AVG Logistics

A thread about this ISO 9001 - 2015 accredited logistics company .

#avglogistics #retweet #StocksInFocus

A thread about this ISO 9001 - 2015 accredited logistics company .

#avglogistics #retweet #StocksInFocus

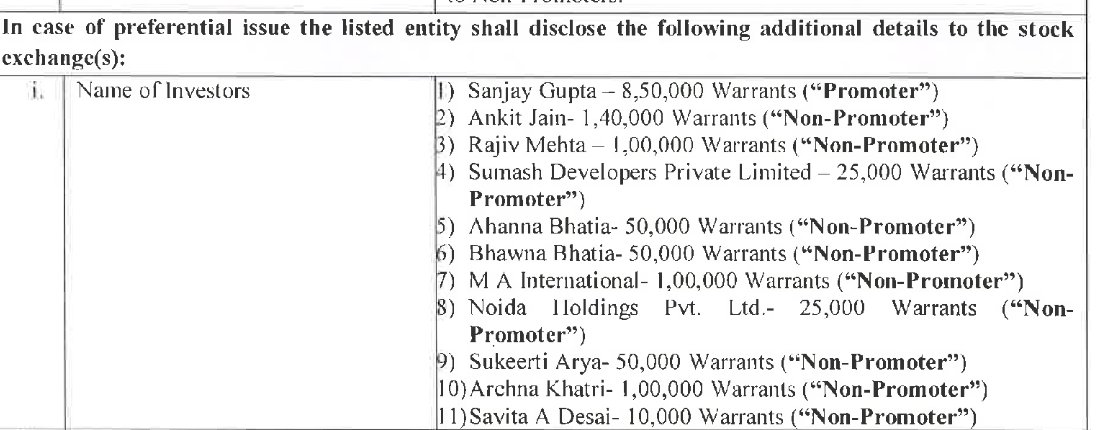

Promoter :

Mr. Sanjay Gupta

He is a visionary logistics professional armed with 30+ years of solid and varied experience. He has been instrumental in introducing train movements and deployment of 32ft. containers on high volume road routes for cost reduction.

Mr. Sanjay Gupta

He is a visionary logistics professional armed with 30+ years of solid and varied experience. He has been instrumental in introducing train movements and deployment of 32ft. containers on high volume road routes for cost reduction.

They specialize in two of the most important functions of logistics, Transportation and Warehousing. With over 50 fully computerized branches all over India, AVG Logistics Limited has a large customer base from different sectors of India.

Clients :

Nestle, ITC, Mondelez, GSK, Amara Raja, Airtel, MRF, Mother Dairy, UltraTech Cement, Coca Cola, IGNOU, Patanjali etc

Nestle, ITC, Mondelez, GSK, Amara Raja, Airtel, MRF, Mother Dairy, UltraTech Cement, Coca Cola, IGNOU, Patanjali etc

Workforce : 500+

1200+ trucks

354,000 Sq. Ft. of extensive warehousing space.

Promoters mission is to transform AVG Logistics Limited into a market leader for providing customized logistics solutions for every need .

1200+ trucks

354,000 Sq. Ft. of extensive warehousing space.

Promoters mission is to transform AVG Logistics Limited into a market leader for providing customized logistics solutions for every need .

Tech is used extensively in their operations

Transportation Management System(Software ) helps with the planning, execution and optimization of the physical movements of goods. The daily optimization and management of operations is easier for the users with the platform.

Transportation Management System(Software ) helps with the planning, execution and optimization of the physical movements of goods. The daily optimization and management of operations is easier for the users with the platform.

Real Time Tracking

They have a Google based tracking system, which helps , us and our clients can easily track the cargo.

Load Board:

An Online platform, where the clients can consolidate the indent. Improves transparency between services and customers.

They have a Google based tracking system, which helps , us and our clients can easily track the cargo.

Load Board:

An Online platform, where the clients can consolidate the indent. Improves transparency between services and customers.

24X7 Control room

They have 24x7 control room, which makes sure that goods dispatch on the scheduled network. It also monitors the status of our own fleet. It keeps a check on running and idle vehicles. I

They have 24x7 control room, which makes sure that goods dispatch on the scheduled network. It also monitors the status of our own fleet. It keeps a check on running and idle vehicles. I

March 2023 results : Good

The company has reported total income of Rs. 132.1977 crores during the period ended March 31, 2023 as compared to Rs. 107.2030 crores during the period ended December 31, 2022.

The company has reported total income of Rs. 132.1977 crores during the period ended March 31, 2023 as compared to Rs. 107.2030 crores during the period ended December 31, 2022.

I feel the promoter is good , in this latest concall as well one key concept which i liked was Multi Modal segment ( rail cum road model )

Market Cap ₹ 274 Cr.

cmp : 232

PEG Ratio 15.4

COns

Debt : 2.96

Lets hope for the best ! #retweet for max outreach .

cmp : 232

PEG Ratio 15.4

COns

Debt : 2.96

Lets hope for the best ! #retweet for max outreach .

Loading suggestions...