PS. If you're not an already above average trader then tips in this Thread may not resonate to you

If you followed this Prop firm Thread series then you should be familiar with Prop firms, their rules & types and so on

This thread would be long but super informative!!

Trust me

If you followed this Prop firm Thread series then you should be familiar with Prop firms, their rules & types and so on

This thread would be long but super informative!!

Trust me

So watch n follow closely

One of the 2 prominent things that makes a lot of traders loose their Prop firm accounts is bad risk and bad psychology but for this thread we'd be focusing more on Risk Management

I'm sure you already know what Drawdowns are ? Before reading this

One of the 2 prominent things that makes a lot of traders loose their Prop firm accounts is bad risk and bad psychology but for this thread we'd be focusing more on Risk Management

I'm sure you already know what Drawdowns are ? Before reading this

A Drawdown is that said amount you're not allowed to loose completely on any of your account size. Now this Drawdown types differ with various firms and so does Drawdown amounts too are unique to various firms offerings

Let's get 2 things down first before we proceed

They are

Let's get 2 things down first before we proceed

They are

Strike/Win rate and Strategy

In as much as no particular strategy is preferred or the best to trade prop firms, traders must have a good win/strike rate backing their strategy

Now Technical Analysis and your strategy gives you an edge over the market

This is simply saying

In as much as no particular strategy is preferred or the best to trade prop firms, traders must have a good win/strike rate backing their strategy

Now Technical Analysis and your strategy gives you an edge over the market

This is simply saying

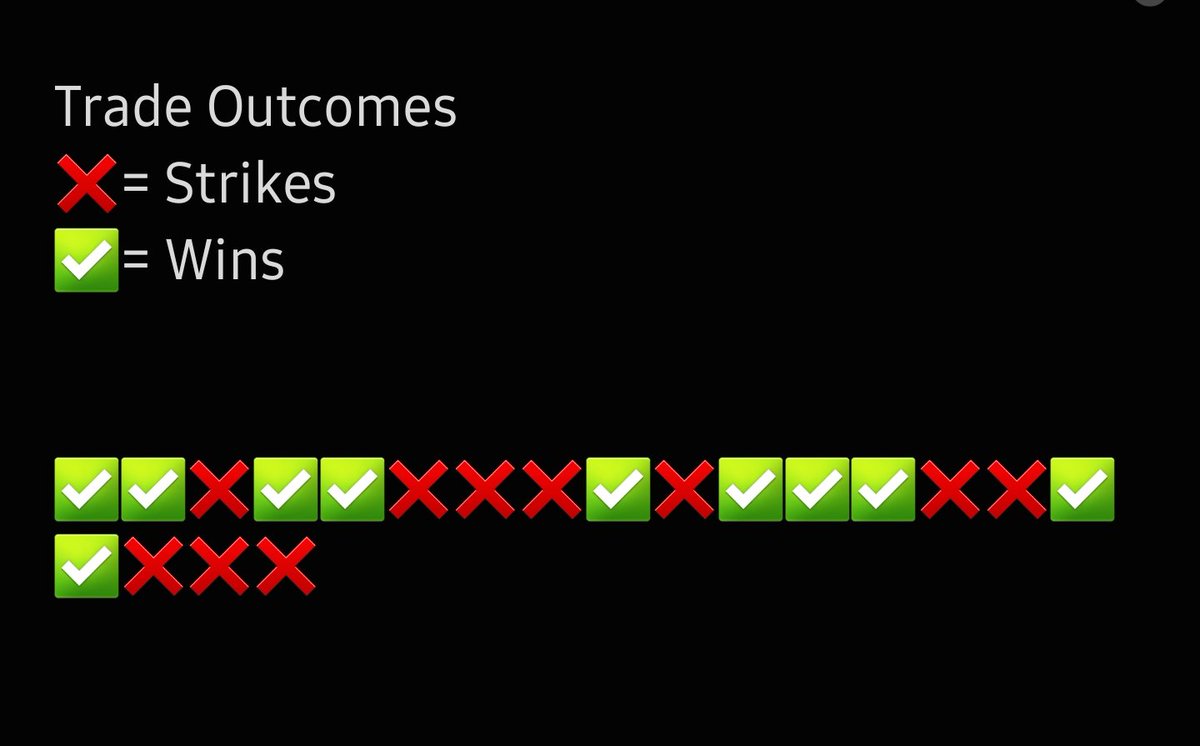

That over the Randomness and probabilities that exists in price movements In the market triggered by uncertain/unexpected events, your technical strategy or approach to the market gives you a number of strikes(failure rate) & a win(pass rate) in a number of trade outcomes

This is why it's important that traders journal their trades after each outcome has played out as this is one of major ways of determining your strike/win rate asides statistical data shown or presented to you by your broker but that aside

I'd be using a simple method for us.

