In this Basic Ultimatum Thread, I'd like to go over a few basic things you should master before attempting to take a prop Challenge

1) There are different sessions in the Forex Market, by sessions I mean the primary trading hour or time and locale for a given asset

1) There are different sessions in the Forex Market, by sessions I mean the primary trading hour or time and locale for a given asset

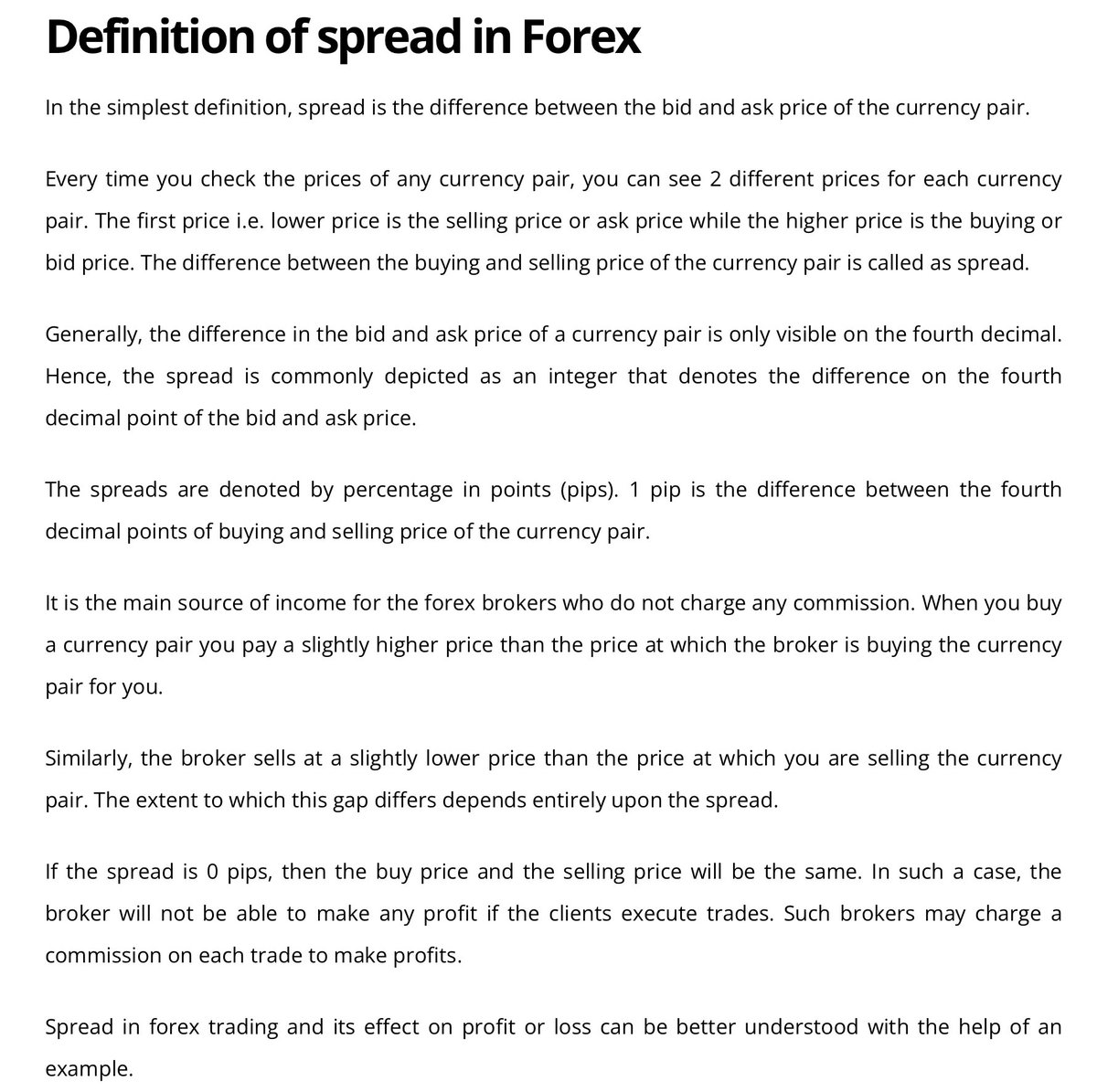

Spreads have been a common enemy & friend to forex traders as it has both its upsides & downsides.

•It is important to note that during market rollovers/close Spreads can go crazily high and may have effect on your trades or orders executed at that time

Here's my experience 👇

•It is important to note that during market rollovers/close Spreads can go crazily high and may have effect on your trades or orders executed at that time

Here's my experience 👇

In this tweet, it could be seen that my trades filled but didn't read in profit

This was because it happened to have triggered during market rollover late 11pm one night

This was because it happened to have triggered during market rollover late 11pm one night

