I've worked in finance for over 5 years and have hosted 1,000s of hours of Twitter Spaces on trading.

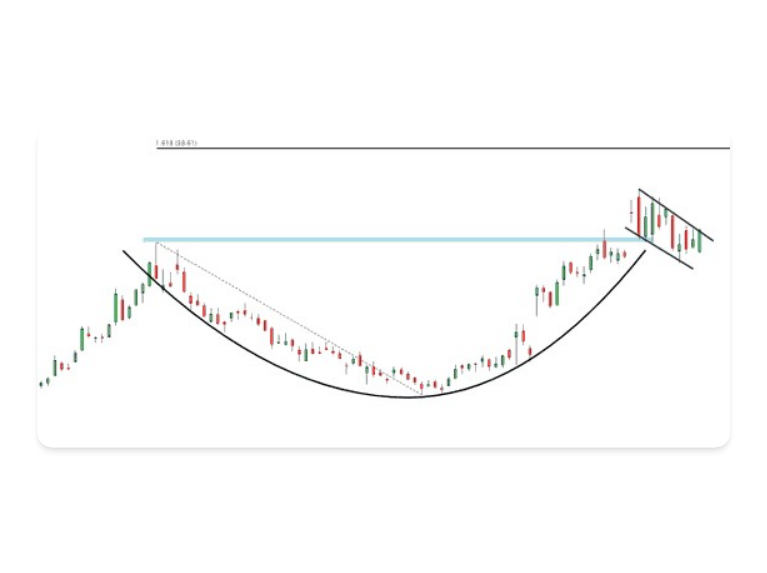

If you want to trade stocks, you must understand these 10 chart patterns:

If you want to trade stocks, you must understand these 10 chart patterns:

Don't have time to tune into my 40+ hours of Twitter Spaces a week?

I share the best insights weekly with 9,700+ investors.

Sign up today 👇

marketmadness-newsletter.beehiiv.com

I share the best insights weekly with 9,700+ investors.

Sign up today 👇

marketmadness-newsletter.beehiiv.com

Loading suggestions...