1️⃣Never use complex formulas

Many investment professionals try to determine the fair value of a company to two decimal places.

This is complete nonsense as there are so much assumptions you must make to determine the intrinsic value of a company.

Many investment professionals try to determine the fair value of a company to two decimal places.

This is complete nonsense as there are so much assumptions you must make to determine the intrinsic value of a company.

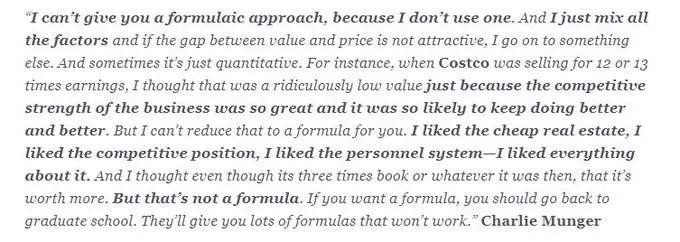

You don’t believe me? Don’t take my word for it:

“It is better to be roughly right than precisely wrong.” - John Maynard Keynes

“Some of the worst business decisions I’ve seen came with detailed analysis. The higher math was false precision." - Charlie Munger

“It is better to be roughly right than precisely wrong.” - John Maynard Keynes

“Some of the worst business decisions I’ve seen came with detailed analysis. The higher math was false precision." - Charlie Munger

So now you know that you shouldn’t use complex formulas.

But how can you know whether a stock is cheap or expensive?

But how can you know whether a stock is cheap or expensive?

2️⃣ The fair value of a company

Let’s start with a very simple example.

When a company would be able to grow at the same rate forever, the value of the company can be calculated as follows...

Let’s start with a very simple example.

When a company would be able to grow at the same rate forever, the value of the company can be calculated as follows...

Value of the company = Free cash flow per share in year 0 / (expected return - yearly growth rate FCF)

An example will make everything more clear.

An example will make everything more clear.

Let’s say that a company called Quality Inc. has the following characteristics:

- Free cash flow per share: $10

- Yearly FCF per share growth: 8%

- Expected return: 10%

The expected return is the return you want to achieve as an investor.

- Free cash flow per share: $10

- Yearly FCF per share growth: 8%

- Expected return: 10%

The expected return is the return you want to achieve as an investor.

In this example, the fair value of Quality Inc. is equal to:

Value of the company = FCF per share in year 0 / (expected return - yearly growth rate FCF)

Value of the company = $10/ (10% - 8%) = $500

Value of the company = FCF per share in year 0 / (expected return - yearly growth rate FCF)

Value of the company = $10/ (10% - 8%) = $500

So now you know that the fair value of Quality Inc. is equal to $500.

This means that you will generate a yearly return of 10% as an investor when you buy Quality Inc. for $500.

As a reminder: we used 10% as our expected return in this example.

This means that you will generate a yearly return of 10% as an investor when you buy Quality Inc. for $500.

As a reminder: we used 10% as our expected return in this example.

3️⃣Always revert

Instead of calculating the intrinsic value of a company, you can also look at the expectations which are implied in the stock price.

After that, you determine whether these expectations are realistic.

Instead of calculating the intrinsic value of a company, you can also look at the expectations which are implied in the stock price.

After that, you determine whether these expectations are realistic.

▪️ Yearly growth rate implied in the stock price

Let’s say that Quality Inc. is trading at a stock price of $400 today.

The company’s FCF per share is still equal to $10 and you still want to achieve a return of 10% per year as an investor.

Let’s say that Quality Inc. is trading at a stock price of $400 today.

The company’s FCF per share is still equal to $10 and you still want to achieve a return of 10% per year as an investor.

As a reminder, this was the formula to calculate the fair value of a company:

Value of the company = FCF per share in year 0 / (expected return - yearly growth rate FCF)

Value of the company = FCF per share in year 0 / (expected return - yearly growth rate FCF)

From this formula, you can also calculate which growth rate of the FCF per share is implied in the current stock price:

Yearly growth rate FCF = Expected return - (FCF per share in year 0 / Value of the company)

Yearly growth rate FCF = 10% - ($10/$400) = 7.5%

Yearly growth rate FCF = Expected return - (FCF per share in year 0 / Value of the company)

Yearly growth rate FCF = 10% - ($10/$400) = 7.5%

At a stock price of $400, the market expects that Quality Inc. should be able to grow its FCF per share with 7.5% per year.

This means that when you think Quality Inc. can grow its FCF per share with more than 7.5% per year, the stock is undervalued.

This means that when you think Quality Inc. can grow its FCF per share with more than 7.5% per year, the stock is undervalued.