I'd be using a simple method for us.

To be able to determine our strike/win rate we need to self access ourselves

You need to ask yourself a simple question, which is > how many wins or losses can you make/take over a defined number of trade outcomes.

To make it easier for calculation I'd be using 20 trades

You need to ask yourself a simple question, which is > how many wins or losses can you make/take over a defined number of trade outcomes.

To make it easier for calculation I'd be using 20 trades

So say to say, how wins can you make out of 20 trades if you were to execute them

Speak to your inner man sincerely

Anyways mine is actually 10

Which translates to about 50% win rate, to most persons they'd say it's poor lol but even a 30% win rate is good enough to scale

Speak to your inner man sincerely

Anyways mine is actually 10

Which translates to about 50% win rate, to most persons they'd say it's poor lol but even a 30% win rate is good enough to scale

Now we've gotten that out of the way. Let's move over to Drawdown

Let's say your trading a $100k account

With a 5% daily Drawdown and a 10% total Drawdown this means in a day you're not allowed to loose more than $5000 and in total you shouldn't loose $10,000 assuming you lost

Let's say your trading a $100k account

With a 5% daily Drawdown and a 10% total Drawdown this means in a day you're not allowed to loose more than $5000 and in total you shouldn't loose $10,000 assuming you lost

Below the daily Drawdown amount daily

For many of you asking how come the figures, its simple maths, 5% of $100,000 is $5,000 and so on

Unfortunately this Drawdown amount is the only amount fraction of the total acc we're given to trade but most persons don't see it that way.

For many of you asking how come the figures, its simple maths, 5% of $100,000 is $5,000 and so on

Unfortunately this Drawdown amount is the only amount fraction of the total acc we're given to trade but most persons don't see it that way.

