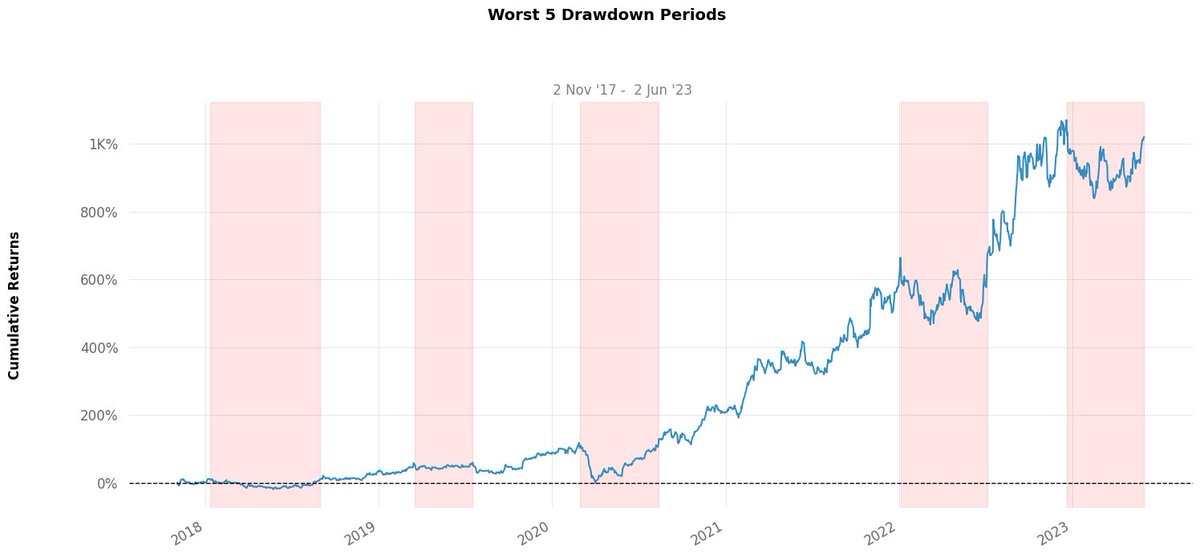

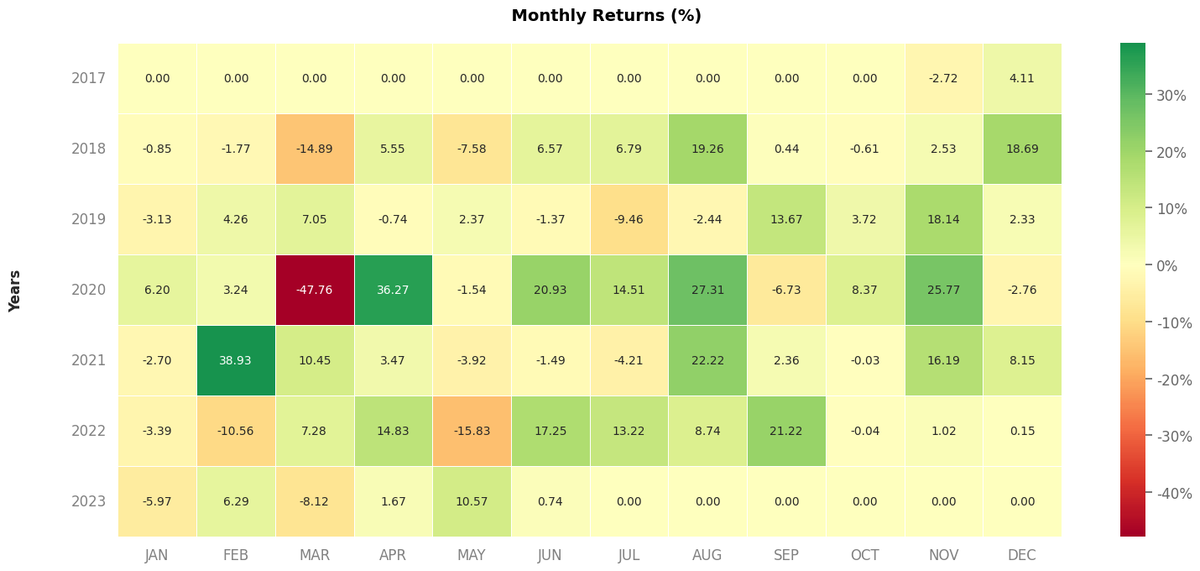

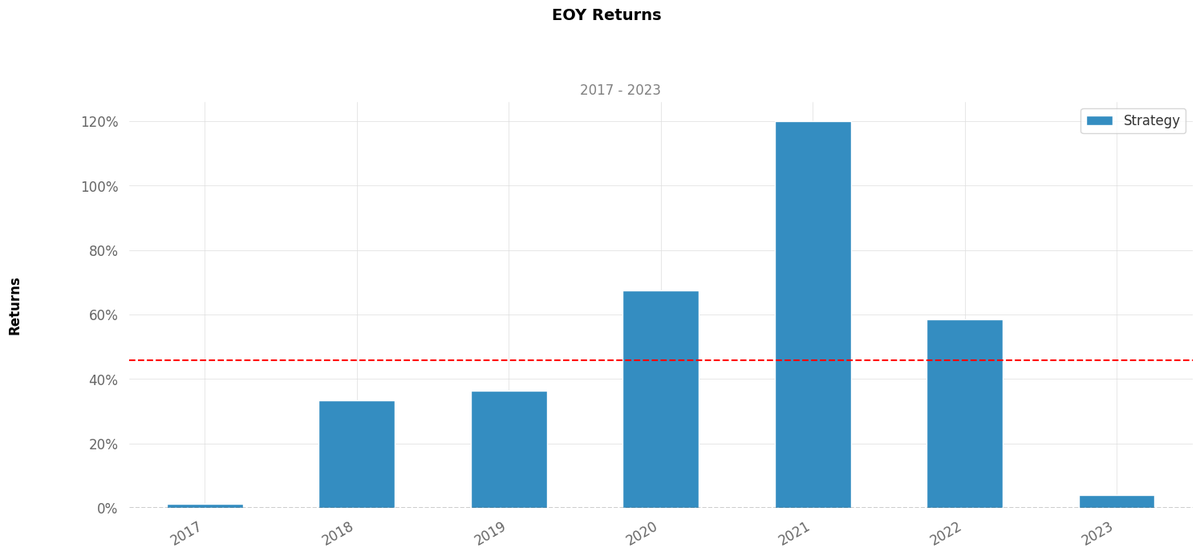

#TII price data points 📊

1. Stock has doubled every 2 years

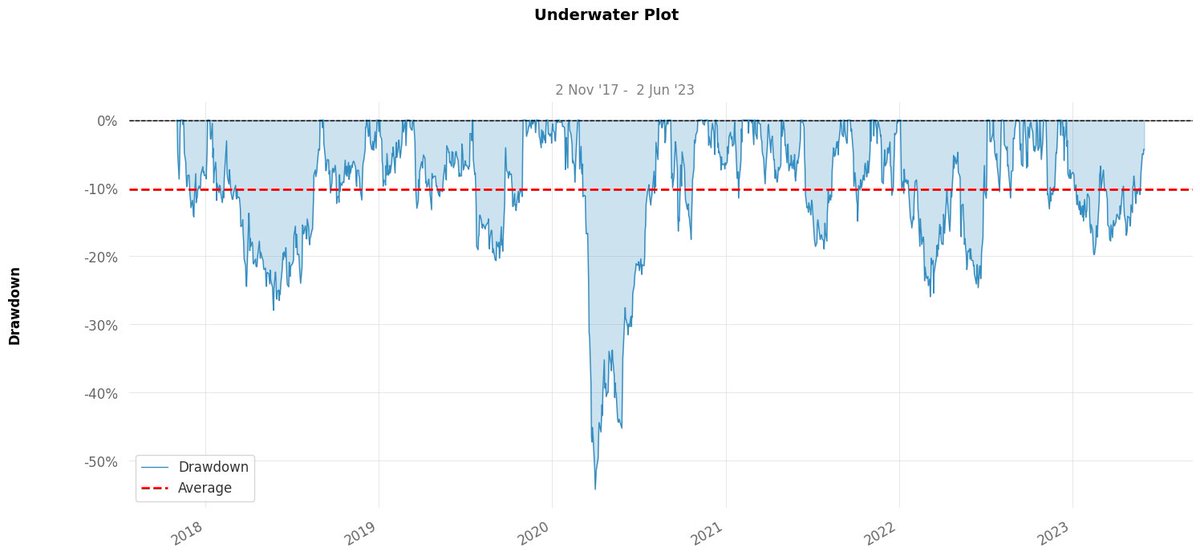

2. Max DrawDown (DD) of -54.18% & an avg DD of -7.35%

3. Worst DD period lasted for 1 years, 2018-19

4. Stock was down <-10%, 16 times since 2017

5. Stock was down <-25%, 3 times since 2017

#StockMarketindia #stocks