▪️Yearly return for shareholders implied in the stock price

You can use the same formula to calculate your expected return as a shareholder.

You can use the same formula to calculate your expected return as a shareholder.

Let’s say that Quality Inc. still trades at $400, has a FCF per share of $10 and can grow its FCF per share with 8% per year into perpetuity:

Expected return = Yearly growth rate FCF + (FCF per share in year 0 / Value of the company)

Expected return = 8% + ($10/$400) = 10.5%

Expected return = Yearly growth rate FCF + (FCF per share in year 0 / Value of the company)

Expected return = 8% + ($10/$400) = 10.5%

This means that you would generate a return of 10.5% per year if you would buy Quality Inc. for $400.

Would you be happy with a yearly return of 10.5%?

In that case you should consider buying Quality Inc.

Would you be happy with a yearly return of 10.5%?

In that case you should consider buying Quality Inc.

4️⃣Reverse DCF

In practice, there is no company that can grow its FCF per share at the same rate forever.

That’s why the examples used before are good to get a first grasp about a company, but shouldn’t be used to base your investment decisions on.

In practice, there is no company that can grow its FCF per share at the same rate forever.

That’s why the examples used before are good to get a first grasp about a company, but shouldn’t be used to base your investment decisions on.

▪️How to calculate the intrinsic value of a company

Do you know how to calculate the intrinsic value of a company?

The intrinsic value of EVERY company is equal to the present value of all cash the company will generate over its remaining lifetime.

Do you know how to calculate the intrinsic value of a company?

The intrinsic value of EVERY company is equal to the present value of all cash the company will generate over its remaining lifetime.

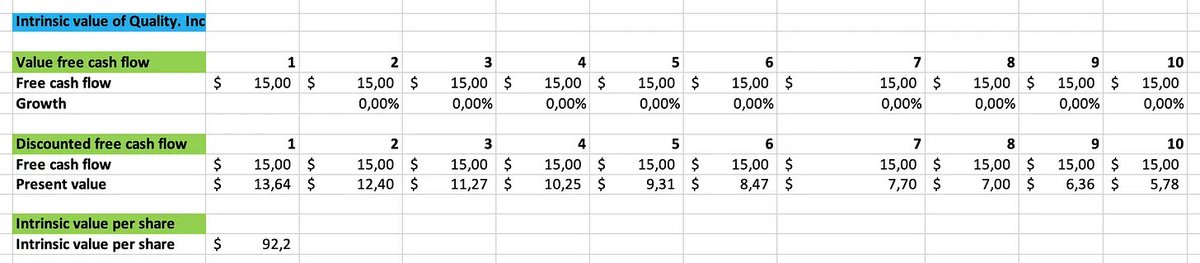

Let’s say that Quality Inc. will still exist for 10 years and will shut down its operations after that.

Over these 10 years, Quality Inc. will generate $15 in free cash flow per year.

Over these 10 years, Quality Inc. will generate $15 in free cash flow per year.

In this example, the intrinsic value of the company is equal to the discounted value of $150 ($15*10).

It’s important to take the discounted value because $15 in 10 years from now is worth less than $15 today.

Why? Because inflation reduces your purchasing power.

It’s important to take the discounted value because $15 in 10 years from now is worth less than $15 today.

Why? Because inflation reduces your purchasing power.

In this example, the intrinsic value of Quality Inc is equal to $92.2.

This means that when you can buy Quality Inc. for $92.2 or less, you will generate a return of at least 10% per year.

This means that when you can buy Quality Inc. for $92.2 or less, you will generate a return of at least 10% per year.

▪️How to execute a reverse DCF

A reverse DCF is one of the best ways to value a company.

With a reverse DCF, you calculate how much growth the stock price has priced in.

A reverse DCF is one of the best ways to value a company.

With a reverse DCF, you calculate how much growth the stock price has priced in.

You compare this growth rate with your own expectations to determine whether the company is undervalued.

In this section we’ll use an example to make this concept more clear.

In this section we’ll use an example to make this concept more clear.

On our website you can find an Excel sheet which you can use for free to do all calculations with me.

The best way to learn something new is by doing it yourself.

You can also use this Excel to make your own calculations for other companies.

The best way to learn something new is by doing it yourself.

You can also use this Excel to make your own calculations for other companies.

