2/ 1️⃣Fed in Tight Spot

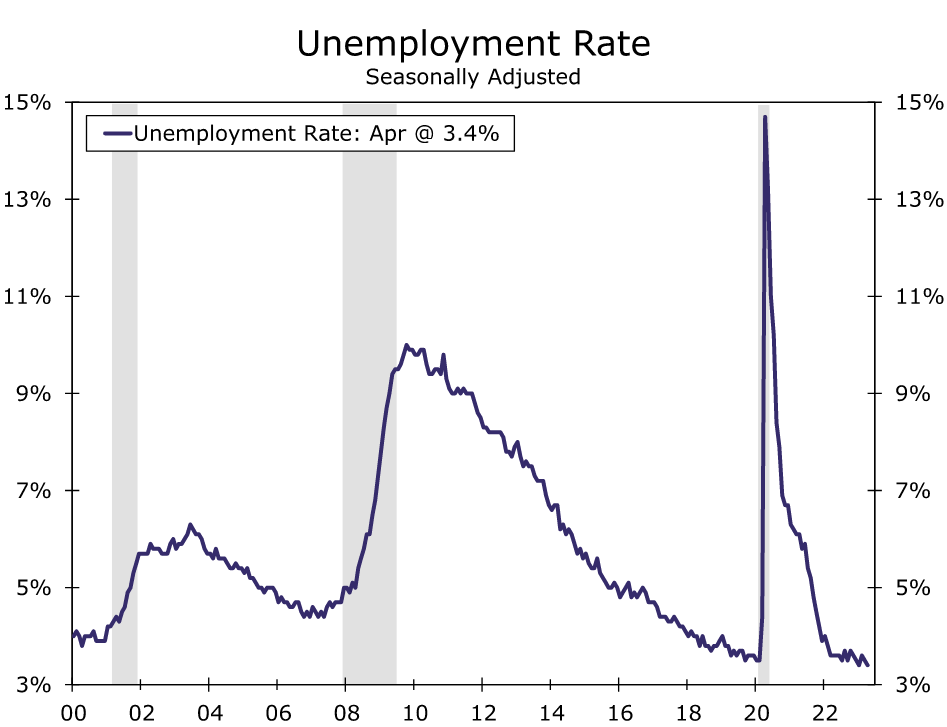

🟢 Job market

Despite the job market's current resiliency, there are indications that it may begin to falter in the coming months.

🟢 Job market

Despite the job market's current resiliency, there are indications that it may begin to falter in the coming months.

3/ However these job gains raises questions as @zerohedge reveals the mystery.

4/ Although there are still plenty of unfilled positions, fewer people are applying for them, and the number of unemployment claims is rising.

Fed aim to strike a balance between controlling inflation and guaranteeing employment creation. This itself is a substantially tough.

Fed aim to strike a balance between controlling inflation and guaranteeing employment creation. This itself is a substantially tough.

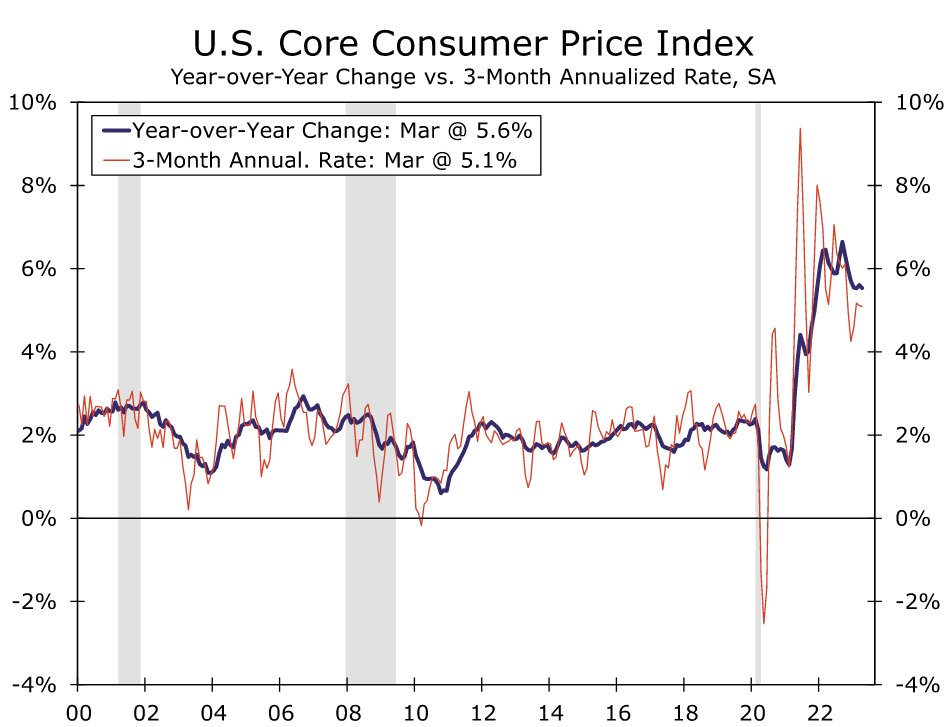

6/ 🟡Service Sector

The high demand for services is contributing to the apparent price gap between goods and services.

This is one of the reasons why the service industry is not experiencing the same inflationary pressures as the goods sector.

The high demand for services is contributing to the apparent price gap between goods and services.

This is one of the reasons why the service industry is not experiencing the same inflationary pressures as the goods sector.

7/ 🟢 Structural Shifts

These structural shifts i.e. increase in construction spending and strong manufacturing projects are expected to sustain economic activity.

Even in the face of macro uncertainty and tighter lending standards could weigh on these fundamental structures.