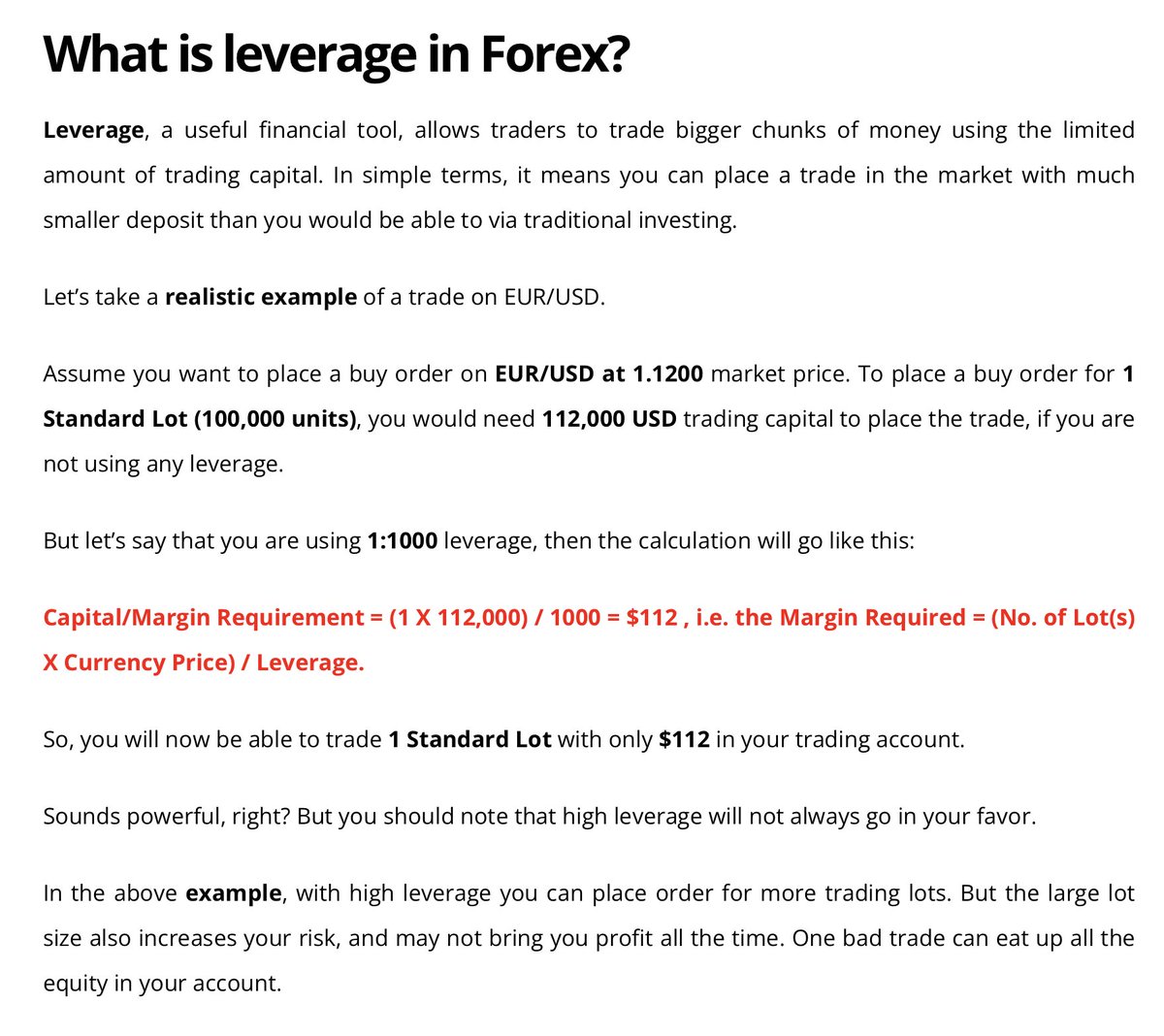

What Is Leverage ??

Leverage simply means buying power

It allows traders to control higher position sizes they would not normally have been able to control withdraw their own money/capital

Meanwhile you can read up lots, pips & other basics from Forextrading.ng 💯👍

Leverage simply means buying power

It allows traders to control higher position sizes they would not normally have been able to control withdraw their own money/capital

Meanwhile you can read up lots, pips & other basics from Forextrading.ng 💯👍

PROP FIRMS TERMS & EXPLANATION ?

Let's go

Trading days - The number of days you're required to have traded before passing your challenge account , let's say a firm has a minimum trading day rule of 5 days, it simply means even if you get to the profit target in a day

Let's go

Trading days - The number of days you're required to have traded before passing your challenge account , let's say a firm has a minimum trading day rule of 5 days, it simply means even if you get to the profit target in a day

You still haven't passed your challenge yet till you have traded for complete 5 days and stayed about the profit target successfully

Time Limit - The maximum amount of time given to attempt passing your evaluation phase, if this time elapses and you still haven't crossed the

Time Limit - The maximum amount of time given to attempt passing your evaluation phase, if this time elapses and you still haven't crossed the

Profit targets, you'd lose the account

This is also one of the rules dreaded by most prop traders, hence why beautiful class-leading firms today like @FundedNext have provisions for a No-Time limit rule evaluation account

EA's (Expert Advisors) - also known as trading bots

This is also one of the rules dreaded by most prop traders, hence why beautiful class-leading firms today like @FundedNext have provisions for a No-Time limit rule evaluation account