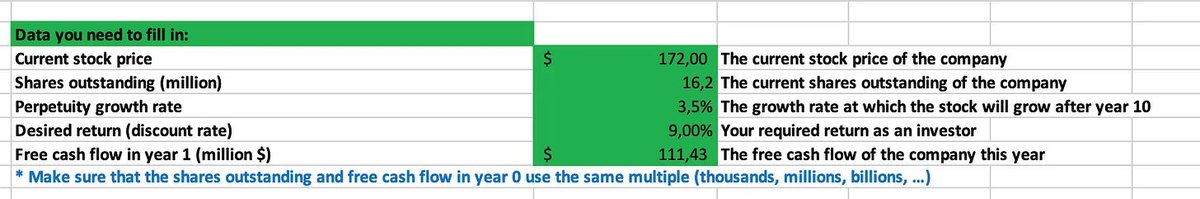

To execute a reverse DCF, you need the following data:

- The current stock price

- Total shares outstanding

- Perpetuity growth rate (this number should be in line with GDP growth)

- Discount rate (proxy for your expected return)

- FCF in year 1

- The current stock price

- Total shares outstanding

- Perpetuity growth rate (this number should be in line with GDP growth)

- Discount rate (proxy for your expected return)

- FCF in year 1

Let's use Apple as an example:

- The current stock price: $172

- Total shares outstanding: 16.2 billion

- Perpetuity growth rate: 3.5%

- Discount rate: 9%

- FCF in year 1: $111.43 billion

- The current stock price: $172

- Total shares outstanding: 16.2 billion

- Perpetuity growth rate: 3.5%

- Discount rate: 9%

- FCF in year 1: $111.43 billion

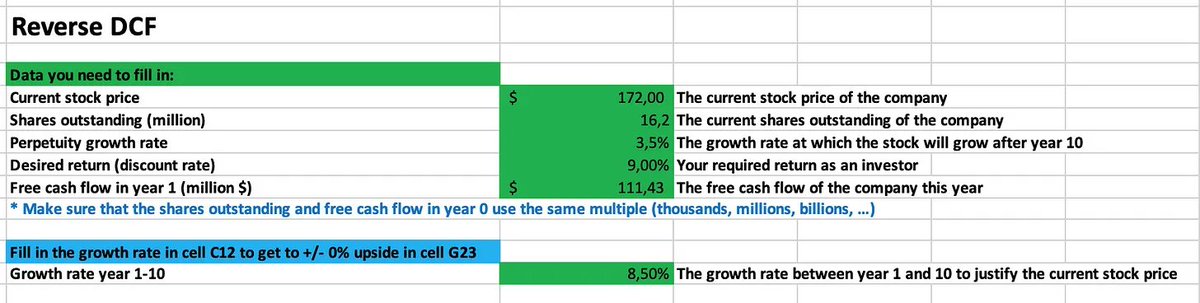

Now there is only one more data point you need: the implied growth rate of the free cash flow between year 1-10.

But how can you know this growth rate? Well… It’s pretty easy.

But how can you know this growth rate? Well… It’s pretty easy.

You just need to play with this number a bit until the intrinsic value per share is more or less equal to the current stock price.

✅ Free cash flow per share growth between year 1 and 10 is 5%

Intrinsic value = $138.5 (Upside/Downside = -19.5%)

✅ Free cash flow per share growth between year 1 and 10 is 5%

Intrinsic value = $138.5 (Upside/Downside = -19.5%)

✅Free cash flow per share growth between year 1 and 10 is 10%

Intrinsic value = $194.7 (Upside/Downside = 13.2%)

Intrinsic value = $194.7 (Upside/Downside = 13.2%)

Now you know that the market is expecting that Apple’s free cash flow will grow more than 5% per year and less than 10% per year over the next 10 years.

After playing around a bit, we find that when Apple’s free cash flow will grow with 8.5% per year over the next 10 years, the intrinsic value per share is equal to $175.8.

This is more or less equal to the current stock price of $172.

This is more or less equal to the current stock price of $172.

This means that Apple should be able to grow its free cash flow per share with 8,5% per year over the next 10 years to generate a return of 9% per year for you as an investor.

6️⃣Conclusion

- Never use complex formulas

- A reverse DCF is the best way to value a company

- A reverse DCF shows you how much growth the stock price has priced in. You compare this growth rate with your own expectations to determine whether the company is undervalued

- Never use complex formulas

- A reverse DCF is the best way to value a company

- A reverse DCF shows you how much growth the stock price has priced in. You compare this growth rate with your own expectations to determine whether the company is undervalued

That's it for today.

If you liked this, you'll love the full article and the free Excel to make the calculations yourself.

You can find it here:

compoundingquality.net

If you liked this, you'll love the full article and the free Excel to make the calculations yourself.

You can find it here:

compoundingquality.net

Loading suggestions...