1. Stock has doubled every 2 years

2. Max DrawDown (DD) of -54.18% & an avg DD of -7.35%

3. Worst DD period lasted for 1 years, 2018-19

4. Stock was down <-10%, 16 times since 2017

5. Stock was down <-25%, 3 times since 2017

#StockMarketindia #stocks

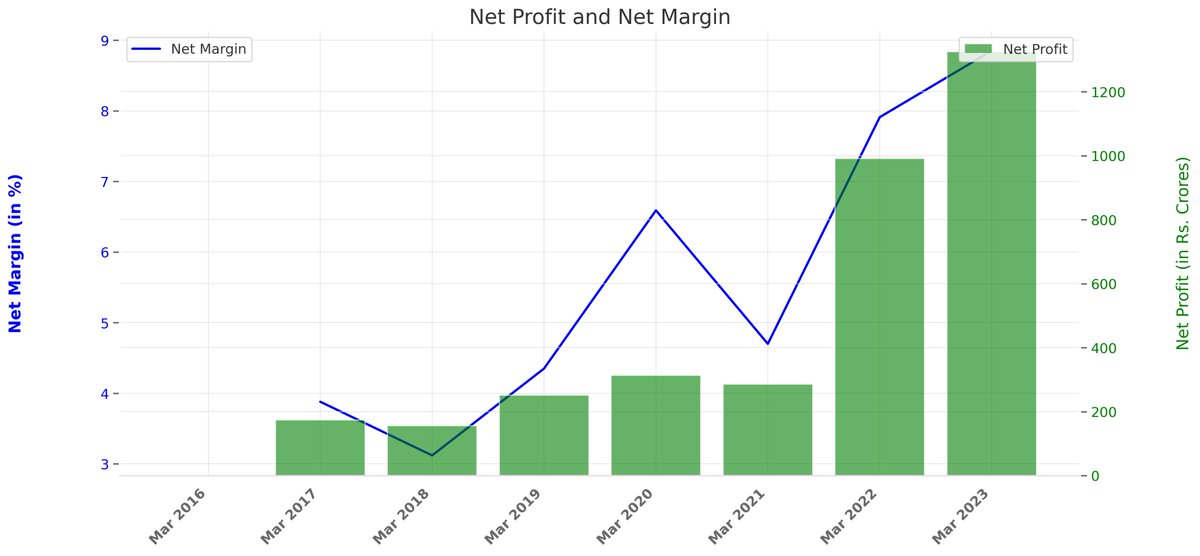

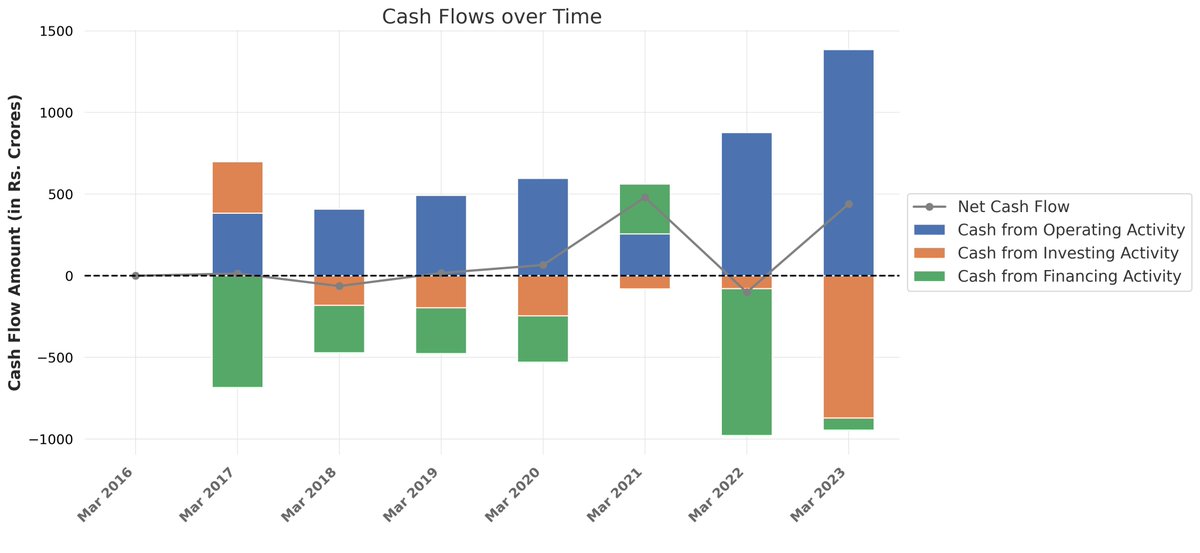

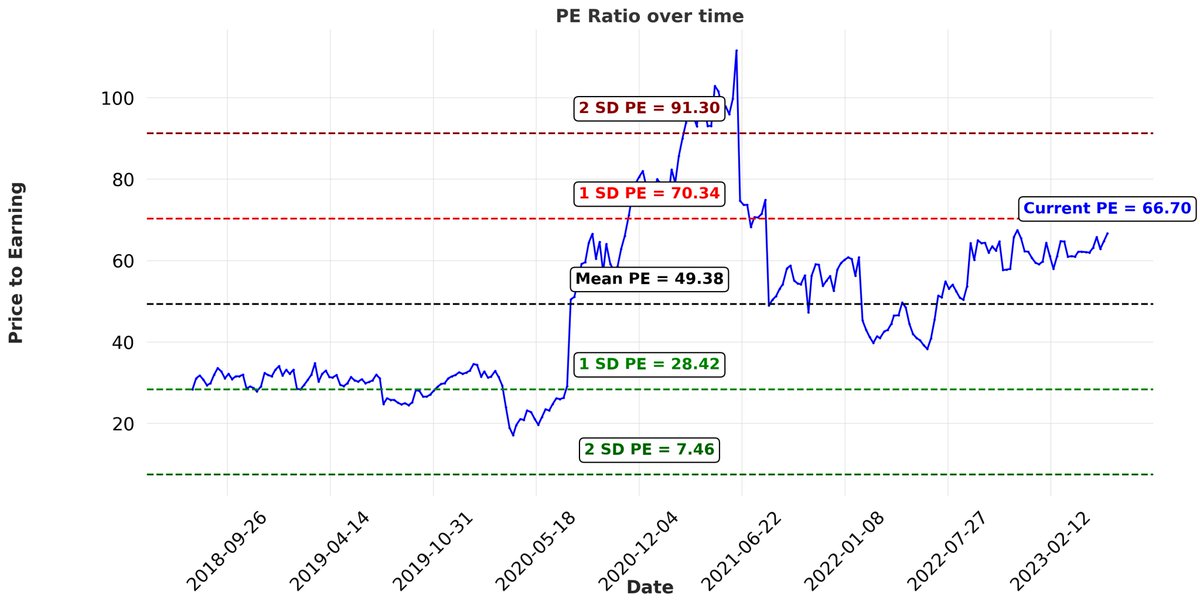

#TII Fundamental points based on last 5 years 📊

1. Compounded Sales Growth at 25%

