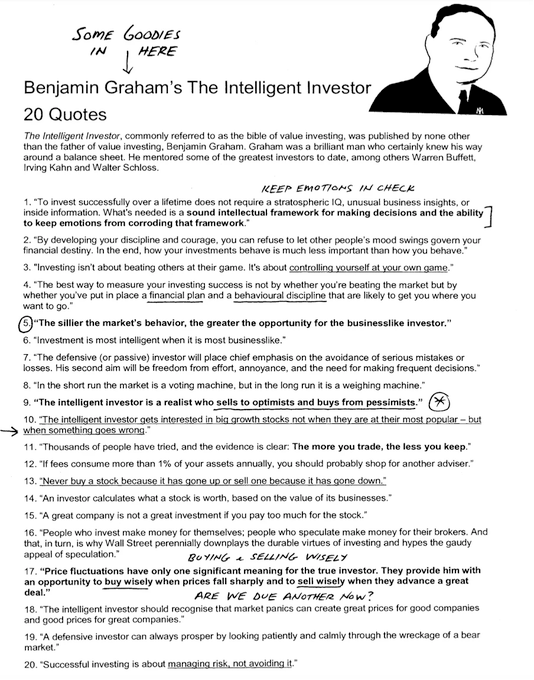

1. Keep your emotions in check

To invest successfully, you don’t need a high IQ or unusual business insights.

What you need is a good strategy that allows you to make intelligent decisions and keep your emotions in check.

To invest successfully, you don’t need a high IQ or unusual business insights.

What you need is a good strategy that allows you to make intelligent decisions and keep your emotions in check.

2. It’s about discipline and courage

How your investments perform in the short term is much less important than how you behave.

Have a lot of discipline and courage and don’t let other people’s mood swings influence you.

How your investments perform in the short term is much less important than how you behave.

Have a lot of discipline and courage and don’t let other people’s mood swings influence you.

3. Be contrarian

The intelligent investor is a realist who sells to optimists and buys from pessimists.

Buy stocks when there is blood in the streets.

“The intelligent investor should recognize that market panics can create great prices for good companies.” - Benjamin Graham

The intelligent investor is a realist who sells to optimists and buys from pessimists.

Buy stocks when there is blood in the streets.

“The intelligent investor should recognize that market panics can create great prices for good companies.” - Benjamin Graham

4. Have a financial plan

It’s not important whether you are beating the market.

It’s important to have a financial plan that will get you where you want to be.

It’s not important whether you are beating the market.

It’s important to have a financial plan that will get you where you want to be.

5. Bear markets offer opportunities

The sillier the market behavior, the greater the opportunity for investors.

Bear markets can make you very rich, you just don’t realize it at the time.

The sillier the market behavior, the greater the opportunity for investors.

Bear markets can make you very rich, you just don’t realize it at the time.

6. You are an owner

Invest. Don’t speculate.

As an investor, you own a part of the company you invest in. Act like it.

Invest. Don’t speculate.

As an investor, you own a part of the company you invest in. Act like it.

7. This time it’s not different

Abnormally good or abnormally bad conditions do not last forever.

In the long term, the stock market will be the best place to invest your money in.

Abnormally good or abnormally bad conditions do not last forever.

In the long term, the stock market will be the best place to invest your money in.

9. Focus on yourself

Investing isn’t about beating others at their game.

It’s about controlling yourself at your own game.

Always stick to your investment plan and goals.

Investing isn’t about beating others at their game.

It’s about controlling yourself at your own game.

Always stick to your investment plan and goals.

10. Use Mr. Market in your advantage

Mr. Market is there to serve you. Use volatility in your advantage.

“Always remember that market quotations are there for convenience, either to be taken advantage of or to be ignored.” - Benjamin Graham

Mr. Market is there to serve you. Use volatility in your advantage.

“Always remember that market quotations are there for convenience, either to be taken advantage of or to be ignored.” - Benjamin Graham

11. Don’t trade too much

The evidence is clear: the more you trade, the less you keep.

The best investor is a dead investor.

The evidence is clear: the more you trade, the less you keep.

The best investor is a dead investor.

12. Costs matter

Every tax and cost you pay will harm your investment results.

Try to minimize costs as much as possible.

Every tax and cost you pay will harm your investment results.

Try to minimize costs as much as possible.

13. Have good arguments to buy or sell a stock

Never buy a stock because it has gone up or sell one because it has gone down.

Only buy or sell a stock when your investment case has changed or you’ve found a better opportunity.

Never buy a stock because it has gone up or sell one because it has gone down.

Only buy or sell a stock when your investment case has changed or you’ve found a better opportunity.

14. Buy below intrinsic value

The cheaper you can buy a stock, the higher your margin of safety.

Try to buy stocks which are trading at a discount compared to their intrinsic value.

The cheaper you can buy a stock, the higher your margin of safety.

Try to buy stocks which are trading at a discount compared to their intrinsic value.

15. Don’t overpay

A great company is not equal to a great investment if you pay too much.

Comparing the current valuation of a company to its average valuation of the past 5 years is a good start.

A great company is not equal to a great investment if you pay too much.

Comparing the current valuation of a company to its average valuation of the past 5 years is a good start.

16. Never speculate

People who invest make money for themselves.

People who speculate make money for their brokers.

People who invest make money for themselves.

People who speculate make money for their brokers.

17. Embrace price fluctuations

Price fluctuations only have one significant meaning for the true investor……

… they give you the opportunity to buy wisely when prices fall sharply and sell wisely when the stock has gone up too much.

Price fluctuations only have one significant meaning for the true investor……

… they give you the opportunity to buy wisely when prices fall sharply and sell wisely when the stock has gone up too much.

18. Use panic to your advantage

Bear markets and stock market crashes create opportunities.

Bear markets and stock market crashes create opportunities.

19. Have patience

When you have a long-term mindset, you shouldn’t worry about daily stock market fluctuations.

The best investors are very patient.

When you have a long-term mindset, you shouldn’t worry about daily stock market fluctuations.

The best investors are very patient.

20. Successful investing is about managing risk

Successful investing is about managing risk, not avoiding it.

In the long run, stocks are less risky than bonds.

Successful investing is about managing risk, not avoiding it.

In the long run, stocks are less risky than bonds.

That's it for today.

If you liked this, you'll LOVE our full article about Benjamin Graham as well as a PDF with ALL his public writings.

Sign up here to receive it for free: eepurl.com

If you liked this, you'll LOVE our full article about Benjamin Graham as well as a PDF with ALL his public writings.

Sign up here to receive it for free: eepurl.com

Loading suggestions...