Stop PLAYING!

Imagine this...

Being able to trade the crypto market with unlimited capital.

Start trading DeFi like a whale, and stop earning peanuts!

Borrow and lend crypto assets on your terms with @QodaFinance

Imagine this...

Being able to trade the crypto market with unlimited capital.

Start trading DeFi like a whale, and stop earning peanuts!

Borrow and lend crypto assets on your terms with @QodaFinance

To answer this question, let's take a look at the existing money market protocols.

The truth is...

There are 3 hidden problems with existing money market protocols :

▫️ The Global collateral problem: Money market protocols like Compound, work perfectly for blue-chip assets.

The truth is...

There are 3 hidden problems with existing money market protocols :

▫️ The Global collateral problem: Money market protocols like Compound, work perfectly for blue-chip assets.

...how much interest people pay when they borrow money.

This special way is based on a line that shows different interest rates.

The rates change based on how many people are borrowing and lending assets in the market.

This special way is based on a line that shows different interest rates.

The rates change based on how many people are borrowing and lending assets in the market.

▫️ Overcollateralization problem: Overcollateralization means providing more assets or value than required to secure a loan.

In a trustless defi ecosystem, over-collateralization is a necessity, but...

In a trustless defi ecosystem, over-collateralization is a necessity, but...

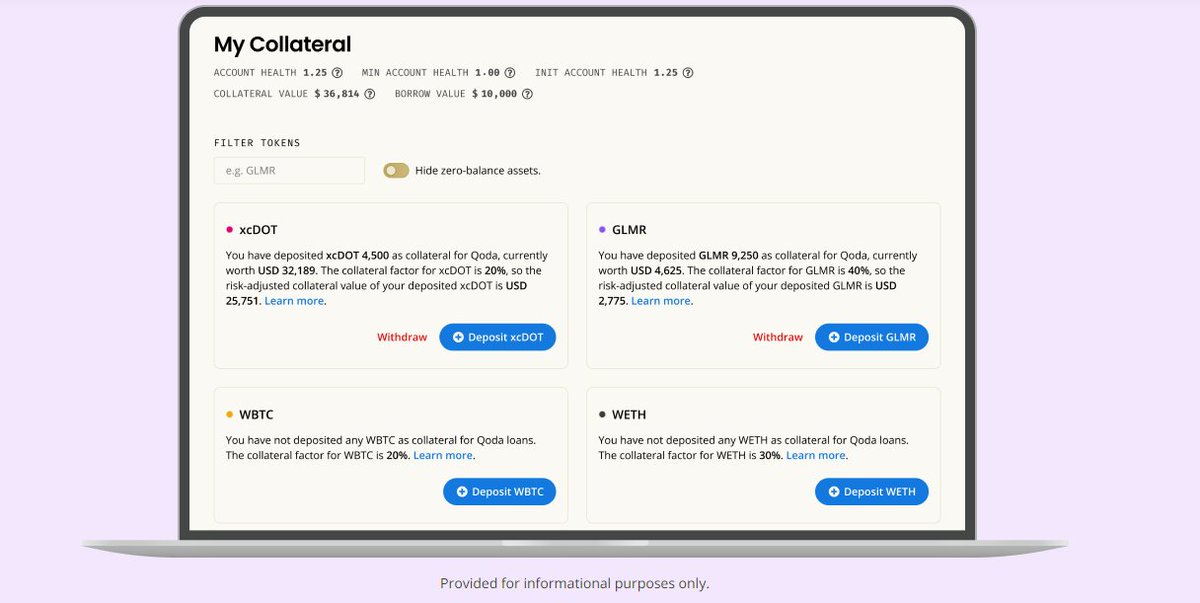

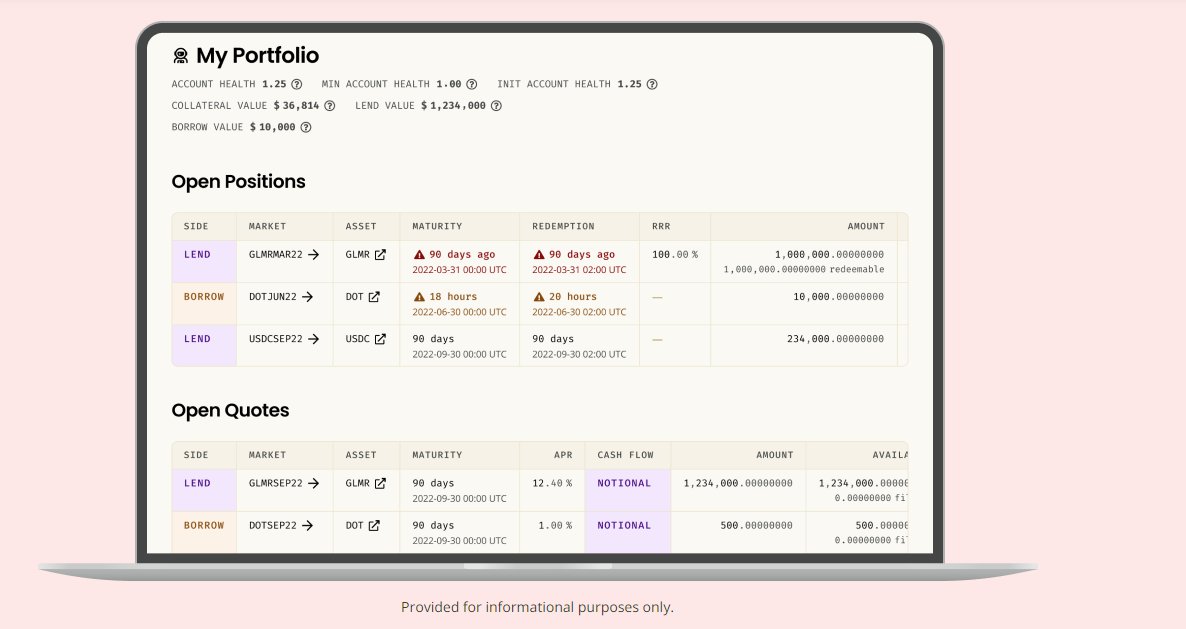

- To solve the price discovery problem, Qoda uses an on-chain order book of:

▪️ Fixed interest rate.

▪️ Fixed maturity borrow/lend orders.

Qoda's qToken feature allows lenders (and borrowers) the flexibility to exit early from their loans.

▪️ Fixed interest rate.

▪️ Fixed maturity borrow/lend orders.

Qoda's qToken feature allows lenders (and borrowers) the flexibility to exit early from their loans.

...collateral.

Hey, guess what?

🔸 Benefits of Qoda Finance.

▪️ There is no collateral deposit required from users that choose to lend on Qoda.

▪️ Qoda Finance allows users to exit early from their loans with the qToken feature.

Hey, guess what?

🔸 Benefits of Qoda Finance.

▪️ There is no collateral deposit required from users that choose to lend on Qoda.

▪️ Qoda Finance allows users to exit early from their loans with the qToken feature.

