For a full recap of this Deutche Mark momentum alpha, check out this thread

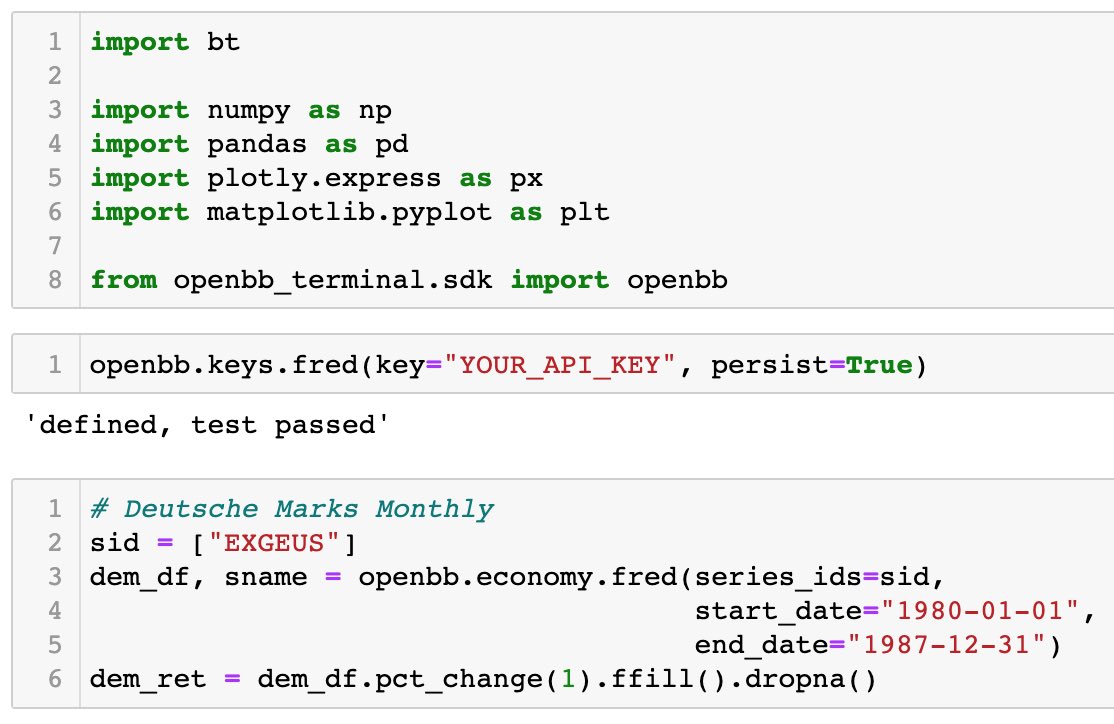

First, register a FRED API and use #openbb to download the Deutsche Mark rates back in the 80s

Since daily Deutsche Mark data has been discontinued at most data sources, we’ll just work with monthly data for now

Since daily Deutsche Mark data has been discontinued at most data sources, we’ll just work with monthly data for now

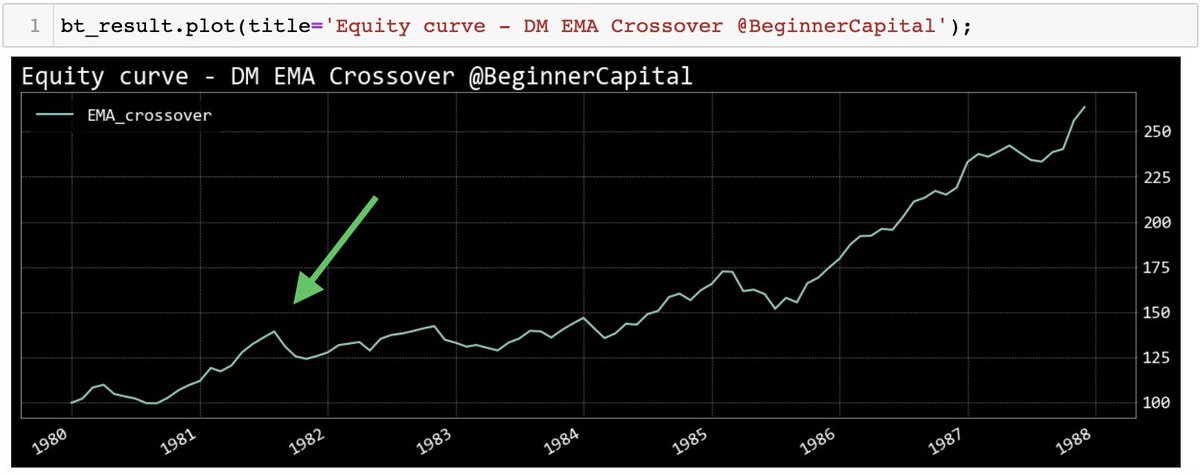

MA crossover is one way to trade momentum

I’m certain the early RenTech team had much more advanced algos AND better data (intraday vs. my monthly rates)

I’m probably underestimating their Sharpe by a long shot

#buildinpublic

investopedia.com

I’m certain the early RenTech team had much more advanced algos AND better data (intraday vs. my monthly rates)

I’m probably underestimating their Sharpe by a long shot

#buildinpublic

investopedia.com

Instead of coding your own backtest, the [bt] library has easy-to-use functions to test your strategy

We’ll plot the equity curve. Notice how it just goes up? $100 in capital more than 2x over 8 years; an annual return of 13%!

And let’s not forget I’m still undershooting RenTech’s actual alpha with only monthly data

We’ll plot the equity curve. Notice how it just goes up? $100 in capital more than 2x over 8 years; an annual return of 13%!

And let’s not forget I’m still undershooting RenTech’s actual alpha with only monthly data

The [bt] package prints and plots every possible return metric, risk ratio, etc. under the sun.

All in one line of code

If you want to play with it, check it out here pmorissette.github.io

All in one line of code

If you want to play with it, check it out here pmorissette.github.io

Follow @beginnercapital for more quant + python content like this!

And for an even better alternative to [bt], check out this thread from @pyquantnews

I don’t have a referral code anymore but tell him I sent you!

And for an even better alternative to [bt], check out this thread from @pyquantnews

I don’t have a referral code anymore but tell him I sent you!

جاري تحميل الاقتراحات...

![The [bt] package allows you to combine diff trading logics.

Whether you need to rebalance, hedge,...](https://pbs.twimg.com/media/FwAvdHUWYAYZ-jp.jpg)

![Instead of coding your own backtest, the [bt] library has easy-to-use functions to test your strateg...](https://pbs.twimg.com/media/FwAvdYcXgAMKgy_.jpg)

![The [bt] package prints and plots every possible return metric, risk ratio, etc. under the sun.

Al...](https://pbs.twimg.com/media/FwAveItXgAI2y_2.jpg)

![The [bt] package prints and plots every possible return metric, risk ratio, etc. under the sun.

Al...](https://pbs.twimg.com/media/FwAveIuX0AQnvpy.jpg)

![The [bt] package prints and plots every possible return metric, risk ratio, etc. under the sun.

Al...](https://pbs.twimg.com/media/FwAveItWcAIy3Nt.jpg)