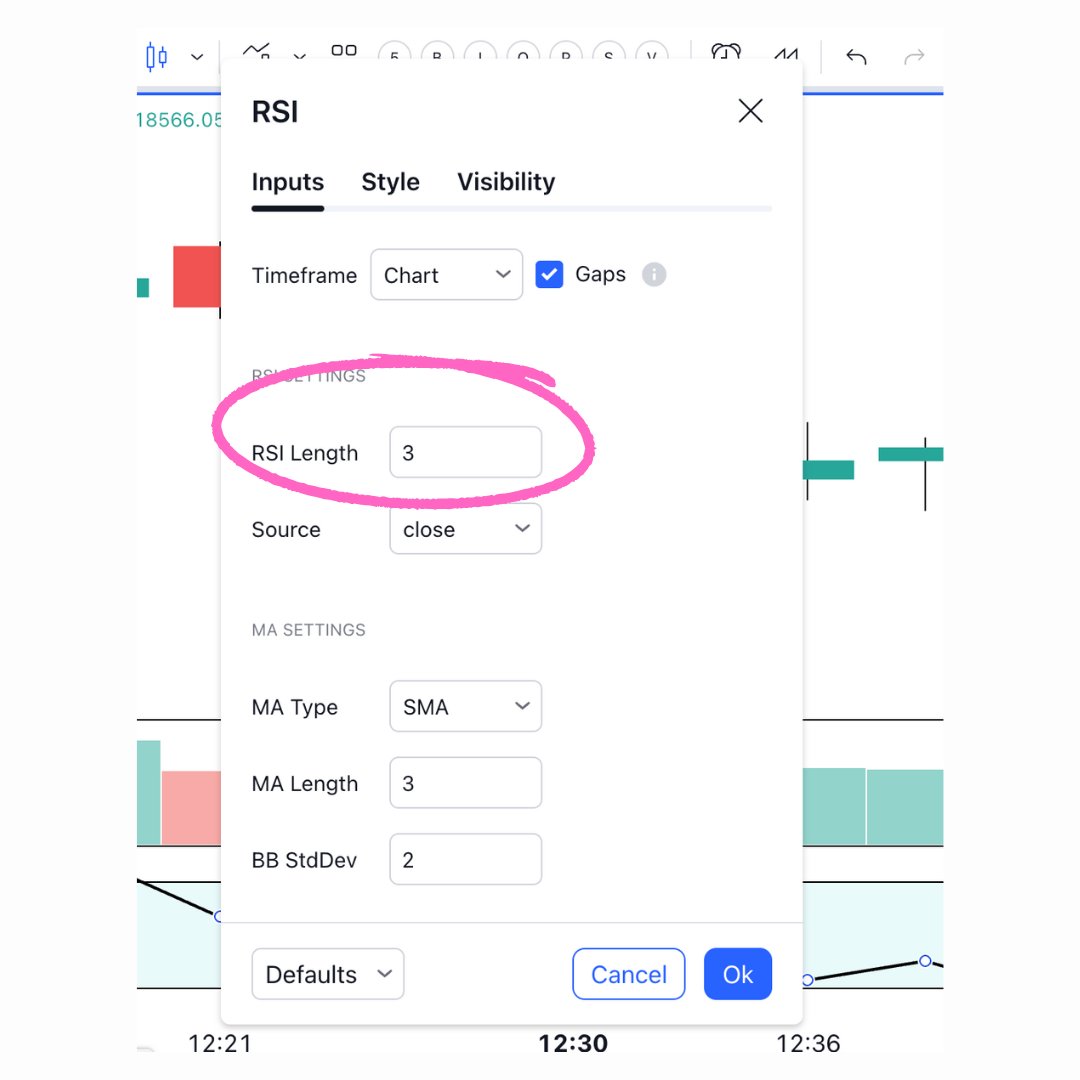

This thread is all about one of my favorite Setup of "Two Bullish/Bearish candles & RSI (3) >80/<20."

I will explain every detail of this setup in this thread, so let's get started.

I will explain every detail of this setup in this thread, so let's get started.

Before implementing any setup, we should understand the broader trend of the market. So to understand the direction of the market, we will use 50EMA on any timeframe.

If the price is above 50 EMA, consider the broader trend is bullish & below 50EMA, the trend will be bearish.

If the price is above 50 EMA, consider the broader trend is bullish & below 50EMA, the trend will be bearish.

