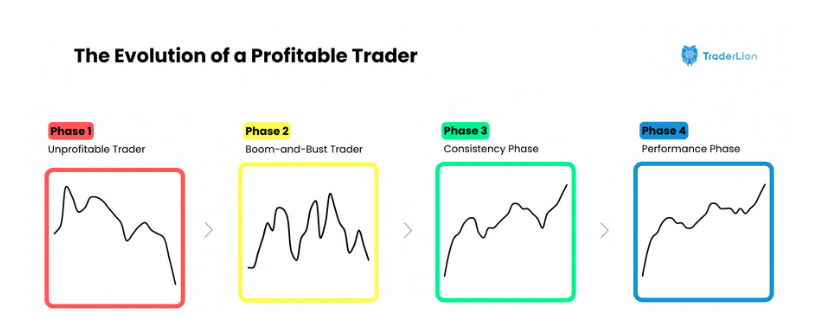

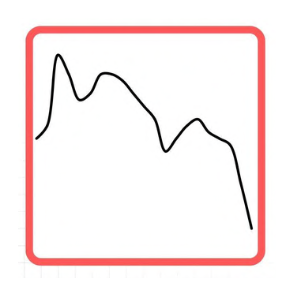

Traders in Phase 1 act randomly without a system, acting on tips and impulses. They lack any cohesive plan or trading rules concerning entries, exits, and risk management.

Traders in this phase may decide to leave trading behind them. If you recognize yourself as a

Phase 1 Trader, keep going! You can move past this phase and advance along your journey with discipline. It will take a lot of hard work, but it will be worth it.

Phase 1 Trader, keep going! You can move past this phase and advance along your journey with discipline. It will take a lot of hard work, but it will be worth it.

In this Phase, traders have often gotten more serious about trading; however, they need help consistently implementing a system and often need proper risk management.

Phase 2 traders feel disheartened when attempting strategies they have read about and still can’t make it work.

With more effort, tighter risk management, and trade discipline, they can quickly turn the corner and enter.

Phase 3: The Consistency Phase.

With more effort, tighter risk management, and trade discipline, they can quickly turn the corner and enter.

Phase 3: The Consistency Phase.

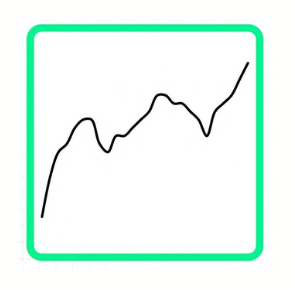

In this phase, traders have fully committed and found a sound strategy that makes sense for them and their situation.

The transition from 2 to 3 occurs when traders limit noise and focus on mastering one strategy or just one setup.

The transition from 2 to 3 occurs when traders limit noise and focus on mastering one strategy or just one setup.

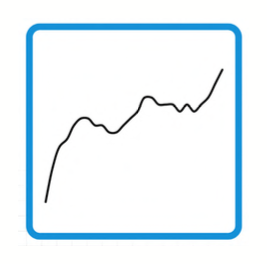

Phase 4 may be the last, but it does not mean the learning or hard work is done.

Performance Phase traders have nailed down routines that keep them focused on the highest potential stocks for their system and aware of the current market conditions.

Performance Phase traders have nailed down routines that keep them focused on the highest potential stocks for their system and aware of the current market conditions.

Advancing phases start with a strong foundation. If you're a growth trader/investor, @TraderLion_ put together a free 115-page Trading Guide to help you do just that: traderlion.com

#NTUpartner

#NTUpartner

Loading suggestions...