A thread 🧵 on different Intraday trading Strategy.

Retweet ♻ if you find it useful.

Telegram: t.me

@kuttrapali26

@KommawarSwapnil

@caniravkaria @Stocktwit_IN

#StockMarketindia #trading #forex #stockmarket #Nifty #banknifty

Retweet ♻ if you find it useful.

Telegram: t.me

@kuttrapali26

@KommawarSwapnil

@caniravkaria @Stocktwit_IN

#StockMarketindia #trading #forex #stockmarket #Nifty #banknifty

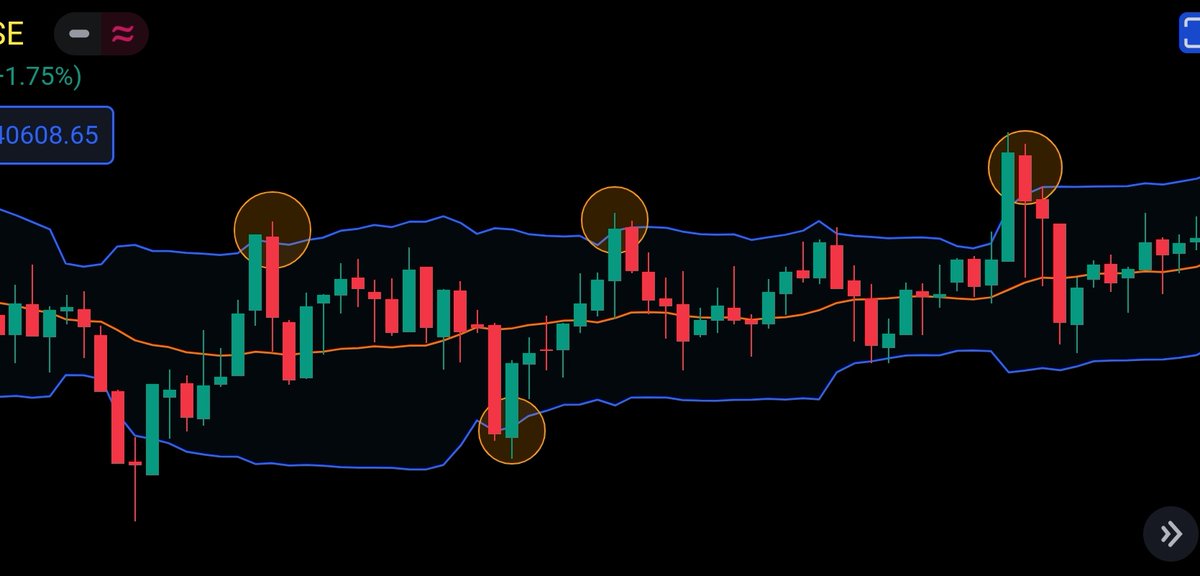

📍Virgin CPR Intraday Strategy

When the price fails to touch the CPR even once in a session, then it is called Virgin CPR.

Virgin CPR acts as support and resistance.

If there is virgin CPR, then on the next day we can expect a reversal from the virgin CPR.

When the price fails to touch the CPR even once in a session, then it is called Virgin CPR.

Virgin CPR acts as support and resistance.

If there is virgin CPR, then on the next day we can expect a reversal from the virgin CPR.

That's a wrap!

If you enjoyed this thread:

1. Follow @me__kaushik for more threads relating to trading.

2. RT the first tweet of this thread for maximum reach.

Also, join our telegram channel for live market updates.t.me

If you enjoyed this thread:

1. Follow @me__kaushik for more threads relating to trading.

2. RT the first tweet of this thread for maximum reach.

Also, join our telegram channel for live market updates.t.me

Loading suggestions...