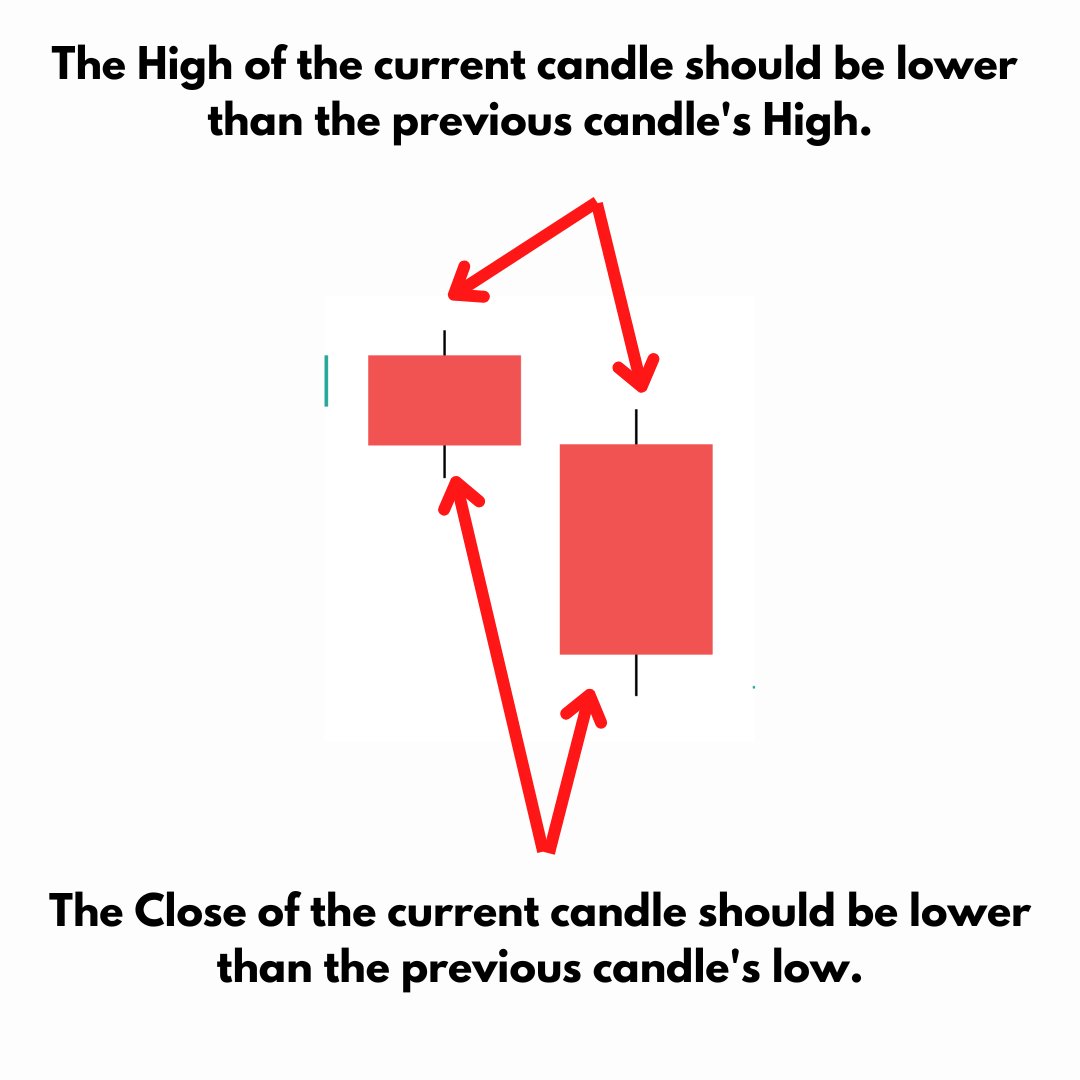

Instructions about initiating the setup :

In the case of a Bullish setup, place the bet above the High of the current candle + some buffer.

& place the SL below the previous candle's low - some buffer.

In the case of a Bullish setup, place the bet above the High of the current candle + some buffer.

& place the SL below the previous candle's low - some buffer.

In the case of a Bearish setup, place the bet below the low of the current candle - some buffer.

& place the SL above the previous candle's High + some buffer.

Book the profit at 1:1.5 & 1:2.

& place the SL above the previous candle's High + some buffer.

Book the profit at 1:1.5 & 1:2.

While a trading setup serves as a guiding compass in the market, traders must tread cautiously knowing that it's not a holy grail Strategy

It's also essential to manage your risk appropriately & ensure that your trading strategy aligns with your risk tolerance.

Happy trading!

It's also essential to manage your risk appropriately & ensure that your trading strategy aligns with your risk tolerance.

Happy trading!

Loading suggestions...