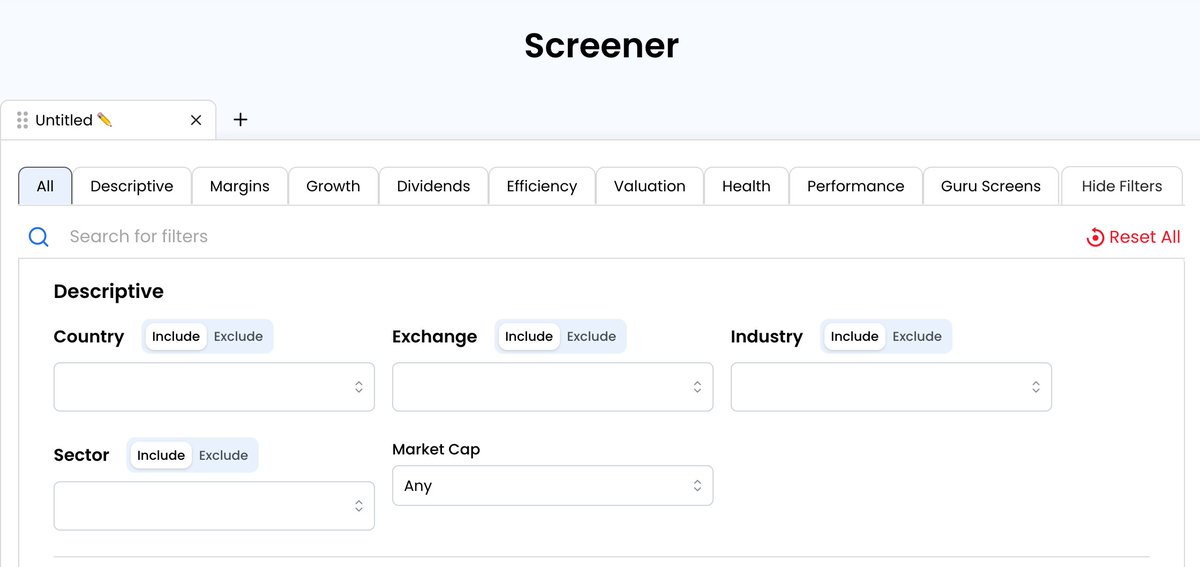

You want to know how you can screen for these criteria yourself?

Personally, I use Bloomberg.

But you can also use free stock screeners like @stratosphere_io.

Personally, I use Bloomberg.

But you can also use free stock screeners like @stratosphere_io.

You want more?

I'm sharing a FREE COURSE with more than 50 examples of quality companies.

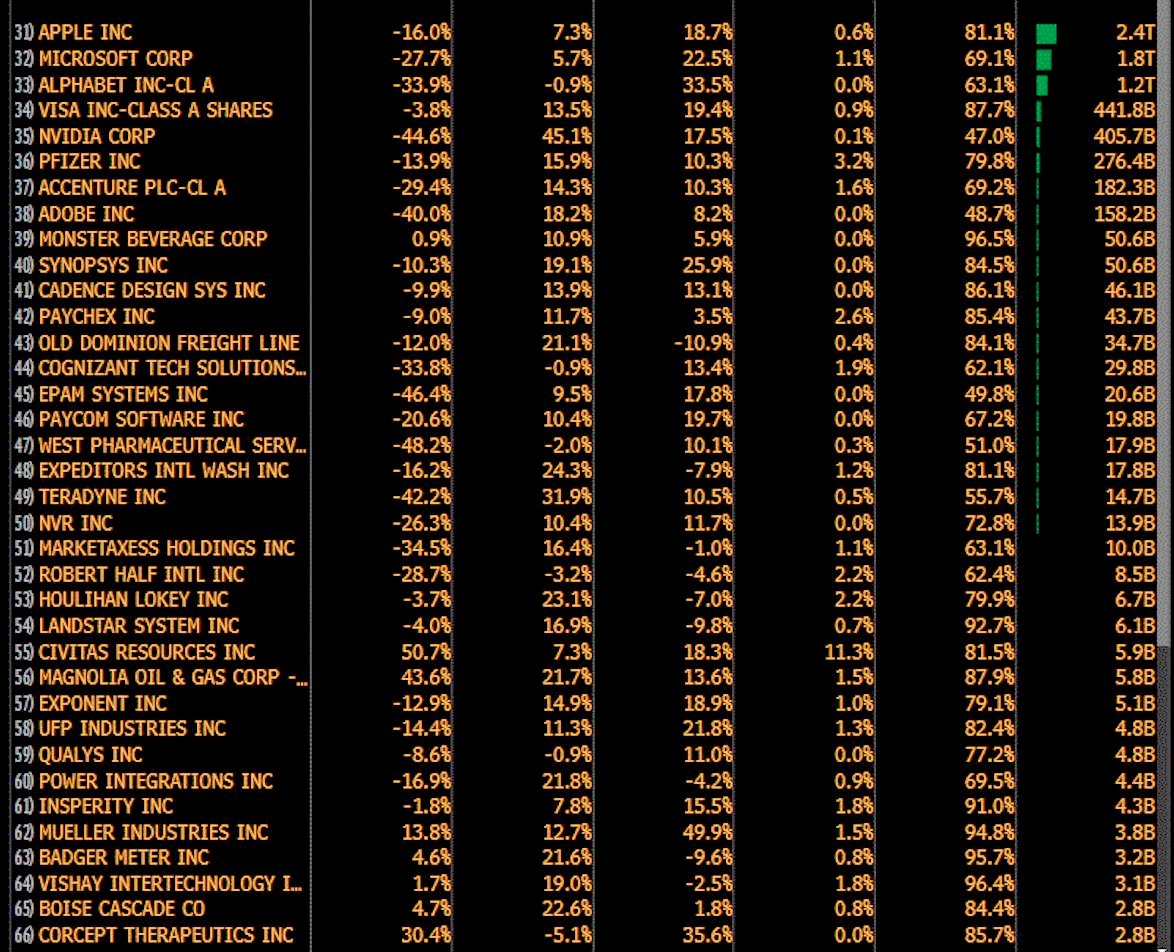

This list managed to massively outperform the S&P500.

Sign up here:

eepurl.com

I'm sharing a FREE COURSE with more than 50 examples of quality companies.

This list managed to massively outperform the S&P500.

Sign up here:

eepurl.com

Loading suggestions...