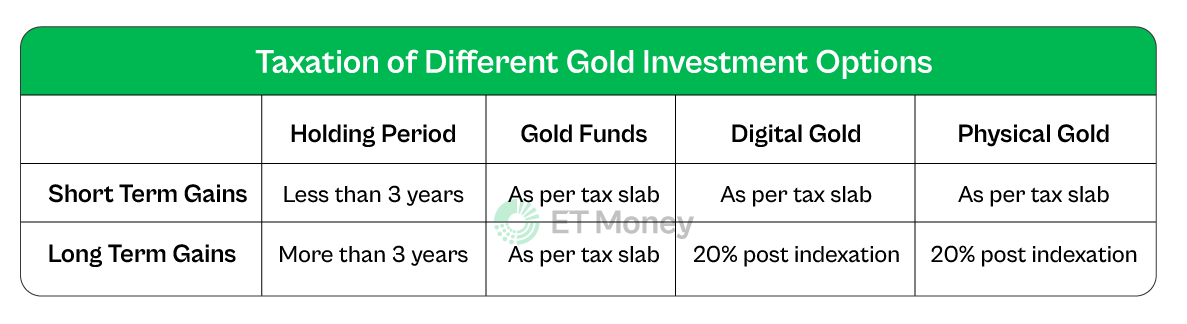

Irrespective of the holding period, gains from gold funds (ETFs & FoFs) are taxed as per your slab rate.

So, if you are in the 20% or 30% tax bracket, you’ll pay more tax.

In comparison, digital & physical gold still give you the indexation benefit. So, less tax.

So, if you are in the 20% or 30% tax bracket, you’ll pay more tax.

In comparison, digital & physical gold still give you the indexation benefit. So, less tax.

Yet, gold funds can be better.

Let’s start the comparison with digital gold, a way to buy gold virtually.

Its main attraction: You can buy gold for as low as Rs

1.

But there are certain limitations associated with digital gold.

Let’s start the comparison with digital gold, a way to buy gold virtually.

Its main attraction: You can buy gold for as low as Rs

1.

But there are certain limitations associated with digital gold.

A big drawback is its cost.

On every purchase, digital gold includes 3% GST (goods & services tax).

Another 3% is charged when you sell back.

So, at any point, close to 6% is the difference between its buy & sell price.

There’s no such thing in gold funds.

On every purchase, digital gold includes 3% GST (goods & services tax).

Another 3% is charged when you sell back.

So, at any point, close to 6% is the difference between its buy & sell price.

There’s no such thing in gold funds.

Another big concern in digital gold is the absence of a regulator.

There are no regulations to safeguard the interests of investors.

Contrary to this, for gold mutual funds, #SEBI has clearly defined rules in place.

There are no regulations to safeguard the interests of investors.

Contrary to this, for gold mutual funds, #SEBI has clearly defined rules in place.

Next comes physical gold.

Here the cost of investing is too high.

You pay 3% GST on purchase.

Plus, close to 12-20% can be making charges.

Add to it the storage and handling costs.

And if you decide to sell it, a jeweller pay you lower than the prevailing gold prices.

Here the cost of investing is too high.

You pay 3% GST on purchase.

Plus, close to 12-20% can be making charges.

Add to it the storage and handling costs.

And if you decide to sell it, a jeweller pay you lower than the prevailing gold prices.

Gold funds, on the other hand, are highly liquid.

Fund houses only charge you an expense ratio, generally limited to 50-70 basis points (100 basis points is equal to one per cent).

And there’s one big advantage that comes with gold mutual funds. 👇

Fund houses only charge you an expense ratio, generally limited to 50-70 basis points (100 basis points is equal to one per cent).

And there’s one big advantage that comes with gold mutual funds. 👇

In the past three months, gold gave close to 8% returns.

Suppose you want to take a tactical bet on the yellow metal.

You will lose money if you invested in digital gold and physical gold for the reasons stated above.

Gold mutual funds are the best way to do this.

Suppose you want to take a tactical bet on the yellow metal.

You will lose money if you invested in digital gold and physical gold for the reasons stated above.

Gold mutual funds are the best way to do this.

Some investors also hold the yellow metal as part of their portfolio.

If the investor wants to rebalance the portfolio because the allocation has changed, he may need to either buy or sell gold.

For this, gold mutual funds are the most convenient.

If the investor wants to rebalance the portfolio because the allocation has changed, he may need to either buy or sell gold.

For this, gold mutual funds are the most convenient.

For tactical bets and asset allocation in your portfolio, gold mutual funds are the most preferable option.

If you are saving specifically to buy jewellery in the future, you can look at mutual funds, physical gold or digital gold based on your preference.

If you are saving specifically to buy jewellery in the future, you can look at mutual funds, physical gold or digital gold based on your preference.

You may be thinking, what about Sovereign Gold Bonds?

Consider them if you are fine with a 5-8 years lock-in.

But remember, they may not be the best option for tactical bets and asset allocation.

So, in short, be sure about the end-use before you buy gold in any form.

Consider them if you are fine with a 5-8 years lock-in.

But remember, they may not be the best option for tactical bets and asset allocation.

So, in short, be sure about the end-use before you buy gold in any form.

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

Loading suggestions...