EA's (Expert Advisors) - also known as trading bots

They're programmed or pieces of codes which when uploaded into the MetaTrader 4 or 5 enable you to engage in forex trading via automation

Profit Targets- are simply % growth your evaluation account is supposed to meet before its considered passed ✔️ it is calculated in $$ or %

Profit Targets- are simply % growth your evaluation account is supposed to meet before its considered passed ✔️ it is calculated in $$ or %

Holding Restrictions - This means you'd not be allowed to hold Trades either overnight or over the weekend

News Restrictions- Whenever there's a high impact news, your open trades would be closed automatically before then

This can be Extreemly helpful & also annoying 😅😅

News Restrictions- Whenever there's a high impact news, your open trades would be closed automatically before then

This can be Extreemly helpful & also annoying 😅😅

Most persons love to trade during news days because of the volatility it brings

And volatility eases transfer of wealth

Withdrawal days - States the number of times in a month a live funded Trader would be allowed to withdraw his profit share/split

And volatility eases transfer of wealth

Withdrawal days - States the number of times in a month a live funded Trader would be allowed to withdraw his profit share/split

Profit split (70/30) - simply means that as a live funded Trader, whatever Profit you make off the account 70% belongs to you and 30% belongs to the firm

Most firms go higher than these today tho maybe to drive starting publicity but this is considered the standard or normale

Most firms go higher than these today tho maybe to drive starting publicity but this is considered the standard or normale

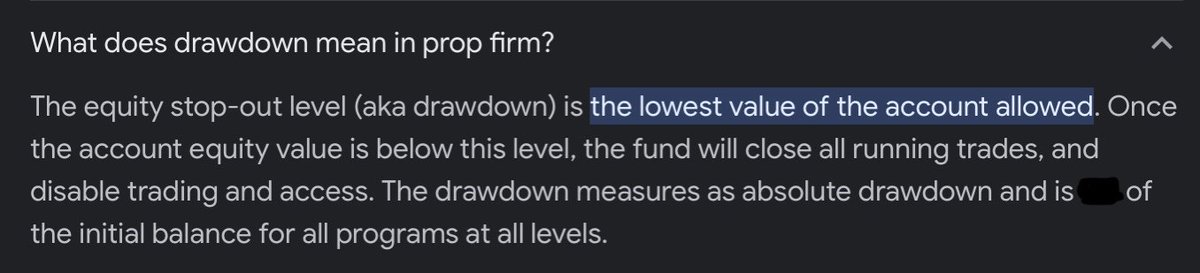

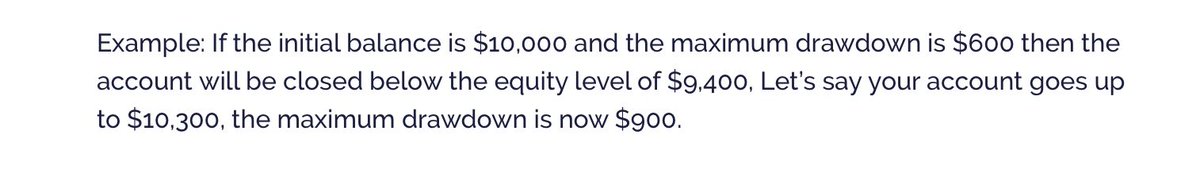

Let's say your Max Drawdown is $300 and you're on a profit of +$600 on your ongoing open trade & then suddenly there's a little reversal in price which amounted to a regression in floating profit to about +$250

On an equity based DD account, your acc would be breached

On an equity based DD account, your acc would be breached

Why ? This is because the reversal caused a decline in price more than the required amount the equity is meant to impact at any given time.

Many firms today use equity based Drawdown today and most traders are in aware of it

@Starr_gael even tweeted out how she was a victim

Many firms today use equity based Drawdown today and most traders are in aware of it

@Starr_gael even tweeted out how she was a victim

@JeremyofCrypto would be threading on everything Drawdown more intensively than I did when he does I'd retweet for y'all to learn more

Swaps - is an agreement or a Derivative contract between 2 parties for a financial exchange so that they can exchange cash flow or liability

Swaps - is an agreement or a Derivative contract between 2 parties for a financial exchange so that they can exchange cash flow or liability

When you hold trades overnight or over the weekends you're charged a certain amount in fee called swaps to keep your position opened for you

That'd be all for now

Tho the list is inexhaustible, myself I'm exhausted 😅😅

If you did appreciate this thread

Do well to follow me❤️

That'd be all for now

Tho the list is inexhaustible, myself I'm exhausted 😅😅

If you did appreciate this thread

Do well to follow me❤️

see you at Ep3 (The Ultimate Prop Risk Mgt )

That one would be a banger cuz I'm literally going to spill lots of secrets on it so do well to follow @Techriztm

And below are good Traders with great contents. Follow

@Alh_Myke1 @DipoAdepoju @Starr_gael @Kelvintalent_ @Vee_forex

That one would be a banger cuz I'm literally going to spill lots of secrets on it so do well to follow @Techriztm

And below are good Traders with great contents. Follow

@Alh_Myke1 @DipoAdepoju @Starr_gael @Kelvintalent_ @Vee_forex

Loading suggestions...