2. Compounded Profit Growth at 41%

3. Stock Price CAGR at 67%

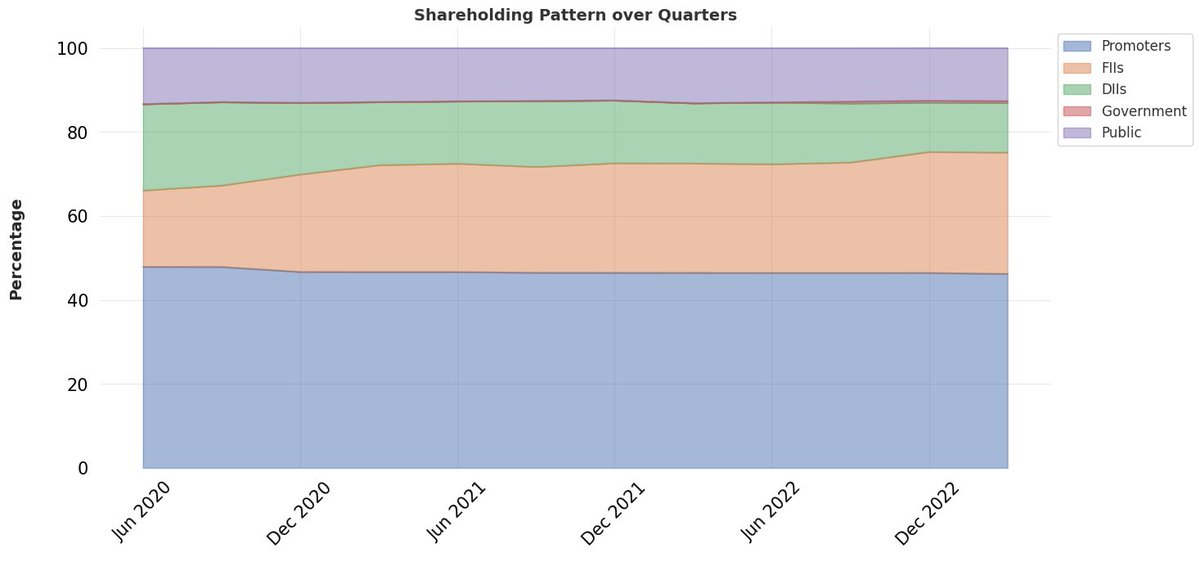

4. Promoter holding at 46.2%

5. Current P/E ratio is 67.2, 5 Yrs PE is 29.9, while Industry PE is 25.6

#stockmarkets #stockstowatch

1. Compounded Sales Growth at 25%

2. Compounded Profit Growth at 41%

3. Stock Price CAGR at 67%

4. Promoter holding at 46.2%

5. Current P/E ratio is 67.2, 5 Yrs PE is 29.9, while Industry PE is 25.6

#stockmarkets #stockstowatch