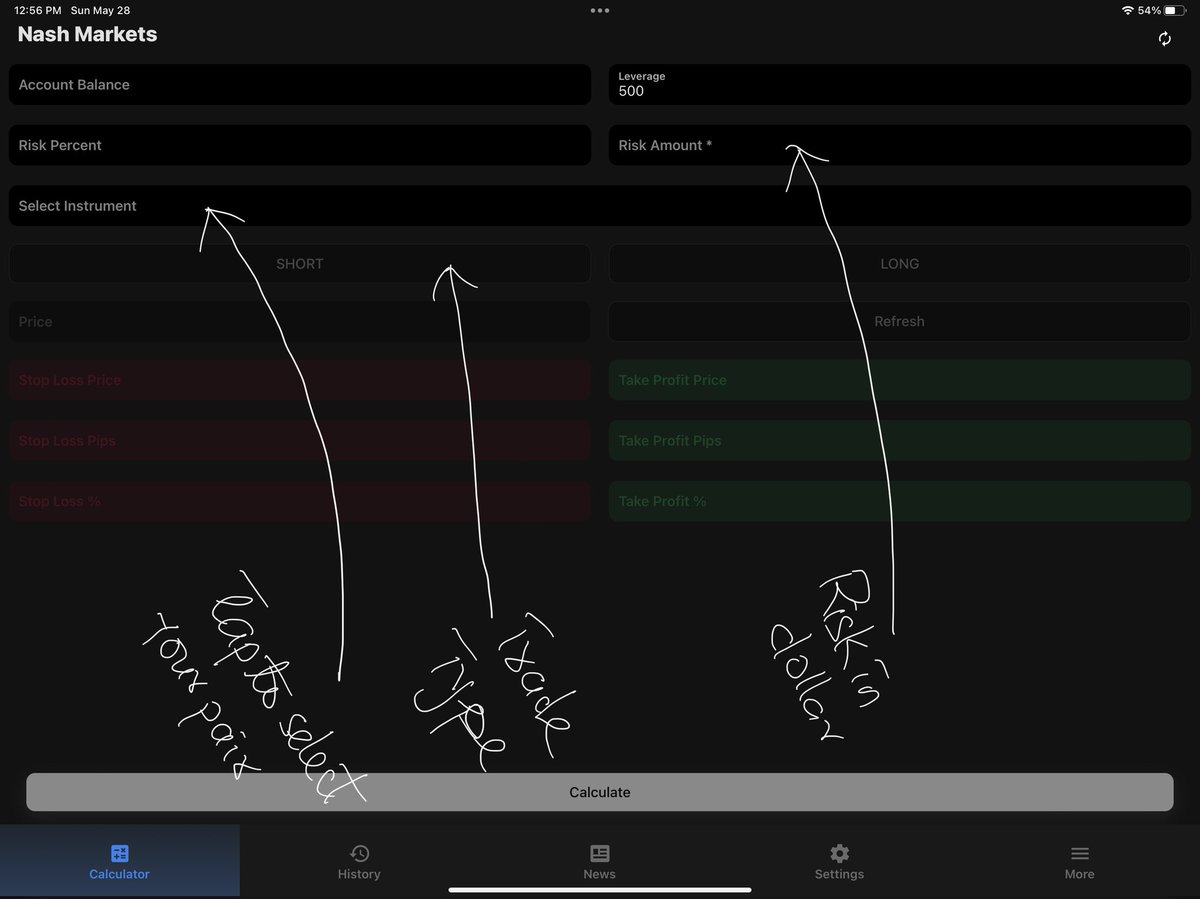

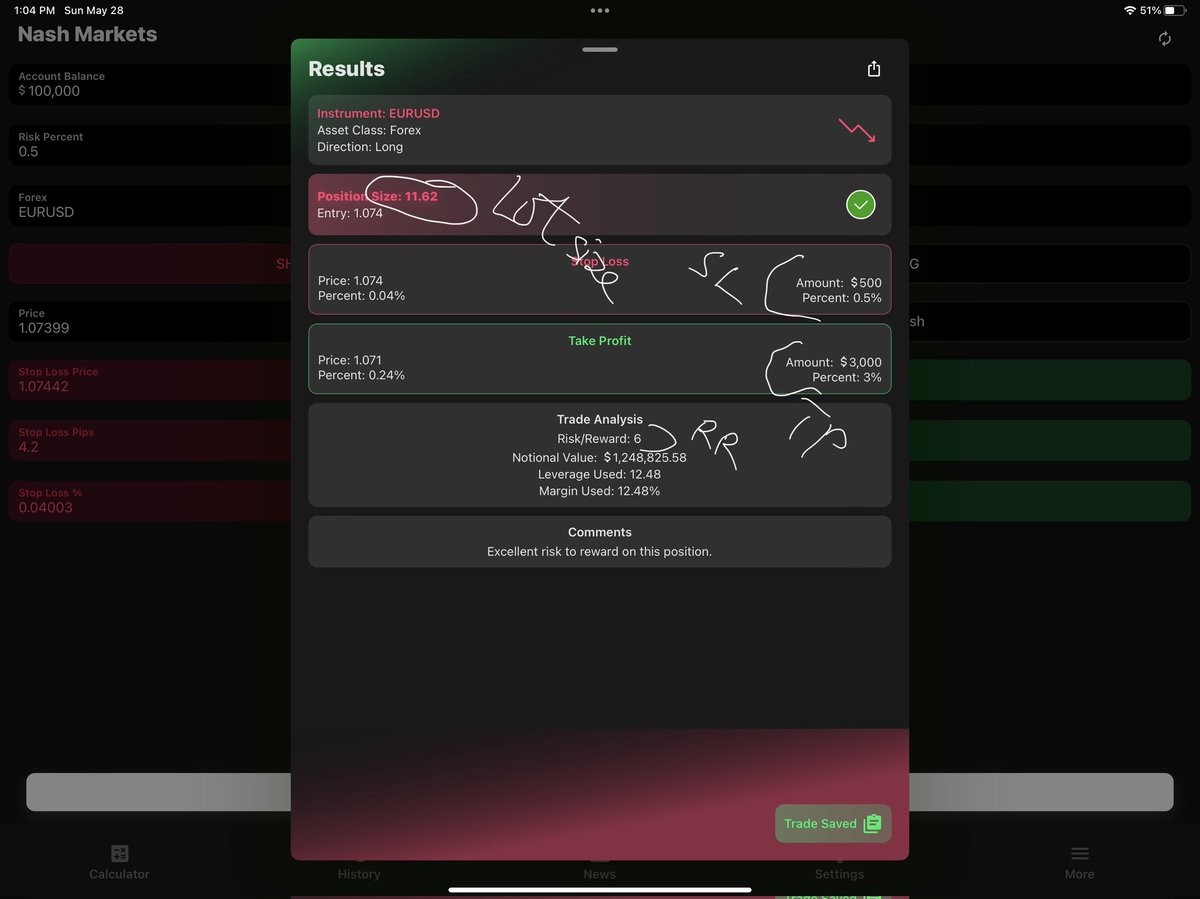

So To build our Risk Management along side our strike rate, we take the DD and divide it by the trade Nō outcomes we're willing to take, $10,000/20 = Translates to $500