▪️ As a lender, uncollateralized borrowers get to pay you higher APRs.

▪️ Users receive rewards from trading and staking on the protocol.

🔸 Real-Life Use Cases of Qoda Finance

To illustrate the use case of the Qoda protocol, I'll use the following two examples :

▪️ Users receive rewards from trading and staking on the protocol.

🔸 Real-Life Use Cases of Qoda Finance

To illustrate the use case of the Qoda protocol, I'll use the following two examples :

Through qTokens.

qTokens are minted to Paul as a receipt when he lends out his $QODA tokens.

Advantages of QODA tokens:

-> Flexibility of greater capital allocation efficiency.

Without qTokens, Paul would have had to wait for the return of his funds and interest.

qTokens are minted to Paul as a receipt when he lends out his $QODA tokens.

Advantages of QODA tokens:

-> Flexibility of greater capital allocation efficiency.

Without qTokens, Paul would have had to wait for the return of his funds and interest.

Qoda protocol treats lending and borrowing as inverse functions.

Paul has lent to the market and can reverse it anytime by borrowing the equivalent amount.

Hence, he can take advantage of trade opportunities profitably.

How about if Paul wants to borrow a loan?

Paul has lent to the market and can reverse it anytime by borrowing the equivalent amount.

Hence, he can take advantage of trade opportunities profitably.

How about if Paul wants to borrow a loan?

Paul can use the Qoda mToken feature to automatically earn interest on his deposited collateral via the Moonwell protocol.

Wait!

Loans should always be paid back promptly.

But, check this...

Wait!

Loans should always be paid back promptly.

But, check this...

🔸 Qoda Tokenomics

$QODA is the native token of the protocol.

It has a fixed, fully diluted, and non-inflationary of 1,000,000,000 tokens.

$QODA token has no utility but can be staked for veQODA.

veQODA is the unit of measure for staking activity on Qoda.

$QODA is the native token of the protocol.

It has a fixed, fully diluted, and non-inflationary of 1,000,000,000 tokens.

$QODA token has no utility but can be staked for veQODA.

veQODA is the unit of measure for staking activity on Qoda.

-> They accrue in real-time at a rate of 0.00004 veQODA per 1 QODA token staked per block.

-> If you stake $QODA tokens, you lose all your earned veQODA tokens.

-> It has a max cap of 100 veQODA rewards for each 1 $QODA staked.

