Capital allocation is the most important task of management.

The Outsiders covers 8 CEOs who did an excellent job in this.

An investment of $10,000 would be worth $1.5 million (!) 20 years later if you invested with these excellent CEOs.

The Outsiders covers 8 CEOs who did an excellent job in this.

An investment of $10,000 would be worth $1.5 million (!) 20 years later if you invested with these excellent CEOs.

The best CEOs invest in projects that yield the highest return with the lowest possible risk.

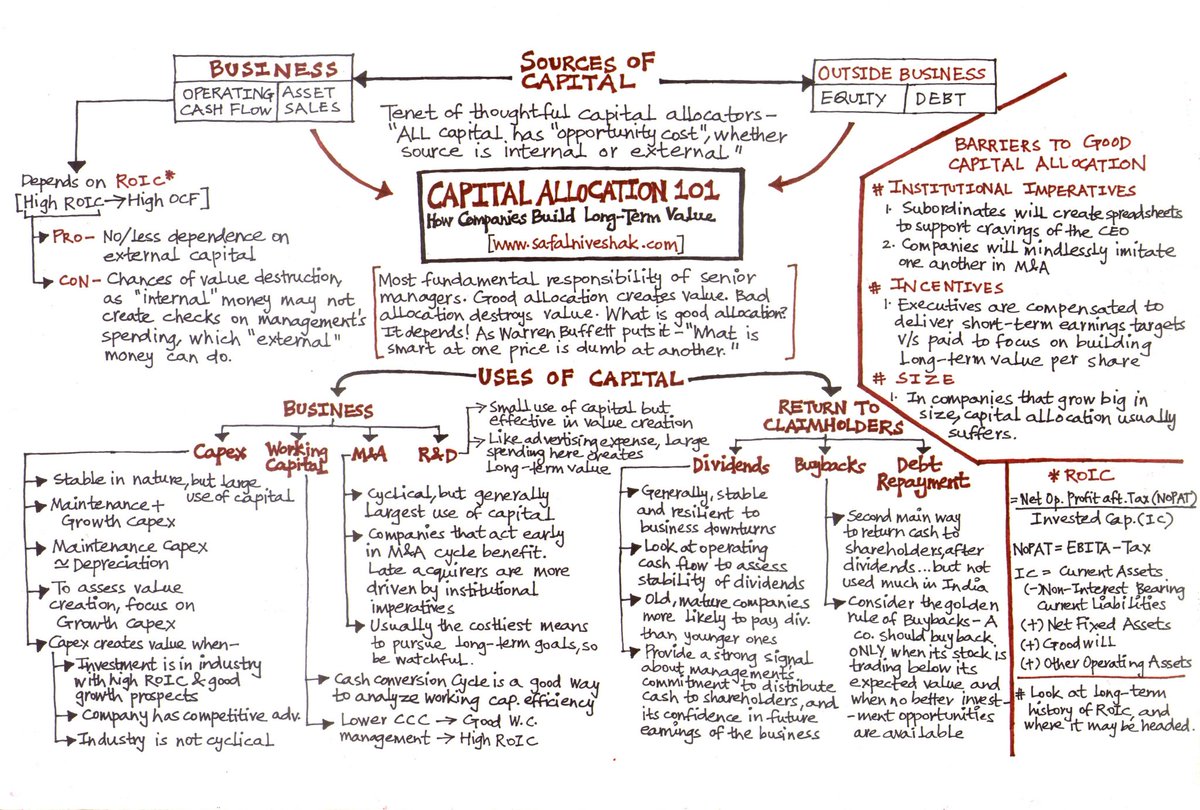

Here's everything you need to know about the subject (H/T @safalniveshak):

Here's everything you need to know about the subject (H/T @safalniveshak):

A CEO’s overall performance depends on doing two things well:

1️⃣ Running operations efficiently

2️⃣ Effectively redeploying cash from operations

That's it.

1️⃣ Running operations efficiently

2️⃣ Effectively redeploying cash from operations

That's it.

Here are 4 CRUCIAL things you should remember from the book:

1️⃣ Focus on intrinsic value per share

Most CEOs make poor acquisitions or pay high dividends which are in their own interest.

This destroys value for shareholders.

1️⃣ Focus on intrinsic value per share

Most CEOs make poor acquisitions or pay high dividends which are in their own interest.

This destroys value for shareholders.

Outsider CEOs do the opposite: they allocate capital in a way that maximizes shareholder value.

Think about the following:

📌 Organic growth investments

📌 Share buybacks

📌 Value accretive acquisitions

📌 Paying down debt

Think about the following:

📌 Organic growth investments

📌 Share buybacks

📌 Value accretive acquisitions

📌 Paying down debt

2️⃣ Independent thinkers

It's impossible to outperform the market if you do the same as everyone else.

The same goes for CEOs.

Outsider CEOs think independently and love the process. Their company is like a baby for them.

It's impossible to outperform the market if you do the same as everyone else.

The same goes for CEOs.

Outsider CEOs think independently and love the process. Their company is like a baby for them.

Then in the 1970s, Teledyne’s stock got cheap, and Singleton repurchased over 90% of shares outstanding.

Both of these moves were very unconventional.

When the market zigged, Outsider CEOs would zag.

Both of these moves were very unconventional.

When the market zigged, Outsider CEOs would zag.

4️⃣ Humility

Outsider CEOs are very humble

When most people think of a successful CEO, they think of a charismatic leader that loves being in the spotlight...

Outsider CEOs are very humble

When most people think of a successful CEO, they think of a charismatic leader that loves being in the spotlight...

This thread was made by my great friend @Clay_Finck from @WSM_TIP.

If you’d like to learn more about The Outsiders, we highly recommend you check out TIP's latest podcast covering it in detail: link.chtbl.com

If you’d like to learn more about The Outsiders, we highly recommend you check out TIP's latest podcast covering it in detail: link.chtbl.com

If you liked this, you'll love our website.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Sign up today and receive a free Financial Analysis Course:

eepurl.com

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Sign up today and receive a free Financial Analysis Course:

eepurl.com

Loading suggestions...