This automatically becomes our Risk

This means for every 20 trades RR we take we're risking $500 on each

This automatically becomes our Risk

This means for every 20 trades RR we take we're risking $500 on each

If you take a close look at our Daily DD you'd realise that we would be able to take 10 trade Fails before we get to Daily DD of -$5000

How I got 10 trades ??

$5,000/$500 = 10 Trades

Unfortunately chances of this happening are rather rare than low, speaking for the vast majority

How I got 10 trades ??

$5,000/$500 = 10 Trades

Unfortunately chances of this happening are rather rare than low, speaking for the vast majority

Which leaves my losses up to -$4,500 total which is $500 shy of hitting the daily Drawdown.

(9 trade fails × $500 = -$4,500)

Some persons would also want to be able to take more than just 10 trades in order to let their probability outcome run, they can divide by a higher trade

(9 trade fails × $500 = -$4,500)

Some persons would also want to be able to take more than just 10 trades in order to let their probability outcome run, they can divide by a higher trade

Number, for example, 50 trades or 40 trades whatever works for them.

Combine this Risk plan with your preferred types of trade, trade plan and strategy and you'd be on a more sustainable side of things whilst trading your prop accounts

For myself I take 5RR+ trades which means

Combine this Risk plan with your preferred types of trade, trade plan and strategy and you'd be on a more sustainable side of things whilst trading your prop accounts

For myself I take 5RR+ trades which means

For every trade I win, I make $2,500+

(5 x $500 (Risk x Reward ratio) = $2,500)

The aim of Risk Management is to keep you in the game for longer and not to give you a strategic edge so if you ran down to open this thread in hopes for a miracle strategy, wake up there's NONE

(5 x $500 (Risk x Reward ratio) = $2,500)

The aim of Risk Management is to keep you in the game for longer and not to give you a strategic edge so if you ran down to open this thread in hopes for a miracle strategy, wake up there's NONE

I would have written more on the Psychology stuffs in Prop firm trading but I feel @Alh_Myke1 & @SDX_Trades delivered beautifully in their latest threads

Links tagged below ⬇️

@Alh_Myke1 thread below

Links tagged below ⬇️

@Alh_Myke1 thread below

@SDX_Trades Thread below on Psychology ⬇️

We've successfully come to an end of this Prop firm series. In case you missed any of the episodes, here are their links below to help you understand and flow better ⬇️

Ep1

Ep2

Ep1

Ep2

This thread took my lots of sitting & hours of writing even whilst my course mates attempted distracting me during the video processs😅😅😅

I'd really appreciate if you Liked & Retweeted this thread so others get to see it as well

And don't forget to follow me @Techriztm

I'd really appreciate if you Liked & Retweeted this thread so others get to see it as well

And don't forget to follow me @Techriztm

Here are some valuable persons in the space you can't afford not following, I personally have learnt lots from their tweets, you too will

@Alh_Myke1 @SDX_Trades @Starr_gael @Vee_forex @Kelvintalent_ @Kelvin_Graph @_Krypto_Khan @CryptoDefiLord @thissdax @chaxbtbg @JeremyofCrypto

@Alh_Myke1 @SDX_Trades @Starr_gael @Vee_forex @Kelvintalent_ @Kelvin_Graph @_Krypto_Khan @CryptoDefiLord @thissdax @chaxbtbg @JeremyofCrypto

Tell me in the comments. What and What are your concerns ?? And what did you learn from this thread series ??

PS. I'm sure lots of grammatical errors will preceed this thread cuz I was really rushing to meet up with time 😅😅 anyways of the most you'd definitely relate❤️❤️

PS. I'm sure lots of grammatical errors will preceed this thread cuz I was really rushing to meet up with time 😅😅 anyways of the most you'd definitely relate❤️❤️

Loading suggestions...