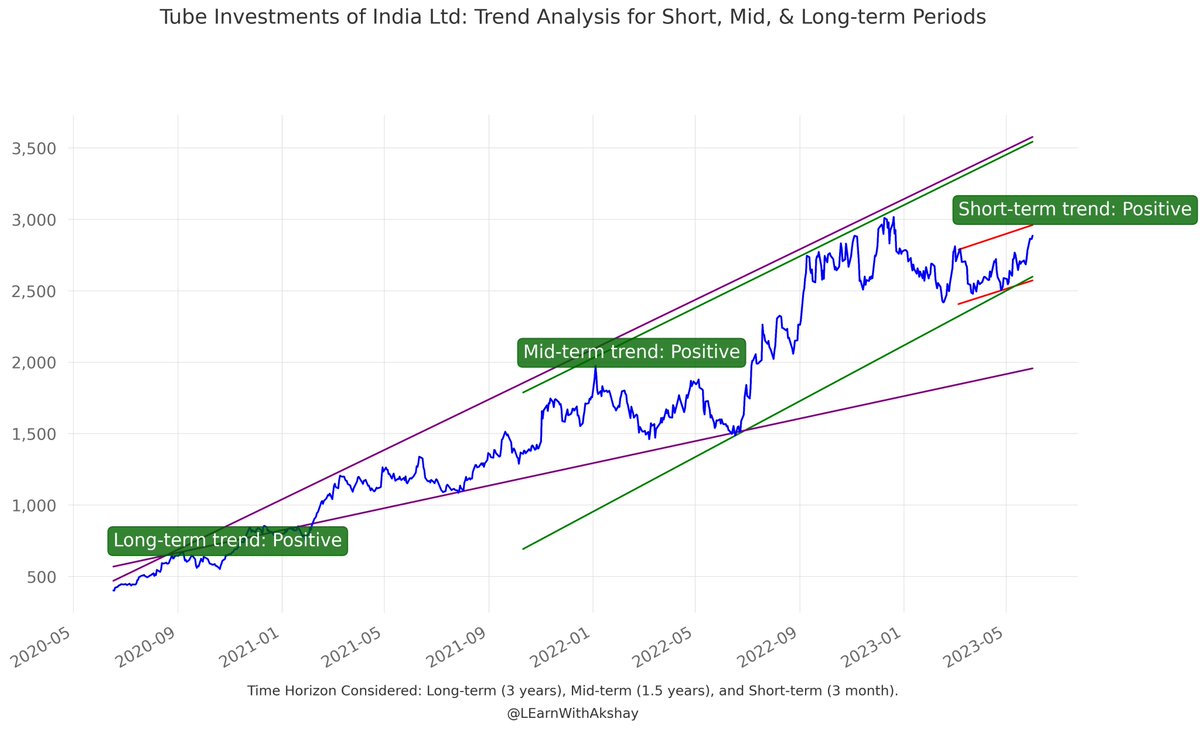

Curious about #Tube Investment India Ltd trend? 🤔

According to the trend analysis:

Long-term trend: Positive📈

Mid-term trend: Positive📈

Short-term trend: Positive📈

Check out the chart and decide for yourself. 👀

#TrendAnalysis #stockstowatch #StockMarketindia #nifty50

According to the trend analysis:

Long-term trend: Positive📈

Mid-term trend: Positive📈

Short-term trend: Positive📈

Check out the chart and decide for yourself. 👀

#TrendAnalysis #stockstowatch #StockMarketindia #nifty50

Considering #TII's growth trajectory, profitability, and market positioning over the past 5 years, it may be worth exploring as a potential investment opportunity.

However, before making any investment, make sure to do your research and always have a stop loss in place🛡️

However, before making any investment, make sure to do your research and always have a stop loss in place🛡️

Loading suggestions...