-> veQODA tokens are non-transferable.

-> If you stake $QODA tokens, you lose all your earned veQODA tokens.

-> It has a max cap of 100 veQODA rewards for each 1 $QODA staked.

-> veQODA tokens are non-transferable.

Benefits of veQODA tokens:

-> Right to claim protocol fees, denominated in $GLMR.

-> Right to claim issuance of new $QODA tokens.

-> Governance/DAO voting rights.

But, that's not all...

-> Right to claim protocol fees, denominated in $GLMR.

-> Right to claim issuance of new $QODA tokens.

-> Governance/DAO voting rights.

But, that's not all...

🔸 Rewards and Incentives

- Trading Rewards: For being an active trader on Qoda, you receive $QODA tokens for successfully borrowing and lending on the platform.

- Staking Rewards: For choosing to stake $QODA tokens veQODA token holders receive...

- Trading Rewards: For being an active trader on Qoda, you receive $QODA tokens for successfully borrowing and lending on the platform.

- Staking Rewards: For choosing to stake $QODA tokens veQODA token holders receive...

Here is an official link to the extensive roadmap.

docs.qoda.fi

🔸 Concluding Remarks.

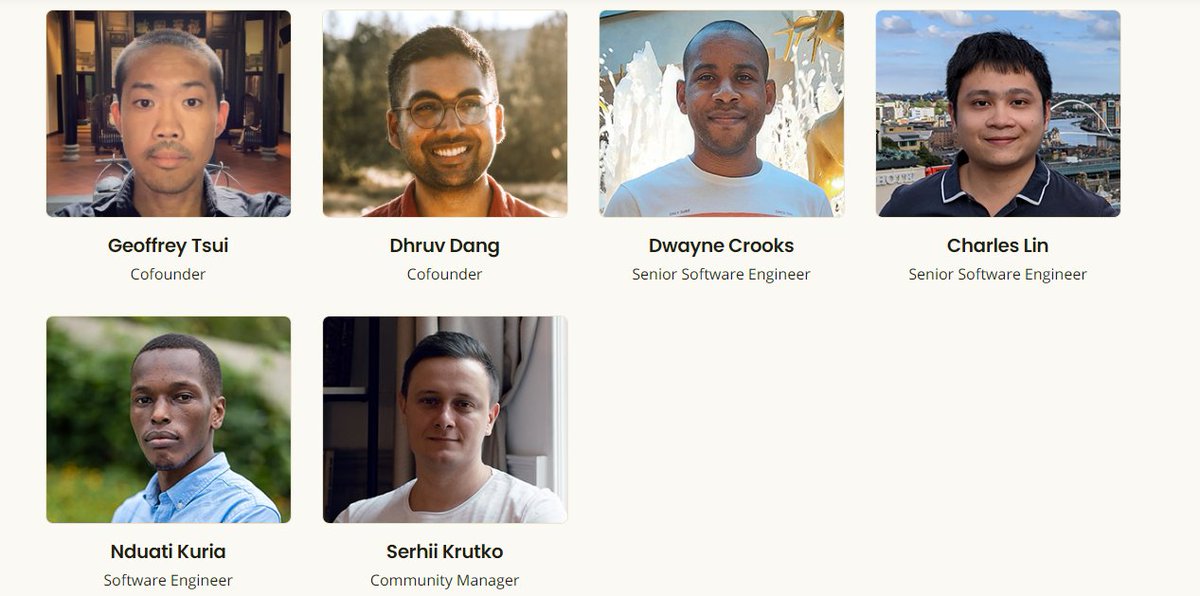

Qoda is built by Enso Labs, a web3 consultancy.

The core team is well experienced in the financial markets as well as in the software development space.

docs.qoda.fi

🔸 Concluding Remarks.

Qoda is built by Enso Labs, a web3 consultancy.

The core team is well experienced in the financial markets as well as in the software development space.

Nothing in this thread is financial advice, this is purely educational content.

If you've found value in this thread, do well to:

- Give me a follow as I post content like this often.

- Like and Rt the first tweet for more exposure.

Also:

If you've found value in this thread, do well to:

- Give me a follow as I post content like this often.

- Like and Rt the first tweet for more exposure.

Also:

- Follow @QodaFinance for more updates.

- Follow @paulchristain__ for educational DeFi content too!

Here are other DeFi educators to follow for premium content:

@david_choya

@enicrypt

@VanessaDefi

@thelearningpill

@Only1temmy

- Follow @paulchristain__ for educational DeFi content too!

Here are other DeFi educators to follow for premium content:

@david_choya

@enicrypt

@VanessaDefi

@thelearningpill

@Only1temmy

Loading suggestions...