Saying that bank deposits are money but bank reserves are not money, is kind of like saying food comes from the grocery store rather than the farm.

Dollars are liabilities of the Fed (banknotes + reserves). That's the monetary base. That's the farm.

Bank deposits are bank IOUs for dollars. When you send money to someone, you tell your bank to send reserves to their bank and credit that person's account with the same value.

Bank deposits are bank IOUs for dollars. When you send money to someone, you tell your bank to send reserves to their bank and credit that person's account with the same value.

So, bank deposits are IOUs for dollars, and serve as an instruction set for the depositor to tell their bank how to send dollars around in various ways, usually through bank reserve transfers.

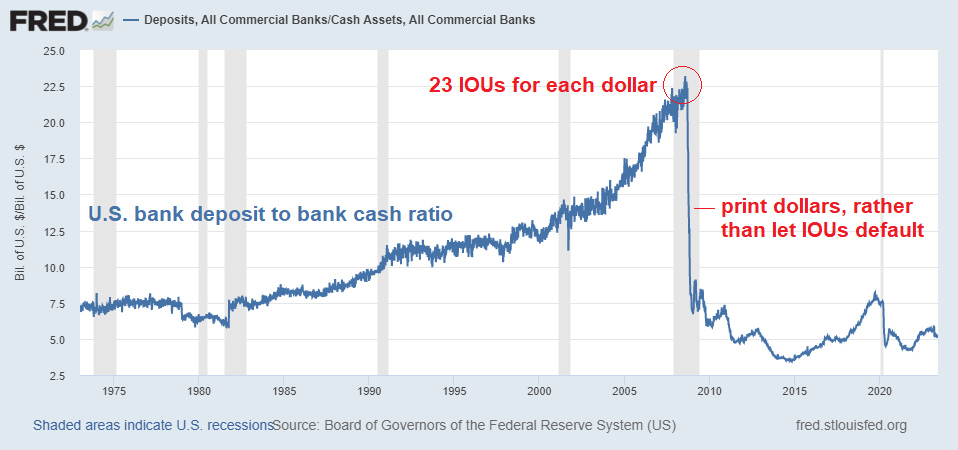

The problem is, banks always owe far more IOUs for dollars, than they have dollars.

The problem is, banks always owe far more IOUs for dollars, than they have dollars.

If anyone has any doubt about this, they were reminded in March 2023.

Silicon Valley Bank depositors had IOUs for dollars, but SVB itself had a mix of dollars plus other assets that needed to be sold for dollars to meet depositor redemptions and transfers.

Silicon Valley Bank depositors had IOUs for dollars, but SVB itself had a mix of dollars plus other assets that needed to be sold for dollars to meet depositor redemptions and transfers.

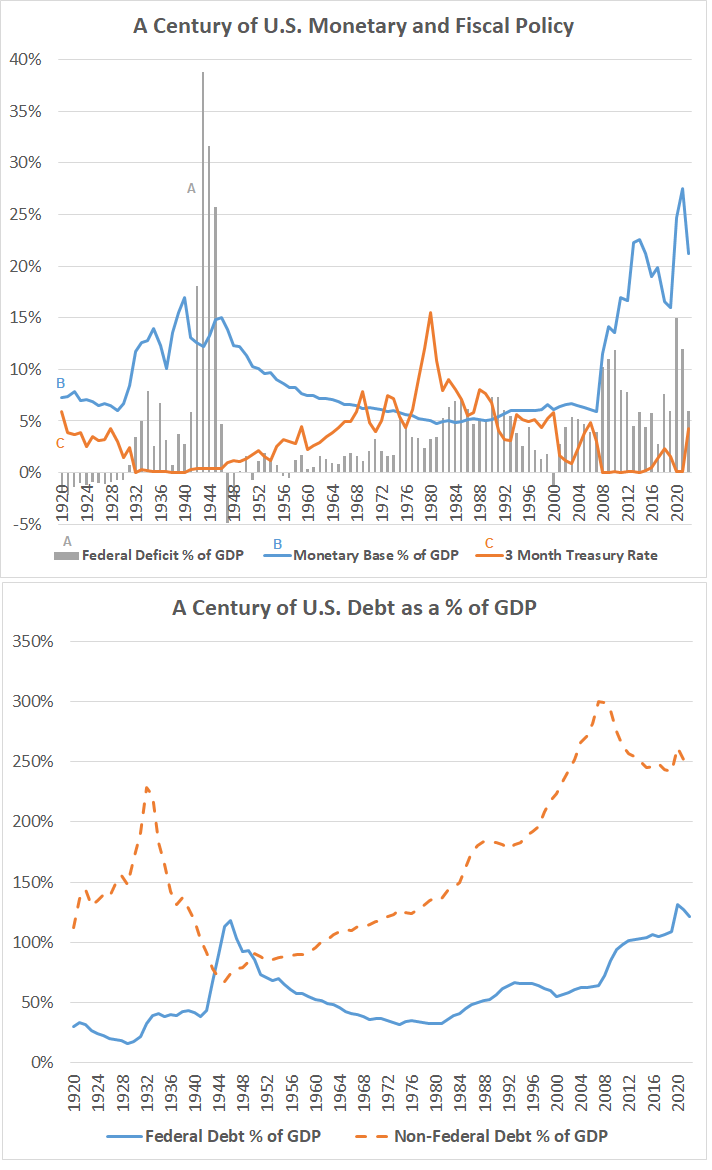

In certain eras, the ratio of IOUs for dollars vs actual dollars for the *whole* system gets out of hand, and so either it all implodes (bank deposits collapse down towards reserves) or the Fed prints the difference (reserves expand upwards towards deposits to cover them).

Broad money (the IOUs) are more impactful for our everyday price inflation experience.

The more IOUs we collectively have to send around to each other, the richer we feel, and the more we bid up prices for things.

Changes in broad money (IOUs) affect consumer price inflation.

The more IOUs we collectively have to send around to each other, the richer we feel, and the more we bid up prices for things.

Changes in broad money (IOUs) affect consumer price inflation.

This is because we assume (usually rightly) that all of those bank IOUs can be redeemed for dollars (which can only be created by the Fed) and are functionally equivalent for dollars.

Or as Allen elegantly said:

Or as Allen elegantly said:

Creating base money (what the IOUs technically get us) is impactful for maintaining the solvency of those IOUs.

IOUs become worthless if we realize we can't redeem them for dollars, and so their existence is based on the idea that we can get actual dollars when asked for.

IOUs become worthless if we realize we can't redeem them for dollars, and so their existence is based on the idea that we can get actual dollars when asked for.

Creating more base dollars (which happened most aggressively during 1932-1934 and 2008-2009) is an act of making sure the tremendous amount of IOUs for dollars remain redeemable for dollars.

It's an act of anti-deflation, via money-printing. It keeps bank IOUs good for dollars.

It's an act of anti-deflation, via money-printing. It keeps bank IOUs good for dollars.

That's why QE is money printing.

QE creates base money, which all bank IOUs are redeemable for.

But it's the number of IOUs that most impact everyday consumer prices because that's what people use and what are always (except 1930-1933 until they capitulated) honored as dollars.

QE creates base money, which all bank IOUs are redeemable for.

But it's the number of IOUs that most impact everyday consumer prices because that's what people use and what are always (except 1930-1933 until they capitulated) honored as dollars.

Loading suggestions...