These structural shifts i.e. increase in construction spending and strong manufacturing projects are expected to sustain economic activity.

Even in the face of macro uncertainty and tighter lending standards could weigh on these fundamental structures.

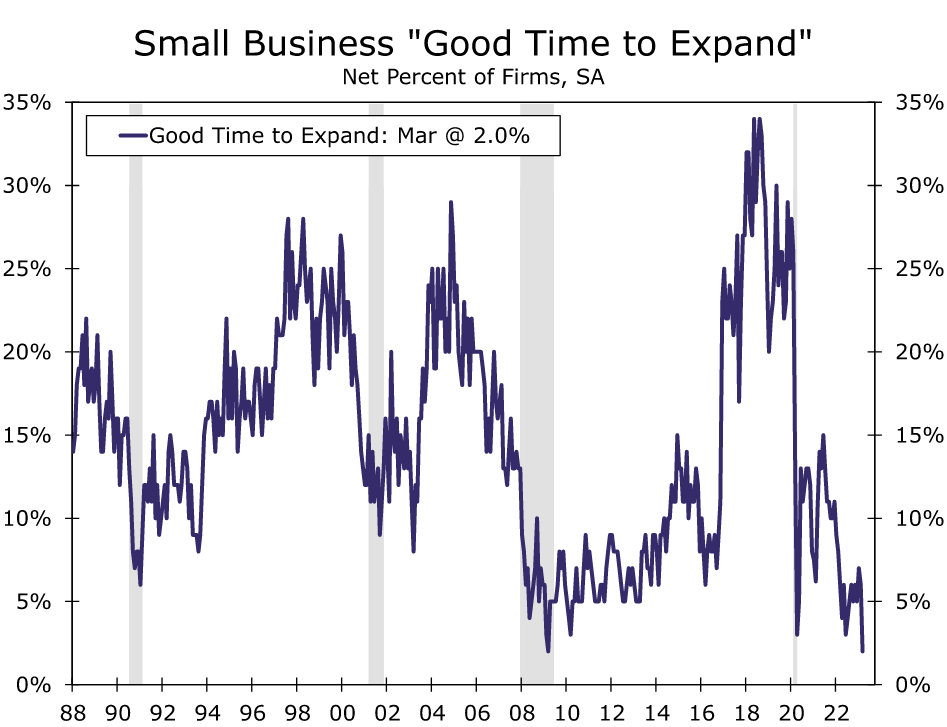

8/ 2️⃣US Outlook

🔴Business sentiments

Economic outlook for small companies looks bad. Might signal a looming recession

Only 2% of businesses thought it was a good time to expand despite lower pricing pressure.

🔴Business sentiments

Economic outlook for small companies looks bad. Might signal a looming recession

Only 2% of businesses thought it was a good time to expand despite lower pricing pressure.

11/ 3️⃣China Economic Upswing 🟡

Chinese economy continued to grow in April, albeit unevenly and with slightly less vigor.

Despite a minor slowdown in momentum, China's economy is still strong, and the 5.2% GDP growth prediction for 2023 stands.

Chinese economy continued to grow in April, albeit unevenly and with slightly less vigor.

Despite a minor slowdown in momentum, China's economy is still strong, and the 5.2% GDP growth prediction for 2023 stands.

12/ 4️⃣Fed Hikes Again 🟡

The FOMC raise rates by 25 basis points to 5.00%-5.25%.

Seems like this could be the final rate increase. The next FOMC is in June. If its a hike or not will depend on how economy performs.

I am leaning towards a 🟢 for June

The FOMC raise rates by 25 basis points to 5.00%-5.25%.

Seems like this could be the final rate increase. The next FOMC is in June. If its a hike or not will depend on how economy performs.

I am leaning towards a 🟢 for June

13/ Also, the fact that the FOMC did not commit in advance to another raise shows that they are closely observing the situation and prepared to to take action if necessary.

14/ 5️⃣Countdown to Debt Ceiling 🟡

Due to the debt ceiling restriction, the US Treasury may not have enough money to cover all of its commitments as early as June.

Due to the debt ceiling restriction, the US Treasury may not have enough money to cover all of its commitments as early as June.

15/ Three options are possible:

▫ Reaching an agreement to raise or suspend the debt ceiling

▫ Deciding on a temporary rise in the debt ceiling to buy more time for talks

▫ Maintaining the political impasse and entering the early June without a solution

▫ Reaching an agreement to raise or suspend the debt ceiling

▫ Deciding on a temporary rise in the debt ceiling to buy more time for talks

▫ Maintaining the political impasse and entering the early June without a solution

16/ Inflation or Stability to prevail?

@rektdiomedes

@milesdeutscher

@ThHappyHawaiian

@Bernin1001

@danblocmates

@Deebs_DeFi

@0xSalazar

@CryptMoose_

@DAdvisoor

@insomniac_ac

@matrixthesun

@CryptoShiro_

@0xsurferboy

@_FabianHD

@OnChainWizard

@CoinNotes_io

@0xYugiAI

@Nicknick2109

@rektdiomedes

@milesdeutscher

@ThHappyHawaiian

@Bernin1001

@danblocmates

@Deebs_DeFi

@0xSalazar

@CryptMoose_

@DAdvisoor

@insomniac_ac

@matrixthesun

@CryptoShiro_

@0xsurferboy

@_FabianHD

@OnChainWizard

@CoinNotes_io

@0xYugiAI

@Nicknick2109

17/ I hope you've found this thread helpful.

Follow me @arndxt_xo for more.

Like/Retweet the first tweet below if you can:

Follow me @arndxt_xo for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...