnings: After some friendly conversation, you discover that he sells 100 pieces daily.

Revenue (₹50*100) = ₹5000

Profit (Earnings) = ₹2500

➡️Earnings: After some friendly conversation, you discover that he sells 100 pieces daily.

Revenue (₹50*100) = ₹5000

Profit (Earnings) = ₹2500

Now, we can calculate the P/E ratio:

P/E Ratio = Price per serving / Earnings per serving

= ₹50 / (₹2500 / 100) = ₹50 / ₹25 = 2

P/E Ratio = Price per serving / Earnings per serving

= ₹50 / (₹2500 / 100) = ₹50 / ₹25 = 2

Understanding the P/E Ratio:

In this case, Nariyal Paani Wala's P/E ratio is 2.

So, for every ₹1 of profit he generates, you are willing to pay ₹2 for his business.

In this case, Nariyal Paani Wala's P/E ratio is 2.

So, for every ₹1 of profit he generates, you are willing to pay ₹2 for his business.

Generally, a lower P/E ratio suggests that the stock is relatively undervalued, while a higher P/E ratio may indicate overvaluation

However, keep in mind that the P/E ratio alone doesn't provide a complete picture of a company's value.

It's essential to consider other factors like growth prospects, industry trends, and competition before making investment decisions.

It's essential to consider other factors like growth prospects, industry trends, and competition before making investment decisions.

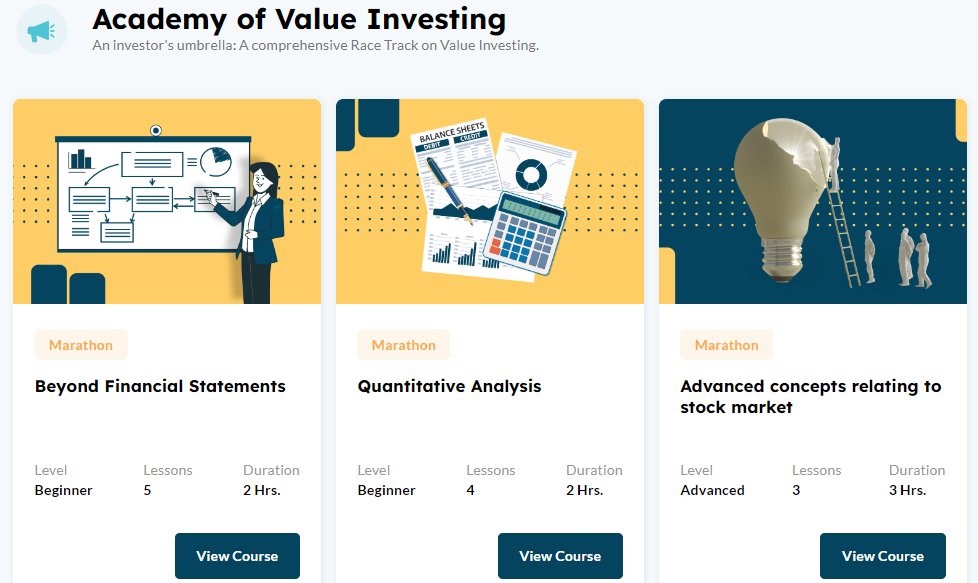

To know more basics of Fundamental analysis, watch this course on Value Investing on Quest - bit.ly

جاري تحميل الاقتراحات...